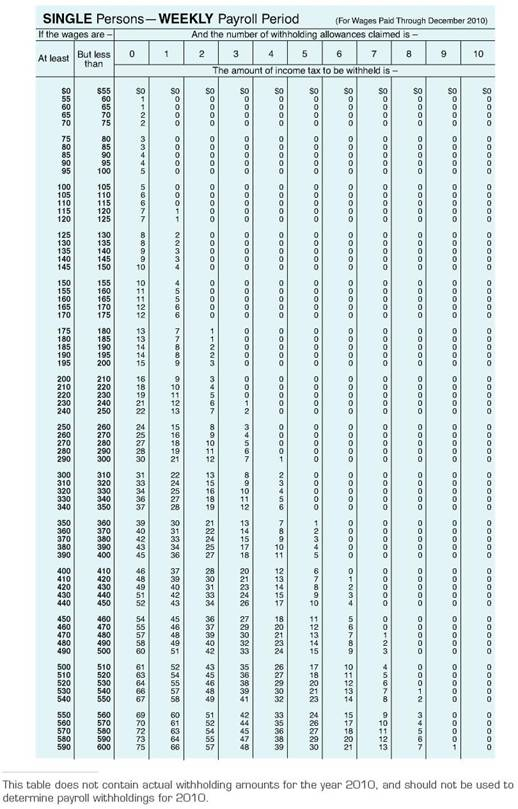

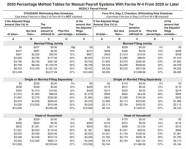

Ato Tax Tables 2022 Weekly Pdf Employers and other payers will be required to use the updated ATO weekly tax table fortnightly tax table monthly tax table and daily tax table to calculate withholding amounts on any regular payments made to their employees

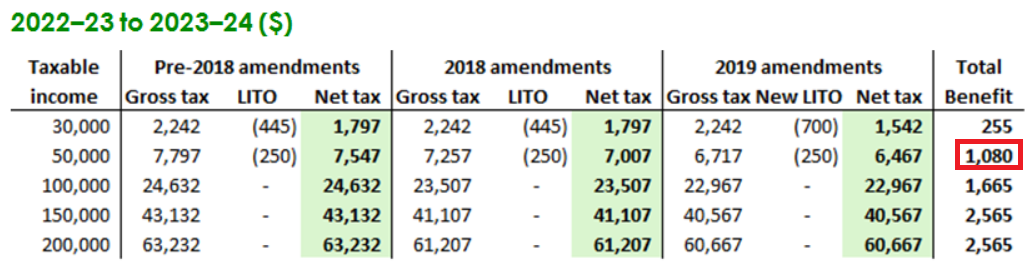

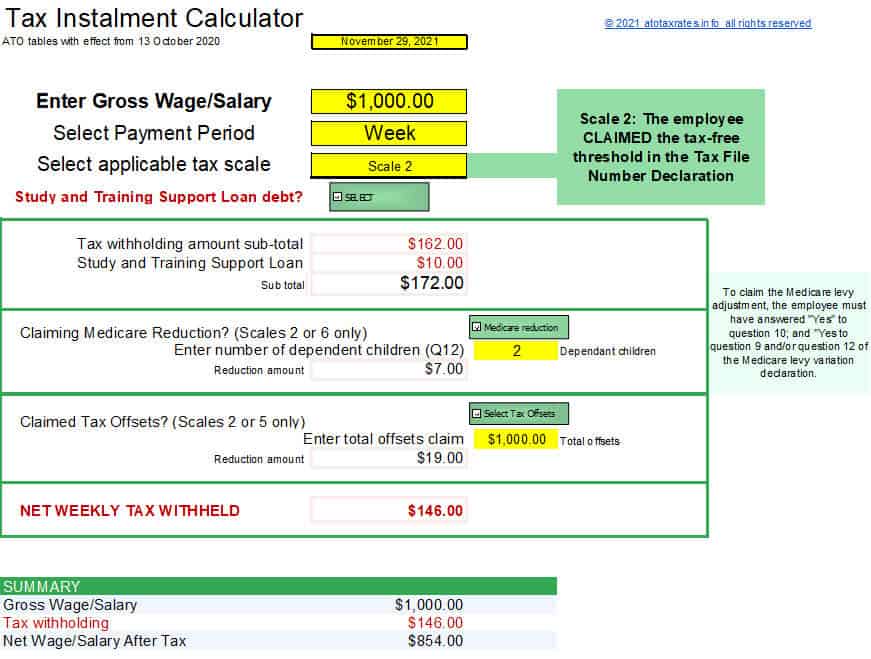

Jun 30 2022 nbsp 0183 32 free tax calculator The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year This tax table reflects the last amended tax brackets from as at 6 October 2020 All income received by individuals is taxed at progressive tax rates in Australia That means your income is taxed in brackets and not at the marginal tax rate Below are the ATO tax rates that applies to individuals who are Australian residents for tax purposes

Ato Tax Tables 2022 Weekly Pdf

Ato Tax Tables 2022 Weekly Pdf

Ato Tax Tables 2022 Weekly Pdf

https://federalwithholdingtables.net/wp-content/uploads/2021/07/solved-determining-federal-income-tax-withholding-data.png

We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees A tax withheld calculator that calculates the correct amount of tax to withhold is available Tax tables for previous years are also available

Templates are pre-designed documents or files that can be used for numerous functions. They can save effort and time by offering a ready-made format and design for developing various sort of material. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Ato Tax Tables 2022 Weekly Pdf

What Australian Businesses Should Know About The Updated Tax Tables

Il Withholding Tables 2020 Gettrip24

2022 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia

ATO WEEKLY TAX TABLE 2012 13 PDF

Tax Tables Weekly Ato Review Home Decor

Ato Tax Rates Nat 1005 Spot Walls

https://www.ato.gov.au/api/public/content/7fbd3be...

