2022 Income Tax Rates Single WEB Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for

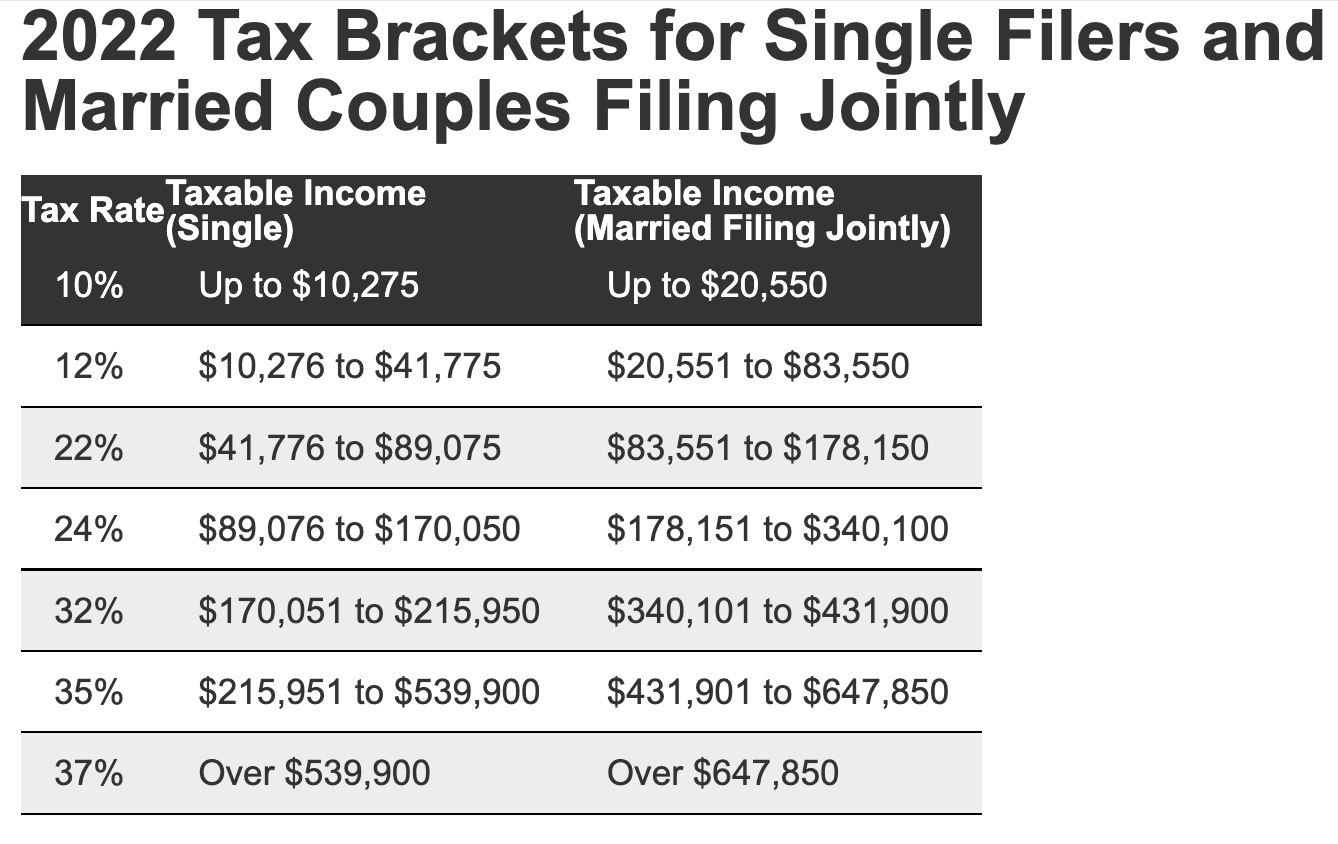

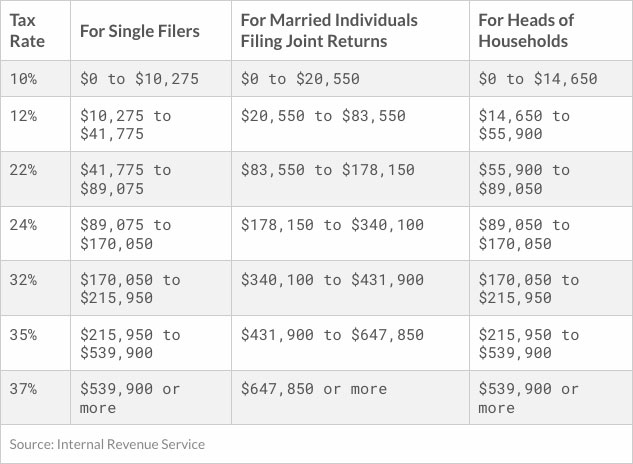

WEB Nov 11 2021 nbsp 0183 32 For single filers and married individuals who file separately the standard deduction will rise by 400 from 12 550 to 12 950 For heads of households the standard deduction will be WEB Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies to a specific range

2022 Income Tax Rates Single

2022 Income Tax Rates Single

2022 Income Tax Rates Single

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636577574/2022_Taxes_On_Screen.jpg

WEB where the taxable income line and filing status column meet is 2 628 This is the tax amount they should enter in the entry space on Form 1040 line 16 If line 15 taxable income is And you are At least But less than Single Married filing jointly Married filing sepa rately Head of a house hold Your tax is 0 5 0 0 0 0 5 15 1 1 1 1

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve time and effort by offering a ready-made format and layout for producing various type of content. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

2022 Income Tax Rates Single

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Federal Tax Brackets And Standard Deduction Printable Form

California Income Tax Brackets 2023 Q2023H

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Will Tax Brackets Change In 2022 2022 CGR

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 2023 tax rates for a single taxpayer For a single taxpayer the rates are Tax rate on taxable income from up to 10 0 11 000 12

https://www.irs.com/en/2022-federal-income-tax...

