What Are The Tax Tables For 2021 Learn how tax brackets work and find the current tax rates for different filing statuses See examples of how to calculate your taxable income and tax liability based on your income and tax bracket

Find the latest tax rates and thresholds for 2021 federal income tax returns as well as links to historic and state tax tables Use the online 2021 tax calculator to estimate your tax liability or refund Feb 1 2021 nbsp 0183 32 Find out the updated tax brackets standard deduction personal exemption and other tax numbers for 2021 Learn how to lower your taxes with multi decade planning and charitable contributions

What Are The Tax Tables For 2021

What Are The Tax Tables For 2021

What Are The Tax Tables For 2021

https://d2wvwvig0d1mx7.cloudfront.net/data/org/15208/media/img/cache/1000x0/2200729_1000x0.jpg

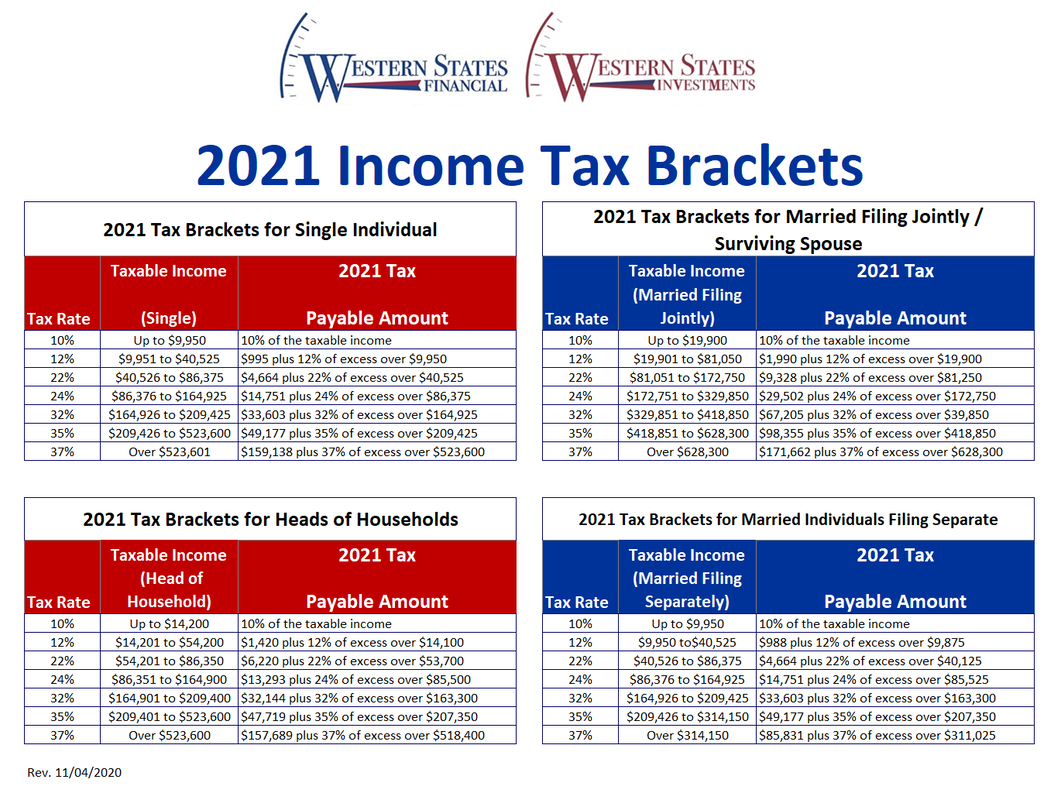

Oct 26 2020 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2021 which affect the taxes that will be filed in 2022 See the new brackets for different filing statuses and the

Pre-crafted templates offer a time-saving option for producing a varied range of documents and files. These pre-designed formats and designs can be made use of for different individual and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the content creation procedure.

