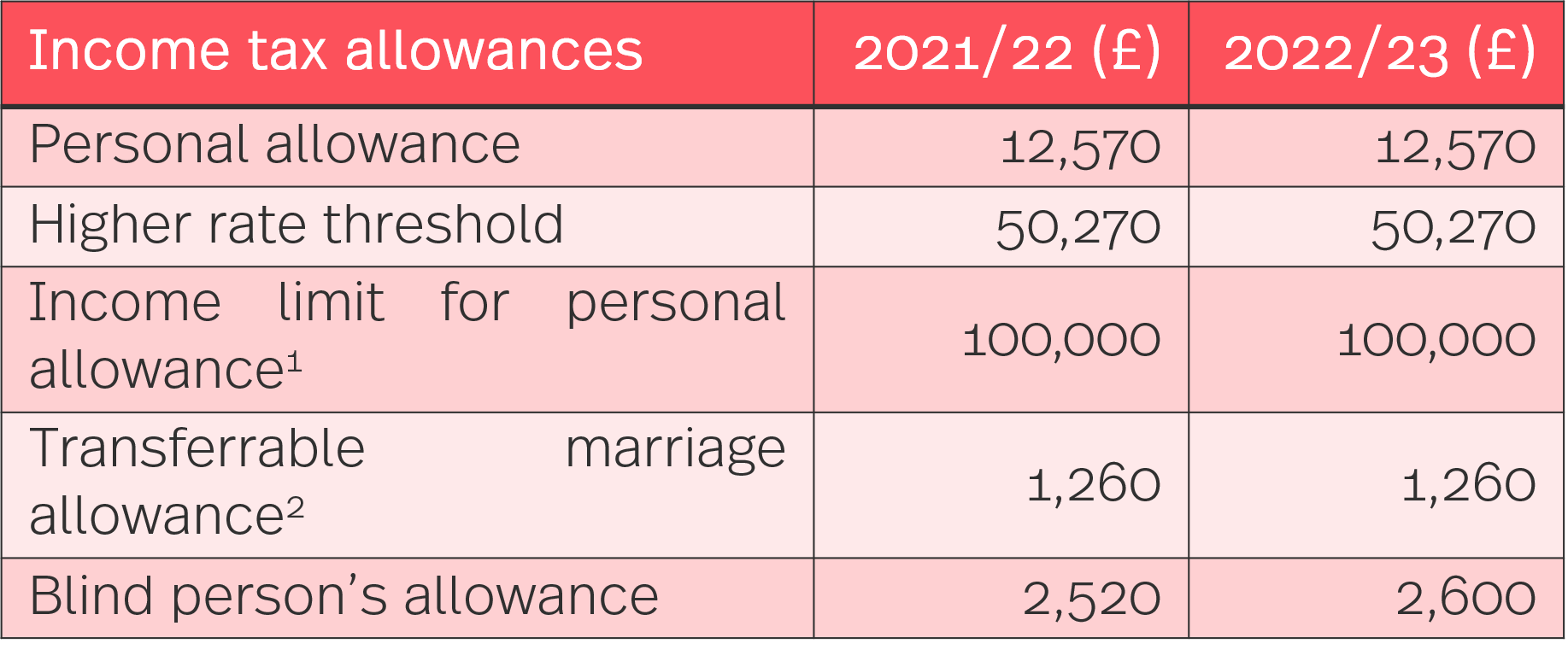

Income Tax Rates 2023 24 Uk Web the amount of gross income you can earn before you are liable to paying income tax Personal Allowance 163 12 570 Dividend Allowance 163 1 000 Personal Savings

Web Jan 2 2024 nbsp 0183 32 The income tax rates for 2023 24 are Personal allowance at 0 12 570 Basic tax rate at 20 From 163 12 571 to 163 50 270 Higher tax rate at 40 From 163 50 271 to 163 125 140 Additional tax rate at 45 Above Web Mar 22 2023 nbsp 0183 32 For the 2023 24 tax year once again many rates remained unchanged however there were some key changes including significant reductions in Capital Gains

