2022 Income Tax Brackets Table Verkko First they find the 25 300 25 350 taxable income line Next they find the column for married filing jointly and read down the column The amount shown where the taxable

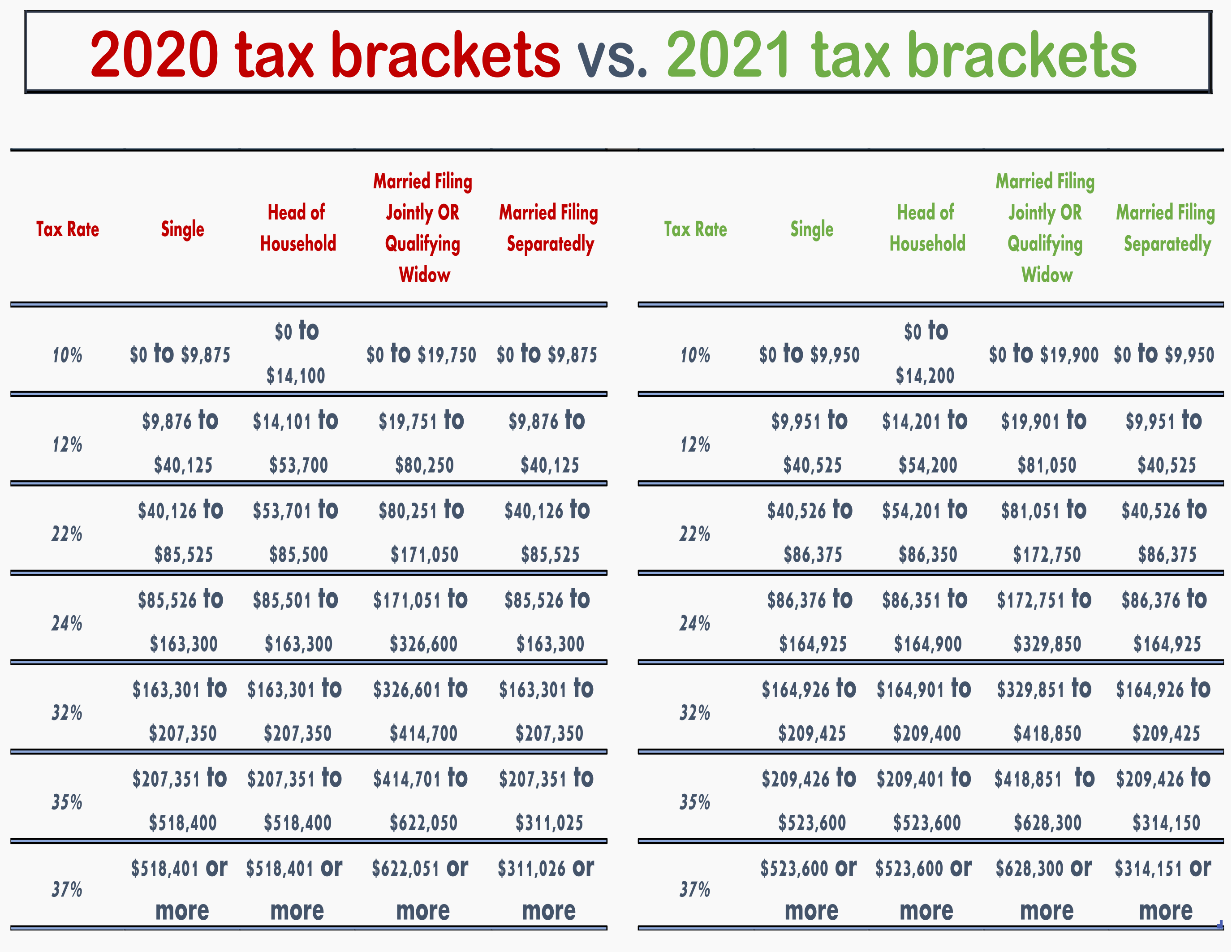

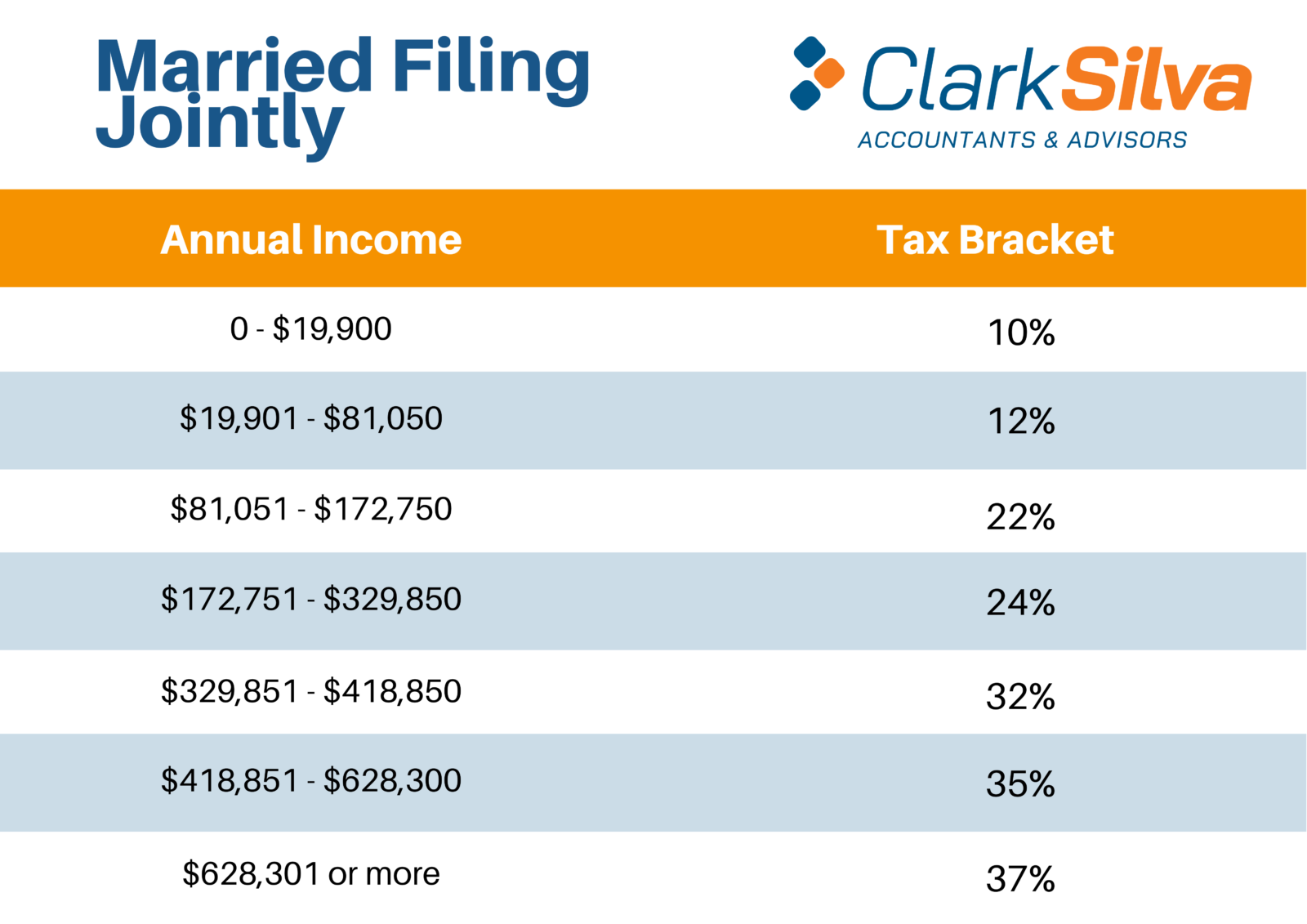

Verkko 13 marrask 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket Verkko 8 marrask 2023 nbsp 0183 32 The first 11 000 of your income is taxed at the 10 rate The next 33 724 of your income i e the amount from 11 001 to 44 725 which will make sense when you see the tax brackets

2022 Income Tax Brackets Table

2022 Income Tax Brackets Table

2022 Income Tax Brackets Table

https://i2.wp.com/fm-static.cnbc.com/awsmedia/chart/2019/11/27/110619_2020_tax_brackets.1574865436818.png

Verkko 18 lokak 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1

Pre-crafted templates provide a time-saving solution for creating a diverse variety of documents and files. These pre-designed formats and layouts can be utilized for different individual and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the content production process.

2022 Income Tax Brackets Table

2022 Georgia State Income Tax Brackets Latest News Update

2022 Tax Brackets AnnmarieEira

2022 Tax Brackets Irs Calculator

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

