2022 Tax Rate Single Filer Web Use Bankrate s free calculator to estimate your average tax rate for 2022 2023 your 2022 2023 tax bracket and your marginal tax rate for the 2022 2023 tax year

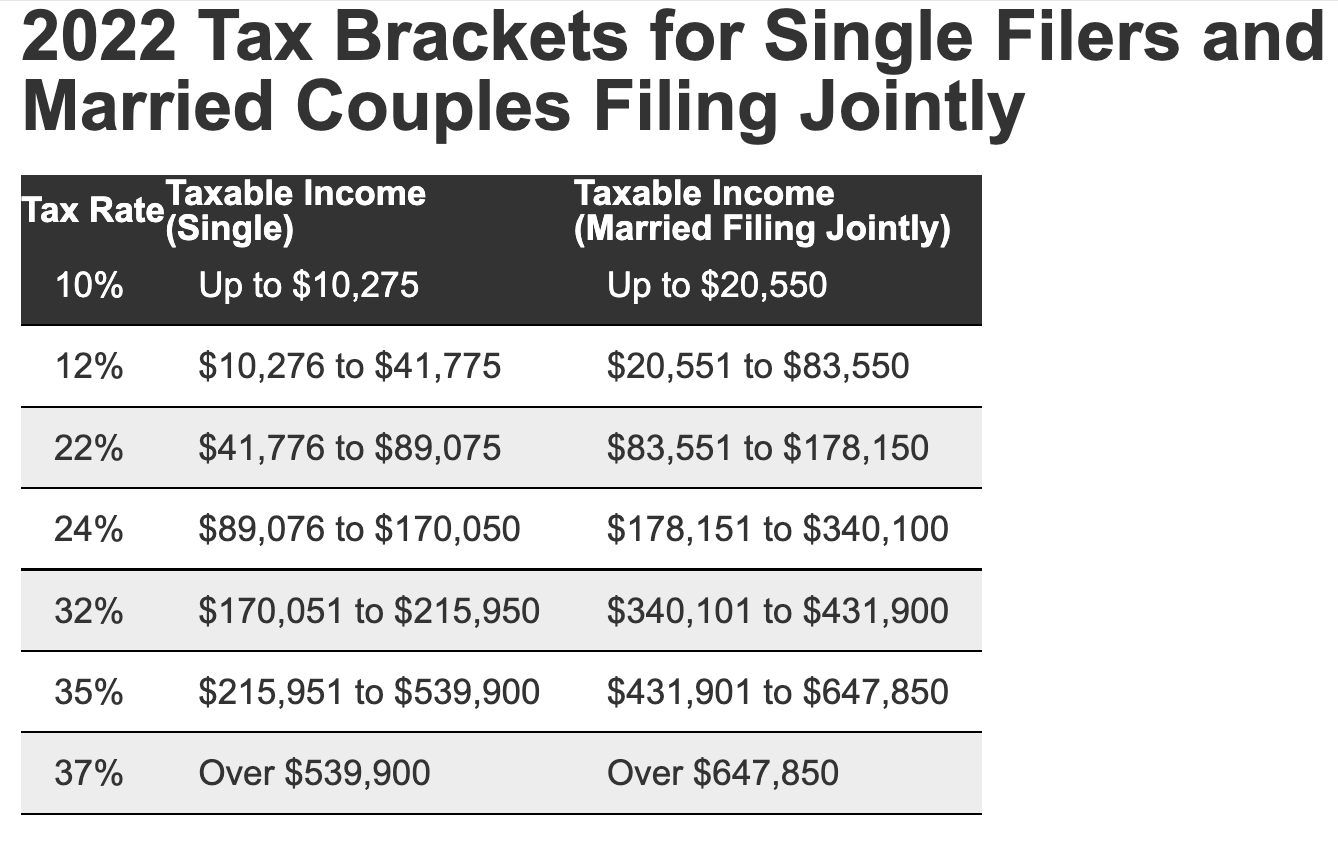

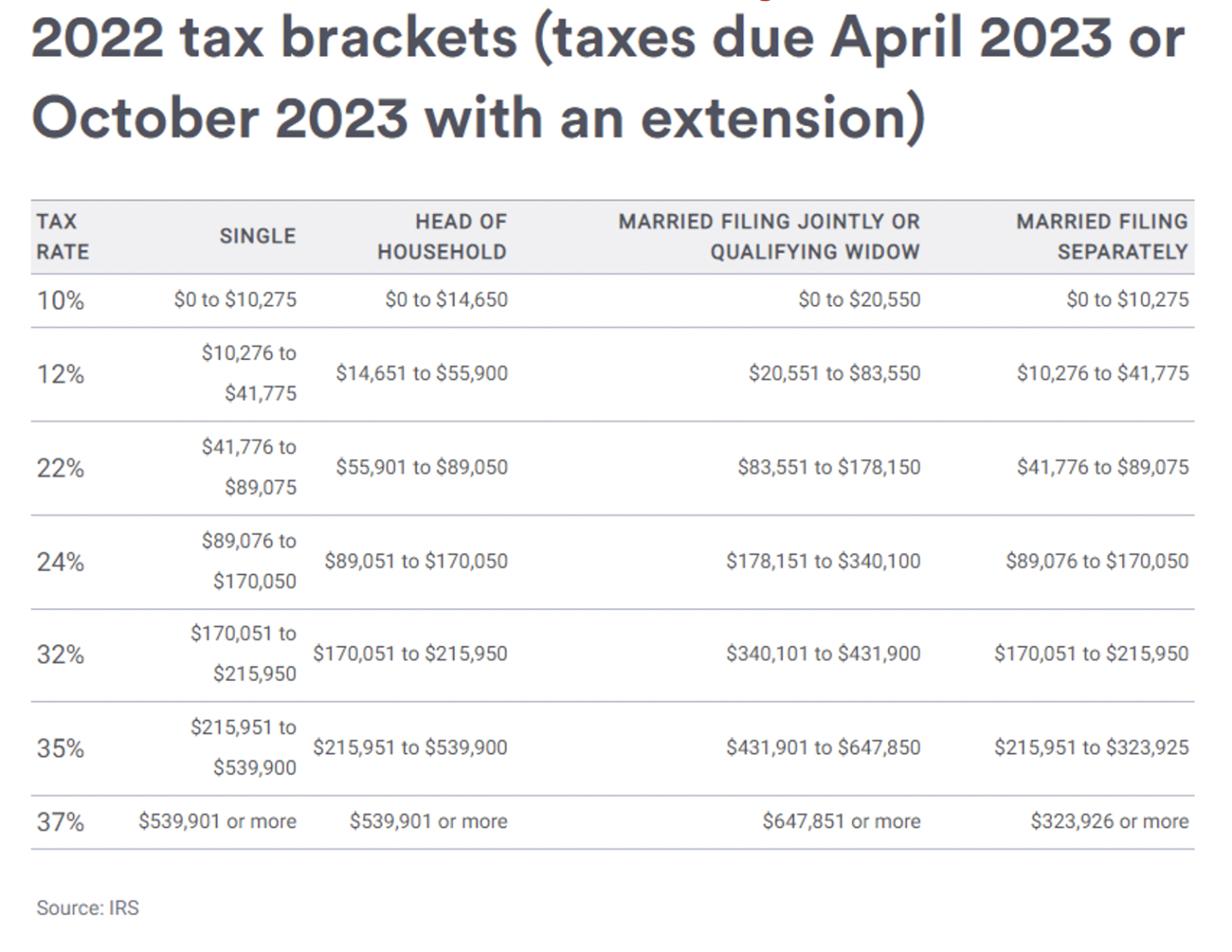

Web What happens if you didn t file your taxes for 2022 yet The rates are a bit different Take note Tax Rate For Single Filers and Married Filing Single For Married Individuals Filing Joint Returns For Heads of Households Web Nov 18 2023 nbsp 0183 32 The lowest tax rate in 2022 is 10 applicable to filers with the lowest income bracket On the other hand the highest earners per filing status have a tax rate of 37 Use the tables below to see how the total

2022 Tax Rate Single Filer

2022 Tax Rate Single Filer

2022 Tax Rate Single Filer

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/Insights/misc/brackets-a-1338x844.png

Web Jan 4 2023 nbsp 0183 32 2022 Tax Brackets and Rates The taxes you pay in early 2023 are for 2022 income The rates below would apply to that income Tax Rate Single Tax Rate

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by providing a ready-made format and design for creating various sort of material. Templates can be utilized for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