Income Tax Rates 2023 24 Uk

Income Tax Rates 2023 24 Uk

Income Tax Rates 2023 24 Uk

https://www.income-tax.co.uk/images/60000-after-tax-salary-uk-2020.png

Web Readers should however be aware of significant mid year changes announced to 2023 24 Class 1 NIC Employee rates including a reduction of the 12 rate to 10 to be enacted

Templates are pre-designed documents or files that can be used for numerous purposes. They can save effort and time by supplying a ready-made format and design for developing different sort of material. Templates can be utilized for personal or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Income Tax Rates 2023 24 Uk

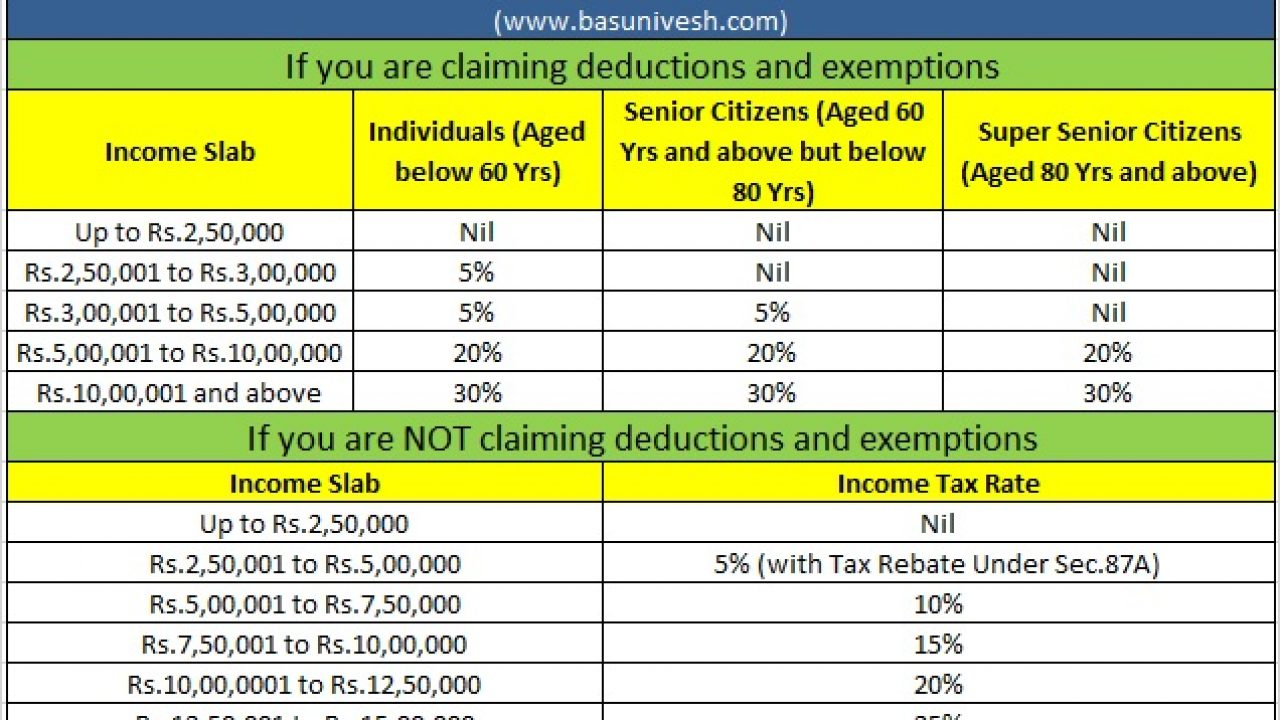

Income Tax Rates For FY 2021 22 AY 2022 23 FY 2022 23 AY 2023 24

