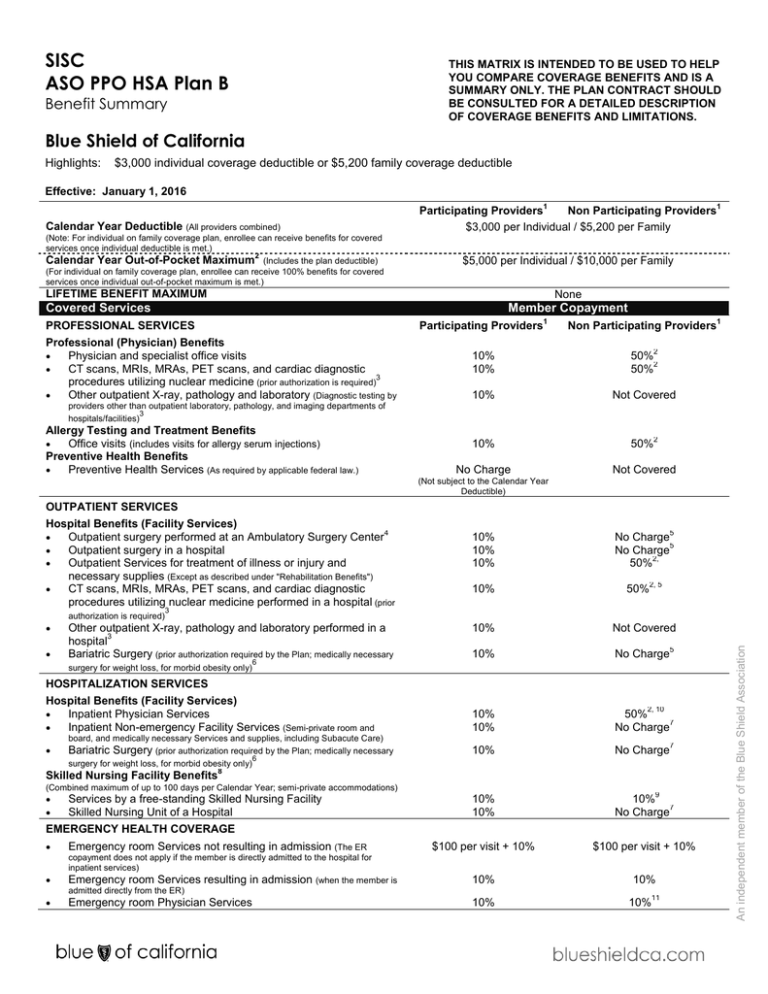

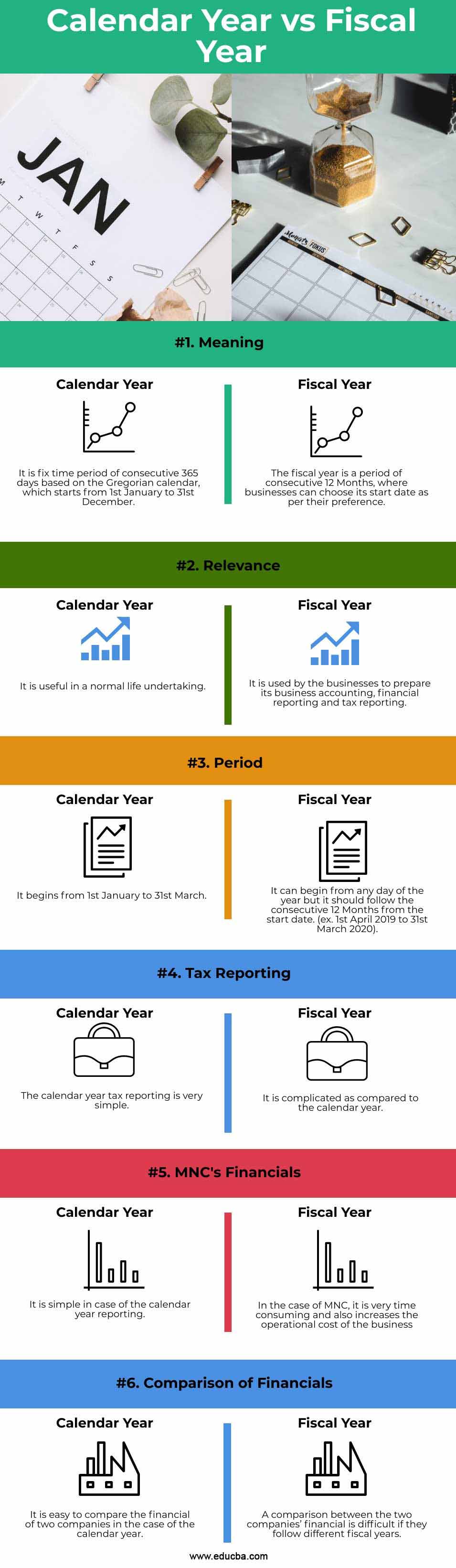

Hsa Plan Year Vs Calendar Year Dec 26 2017 nbsp 0183 32 However for the most part keeping health plans on a calendar year is easier and more efficient for most involved the insurer the employer and even the employees

