Uk Income Tax Rates 2023 24 Ni Jan 8 2024 nbsp 0183 32 For 2023 24 these three rates are 20 40 and 45 respectively Tax is charged on taxable income at the basic rate up to the basic rate limit set at 163 37 700 Taxable income excludes personal allowances which represent the amount of

Mar 6 2024 nbsp 0183 32 National insurance 05 Mar 2024 National Insurance rates and contributions How much national insurance you pay depends on whether you re an employee or self employed as well as your age and retirement status Matthew Jenkin Senior writer In this article What is National Insurance Who pays National Insurance The following five tax rates and bands for non savings non dividend income apply in 2023 24 Subject to Personal Allowance Property Allowance and Trading Allowance see page 3 Income tax rates Wales The Senedd has the power to vary the income tax rates but not the bands for non savings non dividend income of Welsh resident taxpayers

Uk Income Tax Rates 2023 24 Ni

Uk Income Tax Rates 2023 24 Ni

Uk Income Tax Rates 2023 24 Ni

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets-768x510.jpg

11 March 2024 Getty Images BBC The government is cutting National Insurance NI by 2p from April However previous changes to the way tax is calculated mean the amount people pay overall is

Templates are pre-designed documents or files that can be utilized for various purposes. They can save time and effort by offering a ready-made format and design for creating different kinds of content. Templates can be used for individual or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Uk Income Tax Rates 2023 24 Ni

