Uk Dividend Income Tax Rates 2023 24 Web Mar 13 2023 nbsp 0183 32 In this article Dividend tax calculator What is the dividend allowance in 2022 23 and 2023 24 What are the dividend tax rates for 2022 23 and 2023 24 What were the dividend tax rates in 2021 22 Dividends are paid to investors who own shares in a company they are a distribution of the profits a company has made

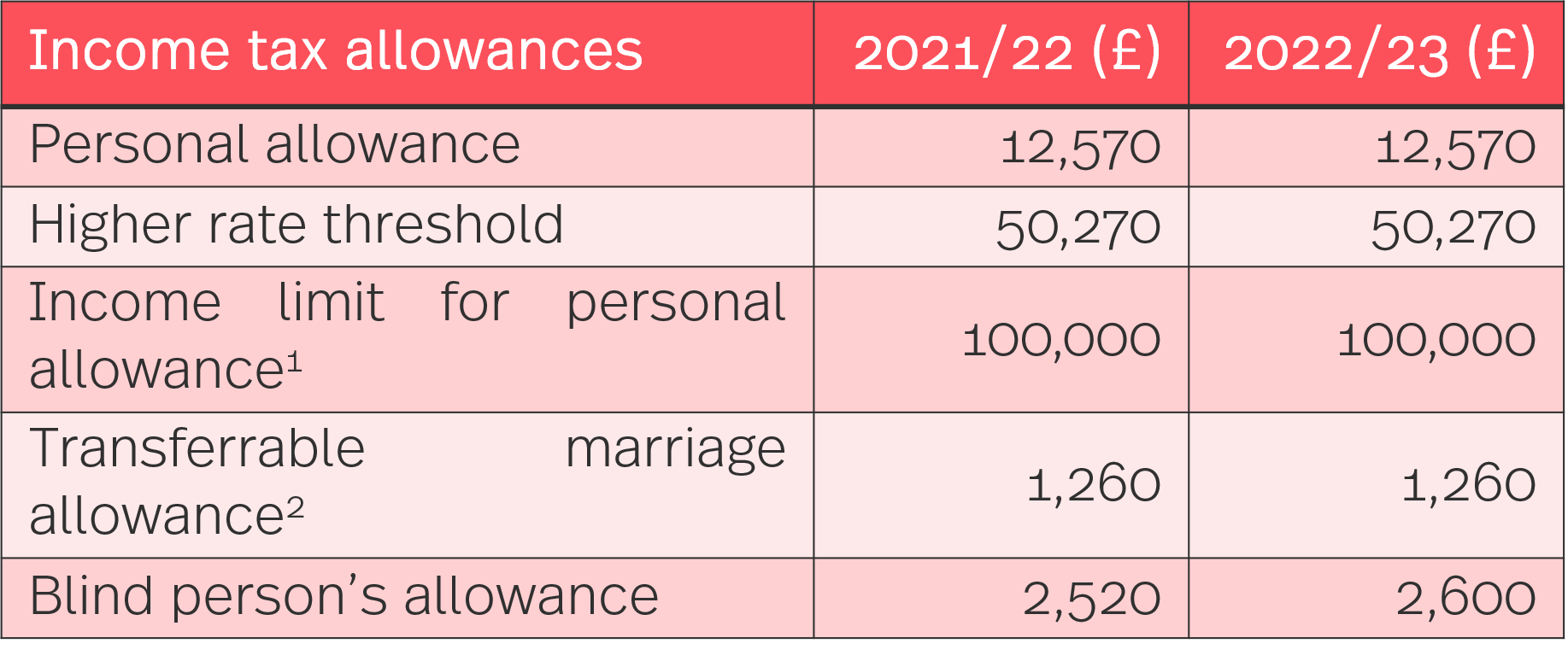

Web Nov 17 2023 nbsp 0183 32 Income tax rates on dividends 2023 24 Web The first 163 1 000 of dividends is tax free Dividends falling within the basic rate tax will be taxed at 8 75 Dividends falling within higher rate tax 163 50 270 for 2023 24 are taxed at 33 75 Dividends falling within the additional rate of tax are taxed at 39 35 For incomes above 163 100 000 your personal allowance starts to get restricted

