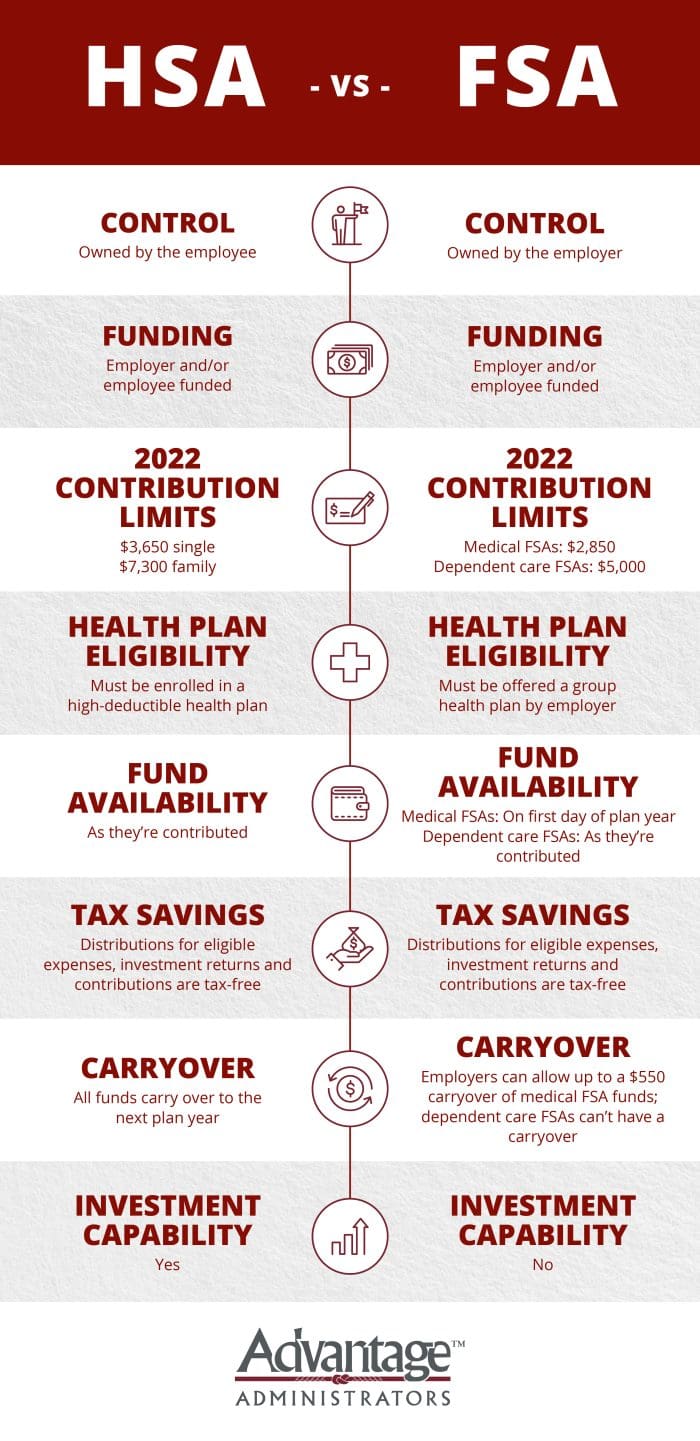

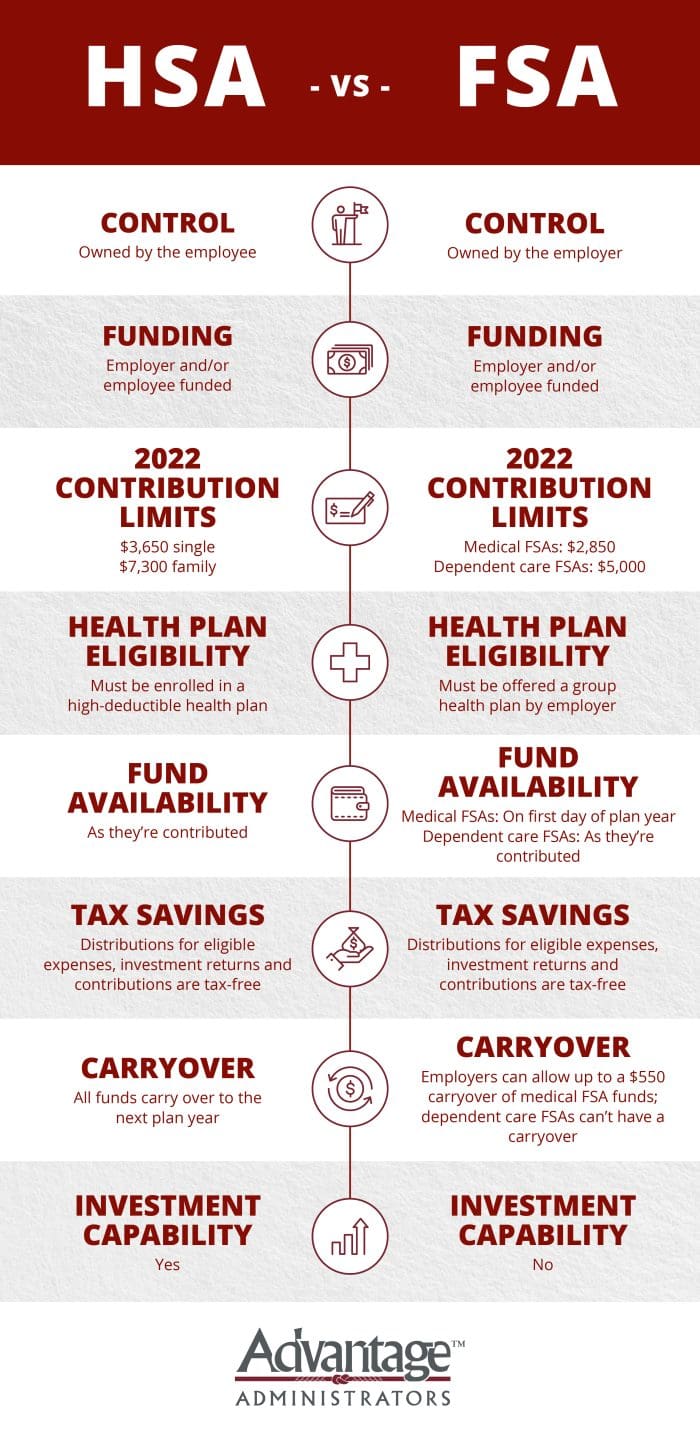

Hsa Plan Year Or Calendar Year Web Dec 12 2023 nbsp 0183 32 Today we ll review HSA contribution limits and deadlines the value of HSAs as a tax planning and retirement planning tool and investing your HSA balance With the year swiftly coming to a close it s time for taxpayers to think about those year end financial housekeeping items

