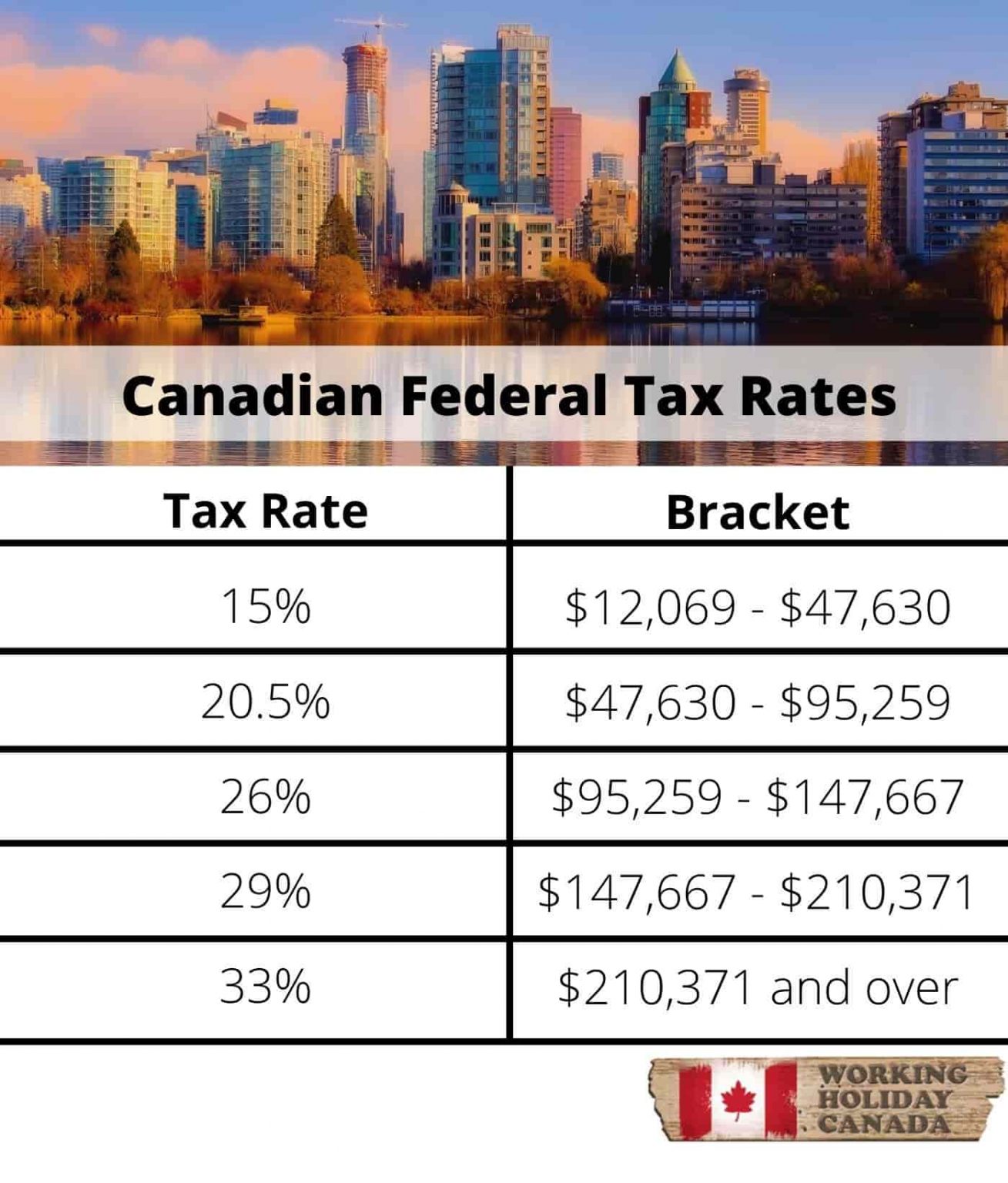

Income Tax Rates Bc Canada 2022 Jan 5 2023 nbsp 0183 32 The lowest tax rate in B C in 2022 is 5 06 and it applies to income up to 43 070 On the other end of the spectrum you pay 20 50 on income over 227 091 Since you are

The BC tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 021 a 2 1 increase The indexation factors tax brackets and tax rates have been Review British Columbia s 2022 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate

Income Tax Rates Bc Canada 2022

Income Tax Rates Bc Canada 2022

Income Tax Rates Bc Canada 2022

https://livetax.ca/wp-content/uploads/2021/08/Picture1-1.png

The Income tax rates and personal allowances in British Columbia are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include

Pre-crafted templates provide a time-saving solution for producing a diverse series of files and files. These pre-designed formats and designs can be used for various personal and professional projects, including resumes, invites, leaflets, newsletters, reports, presentations, and more, improving the material development procedure.

