2022 Personal Income Tax Rates Canada WEB Canada Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Canada are updated annually with new tax tables published for Resident

WEB The 2022 edition of Individual Tax Statistics by Tax Bracket presents basic counts and amounts of individual tax filer information by tax bracket These statistics are based on WEB Nov 3 2023 nbsp 0183 32 How does Canada s personal income tax brackets work How much federal tax do I have to pay based on my income If your taxable income is less than the 53 359 threshold your federal

2022 Personal Income Tax Rates Canada

2022 Personal Income Tax Rates Canada

2022 Personal Income Tax Rates Canada

https://kalfalaw.com/wp-content/uploads/2021/09/Marginal-Tax-Rates-2020_Ontario-1024x791.png

WEB 2022 personal tax rates Ontario Taxes calculated on Canadian dividend amounts assume that the dividends are generated from Canadian public corporations and as

Pre-crafted templates offer a time-saving option for creating a diverse range of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material development procedure.

2022 Personal Income Tax Rates Canada

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

Canada 2019 Corporate Income Tax Rates

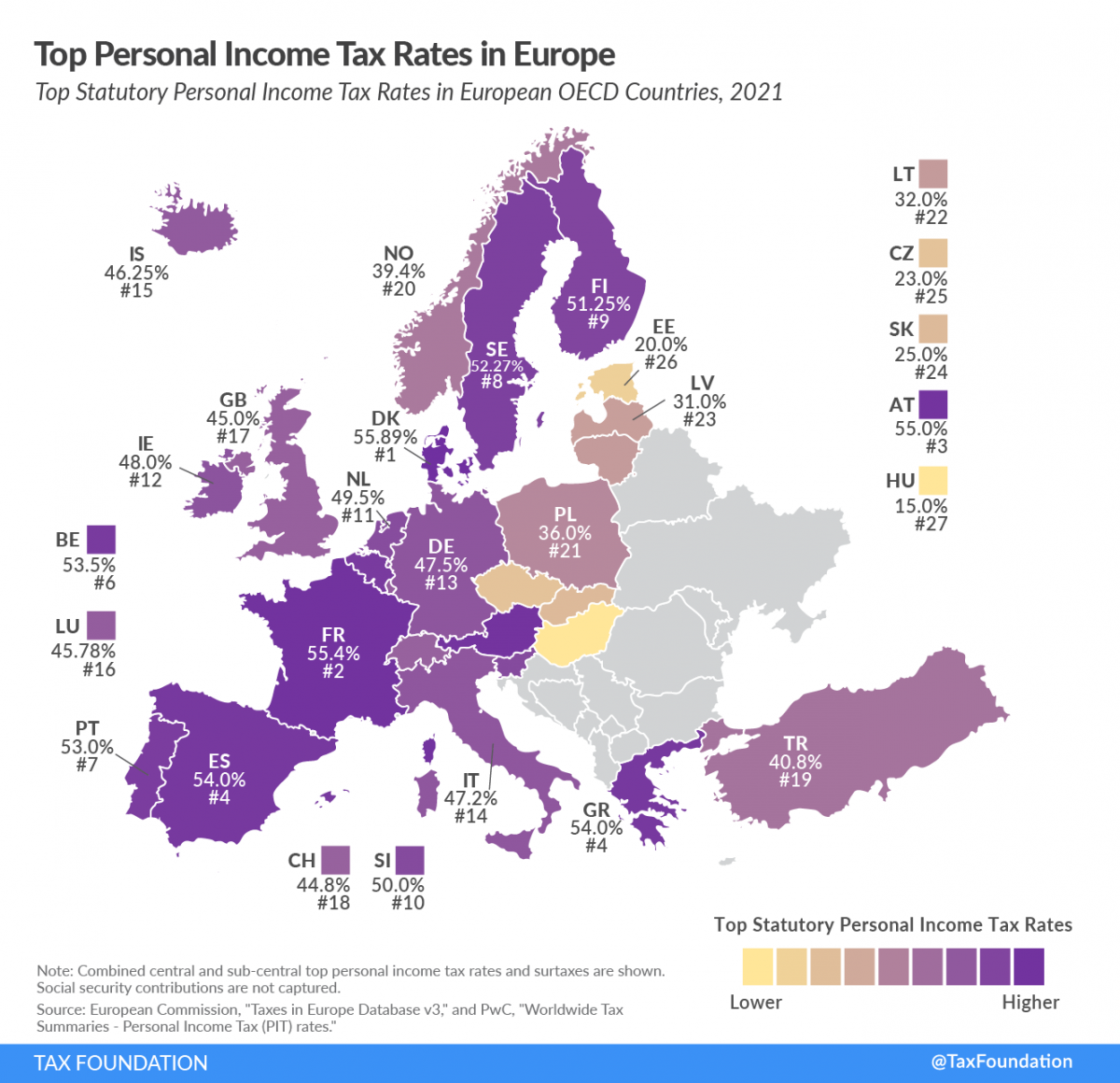

Income Tax Rates In Eu Countries Pay Period Calendars 2023

2022 2023 PAYE Personal Income Tax Rates And Allowances Tax Rates

Income Tax Rates By State INVOMERT

Ontario Continues Trend Of Uncompetitively High Personal Income Tax

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023.htm

WEB Taxtips ca Personal marginal income tax rates for 2022 and 2023 for eligible and non eligible dividends capital gains and other income for Canada and all provinces and

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023/canada.htm

WEB TaxTips ca Canada s 2022 amp 2023 Personal income tax brackets and tax rates for eligible and non eligible dividends capital gains and other income

https://www.eytaxcalculators.com/en/2022-personal-tax-calculator.html

WEB 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December 1 2022

https://www.canada.ca/en/revenue-agency/services/tax/rates.html

WEB Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest rates EI rates corporation tax rates excise tax rates and

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

WEB Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that

WEB Nov 25 2023 nbsp 0183 32 Your tax rate will vary by how much income you declare at the end of the year on your T1 General Income Tax Return and where you live in Canada Importantly WEB Calculate your tax bill and marginal tax rates for 2022

WEB Mar 31 2024 nbsp 0183 32 Federal and Provincial Territorial Income Tax Rates and Brackets for 2024 Current as of March 31 2024