2022 Personal Tax Rates Jun 5 2024 nbsp 0183 32 Medicare levy surcharge income thresholds and rates Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use

Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

2022 Personal Tax Rates

2022 Personal Tax Rates

2022 Personal Tax Rates

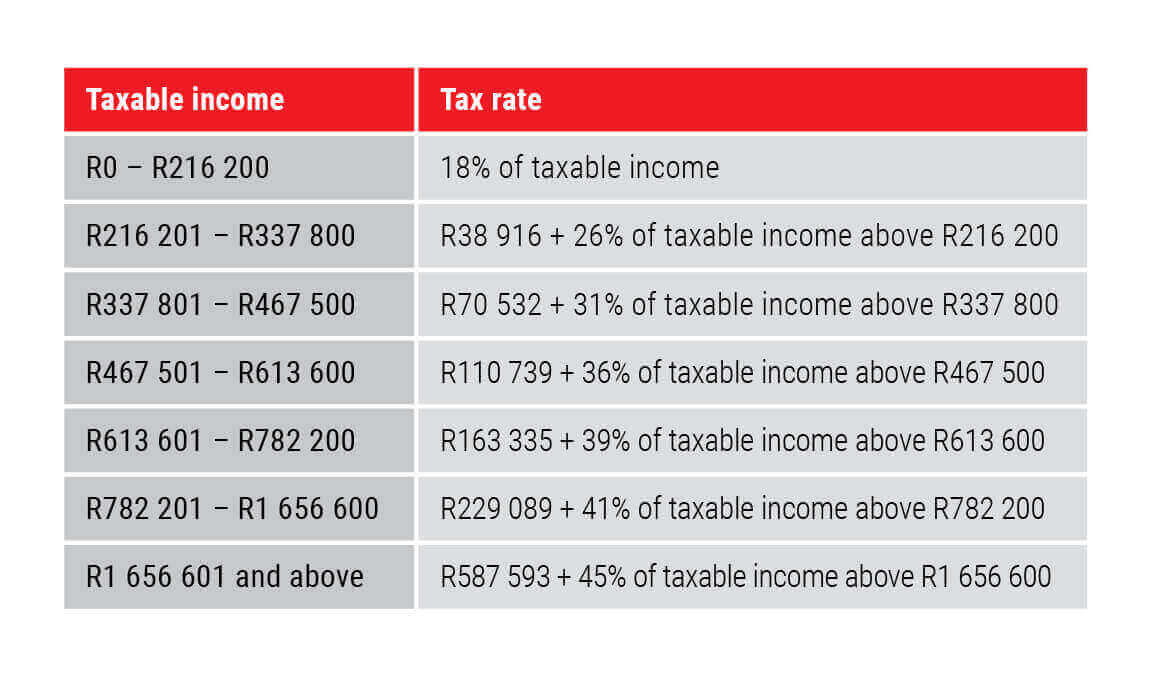

https://www.allangray.com.na/contentassets/3774c8c96f8c4032b78c507e2a0f959c/budget-speech-feb-2021-tables1.jpg

Information on income tax rates in Canada including federal rates and those rates specific to provinces and territories

Pre-crafted templates offer a time-saving option for creating a diverse range of documents and files. These pre-designed formats and designs can be utilized for various personal and expert jobs, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the content development procedure.