60 000 After Tax 2022 2023 Income Tax UK

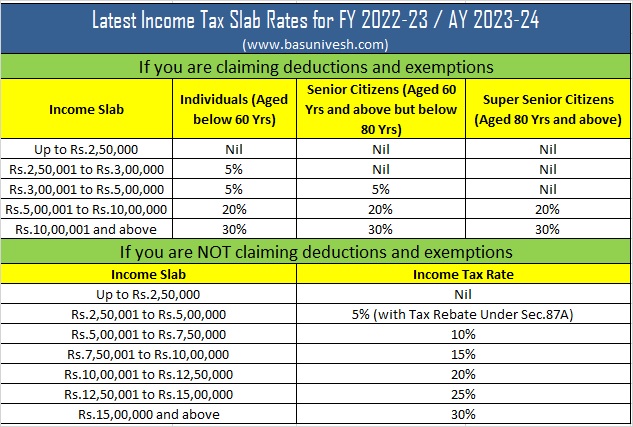

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

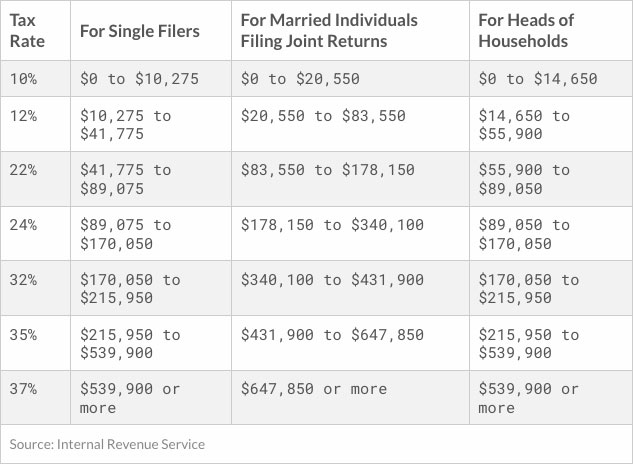

2022 Tax Brackets KrissDaemon

2022 Tax Brackets JeanXyzander

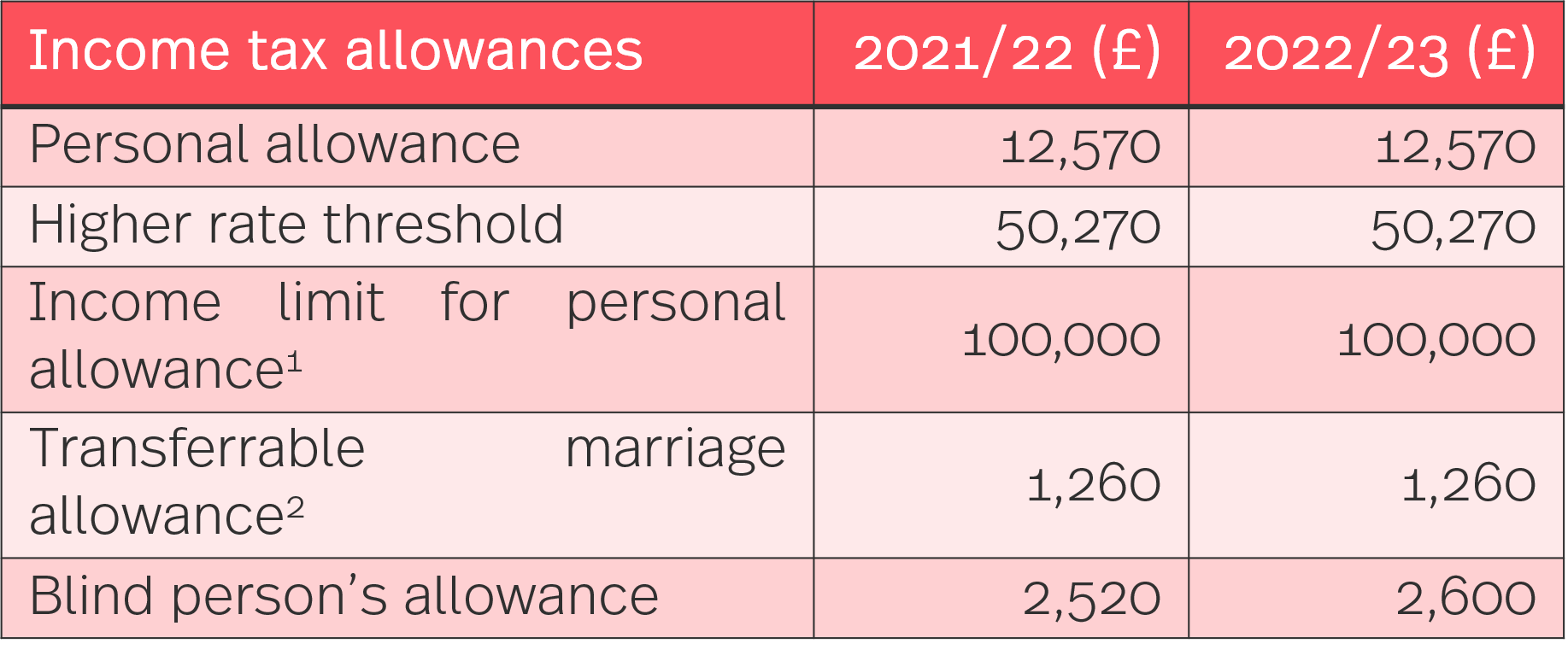

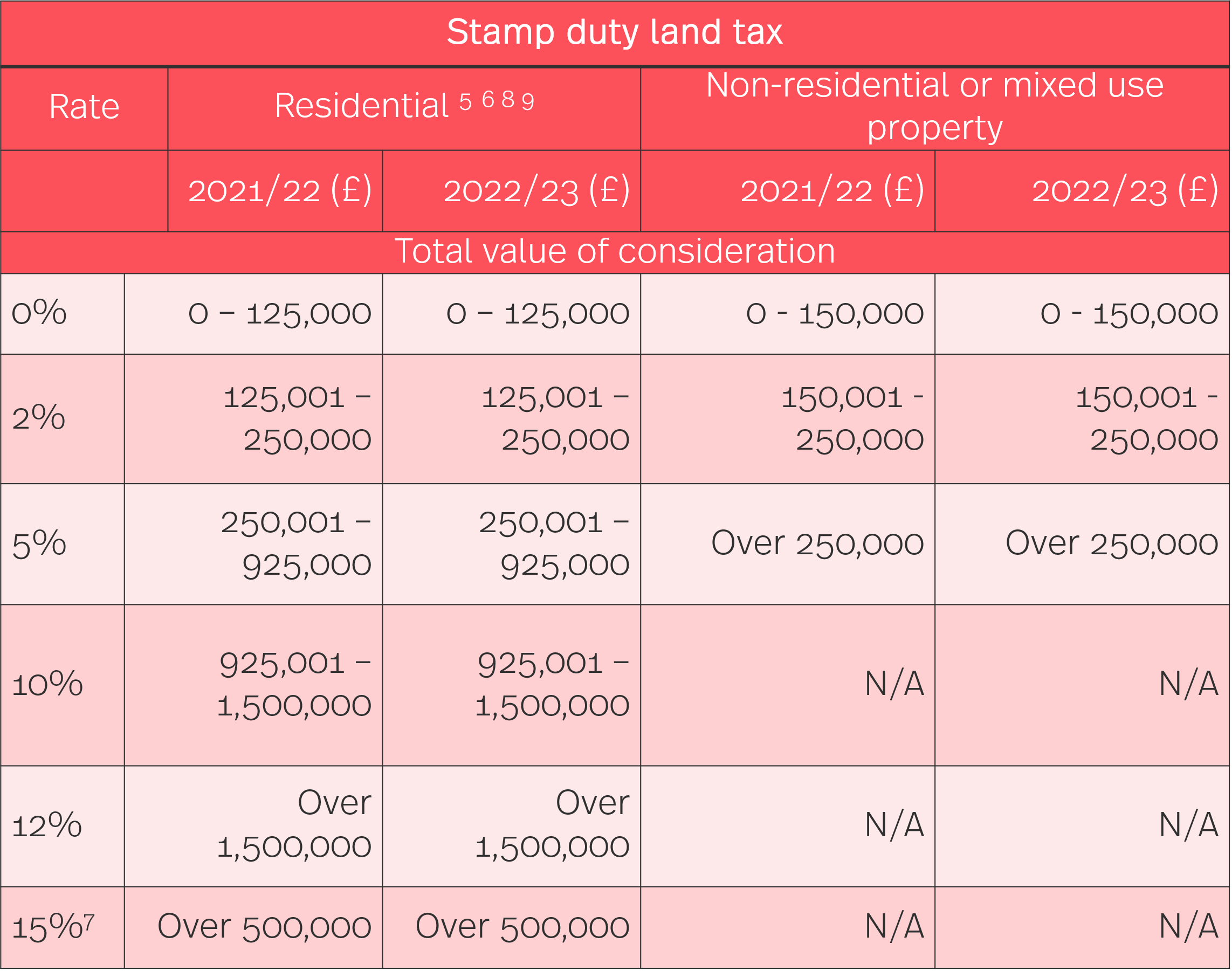

2019 20 Tax Rates And Allowances Boox

U K Income Tax Rates Guidelines Expat US Tax

https://www.gov.uk/guidance/rates-and-thresholds...

Feb 27 2023 nbsp 0183 32 Starter tax rate 19 Up to 163 2 162 Basic tax rate 20 From 163 2 163 to 163 13 118 Intermediate tax rate 21 From 163 13 119 to 163 31 092 Higher tax rate 42 From 163 31 093 to

https://www.gov.uk/national-insurance-rates-letters

2020 to 2021 You can also use calculators and tables to check employees National Insurance Class 1A and Class 1B rates Employers pay Class 1A and 1B National Insurance on expenses and

https://www.which.co.uk/money/tax/income-tax/tax...

Jan 25 2024 nbsp 0183 32 04 Mar 2024 UK income tax rates 2023 24 and 2024 25 Find out how much income tax you ll pay in England Wales Scotland and Northern Ireland Matthew Jenkin Senior writer In this article What is income tax Income tax in England Wales and Northern Ireland Income tax in Scotland Which income tax rate do I pay UK income tax calculator

https://www.uktaxcalculators.co.uk/tax-rates/2023-2024

