Income Tax Rates And Bands 2023 24 Uk Personal Income Tax Rates in England for the 2023 24 Tax Year The income tax rates and thresholds below are for employees in England EN you can use this income tax calculator for

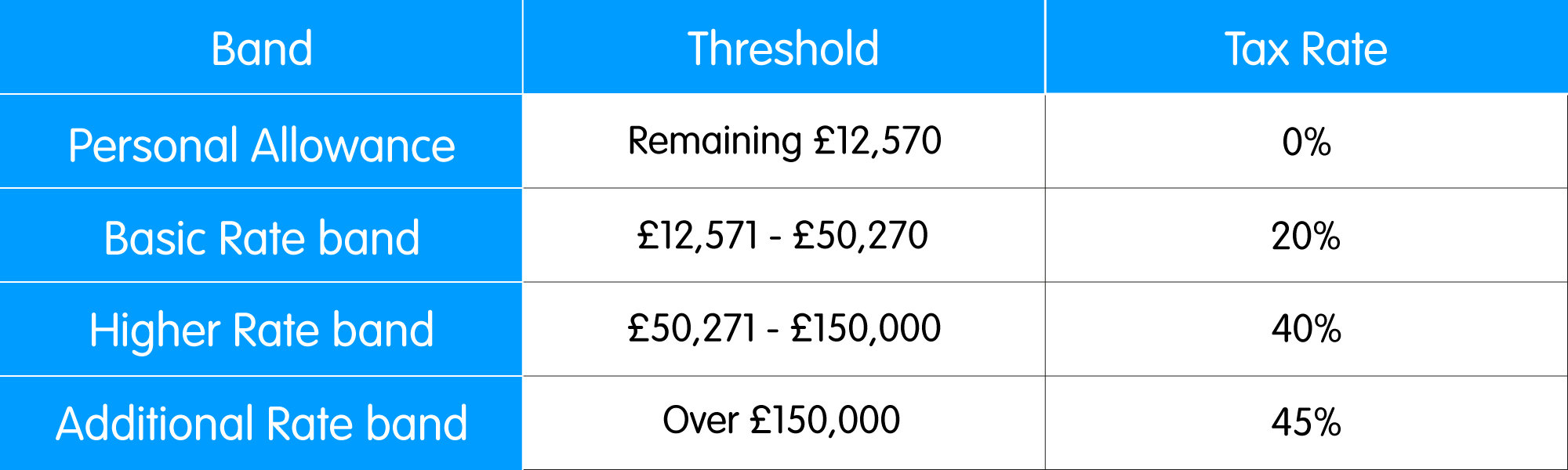

Here are the current tax bands rates and thresholds for England Wales and Northern Ireland for the tax year 2023 24 and 2024 25 Those earning more than 163 100 000 will see their personal 6 days ago nbsp 0183 32 For the 2025 26 tax year as was the case in the 2024 25 2023 24 2022 23 and 2021 22 tax years most people are allowed to earn 163 12 570 per year before paying income

Income Tax Rates And Bands 2023 24 Uk

Income Tax Rates And Bands 2023 24 Uk

Income Tax Rates And Bands 2023 24 Uk

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt30482d40649c84c3/6179a93afdb9af22b36e3ec3/Autumn_budget_table_1.png

Aug 23 2024 nbsp 0183 32 In England Wales and Northern Ireland the tax bands for 2023 24 and 2024 25 are Basic rate 20 163 12 571 to 163 50 270 Higher rate 40 163 50 271 to 163 125 140 Additional

Templates are pre-designed documents or files that can be used for different purposes. They can save effort and time by offering a ready-made format and design for creating various type of material. Templates can be used for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Tax Rates And Bands 2023 24 Uk

