Canada Combined Income Tax Rates 2022 Web Dec 6 2022 nbsp 0183 32 90 000 annual income 50 197 2nd bracket minimum 39 803 x 2nd bracket rate of 20 5 8 159 62 1st bracket maximum total tax of 7 529 55

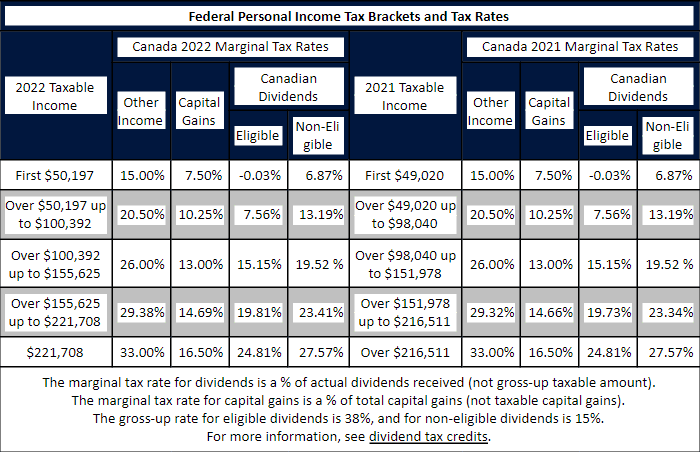

Web Jan 15 2022 nbsp 0183 32 The federal basic personal amount comprises two elements the base amount 12 719 for 2022 and an additional amount 1 679 for 2022 The additional amount is reduced for individuals with net income in excess of 155 625 and is fully eliminated for individuals with net income in excess of 221 708 Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Tax Rates Tax Brackets Surtax Rates Surtax Thresholds Federal1 15 00 20 50 26 00 29 00 33 00 Up to 50 197 50 198 100 392 100 393 155 625 155 626 221 708 221 709 and over British Columbia2 5 06 7 70 10 50 12 29 14 70 16 80 20 50 Up to 43 070 43 071 86 141

Canada Combined Income Tax Rates 2022

Canada Combined Income Tax Rates 2022

Canada Combined Income Tax Rates 2022

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

Web The maximum combined subsidy is 75 of eligible remuneration paid up to a maximum of 847 per week per eligible employee for Periods 11 to 17 Starting in Period 18 CEWS rates will be gradually phased out and only employers with a decline in qualifying revenue of more than 10 will be eligible for the base subsidy

Pre-crafted templates offer a time-saving solution for producing a diverse series of documents and files. These pre-designed formats and layouts can be made use of for different personal and expert projects, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the content development procedure.

Canada Combined Income Tax Rates 2022

Tax Rate In Canada 2020 Hot Sex Picture

2022 Federal Tax Brackets And Standard Deduction Printable Form

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

State And Local Sales Tax Rates 2020 Upstate Tax Professionals

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

https://www.canada.ca/en/revenue-agency/services/tax/rates.html

Web Information for individuals and businesses on rates such as federal and provincial territorial tax rates prescribed interest rates EI rates corporation tax rates excise tax rates and more

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023.htm

Web Personal Income Tax Rates for Canada and Provinces Territories for 2022 and 2023 Choose your province or territory below to see the combined Federal amp Provincial Territorial marginal tax rates See also Current Marginal Tax Rates Canada Alberta British Columbia Manitoba

https://www.manulifeim.com/.../tax-planning/2022-tax-rate-card-for-c…

Web Download now The latest 2022 tax rate card puts the most up to date marginal tax rates and tax brackets by taxable income source non refundable tax credits and much more all in one place This reference card is designed to help you and your clients with tax planning for the 2022 calendar year Included in this piece are tables for

https://www.taxtips.ca/priortaxrates/tax-rates-2021-2022/canada.htm

Web The table of marginal tax rates assume that line 23600 net income is equal to taxable income for this purpose For 2022 the marginal rate for 155 625 to 221 708 is 29 38 because of the above noted personal amount reduction through this tax bracket

https://www.eytaxcalculators.com/en/2022-personal-tax-calculator.html

Web Tax Calculators 2022 Personal Tax Calculator Skip to the content EY Homepage Search Close search See all results in Search Page Explore Who we are What we do What we think Work with us Our locations Connect with us 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The

Web Sep 30 2023 nbsp 0183 32 Combined Top Marginal Tax Rates For Individuals 2023 Current as of September 30 2023 Other Automobiles Deductions and Benefits Current as of September 30 2023 Prescribed Interest Rates 2022 and 2023 Current as of September 30 2023 Old Age Security Benefits Current as of September 30 2023 Retirement and Savings Web Canada Non residents Federal Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 15 Income from 0 000 00 to 55 867 00 20 5 Income from 55 867 01 to 111 733 00 26 Income from 111 733 01 to 173 205 00 29 32 Income from 173 205 01 to

Web Data source Data were taken from the individual income tax and benefit returns filed for the 2020 tax year These statistics contain information from initial assessments up to the cut off date of January 28 2022