401k Plan Year Vs Calendar Year Aug 2 2024 nbsp 0183 32 Find general information about 401 k plans the tax advantages of sponsoring the plan and the types of plans available A 401 k plan is a qualified plan that includes a feature

Jan 18 2024 nbsp 0183 32 Using the principle of maximizing time in the market some 401 k plan holders could consider maximizing their contributions as early as possible in the year After all there is a limit as to how much you can contribute per year Jul 25 2022 nbsp 0183 32 Below describes each necessary task in managing a 401 k plan based on a calendar year January Send the Third Party Administrator TPA a full year census from the

401k Plan Year Vs Calendar Year

401k Plan Year Vs Calendar Year

401k Plan Year Vs Calendar Year

https://jfwaccountingservices.cpa/wp-content/uploads/2022/08/Fiscal-Year-vs-Calendar-Year-1536x864.jpg

May 27 2024 nbsp 0183 32 Employees can contribute up to 23 000 to their 401 k plan for 2024 vs 22 500 for 2023 Anyone age 50 or over is eligible for an additional catch up contribution of 7 500 for both 2024

Templates are pre-designed files or files that can be used for numerous purposes. They can save time and effort by providing a ready-made format and layout for developing various kinds of content. Templates can be used for personal or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

401k Plan Year Vs Calendar Year

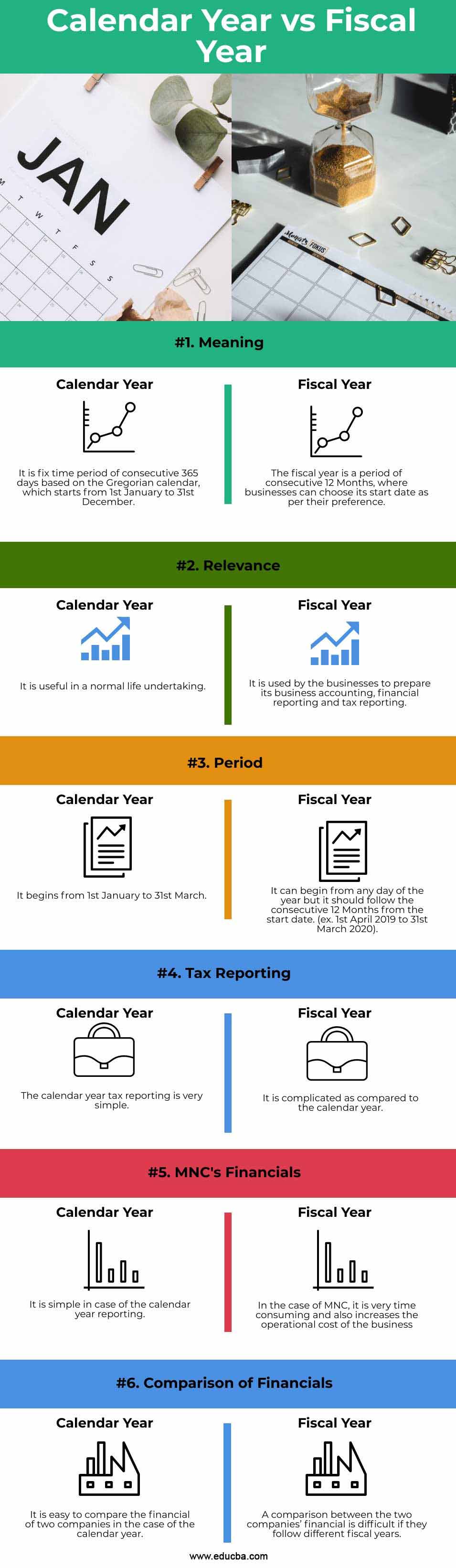

Fiscal Year VS Calendar Year For Business Taxes FundsNet

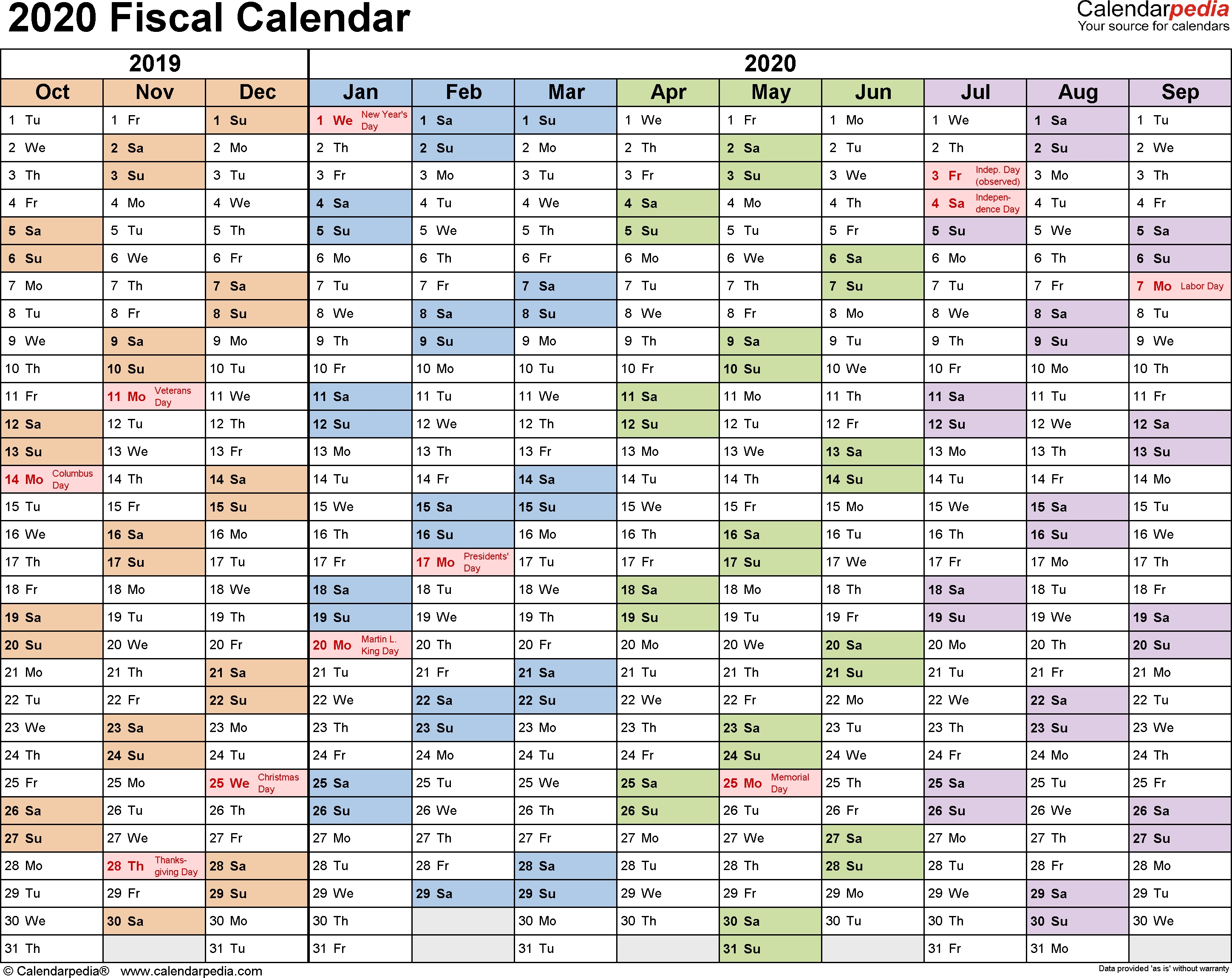

Fiscal Year Vs Calendar Year Marketing Calendar Template Yearly

Us Government Pay Calendar 2023 Get Latest News 2023 Update

Fiscal Year Vs Calendar Year Which To Choose Moose Creek

Fiscal Year Vs Calendar Year Top 8 Differences You Must Know

What Is A Fiscal Year Vs Calendar Year Investment U

