Uk Income Tax Rates 2023 24 Monthly Web Dec 11 2023 nbsp 0183 32 Income tax rates 2023 24 These income tax bands apply to England Wales and Northern Ireland for the 2023 24 tax year Income tax rates in Scotland are different Find out more in our guide to income taxes in Scotland Income up to 163 12 570 0 income tax This is your personal tax free allowance Income between 163 12 571 and

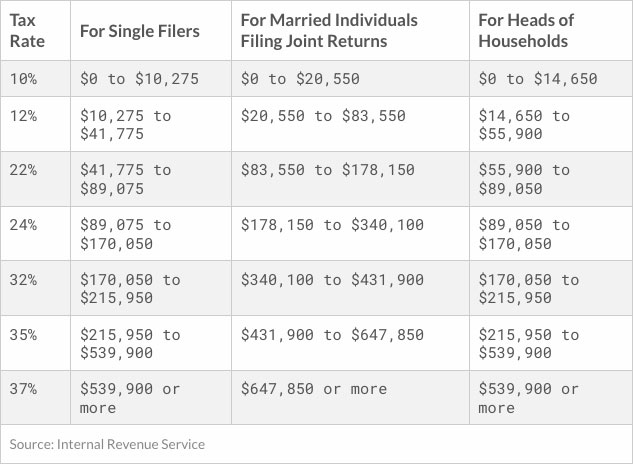

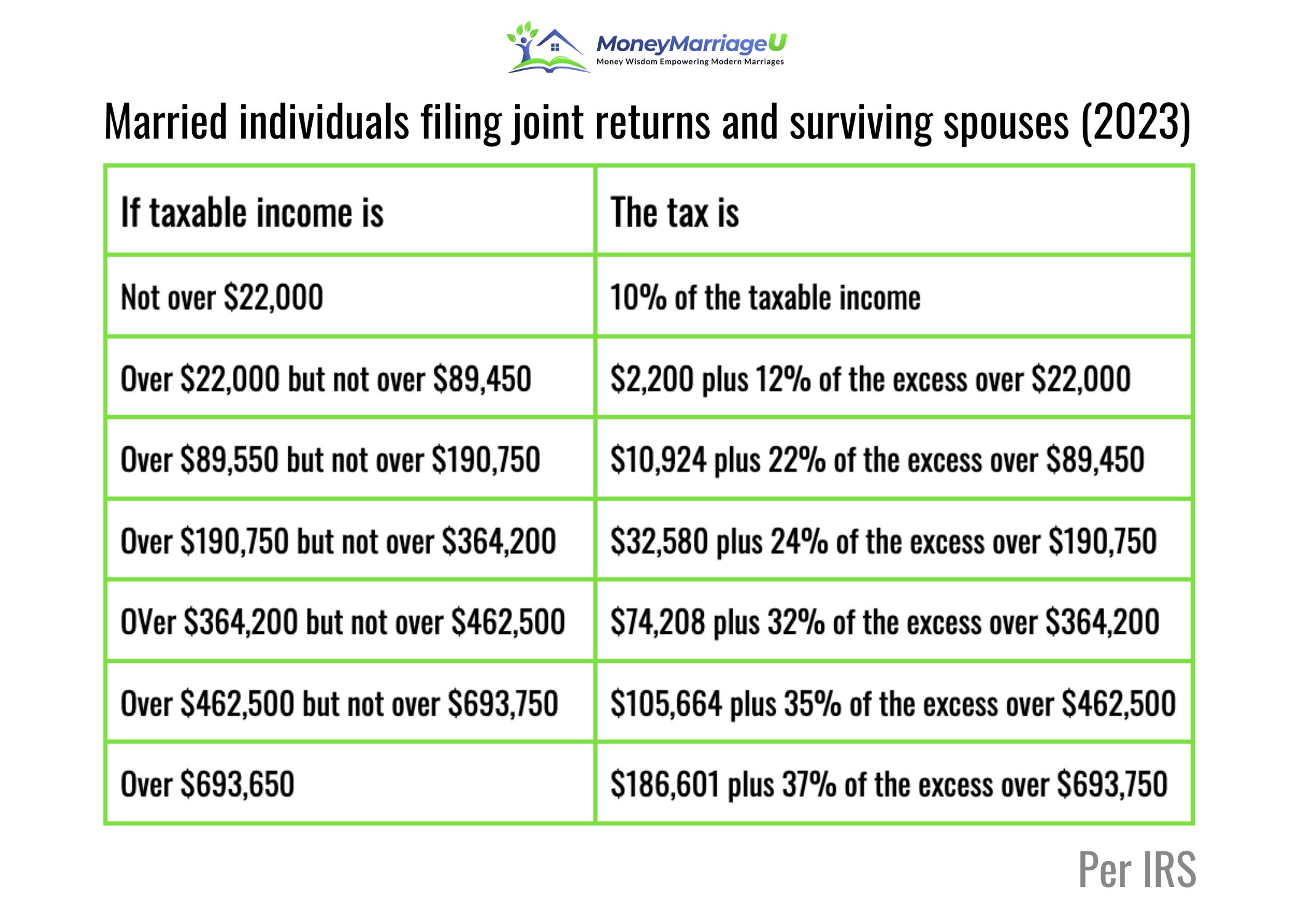

Web Mar 17 2023 nbsp 0183 32 The income tax rates for 2023 24 are therefore Basic tax rate at 20 Up to 163 37 700 Higher tax rate at 40 From 163 37 701 to 163 125 140 Additional tax rate at 45 Above 163 125 140 The income tax Personal Allowance on which no tax is paid remains at 163 12 570 per year This is reduced for those earning over 163 100 000 Web Jun 15 2023 nbsp 0183 32 What is the Personal Allowance for the 2022 23 and 2023 24 tax years Tax Free Personal Allowance and tax thresholds

Uk Income Tax Rates 2023 24 Monthly

Uk Income Tax Rates 2023 24 Monthly

Uk Income Tax Rates 2023 24 Monthly

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110caaad6e4ba113f0747bd_60d8291d00adb95310be397a_london_shopping_spree_1300x867.jpeg