2022 Tax Rate Single Filer

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

2022 Tax Brackets KatherynYahya

2022 Tax Brackets Married Filing Jointly California Kitchen Cabinet

IRS Inflation Adjustments Taxed Right

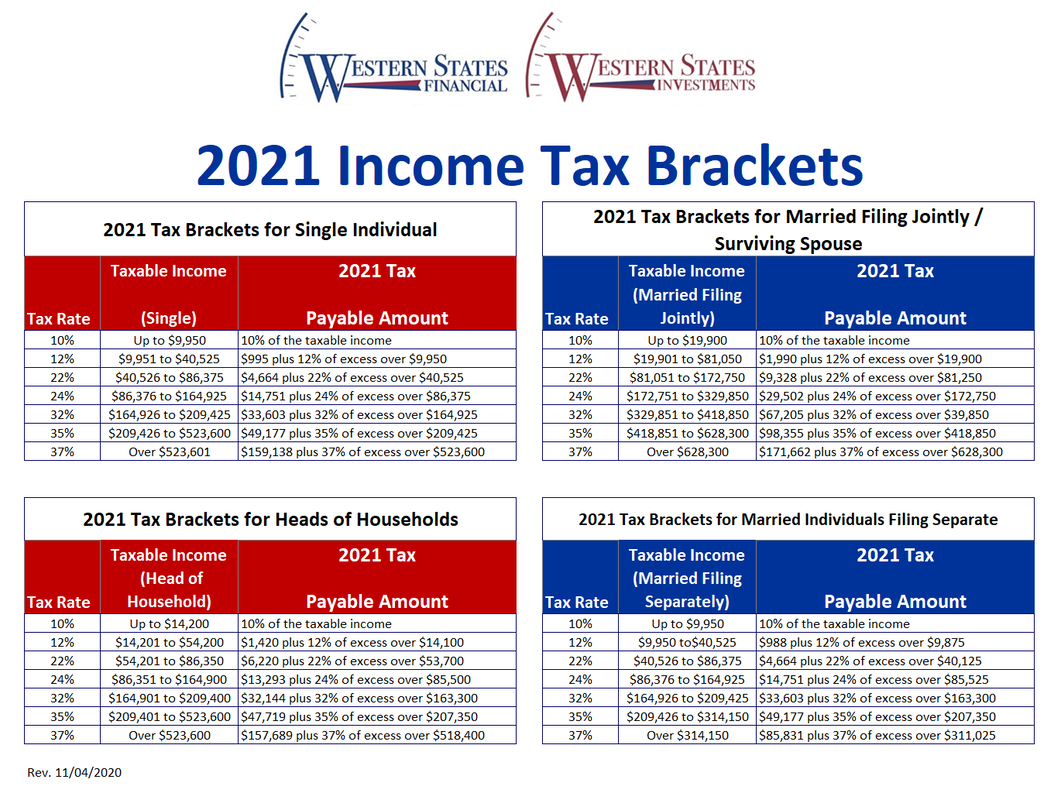

2021 Federal Tax Brackets Tax Rates Retirement Plans Western

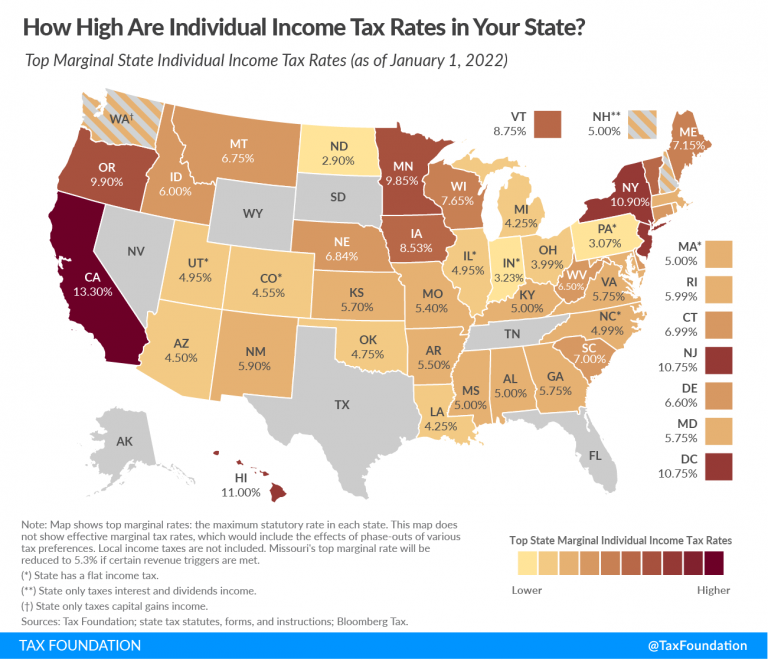

State Income Tax Rates And Brackets 2022 Tax Foundation

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

https://www.cnbc.com/2021/11/10/2022-income-tax...