Weekly tax table NAT 1005 06 2024 DE 65156 This tax table applies to payments made from 1 July 2024 Includes the tax offset ready reckoner on page 13 Amount to be withheld Weekly earnings

https://www.ato.gov.au/api/public/content/f695b8f3...

Oct 13 2020 nbsp 0183 32 Where the tax free threshold is not claimed and your employee earns more 3 275 withhold 1 141 plus 47 cents for each 1 of earnings in excess of 3 275 For all withholding amounts calculated round the result to the nearest dollar

https://www.eris.com.au/assets/files/Updates to tax...

Updates to the tax tables for the 2022 2023 financial year The Pay As You Go PAYG tax tables continue to remain the same for the 2022 2023 financial year These tax tables have remained unchanged since 13 October 2020 To download the PAYG tax tables click on the below Weekly tax table Fortnightly tax table Monthly tax table

https://softwaredevelopers.ato.gov.au/2022-pay-you...

May 9 2022 nbsp 0183 32 Updated schedules and tax tables will be published from mid June at ato gov au tax tables Other important information We do not update the statement of formulas and regular tax tables to only accommodate the annual

https://atotaxcalculator.com.au/tax-tables

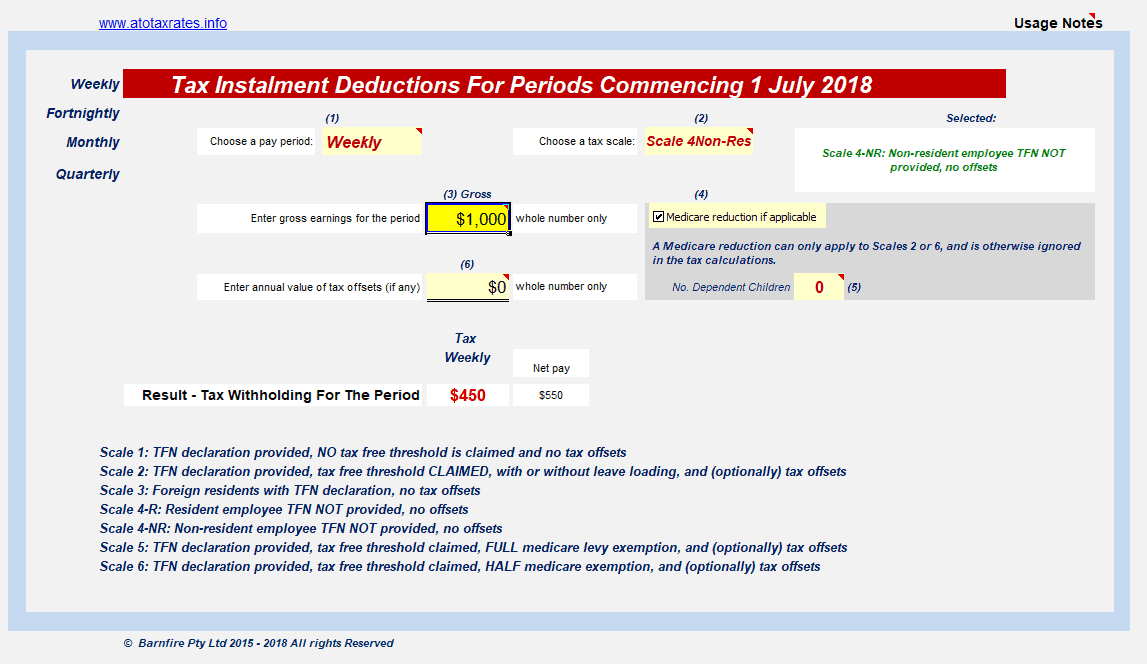

Tax table for daily and casual workers NAT 1024 Weekly tax tables are most popular in Australia However instead of using tax tables you can use our calculator to do weekly tax calculations in a simpler and quicker way

Oct 30 2024 nbsp 0183 32 The ATO provides tax tables for different pay frequencies weekly fortnightly or monthly to guide employers in calculating the correct PAYG withholding amounts This ensures employees meet their tax obligations without facing a large end of year bill The calculator covers individuals using the ATO s tax scales 1 to 6 with weekly fortnightly monthly and quarterly calculations available The tool handles variations for resident non resident and medicare levy reductions and HECS HELP loan additions

The weekly tax tables allow you to calculate how much tax should be withheld for a particular gross weekly wage What is the tax table for 2022 Please refer to the current ATO tax table for weekly wages listed above