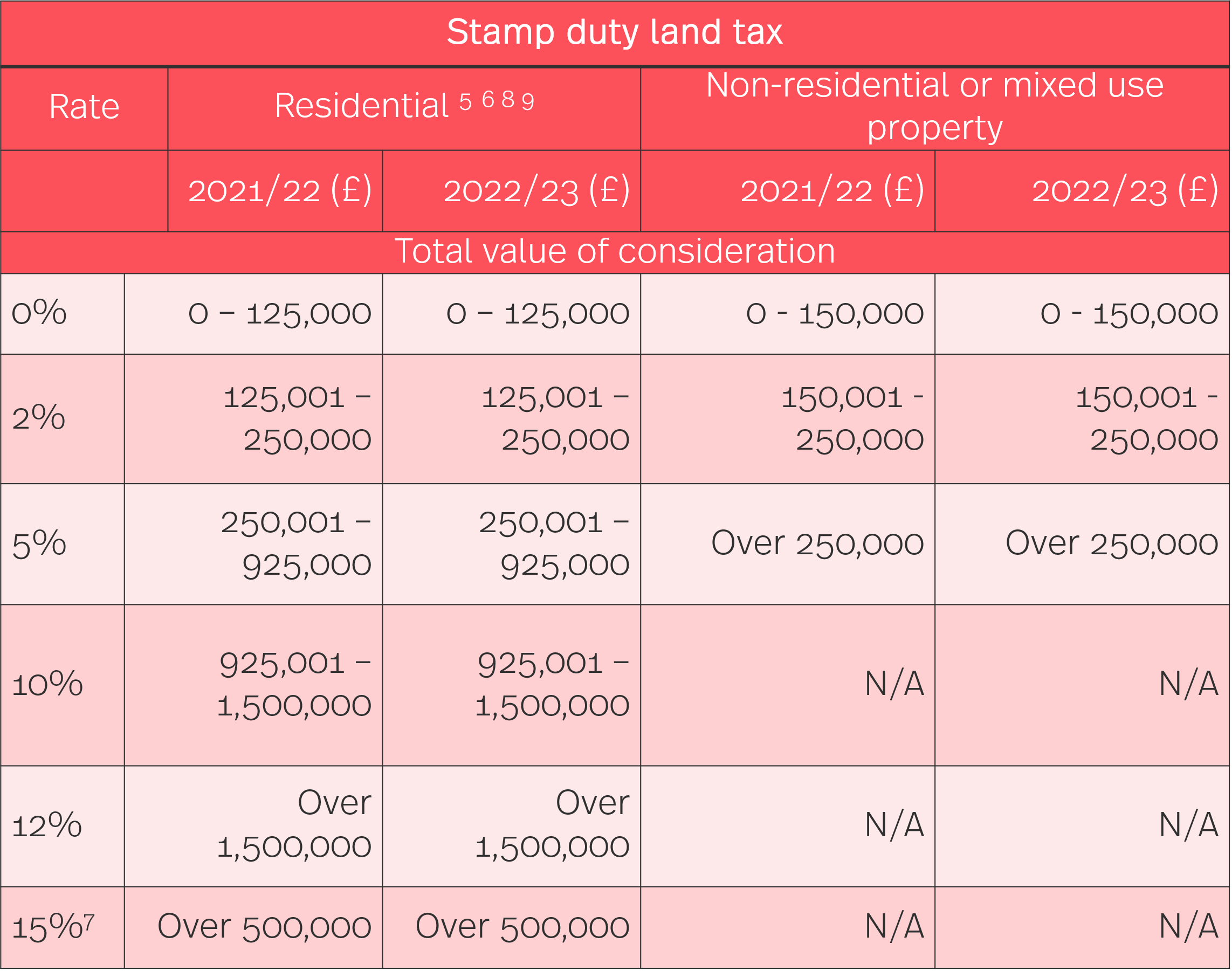

Web Individuals Higher Rate Taxpayer Other Gains 20 Personal Representative of a Deceased Individual Residential Property 28 Personal Representative of a Deceased Individual Other Gains 20 Gains Qualifying for Entrepreneurs Relief 10 2023 2024 Tax Rates and Allowances

Pre-crafted templates use a time-saving solution for creating a varied range of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and professional tasks, including resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the content creation procedure.

Uk Income Tax Rates 2023 24 Monthly

State Local Sales Tax Rates 2023 Sales Tax Rates Tax Foundation

2022 Tax Brackets KrissDaemon

Technologieser

2019 20 Tax Rates And Allowances Boox

CPI OOH CPIH 2016 6 2017 6

2022 Tax Table Philippines Latest News Update

https://www.gov.uk/guidance/rates-and-thresholds...

Web Feb 27 2023 nbsp 0183 32 Starter tax rate 19 Up to 163 2 162 Basic tax rate 20 From 163 2 163 to 163 13 118 Intermediate tax rate 21 From 163 13 119 to 163 31 092 Higher tax rate 42 From 163 31 093 to

https://www.moneysavingexpert.com/banking/tax-rates

Web Dec 20 2023 nbsp 0183 32 For the 2023 24 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 163 100 000

https://www.gov.uk/government/publications/rates...

Web Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 163 30 931 to 163 150 000 Top rate for tax year 2023 to 2024 47 Over 163 125 141

https://commonslibrary.parliament.uk/research-briefings/cbp-9754