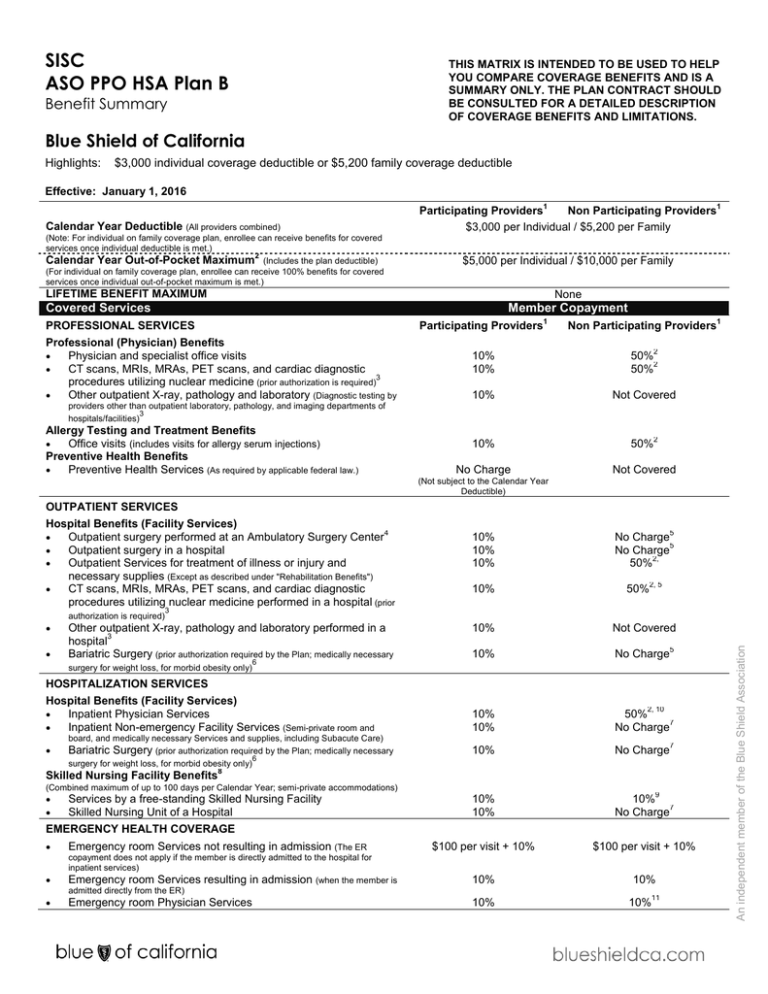

Web Aug 2 2023 nbsp 0183 32 HSA contribution limits apply on a calendar year basis regardless of whether the medical plan runs on a calendar year Employees who join an employer s HDHP plan and become eligible for HSA contributions mid year will need to pro rate their contribution based on the number of months of the year they are HSA eligible Web Jan 5 2024 nbsp 0183 32 The plan must also have an annual out of pocket maximum of 8 050 for self coverage for the 2024 tax year 7 500 for 2023 and 16 100 for families for the 2024 tax year 15 000 for 2023

Hsa Plan Year Or Calendar Year

Hsa Plan Year Or Calendar Year

Hsa Plan Year Or Calendar Year

https://advantageadmin.com/wp-content/uploads/2022/04/HSA-vs-FSA-blog-graphic-700x1441.jpg

Web Jul 17 2020 nbsp 0183 32 HSA Contribution Limits Calendar Year Limit HSA contribution limits are based on the calendar year They are not related to the employer s HDHP plan year The HSA contribution limits are adjusted annually for inflation currently at the following levels 2020 Contribution Limits Individual HDHP Coverage 3 550 Family HDHP Coverage

Pre-crafted templates use a time-saving solution for producing a diverse range of files and files. These pre-designed formats and layouts can be made use of for various personal and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the material development process.

Hsa Plan Year Or Calendar Year

FSA And HSA Plans What s Your Plan Spruce Health Group

:max_bytes(150000):strip_icc()/hsa-vs-ppo-5191333_round2-5443d932f915427a9510be94226152d3.png)

HSA Vs PPO

Health Spending Accounts What s The Difference Between An HSA And FSA

Form 8889 Instructions Information On The HSA Tax Form

HSA FSA Use It Or Lose It Why Not Use For Dental Plan DentalStores

What Is A Health Reimbursement Account HRA

https://skh.one/hsa-calendar-year-vs-plan-year

Web May 19 2021 nbsp 0183 32 The limit in contributions is based on the calendar year meaning the EXCHEQUER prorates allowable contributions by the number of months an individuality lives eligible to contribute to an HSA If you are 55 or older by the finalize of the time you can make an additional 1 000 catch up contribution to get HSA