Does my HSA align with my plan year HSAs always align to the calendar year But your company s plan year is based on their annual renewal date which may or may not align to Health Savings Account HSA rules generally apply to calendar years regardless of when your company s benefits renew when you join the plan or when you leave the plan

Hsa Plan Year Vs Calendar Year

Hsa Plan Year Vs Calendar Year

Hsa Plan Year Vs Calendar Year

https://i.ytimg.com/vi/ioUQFfCXVTc/maxresdefault.jpg

May 20 2024 nbsp 0183 32 An HSA allows you to pay lower federal income taxes by making tax free deposits each year You can enroll in an HSA qualified high deductible health plan during open

Pre-crafted templates provide a time-saving service for developing a varied variety of files and files. These pre-designed formats and layouts can be made use of for numerous personal and expert projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, improving the content creation procedure.

Hsa Plan Year Vs Calendar Year

FSA And HSA Plans What s Your Plan Spruce Health Group

:max_bytes(150000):strip_icc()/hsa-vs-ppo-5191333_round2-5443d932f915427a9510be94226152d3.png)

HSA Vs PPO

Fiscal Year Vs Calendar Year What s Right For Your Business

HSA Compatible High Deductible Health Plans Www westernhealth

Health Spending Accounts What s The Difference Between An HSA And FSA

Fiscal Year VS Calendar Year For Business Taxes FundsNet

https://www.investopedia.com › article…

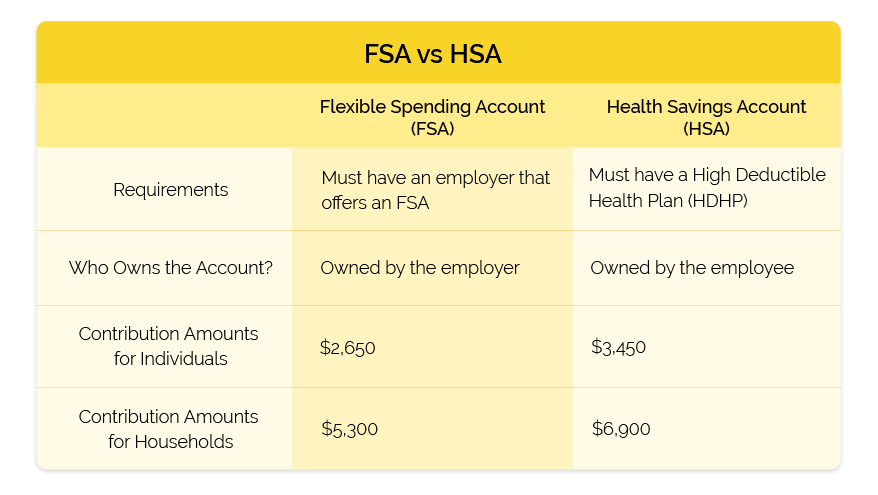

Sep 23 2024 nbsp 0183 32 An HSA lets you set aside pre tax income to cover healthcare costs if you have a qualifying high deductible health plan For the 2024 tax year the maximum contribution amounts are 4 150 for

https://www.fidelity.com › ... › hsa-contribution-limits

Aug 29 2024 nbsp 0183 32 The HSA contribution limits for 2024 are 4 150 for self only coverage and 8 300 for family coverage Those 55 and older can contribute an additional 1 000 as a catch up

https://www.irs.gov › publications

Health FSA contribution and carryover for 2022 Revenue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under section 125 i on

https://www.insuranceisboring.com › wp-content › ...

Health Savings Account HSA rules generally apply to calendar years regardless of when your company s benefits renew when you join the plan or when you leave the plan

https://www.linkedin.com › pulse › mid-year …

May 2 2022 nbsp 0183 32 It almost always makes sense to run the Health FSA and medical plan years concurrently whether the company sponsors a Health Savings Account program or not

Apr 24 2018 nbsp 0183 32 The IRS sets FSA and HSA limits based on calendar year Our benefit year is 10 1 to 9 30 Can we setup our plans so the limits follow the benefit year rather than the calendar Jan 2 2024 nbsp 0183 32 The answer here is very different For starters the HSA contribution deadline is the same date as the tax deadline This means you have roughly an additional 3 5 months after

Dec 12 2023 nbsp 0183 32 Today we ll review HSA contribution limits and deadlines the value of HSAs as a tax planning and retirement planning tool and investing your HSA balance With the year