2022 Income Tax Rates Canada Web 2022 Tax Rate 2021 Personal Amount 1 2021 Tax Rate 14 398 15 13 808 15 1 The personal amount is increased federally and for Yukon for 2022 from 12 719 to 14 398 for taxpayers with net income

Web The calculator reflects known rates as of December 1 2022 Taxable Income Calculate These calculations do not include non refundable tax credits other than the basic Web For incomes above this threshold the additional amount of 1 387 is reduced until it becomes zero at net income of 216 511 The minimum personal amounts 12 719 for

2022 Income Tax Rates Canada

2022 Income Tax Rates Canada

2022 Income Tax Rates Canada

https://cardinalpointwealth.com/wp-content/uploads/2021/12/Winter_2021_Canadian_Income_Tax_Table.jpg

Web 33 on the portion over 235 675 235 675 and up Canadian income tax rates vary according to the total amount of income you earn and how much of that is considered

Templates are pre-designed documents or files that can be utilized for various functions. They can save time and effort by providing a ready-made format and design for producing various kinds of material. Templates can be utilized for personal or professional projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

2022 Income Tax Rates Canada

The Assistance You Need To Process Your Business Income Tax

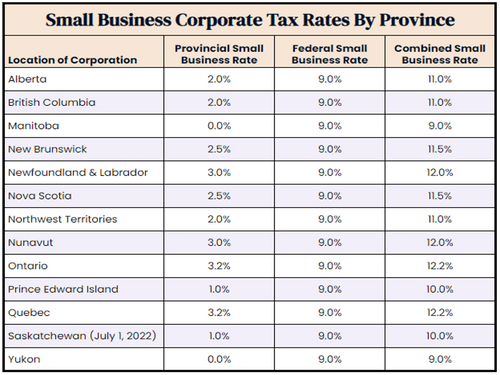

Canada 2019 Corporate Income Tax Rates

TaxTips ca Business 2022 Corporate Income Tax Rates

Tax Rate In Canada 2020 Hot Sex Picture

Income Tax Slab For 2022 23 Pay Period Calendars 2023

2022 Tax Brackets Canada Ontario

https://ca.icalculator.com/income-tax-rates/2022.html

Web Canada Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Canada are updated annually with new tax tables published for Resident

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023.htm

Web Taxtips ca Personal marginal income tax rates for 2022 and 2023 for eligible and non eligible dividends capital gains and other income for Canada and all provinces and

https://assets.kpmg.com/.../07/tax-facts-2022-2023.pdf

Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Tax Rates Tax Brackets Surtax Rates Surtax Thresholds Federal1 15 00 20 50 26 00 29 00 33 00 Up

https://assets.kpmg.com/.../tax-facts-2021-2022-en.pdf

Web Federal and Provincial Territorial Tax Rates for Income Earned by a General Corporation 2021 and 2022 94 Combined Federal and Provincial Territorial Tax

Web Dec 31 2023 nbsp 0183 32 Insights and resources Canadian corporate tax tables Tax rates are continuously changing Get the latest rates from KPMG s corporate tax Tax Facts 2023 Web Determine the tax rate For the second tier the tax rate is 20 5 Calculate the tax amount for this tier Multiply the amount within the tier by the tax rate 6 641 0 205

Web Dec 5 2023 nbsp 0183 32 Current tax brackets in Canada 2023 Federal income tax bracket 2023 Federal income tax rate 53 359 or less 15 53 359 up to 106 717 20 5