Tax Tables For 2022 Web Jan 18 2022 nbsp 0183 32 Tax filing deadline to request an extension until Oct 17 2022 for individuals whose tax return deadline is April 18 2022 Last day to contribute to Rothor traditional IRA or HSA f or 2021 Note Kentucky Illinois and Tennessee tornado victims have until May 16 2022 to file 2021 individual income tax returns as well as various 2021

Web Jan 12 2024 nbsp 0183 32 Overall your tax liability for the 2023 tax year will be 15 107 50 1 100 4047 9 960 50 This means that although you fall under the 22 tax rate your effective tax rate is about 16 8 which is the average tax rate of the total taxable income you re required to pay Web Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

Tax Tables For 2022

Tax Tables For 2022

Tax Tables For 2022

https://www.pdffiller.com/preview/624/911/624911793/big.png

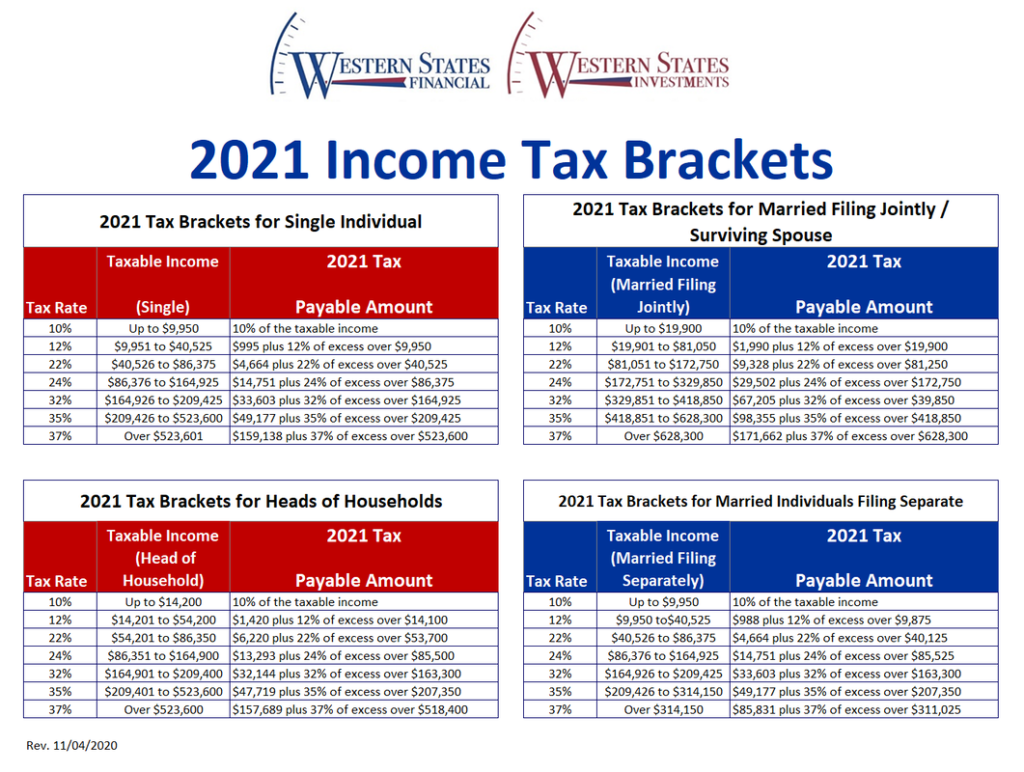

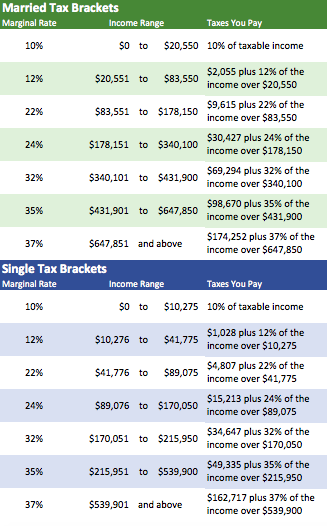

Web Jan 29 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which federal tax rates apply to

Pre-crafted templates offer a time-saving service for producing a varied range of documents and files. These pre-designed formats and designs can be used for different personal and professional projects, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content creation procedure.

Tax Tables For 2022

Federal Income Tax Withholding 2022 Latest News Update

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

Payroll Taxes 2023 Calculator MacharOgulcan

2021 Philippine Income Tax Tables Under TRAIN LaptrinhX News

2021 Nebraska Withholding Tax Tables Federal Withholding Tables 2021

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

https://www.irs.gov/pub/irs-prior/i1040tt--2022.pdf

Web 2022 Tax Table k See the instructions for line 16 to see if you must use the Tax Table below to figure your tax At Least But Less Than SingleMarried ling jointly Married ling sepa rately Head of a house hold Your taxis 25 200 25 250 25 300 25 350 2 822 2 828 2 834 2 840 Sample Table 25 250 25 300 25 350 25 400 2 616 2 622 2 628 2 634

https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

Web This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments NOTE THIS BOOKLET DOES NOT CONTAIN ANY TAX FORMS

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation

https://www.morganstanley.com/content/dam/msdotcom/...

Web tax tables 2022 edition 1 taxable income base amount of tax plus marginal tax rate of the amount over not over over single 0 10 275 0 10 0 0 10 275 41 775 1 027 50 12 0 10 275 41 775 89 075 4 807 50 22 0 41 775 89 075 170 050 15 213 50 24 0 89 075 170 050 215 950 34 647 50 32 0 170 050

https://www.irs.gov/instructions/i1040tt

Web First they find the 25 300 25 350 taxable income line Next they find the column for married filing jointly and read down the column The amount shown where the taxable income line and filing status column meet is 2 599 This is the tax amount they should enter in the entry space on Form 1040 line 16

Web Dec 2 2021 nbsp 0183 32 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023 Web Jan 23 2023 nbsp 0183 32 You can find the latest tax table which you ll use in 2023 to file 2022 taxes on the IRS website specifically its publication named Tax Year 2022 1040 and 1040 SR Tax and Earned Income Credit Tables Tax tables are used to calculate the tax you owe based on your filing status and taxable income

Web Tax tables like the one above show the federal tax brackets to help you understand the amount of tax you owe based on your filing status income and deductions and credits non business returns for the past two tax years 2022 2021 Audit support is informational only We will not represent you before the IRS or state tax authority or