2022 Income Tax Tables Canada Web Dec 31 2023 nbsp 0183 32 Services Tax rates are continuously changing Get the latest rates from KPMG s personal tax tables

Web Jun 15 2023 nbsp 0183 32 Deadline to file and pay taxes for someone who died if they passed between January 1 and October 31 2022 May 1 2023 Deadline to file your taxes if you and or Web The table of marginal tax rates assume that line 23600 net income is equal to taxable income for this purpose For 2023 the marginal rate for 165 430 to 235 675 is 29 32

2022 Income Tax Tables Canada

2022 Income Tax Tables Canada

2022 Income Tax Tables Canada

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636577574/2022_Taxes_On_Screen.jpg

Web Tax Calculators 2022 Personal Tax Calculator Skip to the content The rates apply to the actual amount of taxable dividends received from taxable Canadian corporations

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can conserve effort and time by providing a ready-made format and design for developing different type of material. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

2022 Income Tax Tables Canada

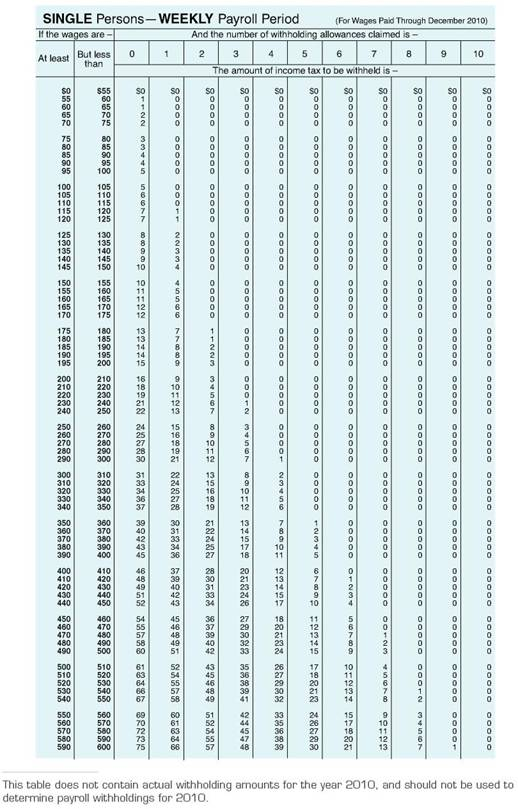

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

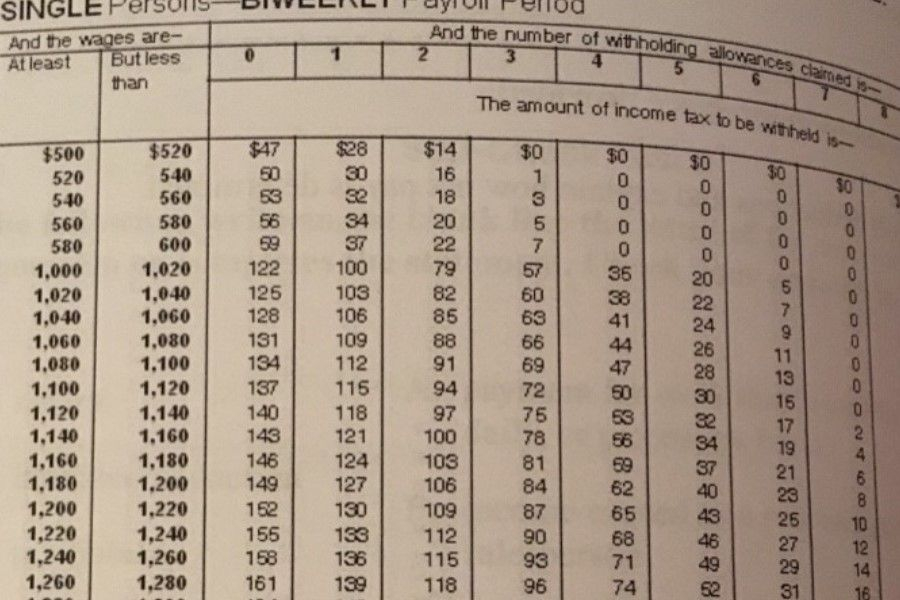

Higher Federal Withholding Table Vs Standard 2021 Federal Withholding

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

Weekly Tax Withholding Chart Federal Withholding Tables 2021

2021 Federal Withholding Tax Tables Publication 15 Federal

2021 IRS Tax Brackets Table Federal Withholding Tables 2021

https://ca.icalculator.com/income-tax-rates/2022.html

Web Canada Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Canada are updated annually with new tax tables published for Resident

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that

https://assets.kpmg.com/.../07/tax-facts-2022-2023.pdf

Web Ontario surtax of 20 applies to the provincial income tax before surtax in excess of 4 991 Ontario surtax of 36 applies in addition to the 20 surtax i e a total surtax of

https://www.taxtips.ca/priortaxrates/tax …

Web The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to

https://assets.kpmg.com/.../tax-facts-2021-2022-en.pdf

Web balances of income tax from May 1 2021 to May 31 2021 Extensions for Deadlines in 2020 Calendar Year Refer to the following tables for Canadian filing and payment deadlines in

Web TaxTips ca 2022 and 2023 Canadian income tax and RRSP savings calculator calculates taxes shows RRSP savings includes most deductions and tax credits Web Canada s income tax brackets for 2023 plus the maximum tax you ll pay based on income Quickly find your federal and provincial tax brackets to help you prep for your 2023

Web 2023 Federal income tax brackets Here are the tax brackets for Canada based on your taxable income Federal tax bracket Federal tax rates 53 359 or less 15 00