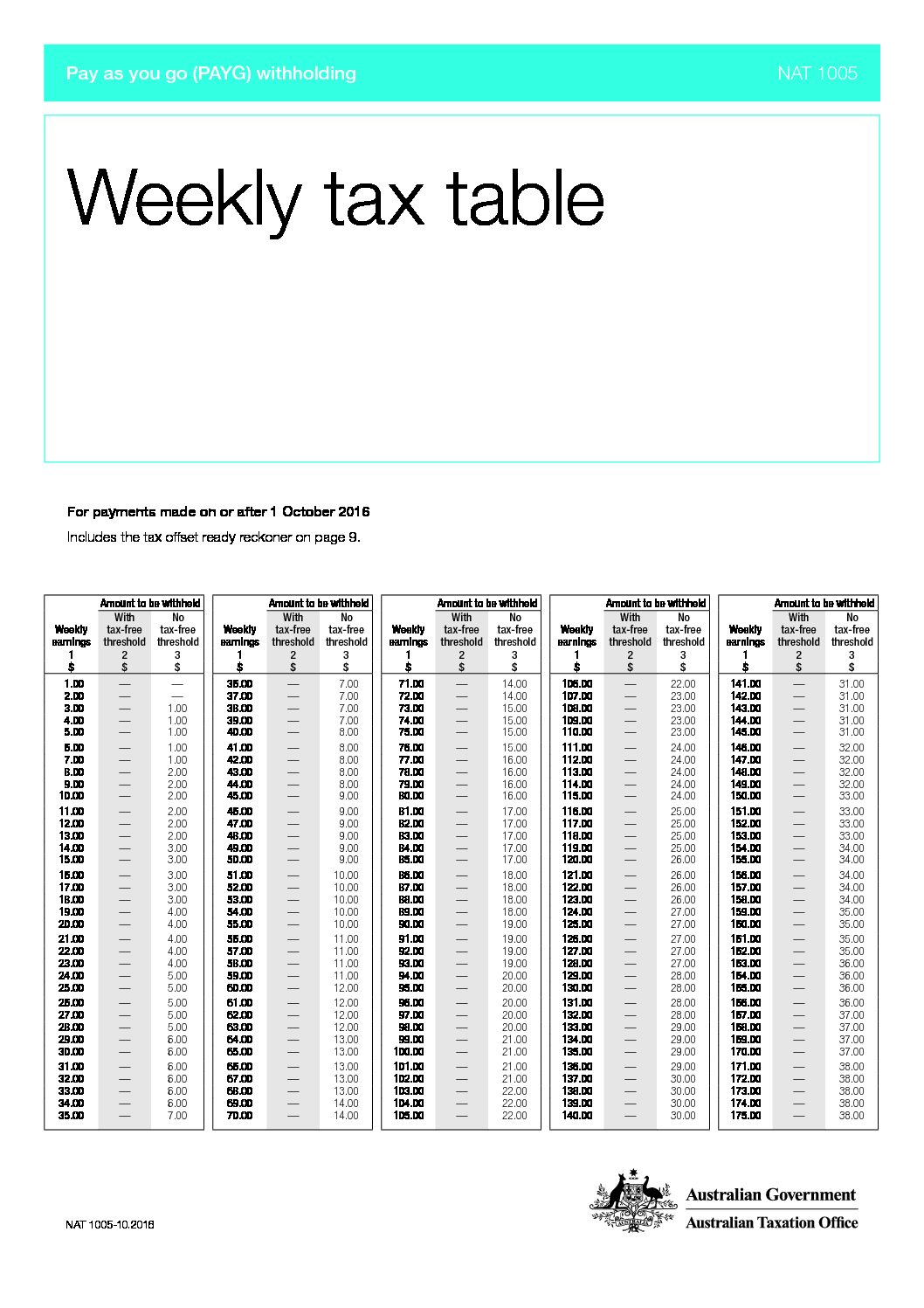

Ato Payg Weekly Tax Table 2022 Pdf WEB Oct 13 2020 nbsp 0183 32 Fortnightly tax table For payments made on or after 13 October 2020 Includes the tax offset ready reckoner on page 9 If exact earnings amount are not shown in the table use the nearest lower figure NAT 1006 10 2020

