Ato Tax Tables 2022 Pdf WEB Monthly tax table For payments made on or after 1 July 2014 Using this table You should use this table if you make any of the following payments on a monthly basis salary wages allowances and leave loading to employees paid parental leave

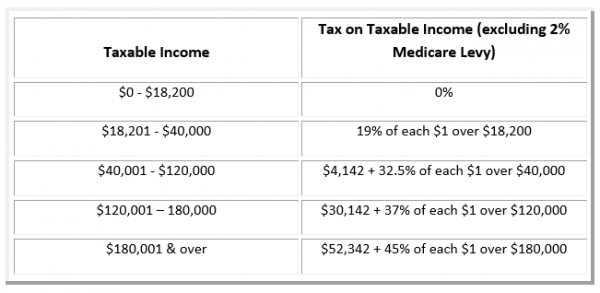

WEB Fortnightly tax table For payments made on or after 1 July 2014 Using this table You should use this table if you make any of the following payments on a fortnightly basis salary wages allowances and leave loading to employees paid parental leave to an eligible worker director s fees WEB Tax Rates 2022 2023 Year Residents The 2023 financial year in Australia starts on 1 July 2022 and ends on 30 June 2023 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year

Ato Tax Tables 2022 Pdf

Ato Tax Tables 2022 Pdf

Ato Tax Tables 2022 Pdf

https://federal-withholding-tables.net/wp-content/uploads/2021/07/weekly-tax-table-2016-17-hqb-accountants-auditors-advisors.jpg

WEB Your MYOB Tax Tables have arrived We ve put together a reference document covering all the legislative changes tax rates and tables for 2022 Click 2022 Tax Tables pdf to download a pdf copy of the document

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by supplying a ready-made format and design for creating different sort of content. Templates can be utilized for personal or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Ato Tax Tables 2022 Pdf

ATO WEEKLY TAX TABLE 2012 13 PDF

Tax Tables 2021 Learngross

2018 19 Federal Budget Personal Income Tax

Tax Tables Weekly Ato Review Home Decor

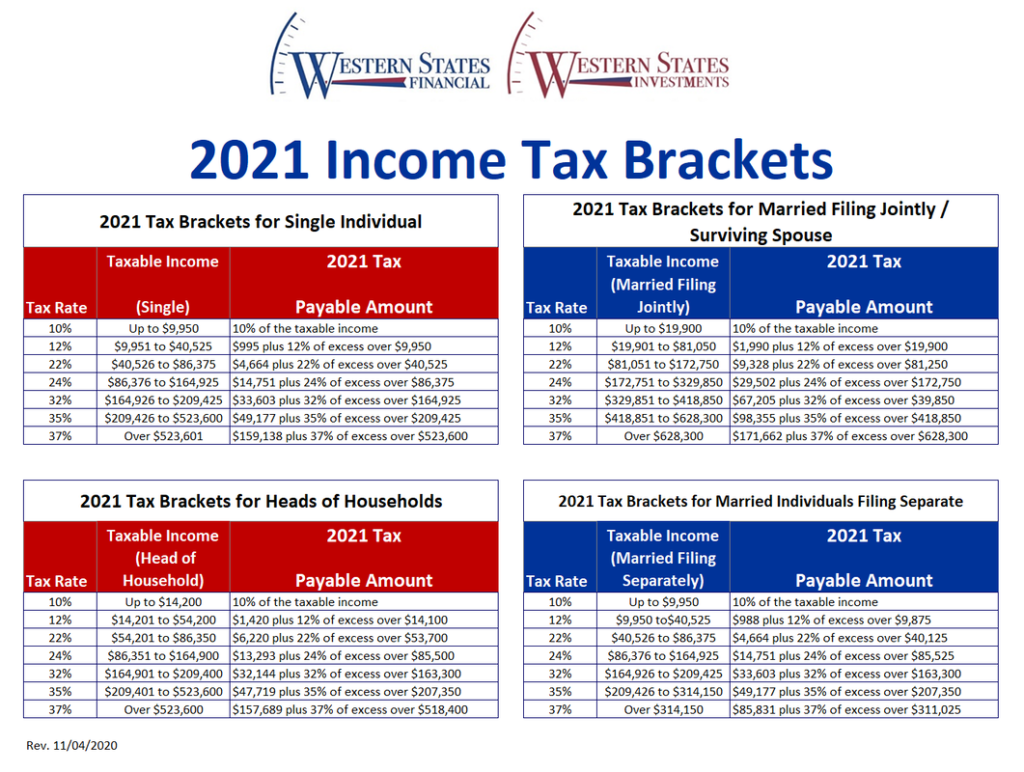

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

Tax Return 2023 Chart Printable Forms Free Online

https://www.ato.gov.au/api/public/content/f695b8f3...

