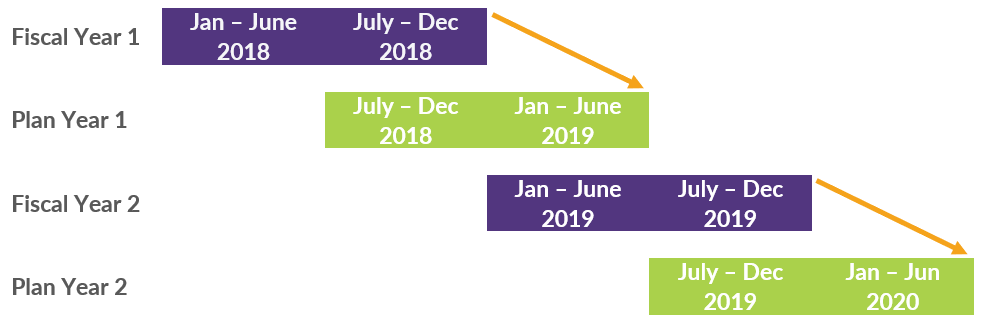

Plan Year Vs Calendar Year All Individual and Family plans are on a calendar year A plan on a contract year also called benefit year runs for any 12 month period

Many employers operate their health plans on a calendar year basis from Jan 1 through Dec 31 of each year Other employers operate their plans on a non All individual plans now have the calendar year match the plan year meaning no matter when you buy the plan it will renew on January 1st Even

Plan Year Vs Calendar Year

Plan Year Vs Calendar Year

Plan Year Vs Calendar Year

https://www.dwc401k.com/hs-fs/hubfs/QOTW/May%202019/5.21.2019%20QOTW%20Graph.png?width=983&name=5.21.2019%20QOTW%20Graph.png

The Employee Retirement Income Security Act ERISA defines the plan year as the calendar policy or fiscal year on which the records of

Templates are pre-designed documents or files that can be utilized for various functions. They can conserve effort and time by supplying a ready-made format and layout for producing different type of material. Templates can be used for personal or professional projects, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Plan Year Vs Calendar Year

Difference Between Group Plan Year & Calendar Year | Best NJ Insurance

Fiscal Year vs Calendar Year | Top 8 Differences You Must Know!

Why Group Health Plans Are Tied to the Calendar Year | Bethany Insurance Agency

David Foster, JD, CLU, ChFC Presenting: The Changing Landscape of Qualified and Non-qualified Retirement Plans. - ppt download

Calendar Year vs. Plan Year Deductible - Health Benefits Associates

Small Business Health Insurance 101: Plan Year Versus Calendar Year

https://cosmoins.com/difference-between-group-plan-year-calendar-year/

A calendar year deductible which most health plans operate on begins on January 1 and ends on December 31 Calendar year deductibles reset every January 1

https://help.ihealthagents.com/hc/en-us/articles/1500003312222-What-s-the-difference-between-calendar-year-and-group-plan-year-

A calendar year deductible what most health plans operate on begins on January 1st and ends on December 31st Calendar year deductibles

http://mylife-ts.adp.com/2023/02/calendar-year-versus-plan-year-and-why-it-matters-for-your-benefits/

Think of a 12 month period of time and chances are it s Jan 1 to Dec 31 known as Calendar Year Benefits coverage provided through the ADP TotalSource

https://www.healthcare.gov/glossary/plan-year

A 12 month period of benefits coverage under a group health plan This 12 month period may not be the same as the calendar year To find out when your plan

https://truenorthcompanies.com/blog/benefits/how-to-determine-your-health-plans-plan-year.aspx

Many employers operate their health plans on a calendar year basis from Jan 1 through Dec 31 of each year Other employers operate their plans on a non

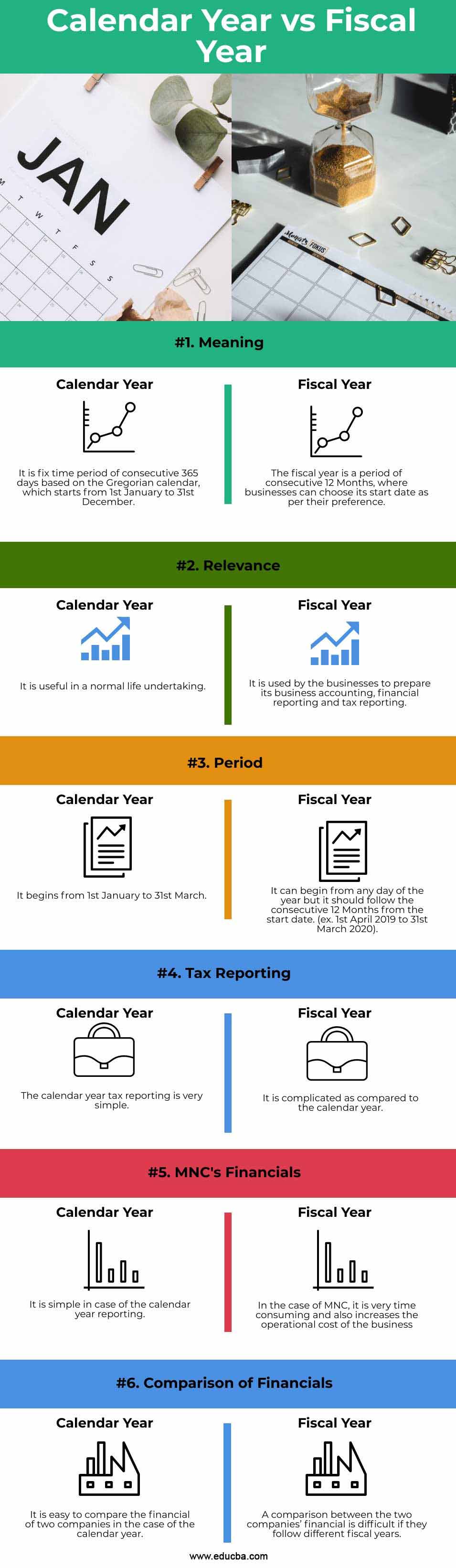

Defined contribution plans generally follow calendar years which prevents compliance and administration complications that arise from an 31 as a calendar year does but not all fiscal years do This is because certain entities can choose when their fiscal year starts and ends

Many 401 k plans for example have quarterly entry dates For calendar year plans these are easy to determine however for off calendar plan years the