2024 5 APRIL 2023 2024 Tax Rates and Allowances Click to select a tax section Income Tax Use our Tax Calculator to Calculate Income Tax Tax Free Personal Allowance the amount of gross income you can earn before you are liable to paying income tax Income Limits For

https://www.moneysavingexpert.com/banking/tax-rates

For the 2023 24 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 163 100 000

We ve now updated this calculator to include the national insurance NI cut from April See what your new take home pay will be for the 2024 25 tax year Gross pre tax Income I live in Scotland Get the latest MoneySaving tips Your Results Read a full breakdown of the tax you pay Tax Rates 2023 24 IMPORTANT Sep 29 2022 nbsp 0183 32 From this point upwards income tax of 19 a 1 cut from the current rate and employee national insurance of 12 a reduction from the 13 25 in force until next month are expected to apply in 2023 24 a combined rate of 31 that reduces take home pay to 69 of each extra pound earned

Feb 28 2024 nbsp 0183 32 The starting rate for savings is a maximum of 163 5 000 Dividend Allowance 163 1 000 Dividend tax rates Basic rate 8 75 Higher rate 33 75 Additional rate 39 35 Trusts Standard rate band 163 1 000 Rate applicable to trusts Dividends 39 35 other income 45 MAIN PERSONAL ALLOWANCES AND RELIEFS Income limit for Personal Allowance 167 163 100 000