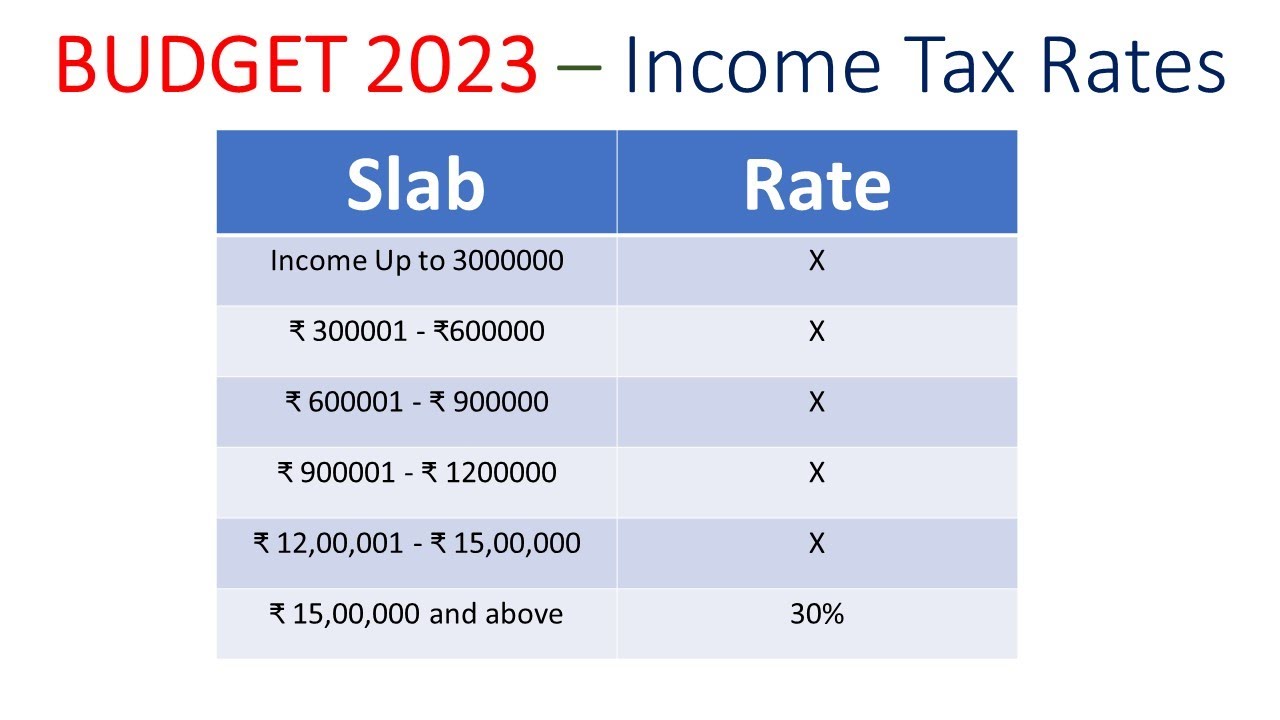

Income Tax Slab Rate FY 2023 24 AY 2024 25 In Budget 2023 FM

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

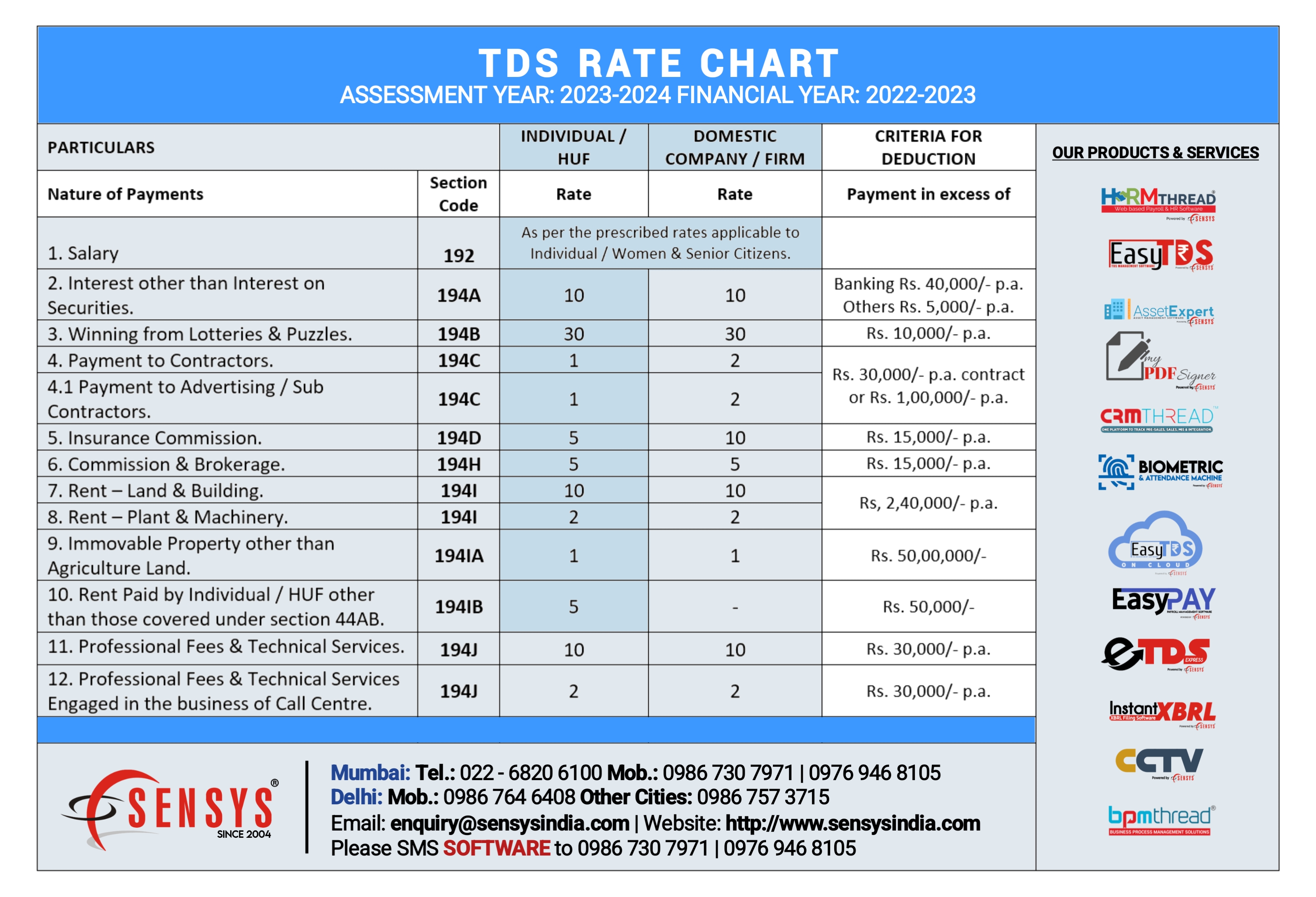

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

2022 Tax Brackets JeanXyzander

Louisiana Tax Free 2020 Template Calendar Design

https://www.gov.uk/government/publications/rates...

