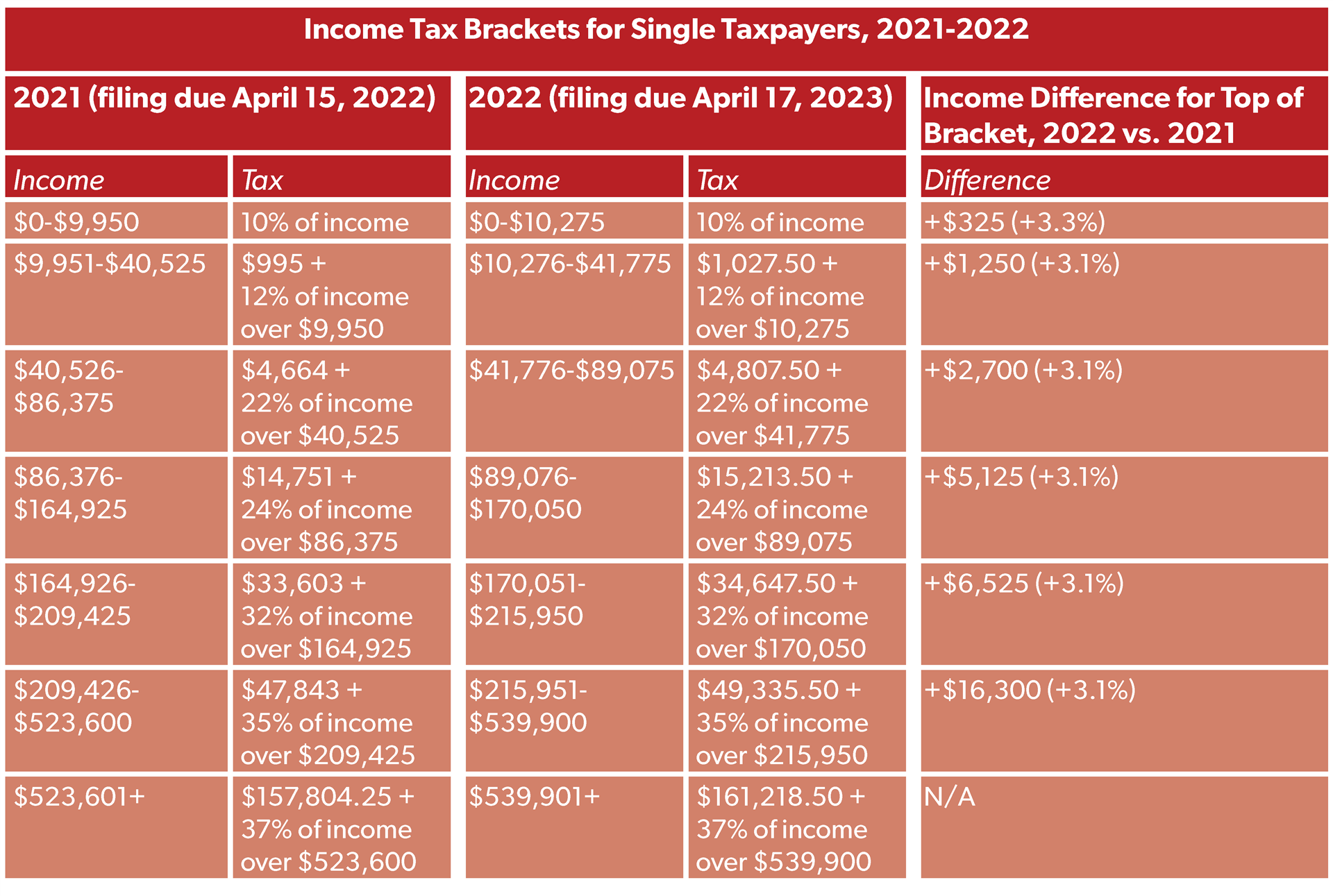

2022 Income Tax Rates Individual Web Result Nov 11 2021 nbsp 0183 32 Tax Rates for Individual Taxpayers Adjusted for Inflation Rev Proc 2021 45 provides that for tax year 2022 The top income tax rate will be 37 for

Web Result Jan 20 2022 nbsp 0183 32 The top 1 percent of taxpayers paid a 25 6 percent average individual income tax rate which is more than seven times higher than taxpayers in the Web Result Nov 10 2021 nbsp 0183 32 For married individuals filing jointly 10 Taxable income up to 20 550 12 Taxable income between 20 550 to 83 550 22 Taxable

2022 Income Tax Rates Individual

2022 Income Tax Rates Individual

2022 Income Tax Rates Individual

https://www.kitces.com/wp-content/uploads/2021/09/01-Ordinary-Income-Tax-Rates-Under-The-Proposed-Legislation-1.png

Web Result Nov 11 2021 nbsp 0183 32 The top rate of 37 will apply to income over 539 900 for individuals and heads of household and 647 850 for married couples who file jointly The full list of tax rates and

Templates are pre-designed documents or files that can be used for various purposes. They can save effort and time by offering a ready-made format and layout for developing different sort of content. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

2022 Income Tax Rates Individual

California Income Tax Brackets 2023 Q2023H

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Cukai Pendapatan How To File Income Tax In Malaysia

The Union Role In Our Growing Taxocracy California Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Will Tax Brackets Change In 2022 2022 CGR

https://www.ato.gov.au/tax-rates-and-codes/tax...

Web Result Sep 28 2023 nbsp 0183 32 Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Result Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Result Nov 10 2021 nbsp 0183 32 We have highlights below We also cover the new higher retirement accounts limits for 2022

https://www.irs.com/en/2022-federal-income-tax...

Web Result Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for

https://www.irs.gov/newsroom/irs-provides-tax...

Web Result Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for

Web Result Chargeable Income Calculations RM Rate Tax RM A 0 5 000 On the First 5 000 0 0 B 5 001 20 000 On the First 5 000 Next 15 000 1 0 150 C 20 001 Web Result Below you will find the 2022 tax rates and income brackets To access your tax forms please log in to My accounts General information Help with your tax

Web Result 3 days ago nbsp 0183 32 The marginal rates are then applied to this taxable income in order The first 11 000 of income 22 000 for joint filers is taxed at 10 taxable