2022 Personal Tax Rates

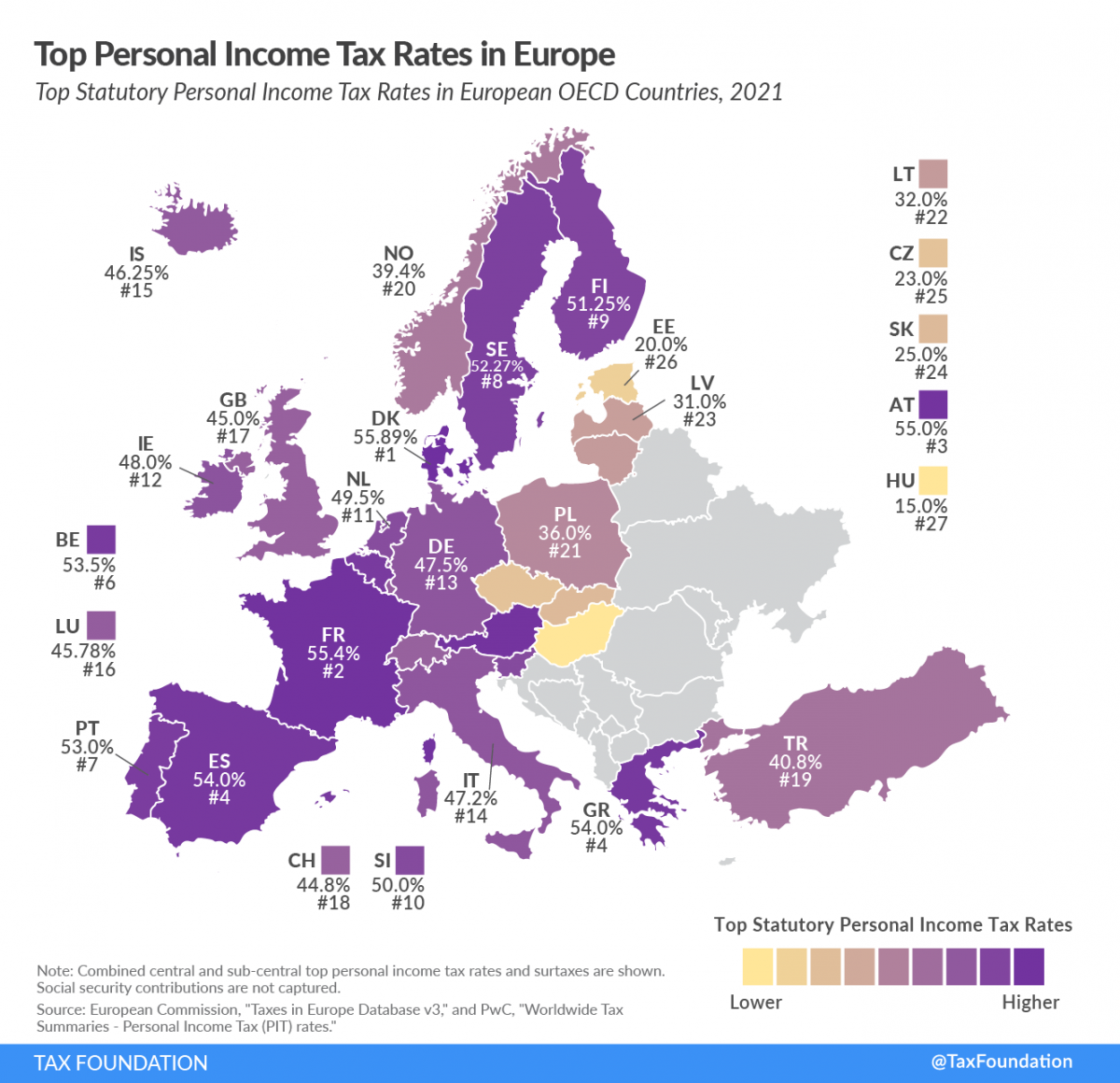

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

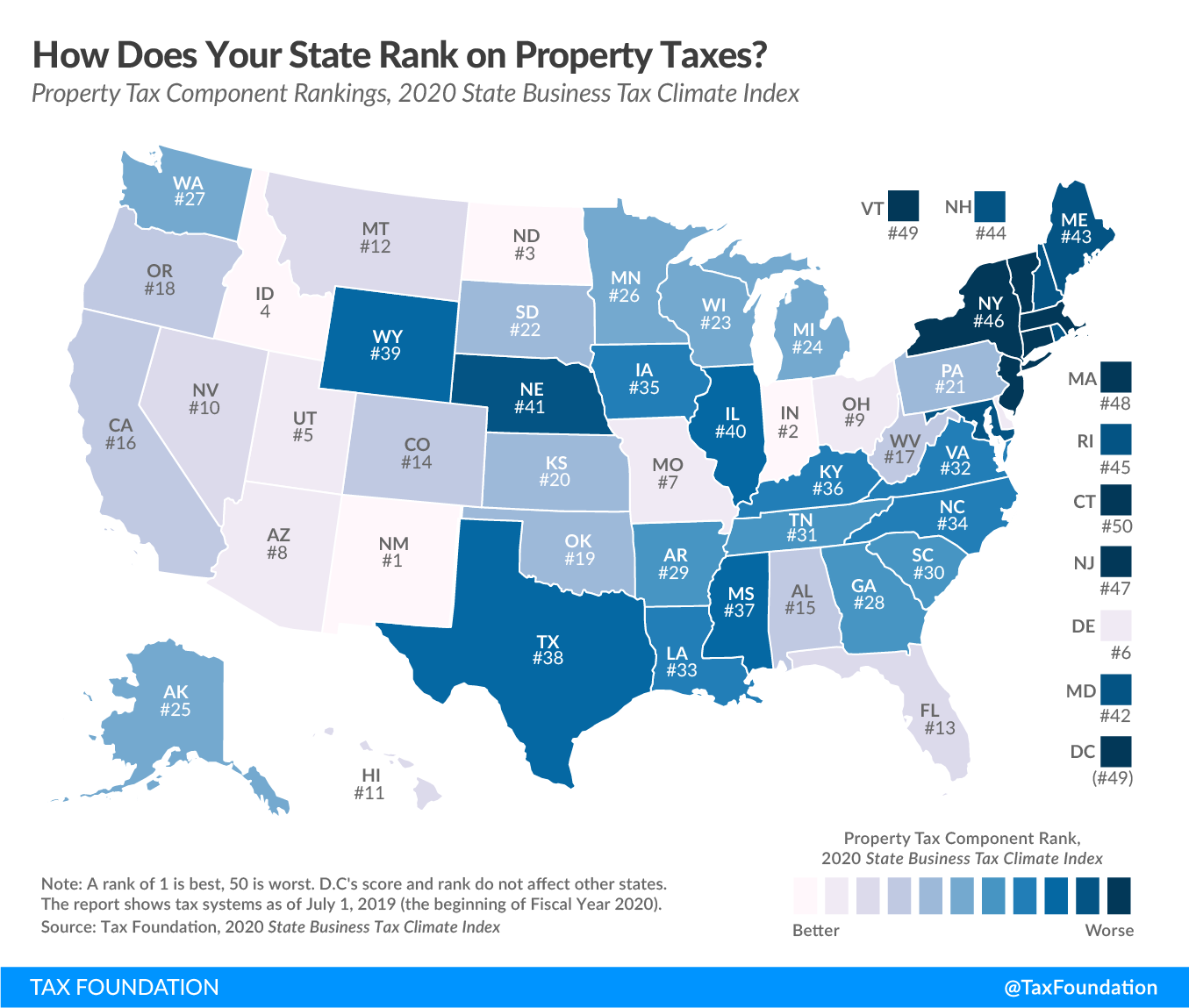

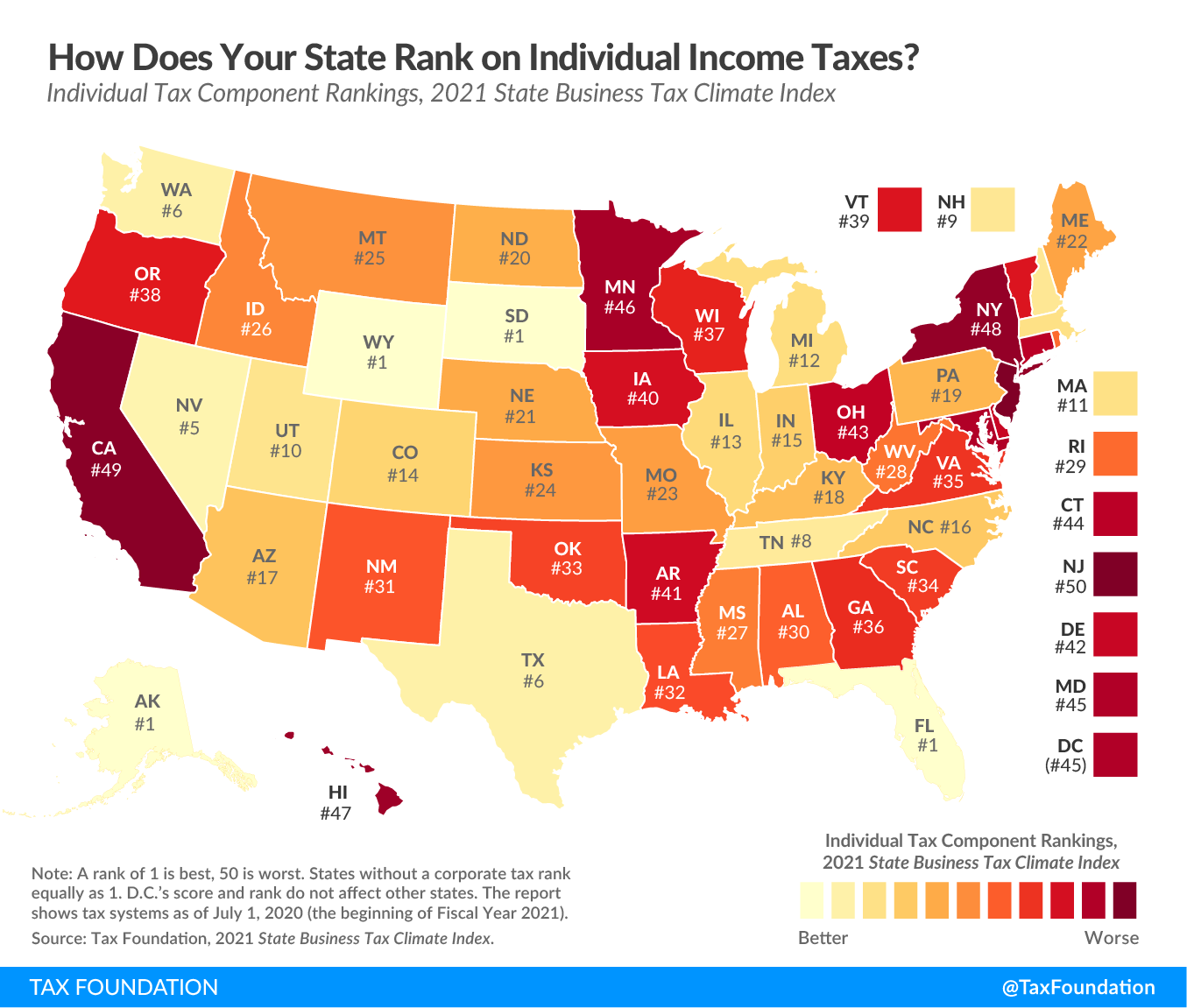

Ranking Property Taxes On The 2020 State Business Tax Climate Index

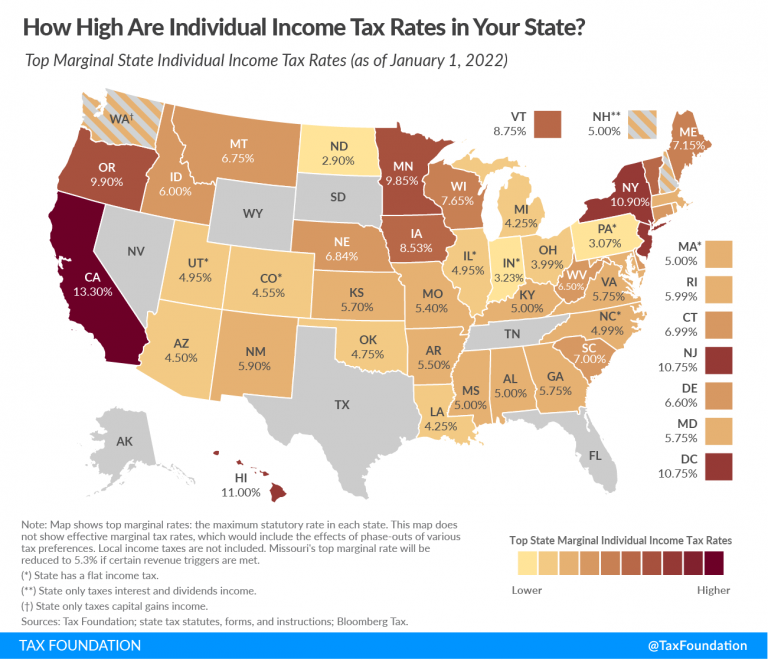

State Income Tax Rates And Brackets 2022 Tax Foundation

To Gauge Whether Your State S Property Tax Structure Has

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Income Tax 2022 23 Slab Bed Frames Ideas

https://fi.icalculator.com/income-tax-rate…

Finland Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Finland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax

https://www.vero.fi/en/individuals/tax-cards-and...

Sep 5 2024 nbsp 0183 32 You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped

https://www.gov.uk/income-tax-rates

How much of your income is above your Personal Allowance how much of your income falls within each tax band Some income is tax free The current tax year is from 6 April 2024 to 5

https://taxfoundation.org/data/all/eu/to…

Feb 8 2022 nbsp 0183 32 Denmark 55 9 percent France 55 4 percent and Austria 55 percent had the highest top statutory personal income tax rates among European OECD countries in 2021 Hungary 15 percent Estonia 20

https://www.gov.uk/government/publications/rates...

Aug 14 2024 nbsp 0183 32 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025 tax

Nov 10 2021 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard Ontario 2025 and 2024 Tax Rates amp Tax Brackets The Ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1 028 2 8 increase except

This dataset shows the top statutory personal income tax rate and top marginal tax rates for employees at the earnings threshold where the top statutory PIT Personal Income Tax rate