Uk Dividend Income Tax Rates 2023 24

Uk Dividend Income Tax Rates 2023 24

Uk Dividend Income Tax Rates 2023 24

https://www.taxproadvice.com/wp-content/uploads/2021-short-term-capital-gains-tax-rate-cryptocurrency-mining-taxes-scaled.jpeg

Web For the 2023 24 tax year dividend tax rates can range from 0 to 39 35 depending on your income tax band and marginal rate of dividend tax What is the difference between dividend tax and other income sources

Templates are pre-designed files or files that can be utilized for various purposes. They can save time and effort by supplying a ready-made format and design for developing various kinds of material. Templates can be used for individual or professional tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Uk Dividend Income Tax Rates 2023 24

A Guide To UK Dividend Tax Rates In 2022 2023 Accounts And Legal

UK Dividend Tax Rates 2018 19

IRS Inflation Adjustments Taxed Right

State Local Sales Tax Rates 2023 Sales Tax Rates Tax Foundation

.png)

What s Your State s Dividend Income Tax ThinkAdvisor

UK Dividend Tax Rates 2022 23 Goselfemployed co

https://www.gov.uk/government/publications/rates...

Web Higher rate for tax year 2023 to 2024 42 31 093 to 163 125 140 Higher rate for tax years up to and including 2022 to 2023 41 163 31 093 to 163 150 000 163 31 093 to 163 150 000 163

https://www.gov.uk/.../income-tax-reducing-the-dividend-allowance

Web Nov 21 2022 nbsp 0183 32 At Autumn Budget 2021 the government announced that the rate of Income Tax applicable to dividend income would increase by 1 25 percentage point to 8 75 for the ordinary rate 33 75

https://www.theaccountancy.co.uk/limited-company/...

Web Dec 8 2023 nbsp 0183 32 Dividend Tax 2022 23 Threshold 2023 24 Dividend Tax 2023 24 Personal Allowance no tax payable on earnings in this band 163 0 163 12 570 0 163 0 163 12 570 0 Basic rate tax payers 163 12 571 163 50 270 8 75 163 12 571 163 50 270 8 75 Higher rate taxpayers 163 50 271 163 150 000 33 75 163 50 271 163 125 140 33 75

https://www.gov.uk/income-tax-rates

Web The current tax year is from 6 April 2023 to 5 April 2024 This guide is also available in Welsh Cymraeg Your tax free Personal Allowance The standard Personal Allowance is 163 12 570 which

https://www.which.co.uk/money/tax/income-tax/...

Web Basic rate 8 75 Higher rate 33 75 Additional rate 39 35 In the 2023 24 tax year you won t need to pay any tax on the first 163 1 000 of dividend income you receive This is called the tax free dividend allowance The allowance was cut from 163 2 000 in the 2022 23 and was 163 5 000 as recently as 2017 18

Web Nov 28 2022 nbsp 0183 32 The Chancellor confirmed in the Autumn Statement the following rates of income tax on dividend income which will remain through 2022 23 and into the 2023 24 year as well ordinary rate 8 75 upper rate 33 75 additional rate 39 35 The dividend allowance the amount of dividend income a UK tax resident individual can receive tax Web Jun 15 2023 nbsp 0183 32 UK Dividend tax rates income allowance and tax thresholds There are changes to dividend tax rates but no change to the Dividend Tax Allowance for dividend income between 2023 24 and 2022 23 tax years The tax free dividend allowance is 163 1 000 Basic rate taxpayers pay 8 75 in the 2023 24 and 2022 23 tax years

Web Income Tax The additional rate tax band falls from 163 150 000 to 163 125 140 in 2023 24 163 0 163 12 570 0 tax free Personal Allowance if eligible 163 12 571 163 50 270 20 basic rate 163 50 271 163 125 140 40 higher rate over 163 125 140 45 additional rate