https://www.rpgconsultants.com/401k-plan-use-calendar-plan-year

Jun 5 2017 nbsp 0183 32 Defined contribution plans generally follow calendar years which prevents compliance and administration complications that arise from an off calendar plan year Off

https://www.dwc401k.com/blog/what-is-a-short-plan...

Nov 12 2019 nbsp 0183 32 Our company operates on a calendar tax year but our 401 k plan runs on a fiscal year ending each June 30 th It is a real hassle to manage two different year ends so we

https://www.dwc401k.com/.../off-calend…

For calendar year plans these dates are easy to manage however for off calendar plan years it is important to identify whether the first day of the quarter is really defined as the first day of every fourth month of the plan year

https://www.employeefiduciary.com/blog/why-a-short...

Mar 13 2024 nbsp 0183 32 401 k plans must define a 12 month plan year for annual administration purposes Most plans choose a calendar year for administrative ease A new plan can specify

https://www.asppa-net.org/news/2019/12/short-plan...

Dec 1 2019 nbsp 0183 32 A recent blog post from DWC The 401 k Experts defines the term but argues that what s more important is why a short plan year exists The post points out that defining a short

May 31 2018 nbsp 0183 32 Retirement plans may experience a short plan year upon termination upon a new plan s adoption or if the plan year is amended for example The Internal Revenue Service Jun 4 2024 nbsp 0183 32 For example let s say your plan has a July 1 to June 30 plan year In determining the 401 a 17 limit for the 2024 plan year you could use the plan year or any 12 month

Sep 16 2024 nbsp 0183 32 Contributions to a 401 k are generally due by the end of the calendar year For instance assume that an employee makes an election to defer part of a bonus to be received