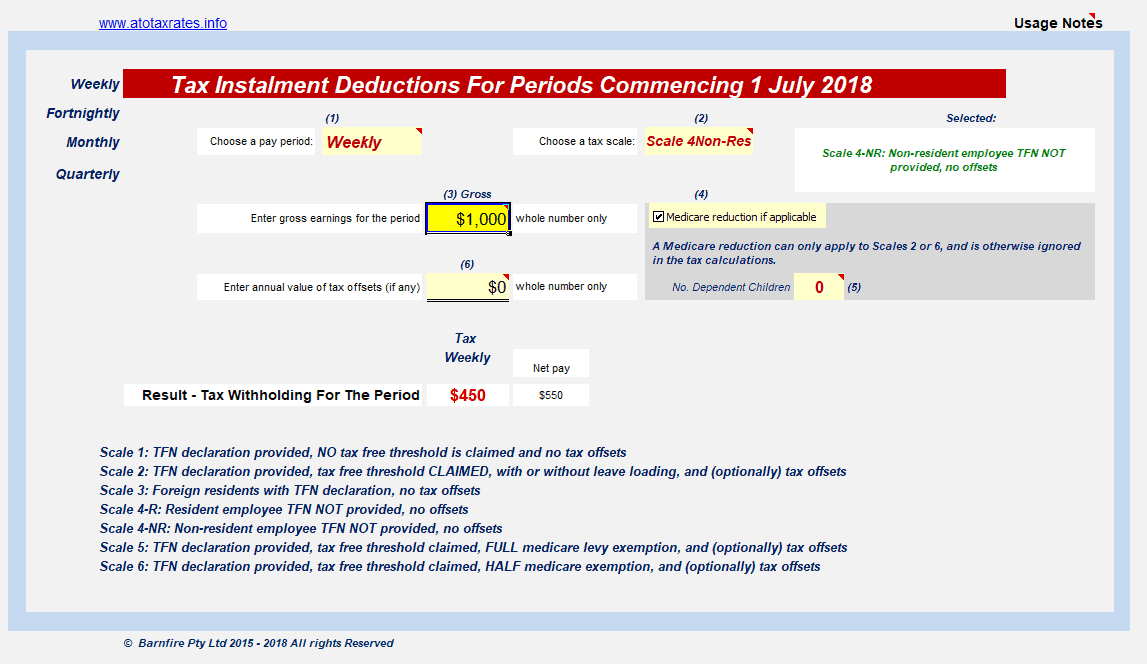

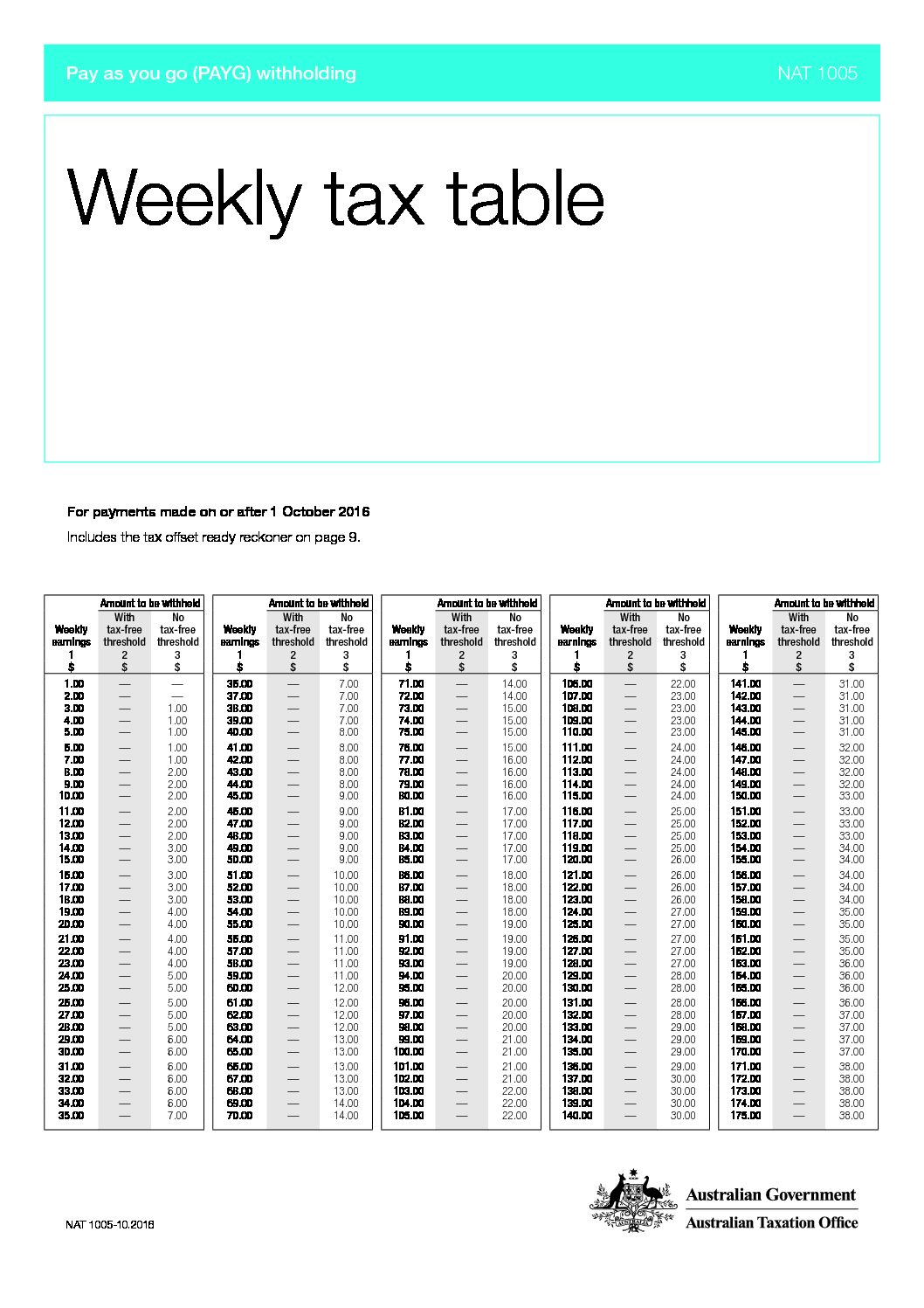

WEB Oct 13 2020 nbsp 0183 32 Weekly tax table For payments made on or after 13 October 2020 Includes the tax offset ready reckoner on page 9 NAT 1005 10 2020

https://www.ato.gov.au/tax-rates-and-codes/tax-table-weekly

WEB This tax table applies to payments made from 1 July 2024 You should use this tax table if you make any of the following payments on a weekly basis salary wages allowances and leave loading to employees

https://www.ato.gov.au/api/public/content/7b14a028...

WEB Oct 13 2020 nbsp 0183 32 Fortnightly tax table For payments made on or after 13 October 2020 Includes the tax offset ready reckoner on page 9 If exact earnings amount are not shown in the table use the nearest lower figure NAT 1006 10 2020

https://softwaredevelopers.ato.gov.au/.../NAT_1005.pdf

WEB Using this table You should use this table if you make any of the following payments on a weekly basis salary wages allowances and leave loading to employees paid parental leave to an eligible worker director s fees

https://softwaredevelopers.ato.gov.au/2022-pay-you...

WEB May 9 2022 nbsp 0183 32 Updated schedules and tax tables will be published from mid June at ato gov au tax tables Other important information We do not update the statement of formulas and regular tax tables to only accommodate the annual indexation of the Medicare levy thresholds

WEB Jun 16 2024 nbsp 0183 32 Print or Download Using this tax table This tax table applies to payments made from 1 July 2024 You should use this tax table if you make any of the following payments on a fortnightly basis salary wages allowances and leave loading to employees paid parental leave directors fees WEB Tax Tables The stage 3 legislated tax cuts take effect from the 2024 25 income year resulting in all withholding schedules being updated to apply from 1 July 2024 as set out below The previous tax tables came into force on 13 October 2020 and apply up to 30 June 2024 with limited exceptions

WEB Oct 12 2020 nbsp 0183 32 download a printable lookup table of monthly tax table PDF 958KB Working out the withholding amount To work out the withholding amount Calculate your employee s total monthly earnings add any allowances and irregular payments that are to be included in this month s pay to the normal monthly earnings ignoring any cents