WEB May 17 2023 nbsp 0183 32 The updated schedule 8 and associated tax tables will be published from mid June at ato gov au tax tables Other important information We do not update the statement of formulas and regular tax tables to only accommodate the annual indexation of the Medicare levy thresholds WEB A downloadable Excel spreadsheet withholding calculator for individuals which contains the most commonly used tax scales for weekly fortnightly monthly and quarterly calculations

Ato Payg Weekly Tax Table 2022 Pdf

Ato Payg Weekly Tax Table 2022 Pdf

Ato Payg Weekly Tax Table 2022 Pdf

https://taxstore.com.au/assets/images/menu.jpg

WEB This tax table applies to payments made from 1 July 2024 You should use this tax table if you make any of the following payments on a fortnightly basis salary wages allowances and leave loading to employees paid parental leave directors fees

Pre-crafted templates use a time-saving option for developing a diverse variety of files and files. These pre-designed formats and designs can be utilized for different personal and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material development procedure.

Ato Payg Weekly Tax Table 2022 Pdf

PAYG Withholding Variation Benefits For Property Investors BMT Insider

Payg Weekly Tax Table

What Australian Businesses Should Know About The Updated Tax Tables

ATO WEEKLY TAX TABLE 2012 13 PDF

Ato Payg Fortnightly Tax Table 2019 Brokeasshome

Irs Withholding Rates 2021 Federal Withholding Tables 2021 Bank2home

https://www.ato.gov.au/api/public/content/f695b8f3...

WEB Oct 13 2020 nbsp 0183 32 Weekly tax table For payments made on or after 13 October 2020 Includes the tax offset ready reckoner on page 9 NAT 1005 10 2020

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

WEB 5 days ago nbsp 0183 32 We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees A tax withheld calculator that calculates the correct amount of tax to withhold is available Tax tables for previous years are also available

https://softwaredevelopers.ato.gov.au/.../NAT_1005.pdf

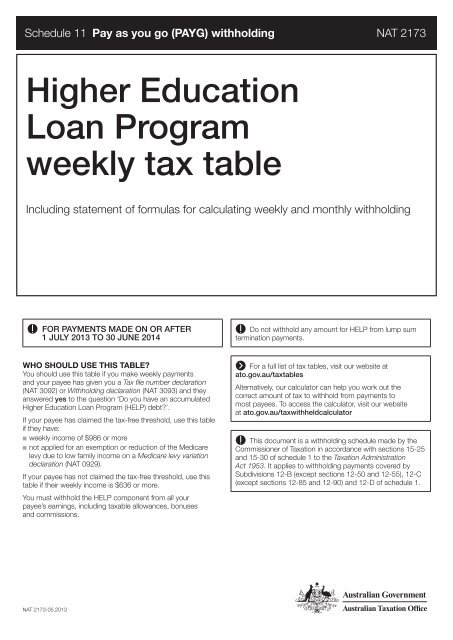

WEB Pay as you go PAYG withholding NAT 1005 Weekly tax table NAT 1004 available on our website at ato gov au taxtables Tax file number TFN declarations The answers your employees provide on their Tax file number 2022 00 558 00 694 00 2023 00 558 00 695 00 2024 00 559 00 695 00

https://softwaredevelopers.ato.gov.au/PAYGWTaxtables

WEB May 17 2024 nbsp 0183 32 This includes study and training support loans schedule and tax tables due to the annual indexing of the repayment income thresholds The statement of formulas and regular tax tables have also been updated to accommodate the

https://softwaredevelopers.ato.gov.au/2022-pay-you...

WEB May 9 2022 nbsp 0183 32 Updated schedules and tax tables will be published from mid June at ato gov au tax tables Other important information We do not update the statement of formulas and regular tax tables to only accommodate the annual indexation of the Medicare levy thresholds

WEB May 17 2021 nbsp 0183 32 For the 2021 22 income year we will be updating Schedule 8 Statement of formulas for calculating study and training support loans components NAT 3539 and study and training support loans weekly fortnightly and monthly tax tables due to the annual indexing of the repayment income thresholds WEB Latest tax tables If you have an AccountRight subscription and you re using the latest version the new tax tables will be used in your software for pays with a payment date of July 1 and later The ATO release updated tax tables also called the tax scales each year

WEB PAYG tax tables The ATO release updated tax tables also called the tax scales each year They contain the rates of tax to be applied to your employees pays so the correct amount of tax is withheld