What Are The Tax Tables For 2021

2021 Federal Tax Brackets Tax Rates Retirement Plans Western

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

What Are The Tax Brackets For 2021 Federal Withholding Tables 2021

2021 Tax Tables For Australia

2022 Tax Brackets DhugalKillen

Us Federal Tax Brackets 2021 Vaultseka

https://www.irs.gov › pub › irs-prior

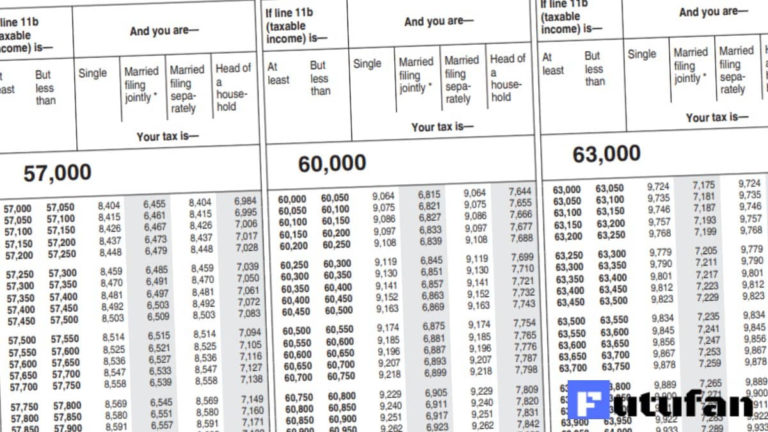

Dec 16 2021 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments

https://taxfoundation.org › data › all › federal

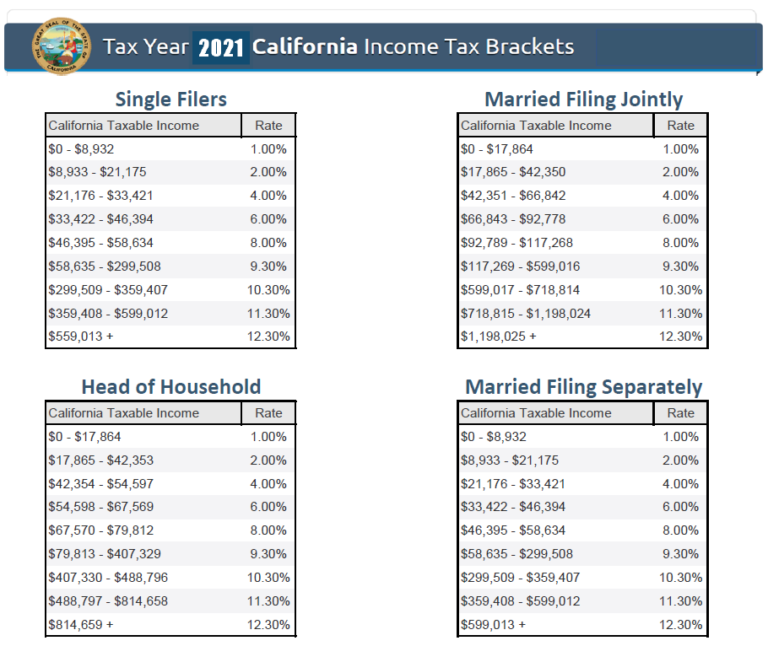

Oct 27 2020 nbsp 0183 32 Find out the latest adjustments for inflation and the top marginal tax rate for 2021 See tables and charts for individual and corporate tax brackets standard deduction alternative minimum tax and more

https://www.irs.com › en

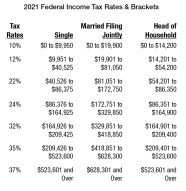

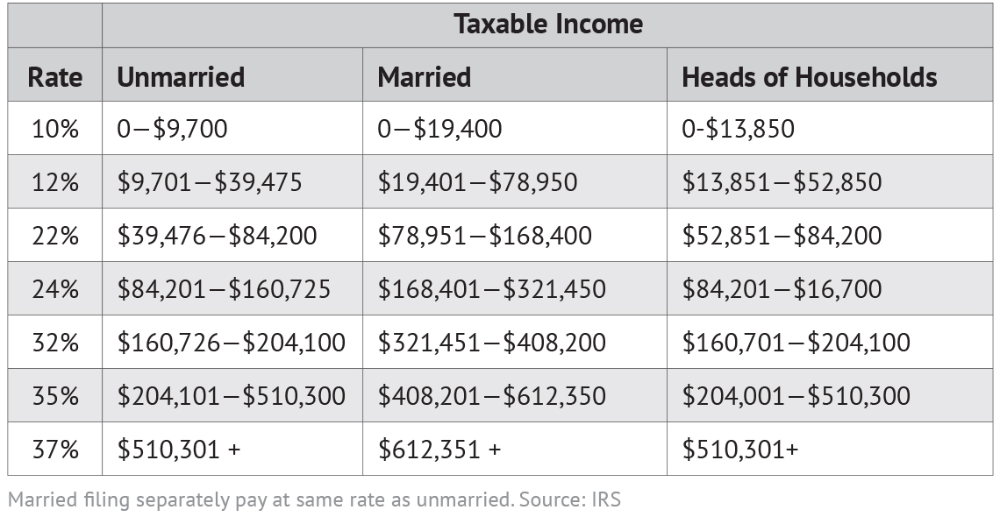

The tax rates for 2021 are 10 12 22 24 32 35 and 37 It s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate Only the money you earn within a particular bracket is subject to the corresponding tax rate The tables below help demonstrate this concept

https://www.irs.gov › pub › irs-prior

Find out how to file your 2021 federal income tax return using Form 1040 or 1040 SR and the numbered schedules Learn about the changes credits and deductions affected by the American Rescue Plan of 2021

https://www.morganstanley.com › ... › en › themes › tax

Tax Tables 2021 Edition 2021 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2021 the standard deduction amount under 167 63 c 5 for an individual

Find out your 2021 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1 Dec 28 2020 nbsp 0183 32 Compare the 2020 and 2021 U S federal income tax brackets and rates for single joint head of household and separate filers See how the IRS adjusts the tax brackets for inflation and what

Jun 10 2021 nbsp 0183 32 Find out the 2021 tax brackets tax rates standard deductions capital gains tax rates and more This guide also covers Social Security changes IRA and retirement plan contributions estimated tax due dates and tax credits