Fsa Plan Year Vs Calendar Year FSAs are an IRS regulated benefit and your FSA enrollment does not carry over from year to year Your contributions end on December 31 You will need to enroll

Some employers run their Health FSAs on a calendar year and renew their medical plans on another date often July 1 but it could be any month An employee is covered by a non calendar year cafeteria plan that offers a DC FSA benefit The cafeteria plan has a July 1 to June 30 plan year

Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year

https://advantageadmin.com/wp-content/uploads/2020/12/20_12_22-700x467.jpeg

When there is a short plan year for a valid business purpose the plan must prorate the Health FSA salary reduction contribution limit for the short plan year

Pre-crafted templates use a time-saving option for producing a varied series of documents and files. These pre-designed formats and designs can be used for numerous individual and expert projects, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the content production process.

Fsa Plan Year Vs Calendar Year

Flexible Spending Accounts 2023 | Beverly, MA

Flexible Spending Accounts (Healthcare FSA & Dependent Care FSA) – Justworks Help Center

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings vs. Flexible Spending Account: What's the Difference?

FSA vs. HSA: Which camp are you? | BRI | Benefit Resource

IRS clarifies aspects of recent FSA and cafeteria plan accommodations | Lockton

HSA and FSA Accounts: What You Need to Know | Readers.com®

https://benefitslink.com/boards/index.php?/topic/62388-hsafsa-benefit-year-vs-calendar-year/

The IRS sets FSA and HSA limits based on calendar year Our benefit year is 10 1 to 9 30 Can we setup our plans so the limits follow the

https://www.benstrat.com/the-fsahsa-misalignment-conundrum/

The company s FSA program runs on the calendar year The medical plan anniversary date is mid year let s say Sept 1 The company wants to

https://www.ascensus.com/news/news-articles/is-your-flexible-spending-account-configured-to-meet-your-company-s-needs/

Though many Health FSAs run on the calendar year either to align with the medical plan renewal or to run on the tax year employers can

https://www.dwt.com/blogs/employment-labor-and-benefits/2012/05/how-do-noncalendar-year-cafeteria-plans-comply-wit

The simple approach is to limit each Health FSA participant to a maximum contribution of 2 500 for the plan year beginning in 2012 This

https://20somethingfinance.com/flexible-spending-account-fsa-basics/

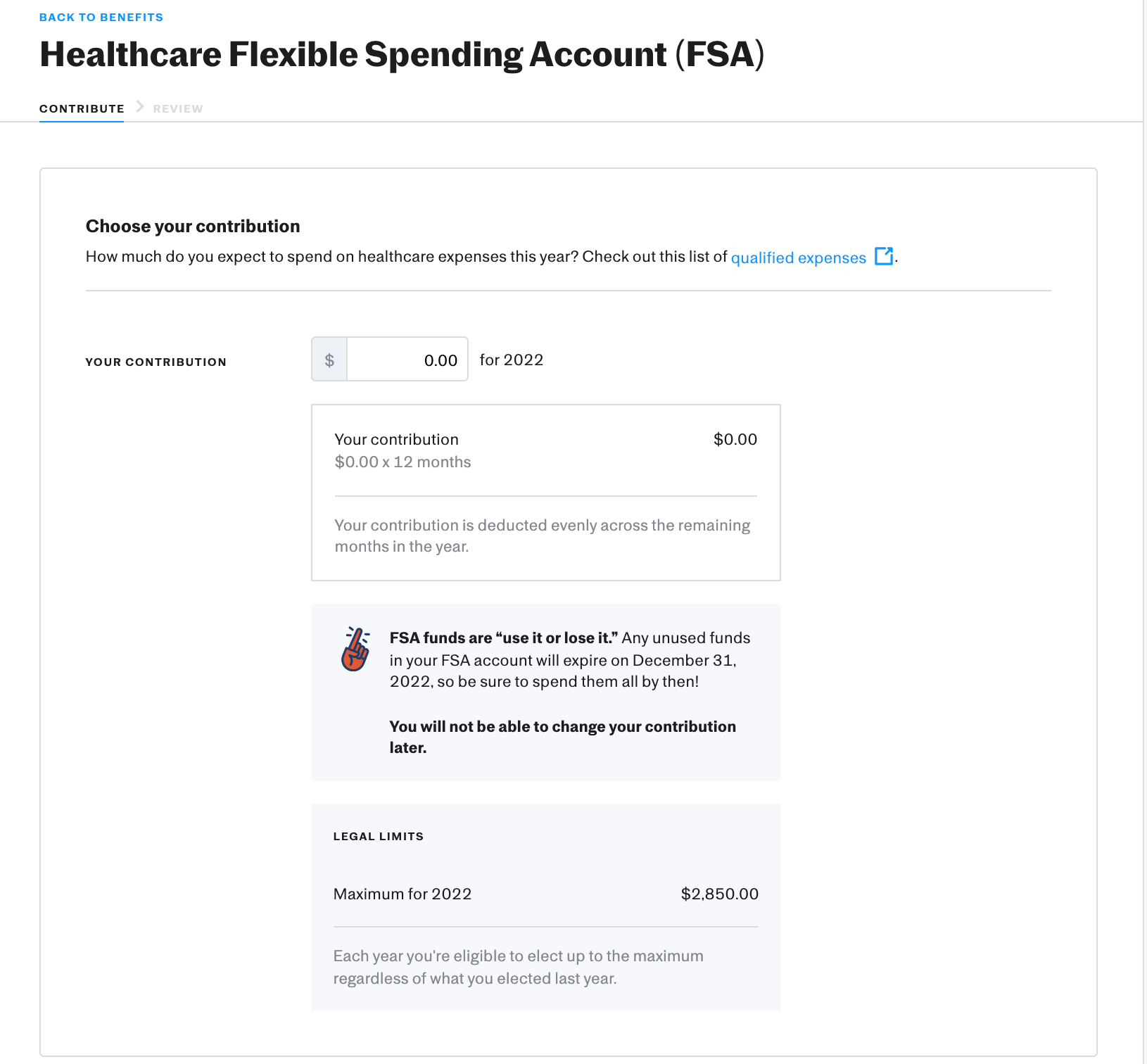

This rule stated that you must use all of your annual contributions to an FSA by the end of that calendar year The challenge with the use it or

Calendar year vs fiscal year All Intuit benefit plans follow the Intuit fiscal year August 1 through July 31 However the IRS annual contribution maximum is Dependent Care FSAs don t require you to prorate the maximum although an employee can t elect more than the IRS maximum within a calendar year If you don t

The FSA plan year begins each July 1 and ends on June 30 The FSA Program has two separate plans If you are eligible you may participate in one plan or