Income Tax Rates Bc Canada 2022

Canadian Tax Rates Www vrogue co

Legislation Could Cut Income Tax Rates For Good The Daily Courier

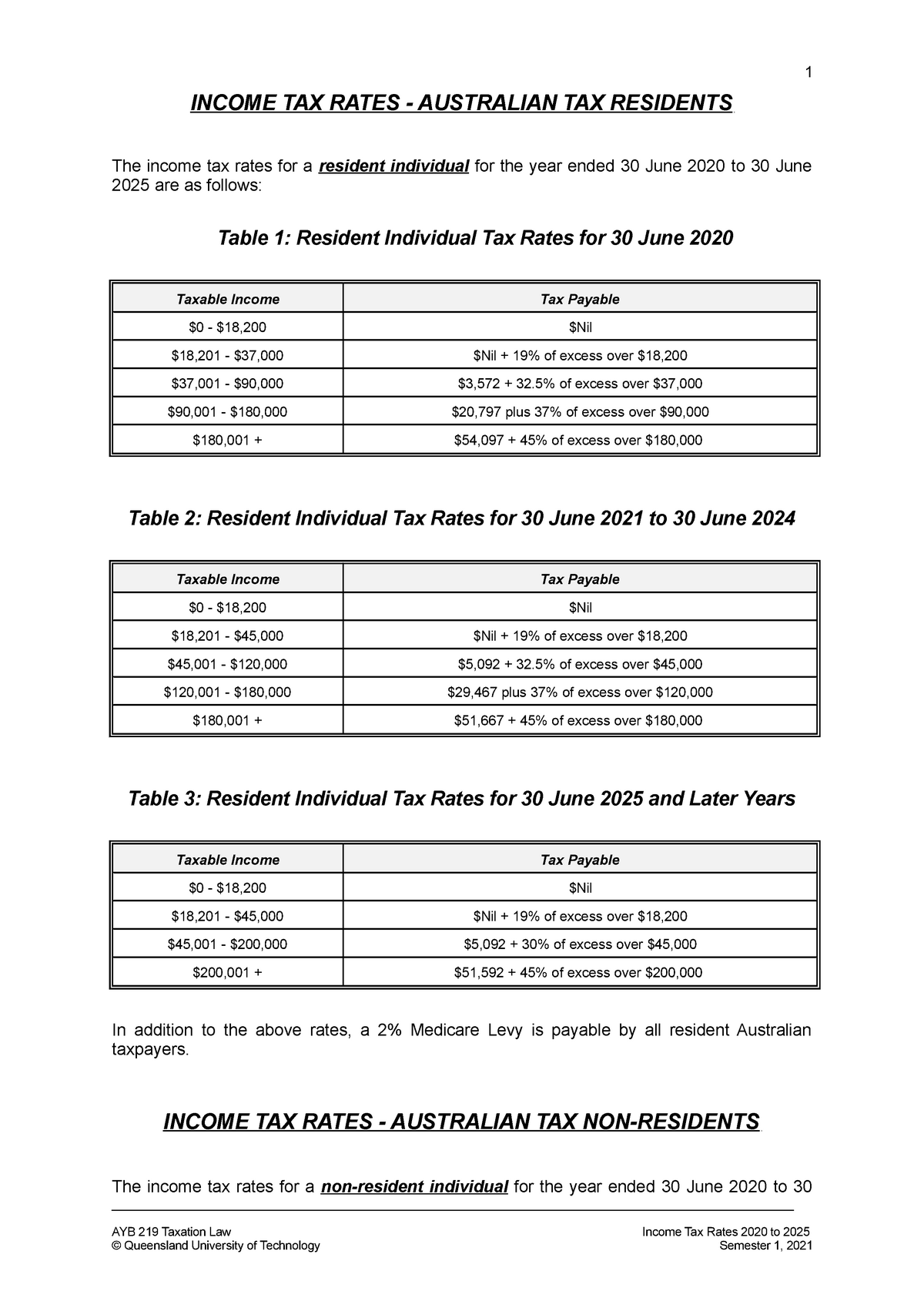

Income Tax Rates 2020 To 2025 INCOME TAX RATES AUSTRALIAN TAX

2022 Tax Brackets PersiaKiylah

Individual Tax Rate Tax Rates Income Tax Rates For Resident

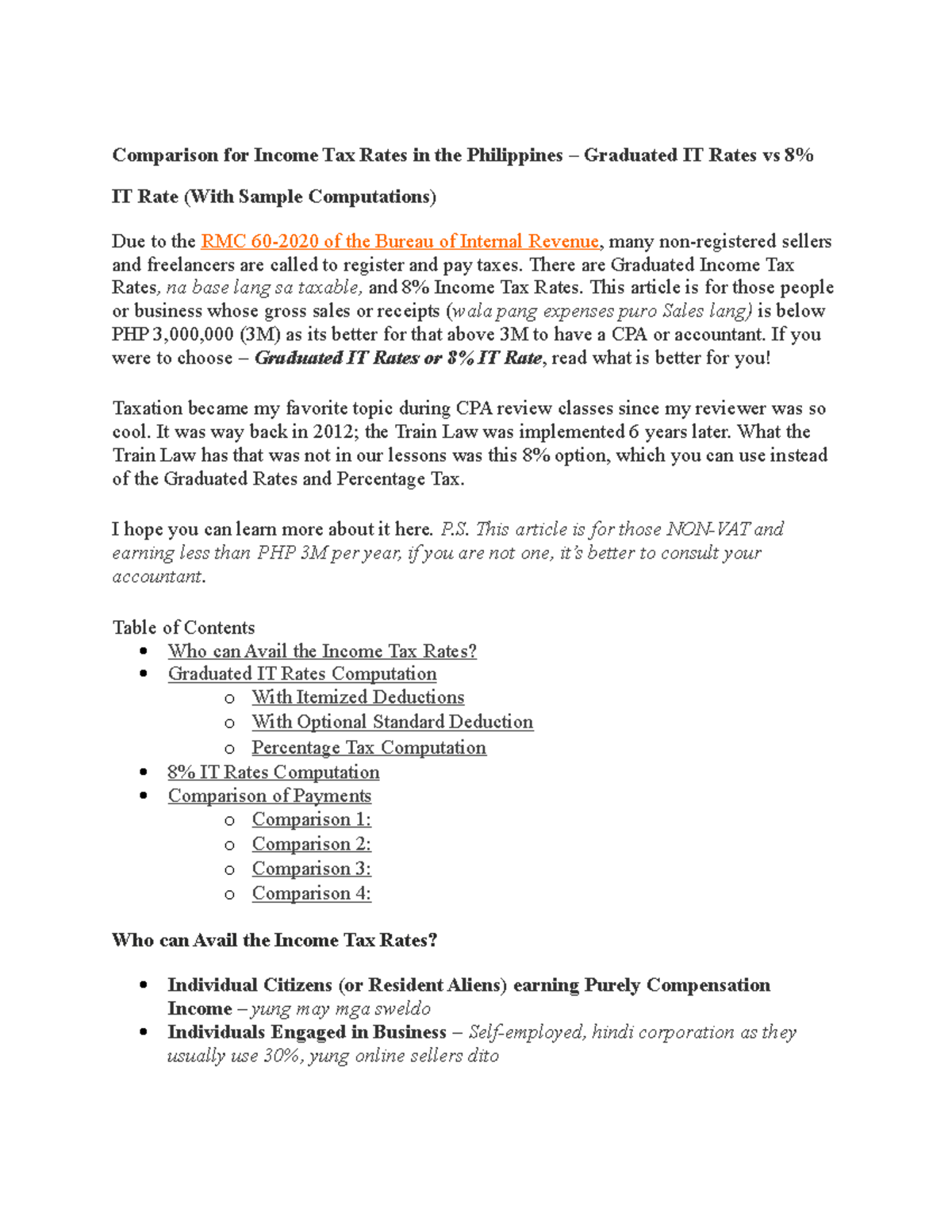

Comparison FOR Income TAX Rates IN THE Philippines Comparison For

https://www.taxtips.ca › priortaxrates › bc.htm

The BC tax brackets and personal tax credit amounts are increased for 2023 by an indexation factor of 1 06 6 increase The Federal tax brackets and personal tax credit amounts are

https://www.canada.ca › en › revenue-agency › services › ...

British Columbia tax rates for 2022 The following tax rates are used in the calculation of your British Columbia tax on taxable income 5 06 on the portion of your taxable income that is

https://www.canada.ca › en › revenue-agency › services...

Information on income tax rates in Canada including federal rates and those rates specific to provinces and territories

https://www.canada.ca › ... › cra-arc › tx › bsnss › tpcs › pyrll

The federal income tax thresholds have been indexed for 2022 The federal Canada Employment Amount has been indexed to 1 287 for 2022 The British Columbia income thresholds and

https://www.taxtips.ca › taxrates › bc

The Federal and BC indexation factors tax brackets and tax rates for 2025 have been confirmed to Canada Revenue Agency information

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December 1 2022 2022 combined corporate tax rates effective from January to December 2022 The small business limit is 500 000 in all provinces amp territories except for Saskatchewan where it is

Income tax rates for 2022 In 2022 BC provincial government increased all tax brackets and base amount by 2 1 Tax rates are the same as previous year Base amount is 11 302