Fsa Plan Year Or Calendar Year WEB Feb 8 2024 nbsp 0183 32 An FSA allows you to save for medical expenses and health insurance costs over the year so you can pay for them tax free There were over 2 4 million flexible

WEB 6 days ago nbsp 0183 32 The inclusion of the grace period extends the plan year to 14 months and 15 days as opposed to the 12 month actual plan For calendar year plans the grace WEB May 11 2024 nbsp 0183 32 2023 amp 2024 flexible spending account FSA basics pros cons maximum contribution qualified medical expenses carryover rule vs HSAs

Fsa Plan Year Or Calendar Year

Fsa Plan Year Or Calendar Year

Fsa Plan Year Or Calendar Year

http://www.fraserlawfirm.com/blog/wp-content/uploads/2013/08/IRS1.jpg

WEB Dec 26 2017 nbsp 0183 32 FSAs are accounts where employees can put away pre taxed funds for eligible medical expenses not covered under their health insurance These accounts are run on a calendar year since the IRS

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by providing a ready-made format and design for developing various sort of content. Templates can be used for personal or expert tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Fsa Plan Year Or Calendar Year

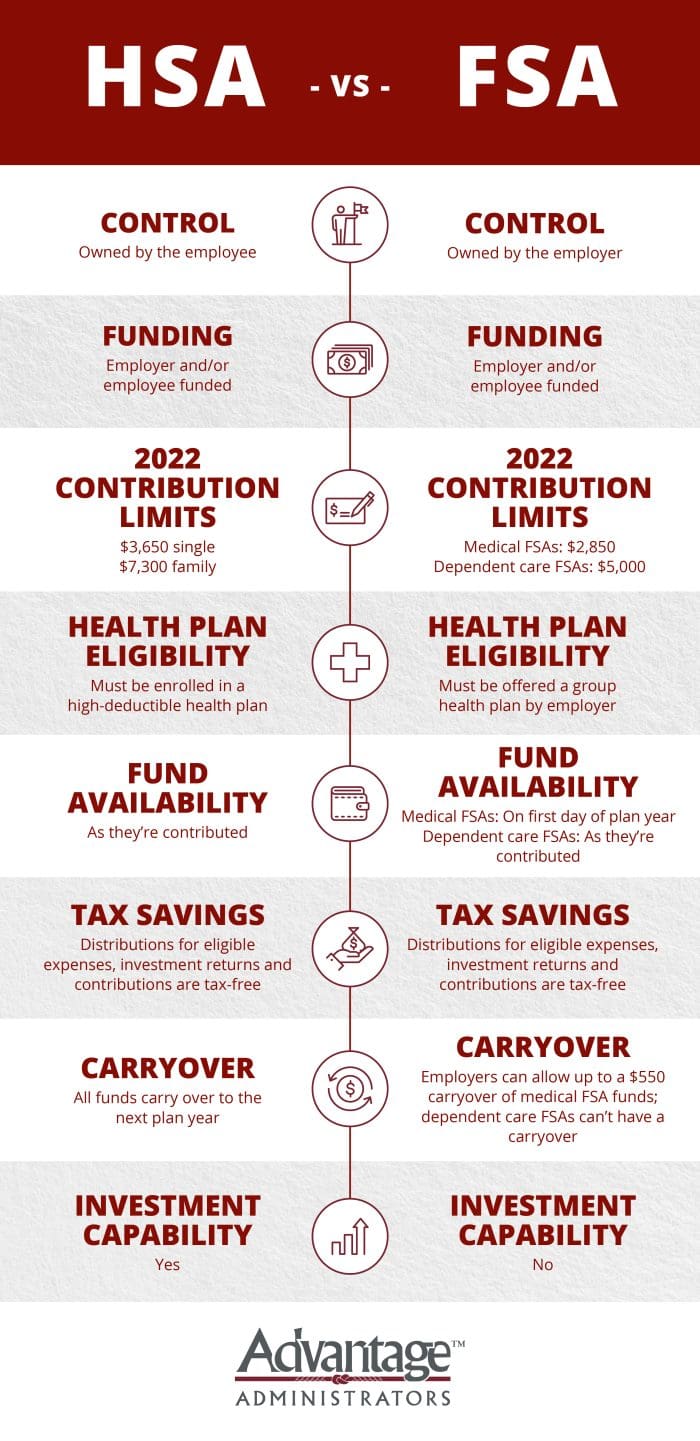

HSA Vs FSA See How You ll Save With Each Advantage Administrators

What Are FSAs And HSAs For Eyes Blog

What Is Fsa hra Eligible Health Care Expenses Judson Lister

Fsa 2023 Contribution Limits 2023 Calendar

FSA And HSA Plans What s Your Plan Spruce Health Group

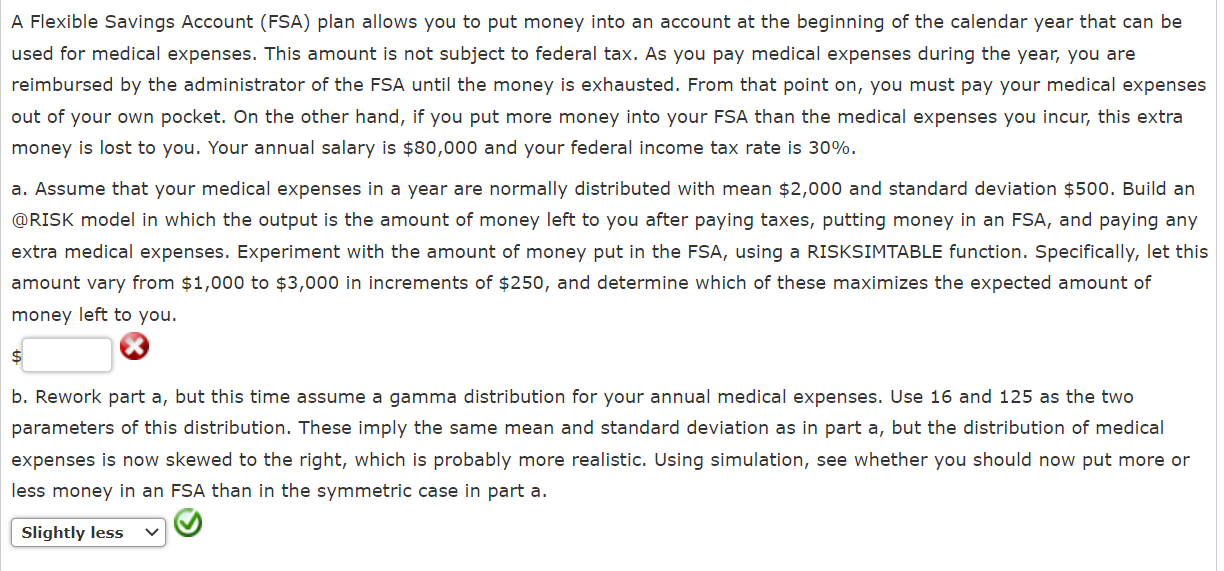

Solved A Flexible Savings Account FSA Plan Allows You To Chegg

https://www.linkedin.com/pulse/mid-year-medical...

