2022 Individual Tax Rates Web Sep 17 2023 nbsp 0183 32 Income Tax Rates under TRAIN from 2018 2022 The first part of the approved TRAIN tax reform law implemented from 2018 until 2022 adopted major changes from the then existing Philippine taxation system as follows i Those earning an annual salary of P250 000 or below will no longer pay income tax zero income tax

Web Rate Tax RM A 0 5 000 On the First 5 000 0 0 B 5 001 20 000 On the First 5 000 Next 15 000 1 0 150 C 20 001 35 000 On the First 20 000 Next 15 000 3 150 450 D 35 001 50 000 On the First 35 000 Next 15 000 8 600 1 200 E 50 001 70 000 On the First 50 000 Next 20 000 13 1 800 2 600 F 70 001 100 000 On the Web Mar 18 2024 nbsp 0183 32 Page Last Reviewed or Updated 18 Mar 2024 See current federal tax brackets and rates based on your income and filing status

2022 Individual Tax Rates

2022 Individual Tax Rates

2022 Individual Tax Rates

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

Web Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

Templates are pre-designed files or files that can be used for various functions. They can conserve effort and time by offering a ready-made format and layout for producing different kinds of material. Templates can be used for personal or expert tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

2022 Individual Tax Rates

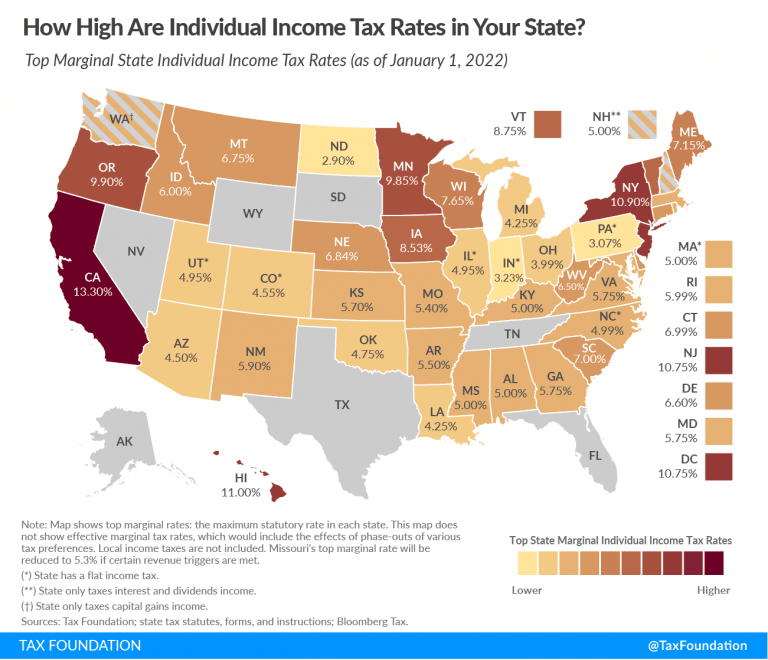

2022 State Income Tax Rate Map Arnold Mote Wealth Management

2022 Tax Brackets Irs Calculator

California Individual Tax Rate Table 2021 2022 Brokeasshome

Irs Tax Rates 2022 Latest News Update

Income Tax Rates 2022 Australia Enid Arteaga

2022 Tax Brackets DhugalKillen

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-australian-residents

Web Sep 28 2023 nbsp 0183 32 Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

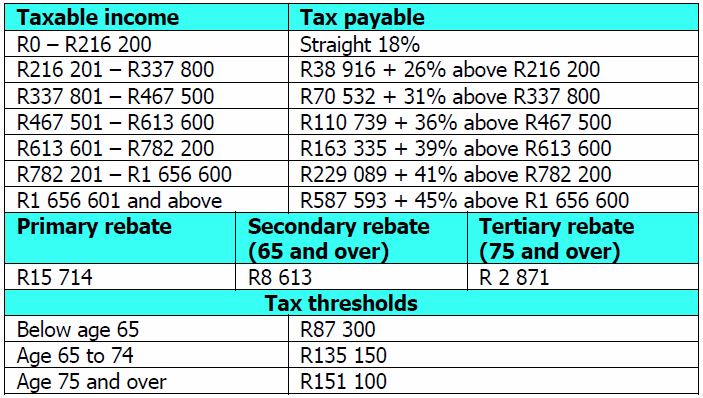

https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals

Web 2022 tax year 1 March 2021 28 February 2022 See the changes from the previous year

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket

Web Chargeable income in excess of 500 000 up to 1 million will be taxed at 23 while that in excess of 1 million will be taxed at 24 both up from the current rate of 22 Resident tax rates From YA 2024 onwards Personal Tax Rebate From YA 2017 to YA 2023 Personal tax rebate For YA 2014 to YA 2016 Personal tax rebate Web Jun 30 2022 nbsp 0183 32 free tax calculator The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year This tax table reflects the last amended tax brackets from as at 6 October 2020

Web Income over 163 100 000 Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income