Income Tax Rates Australia 2023 24 Pay Period Calendars 2023

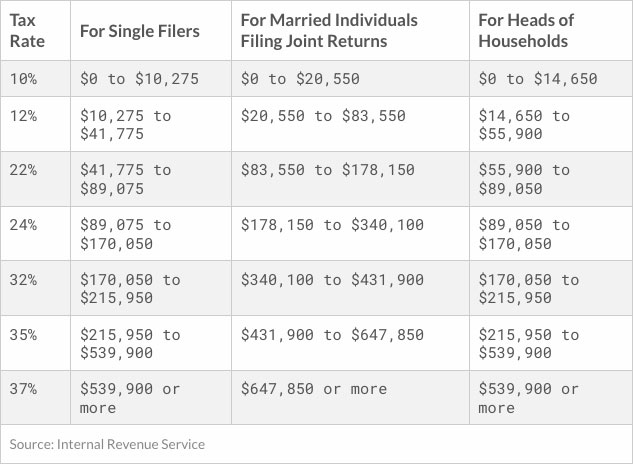

2022 Tax Brackets KrissDaemon

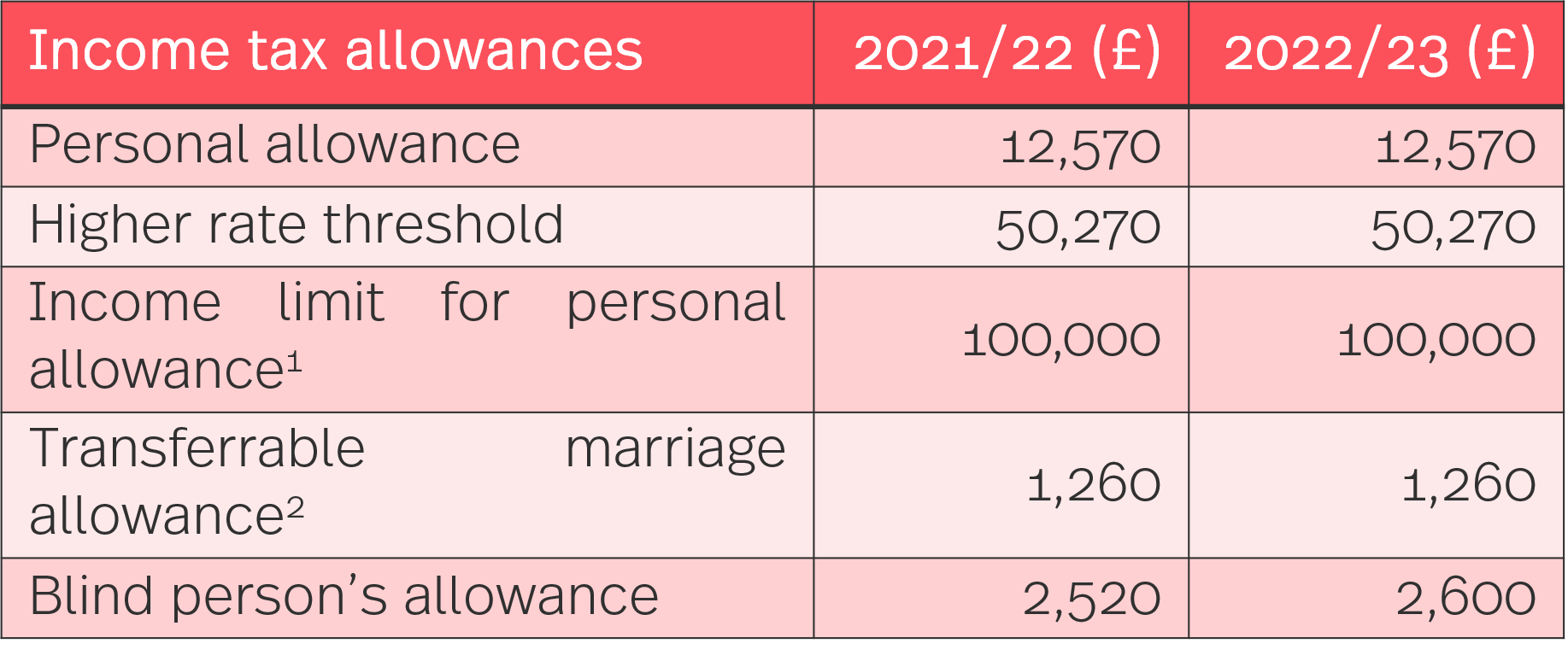

Preparing For The Tax Year 2022 23 PayStream

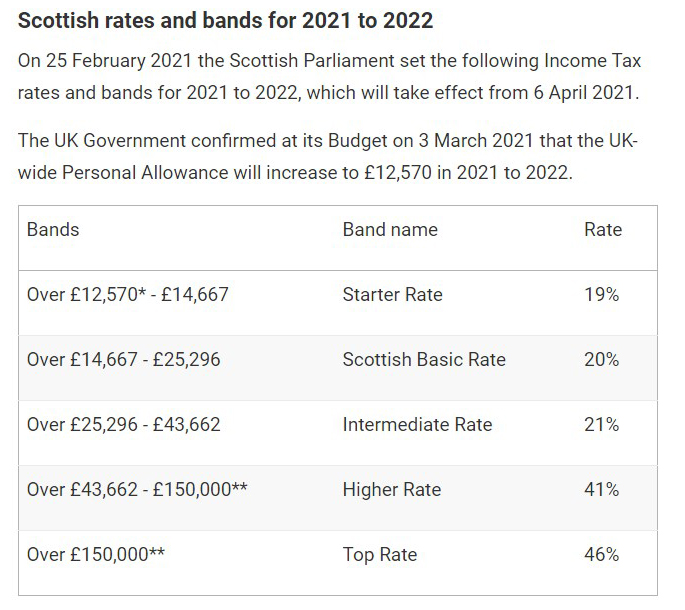

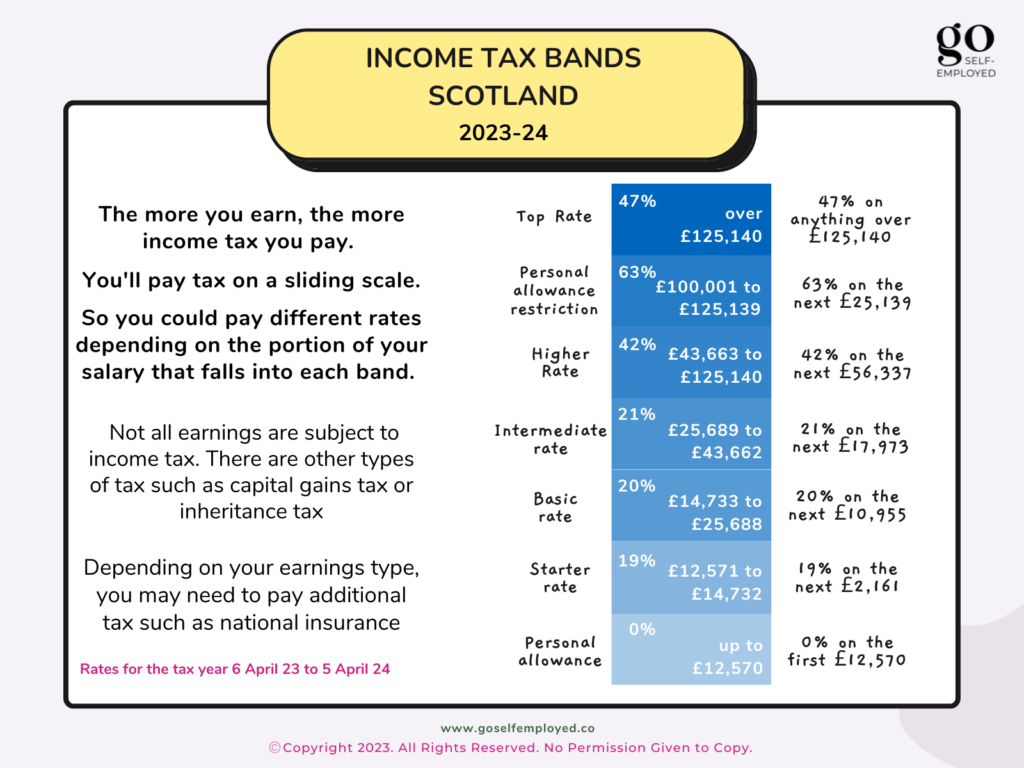

Scottish Income Tax

Technologieser

2022 Tax Brackets DhugalKillen

https://www.gov.uk › government › publications › rates...

Aug 14 2024 nbsp 0183 32 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025 tax

https://www.gov.uk › government › publications

Mar 15 2023 nbsp 0183 32 Rates for bands 75 to 170 grams per km and above will remain frozen for the 2026 to 2027 and 2027 to 2028 tax years From 6 April 2022 to 5 November 2022 the main and

https://www.uktaxcalculators.co.uk › tax-rates

Income Tax Bands and Percentages 0 starting rate is for savings income only if your non savings income is above the starting band level the 0 rate will NOT apply and the basic rate

https://www.income-tax.co.uk › what-are-the-uk-income-tax-bands

Jun 30 2022 nbsp 0183 32 If you earn over 163 12 570 in the UK you pay tax on your income There are three Income Tax rates in the UK beyond the tax free Personal Allowance Income Tax bands

https://www.theaccountancy.co.uk › tax › uk-tax-rates...

Mar 28 2025 nbsp 0183 32 What are the income tax rates and thresholds The table below shows the income tax rates and band thresholds for 2025 26 as well as for last year 2024 25 in England Wales

Mar 22 2023 nbsp 0183 32 A guide to the tax brackets and tax rates for the 2023 24 tax year including Income Tax rates National Insurance and Corporation Tax For the 2023 24 tax year your tax free Personal Allowance is 163 12 570 This is the same amount as the previous tax year although tax years before that look a little different The tax free

Explore detailed UK tax rates and thresholds for 2023 24 and 2024 25 including income tax National Insurance VAT and more