Web Nov 10 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and

https://www.forbes.com/advisor/taxes/taxes …

Web Nov 9 2023 nbsp 0183 32 The 2024 tax year and the return due in 2025 will continue with these seven federal tax brackets 10 12 22 24 32 35 and 37 Your filing status and taxable income including

https://www.kiplinger.com/taxes/tax-bracket…

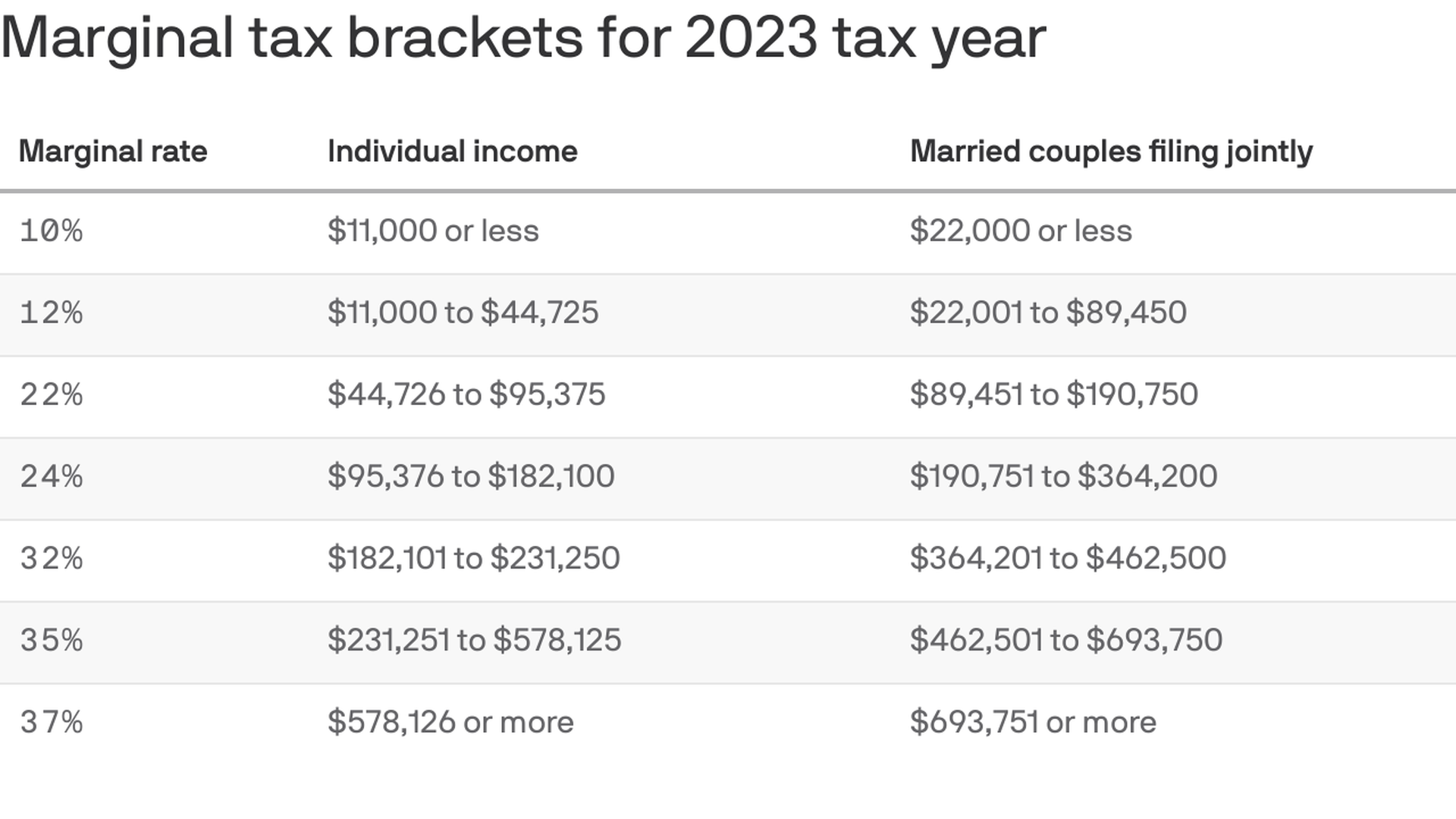

Web Nov 8 2023 nbsp 0183 32 2023 Tax Brackets Single Filers and Married Couples Filing Jointly Tax Rate Taxable Income Single Taxable Income Married Filing Jointly 10 Up to 11 000 Up to 22 000 12 11 001 to

Web Tax Rate Single filers Married filing jointly or qualifying widow er Married filing separately Head of household 10 0 to 9 950 0 to 19 900 0 to 9 950 0 to 14 200 12 Web Dec 11 2023 nbsp 0183 32 There are seven tax rates 10 12 22 24 32 35 and 37 The income thresholds for the 2023 tax brackets were adjusted significantly up about 7

Web Sep 11 2023 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates For example if Andrew who is a single filer sees his taxable income grow from 89 000 to 94 000 from 2022