WEB May 2 2022 nbsp 0183 32 Some employers run their Health FSAs on a calendar year and renew their medical plans on another date often July 1 but it could be any month after January

https://mylife-ts.adp.com/2023/02/calendar-year...

WEB HCFSA contribution limits are based on the enrolled Plan Year as are HCFSA enrollment and contributions elections IRS contribution limits follow Calendar Year so take this into

https://www.quantumsoftech.com/blog/fsa-plan-year...

WEB Dec 26 2022 nbsp 0183 32 The plan year refers to the 12 month period during which the FSA operates typically aligning with the calendar year or the employer s fiscal year These rules

https://www.ascensus.com/industry-regulatory-news/...

WEB Sep 16 2022 nbsp 0183 32 Though many Health FSAs run on the calendar year either to align with the medical plan renewal or to run on the tax year employers can set any 12 month plan

https://www.nerdwallet.com/article/health/what-is-flexible-spending-account

WEB Apr 11 2022 nbsp 0183 32 To decide if an FSA is right for you forecast upcoming health and dependent care expenses for the year plus general drugstore item spending and become familiar

WEB Jul 12 2021 nbsp 0183 32 Contribution limits apply to a plan year which could be the renewal date of the company s group health insurance coverage not necessarily a calendar year How WEB It basically extends the length of time you can use your FSA funds beyond the end of the plan year In this example your plan year is January 1 2023 through December 31

WEB Mar 3 2023 nbsp 0183 32 What is the FSA deadline to submit claims The deadline to submit claims is usually Dec 31 of the plan year but your employer can extend it