Web Jan 8 2024 nbsp 0183 32 Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2023 24 these three rates are 20 40 and 45 respectively Tax is charged on taxable income at the

https://alexander.co.uk/news/tax-brackets-2023-our...

Web Mar 22 2023 nbsp 0183 32 For the 2023 24 tax year once again many rates remained unchanged however there were some key changes including significant reductions in Capital Gains Tax whilst the Pension Annual Allowance is increased to 163 60 000 and the Money Purchase Annual Allowance MPAA rises from 163 4 000 to 163 10 000

Web May 2 2023 nbsp 0183 32 Personal allowance in the UK taxpayers are entitled to a personal allowance which is the level of annual income they can earn before they start paying income tax For the 2023 24 tax year the personal allowance is 163 12 570 For every 163 2 earned over 163 100 000 taxpayers lose 163 1 from their personal allowance which is then taxed at the Web Feb 21 2023 nbsp 0183 32 VAT rate and threshold for 2023 24 The 2023 24 threshold for registration is 163 85 000 and will remain at this level until 31 March 2024 VAT or Value Added Tax is a tax charged by VAT registered businesses on most goods and services procured and supplied in the UK as well as some imported from EU countries

Web Jun 4 2023 nbsp 0183 32 Higher rate In England Wales and Northern Ireland the higher rate is paid on taxable income over from 163 37 701 to 163 125 140 In Scotland the higher rate of 42 is paid on taxable income over the Personal Allowance from 163 31 093 to 163 125 140