2022 2023 Tax Rates Federal Income Tax Brackets Top Dollar

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Verkko 10 marrask 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income

https://www.morganstanley.com/.../tax/2022-federal-tax-tab…

Verkko 18 tammik 2022 nbsp 0183 32 Tax Tables 2022 Edition Traditional IRA Deductibility Limits The max contribution limit for IRAs is 6 000 Social Security FILING STATUS PROVISIONAL

https://www.nerdwallet.com/article/taxes/fed…

Verkko 25 tammik 2018 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments...

Verkko 10 marrask 2021 nbsp 0183 32 The tax year 2022 maximum Earned Income Tax Credit amount is 6 935 for qualifying taxpayers who have three or more qualifying children up from

https://www.cnbc.com/2021/11/10/2022-income-tax-brackets-and-stand…

Verkko 10 marrask 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on

Verkko 18 lokak 2022 nbsp 0183 32 The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts Verkko 1 marrask 2022 nbsp 0183 32 Key Takeaways There are seven tax rates that apply to seven brackets of income 10 12 22 24 32 35 and 37 For tax year 2022

Verkko 18 lokak 2022 nbsp 0183 32 The tax year 2023 maximum Earned Income Tax Credit amount is 7 430 for qualifying taxpayers who have three or more qualifying children up from