2022 Individual Income Tax Rate Schedule Web Pub 17 closely follows Form 1040 U S Individual Income Tax Return and Form 1040 SR U S Tax Return for Seniors and their three Schedules 1 through 3 Pub 17 is divided into four parts Each part is further divided into chapters most of which generally discuss one line of the form or one line of one of the three schedules

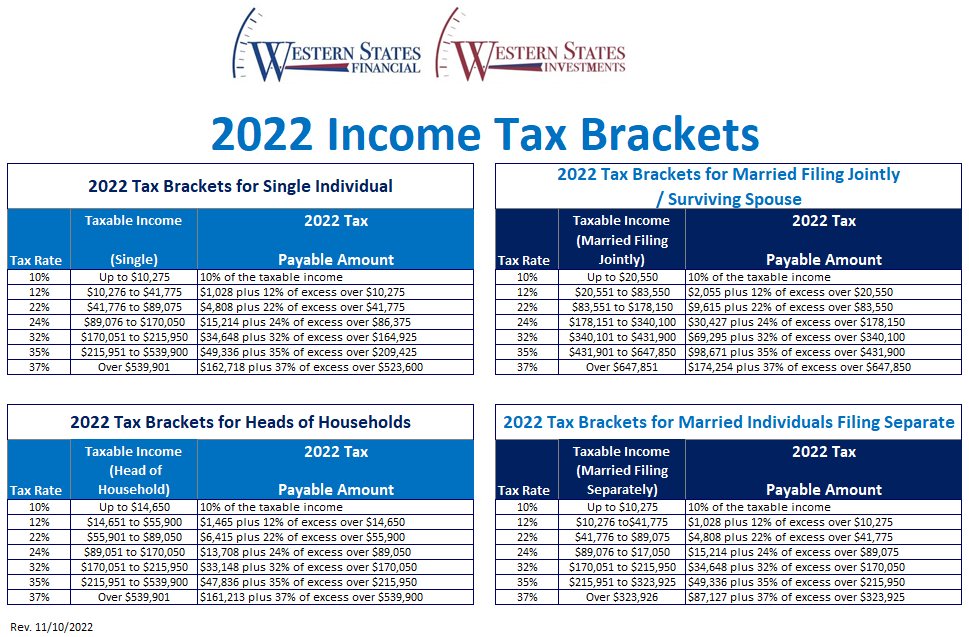

Web Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly 32 for incomes over 170 050 340 100 for married Web Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted for

2022 Individual Income Tax Rate Schedule

2022 Individual Income Tax Rate Schedule

2022 Individual Income Tax Rate Schedule

https://www.westernstatesfinancial.com/uploads/1/8/7/0/18703714/2022-fed-income-tax-brackets_orig.png

Web Nov 28 2022 nbsp 0183 32 Tax brackets for tax years 2022 and 2023 The IRS publishes the range of income for each bracket before it s time to file For those looking ahead the tables below can help you compare the brackets and rates for the 2022 tax year and what you can expect to apply to your 2023 taxable income

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve time and effort by offering a ready-made format and layout for developing various kinds of material. Templates can be used for individual or expert tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

2022 Individual Income Tax Rate Schedule

2022 Georgia State Income Tax Brackets Latest News Update

Capital Gains Tax Rate 2021 And 2022 Latest News Update

2022 Federal Tax Brackets And Standard Deduction Printable Form

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Will Tax Brackets Change In 2022 2022 CGR

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

https://www.irs.gov/pub/irs-pdf/p17.pdf

Web 2022 rate for business use of a ve hicle is 58 5 cents a mile from Jan uary 1 2022 to June 30 2022 and 62 5 cents a mile from July 1 2022 to December 31 2022 The 2022 rate for use of your vehicle to do volunteer work for certain charita ble organizations is 14 cents a mile from January 1 2022 to December 31 2022 The 2022 rate for operat

https://taxformprocessing.com/news/2022/individual...

Web 2022 Federal Individual Income Tax Rate Schedule Below is the 2022 federal income tax rate schedule for quot ordinary income quot based on filing status Single If taxable income is between 1 to 10 275 x

https://www.morganstanley.com/content/dam/msdotcom/...

Web Jan 18 2022 nbsp 0183 32 2022 Tax Rate Schedule Standard Deductions amp Personal Exemption HEAD OF HOUSEHOLD For taxable years beginning in 2022 the standard deduction amount under 167 63 c 5 for an individual Kiddie Tax all net unearned income over a threshold amount of 2 300 for 2022 is taxed using the brackets and rates of the child s parents

Web 2022 Tax Rate Schedule Tax Rates on Long Term Capital Gains and Qualified Dividends 2022 Edition TAXABLE INCOME BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE 2022 to file 2021 individual income tax returns as well as various 2021 business returns Jun 15 2022 2 nd installment deadline to pay 2022 estimated taxes due Sep Web Dec 6 2023 nbsp 0183 32 There are seven federal income tax rates in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which rates apply to you

Web Jun 15 2023 nbsp 0183 32 These tax rate schedules are provided to help you free you 2022 federal earnings tax TurboTax will apply these quotes as you complete your fiscal return These tax rate schedules are provided to help you estimate your 2022 federations income tax