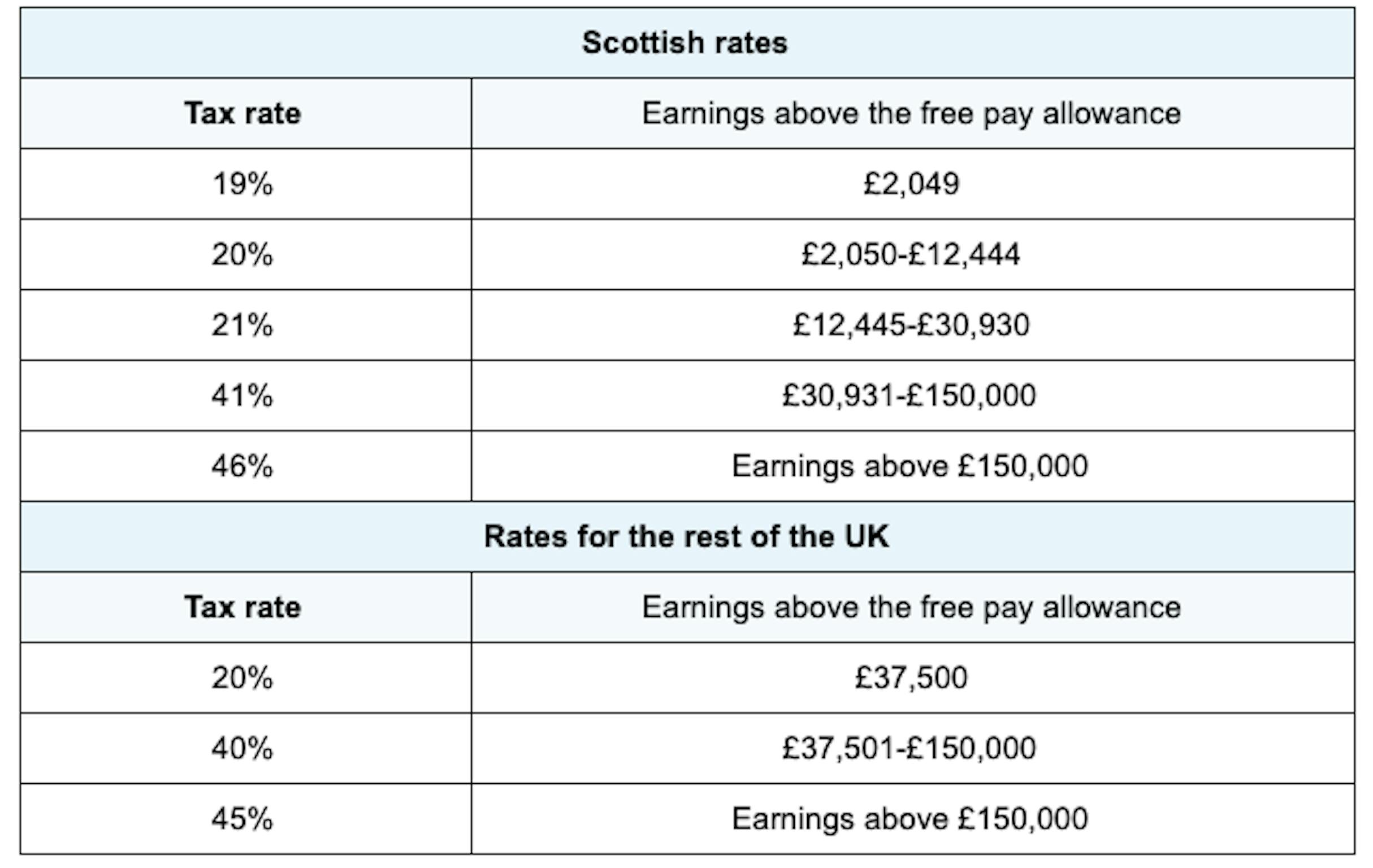

Web Jan 15 2024 nbsp 0183 32 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 163 30 931 to 163 150 000 Top rate for tax year 2023 to

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 27 2023 nbsp 0183 32 Starter tax rate 19 Up to 163 2 162 Basic tax rate 20 From 163 2 163 to 163 13 118 Intermediate tax rate 21 From 163 13 119 to 163 31 092 Higher tax rate 42

https://www.which.co.uk/money/tax/income-tax/t…

Web 2 days ago nbsp 0183 32 Here s what the income tax rates and bands in Scotland are for 2023 24 Those earning more than 163 100 000 will see their personal allowance reduced by 163 1 for every 163 2 they earn over the threshold

https://commonslibrary.parliament.uk/research-briefings/cbp-9754

Web Jan 8 2024 nbsp 0183 32 Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2023 24 these three rates are 20 40 and

https://www.which.co.uk/money/tax/income-tax/tax...

Web 3 days ago nbsp 0183 32 Income tax rates 2023 24 These income tax bands apply to England Wales and Northern Ireland for the 2023 24 tax year Income tax rates in Scotland are

Web Nov 17 2022 nbsp 0183 32 Autumn Statement 2022 HMRC tax rates and allowances for 2023 24 Tax rates and allowances for 2022 23 and 2023 24 1 The individual s personal allowance is Web Sep 29 2022 nbsp 0183 32 From this point upwards income tax of 19 a 1 cut from the current rate and employee national insurance of 12 a reduction from the 13 25 in force until next

Web Feb 21 2023 nbsp 0183 32 For the 2023 24 tax year your tax free Personal Allowance is 163 12 570 This is the same amount as the previous tax year although tax years before that look a little