https://benefitslink.com/boards/topic/62388-hsafsa...

Web Apr 24 2018 nbsp 0183 32 The IRS sets FSA and HSA limits based on calendar year Our benefit year is 10 1 to 9 30 Can we setup our plans so the limits follow the benefit year rather than the calendar year I ve not seen this done but have been told that our legal department has approved this process so long as we stay c

https://www.benstrat.com/downloads/HSA-GPS_HSAs...

Web Last Month Rule If you become eligible by December 1 you can contribute up to the limit for the calendar year in our example up to the full 3 650 rather than only 608 You must remain HSA eligible through the testing period through the

https://mylife-ts.adp.com/2023/02/calendar-year...

Web Calendar Year versus Plan Year and why it matters for your benefits Think of a 12 month period of time and chances are it s Jan 1 to Dec 31 known as Calendar Year Benefits coverage provided through the ADP TotalSource Health and Welfare Plan is based on a Plan Year June 1 through May 31 of the following year

https://www.marketplace.org/2017/12/26/deductible...

Web Dec 26 2017 nbsp 0183 32 When health insurance companies price their insurance premiums and design their plans they do so based on a calendar year Same goes for employers explained Palanker

Web Jun 3 2019 nbsp 0183 32 If you started your hdhp on March 1 you have 10 months of eligibility this year and can contribute 10 12 of the 7k max Next year if you switched to a non HSA eligible plan on March 1 you can contribute 2 12 of the annual max for 2020 If your plan didn t start on March 1 but some day later in the month you d have only 9 months of Web Jul 10 2023 nbsp 0183 32 Every year the Internal Revenue Service IRS sets the maximum that can be contributed to an HSA For example if your HSA contribution limit for the year is 3 850 as it is in 2023 and your employer contributes 1 000 you can only contribute 2 850 unless you re eligible for a catch up contribution of 1 000

Web Feb 1 2024 nbsp 0183 32 HSA contribution limits for 2023 are 3 850 for singles and 7 750 for families HSA contribution limits for 2024 are 4 150 for singles and 8 300 for families As a tax saving money saving vehicle HSAs can t be beat To qualify for an HSA you must have a high deductible health plan