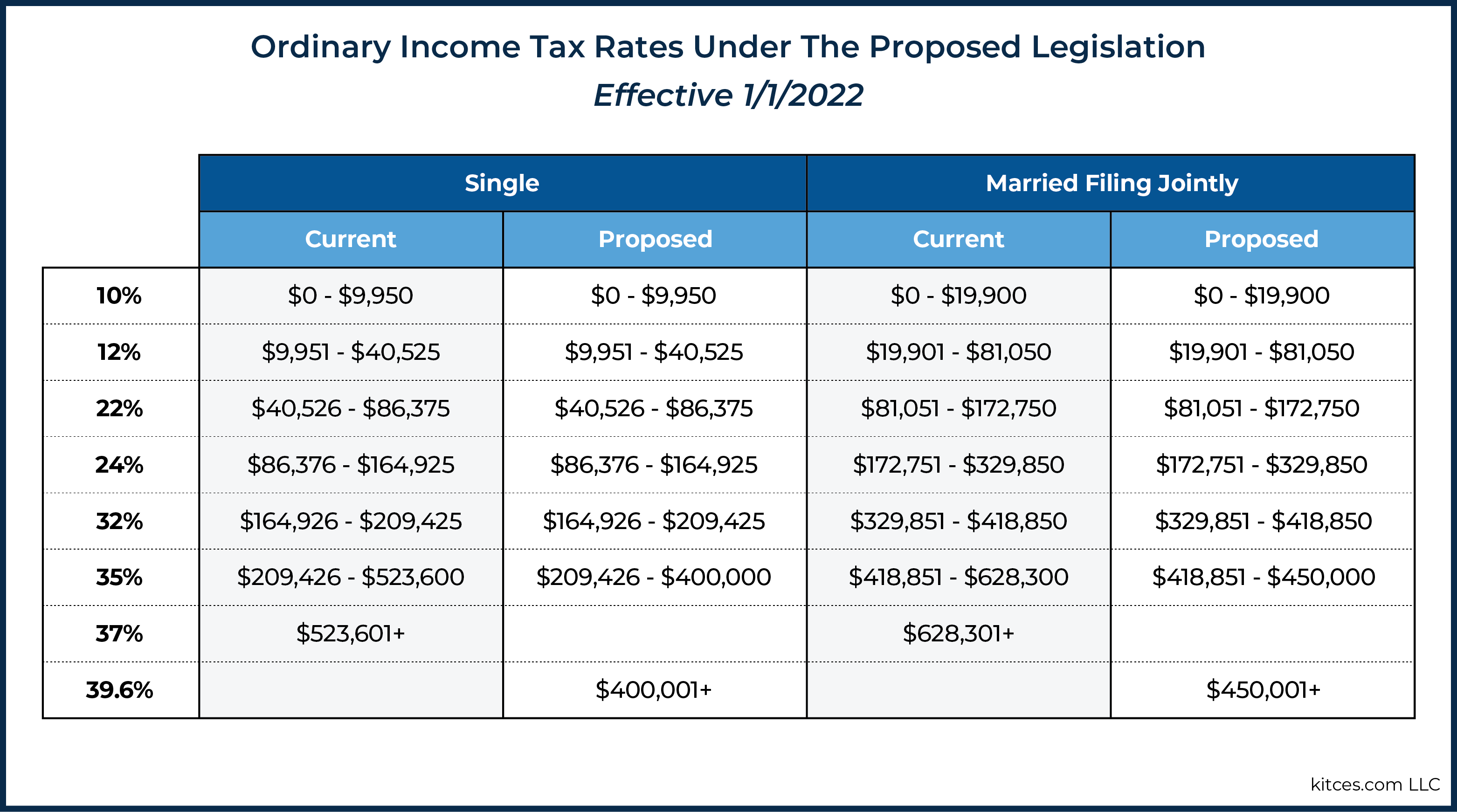

WEB Feb 21 2022 nbsp 0183 32 Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on

https://www.forbes.com/sites/ashleaebeling/2021/11/...

WEB Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

https://taxsummaries.pwc.com/united-states/...

WEB For tax year 2022 the 28 tax rate applies to taxpayers with taxable incomes above USD 206 100 USD 103 050 for married individuals filing separately For tax year 2023 the 28 tax rate applies to taxpayers with taxable incomes above USD 220 700 USD 110 350 for married individuals filing separately

https://www.irs.gov/newsroom/irs-provides-tax...

WEB Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent WEB Apr 8 2022 nbsp 0183 32 By Irina Ivanova Updated on April 8 2022 4 57 PM EDT MoneyWatch If you don t know your tax bracket you re not alone Many Americans have no idea where they fall on the scale that

WEB 6 days ago nbsp 0183 32 In 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to you and how