2022 Income Tax Rates Canada Ontario Web Result Notes Table takes into account federal basic personal amount of 14 398 and Ontario basic personal amount of 11 141 Note that the federal amount of

Web Result Marginal tax rate on 70 000 Taxes calculated on Canadian dividend amounts assume that the dividends are generated from Canadian public corporations and Web Result Nov 24 2023 nbsp 0183 32 Total income tax on taxable income 6 750 2 272 50 9 022 50 total combined federal and provincial taxes One confusing detail to

2022 Income Tax Rates Canada Ontario

2022 Income Tax Rates Canada Ontario

2022 Income Tax Rates Canada Ontario

http://www.mdtax.ca/wp-content/uploads/2020/03/PERSONAL-INCOME-TAX-BRACKETS-2019-1.png

Web Result Estimate your net salary after tax paycheck deductions capital gains taxes RRSP savings and CRA taxes owed using our 2022 Ontario income tax calculator Tax

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve effort and time by supplying a ready-made format and design for creating different type of content. Templates can be used for personal or expert tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

2022 Income Tax Rates Canada Ontario

Provincial Tax Rates 2023 Canada Printable Forms Free Online

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

TaxTips ca Business 2022 Corporate Income Tax Rates

Doing Your Taxes Myths Reality Checks And How Soon To Send Them

2023 Corporate Tax Rates And Small Business Tax Rates In Canada

Ca Tax Brackets Chart Jokeragri

assets.ey.com/content/dam/ey-sites/ey-com/...

Web Result Jan 15 2022 nbsp 0183 32 6 Individuals resident in Ontario on December 31 2022 with taxable income up to 16 230 pay no provincial income tax as a result of a low income

www.taxtips.ca/priortaxrates/tax-rates-2022-2023/on.htm

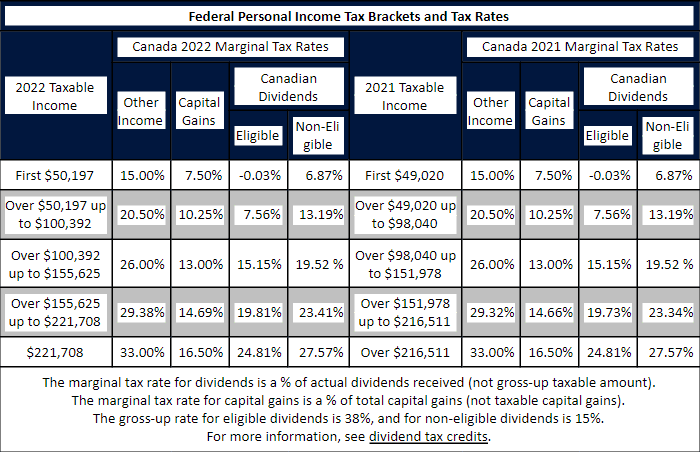

Web Result 2023 Tax Rate 2022 Personal Amount 1 2022 Tax Rate 15 000 15 14 398 15 1 See the federal tax rates page for information on the enhanced federal

www.taxtips.ca/taxrates/on.htm

Web Result 16 rows nbsp 0183 32 Tax Rates gt Current Marginal Tax Rates gt Ontario Personal Income

www.taxtips.ca/.../tax-rates-202…

Web Result Ontario 2022 and 2021 Personal Marginal Income Tax Rates The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The

on-ca.icalculator.com/income-tax-rates/2022.html

Web Result Personal Allowance in Canada for 2022 Amount As of 2022 the basic personal amount in Canada is set at 11 141 00 This amount is adjusted annually to

Web Result Oct 23 2023 nbsp 0183 32 The tax brackets increase each year based on inflation Basic personal amounts are the allowable amount of income that you can earn before Web Result Jan 15 2023 nbsp 0183 32 The low income tax reduction 274 of Ontario tax is clawed back for income in excess of 17 291 until the reduction is eliminated resulting in an

Web Result Sep 17 2021 nbsp 0183 32 2022 Federal Tax Brackets and Rates The federal tax rates in Canada follow the same pattern with rates increasing as your taxable income