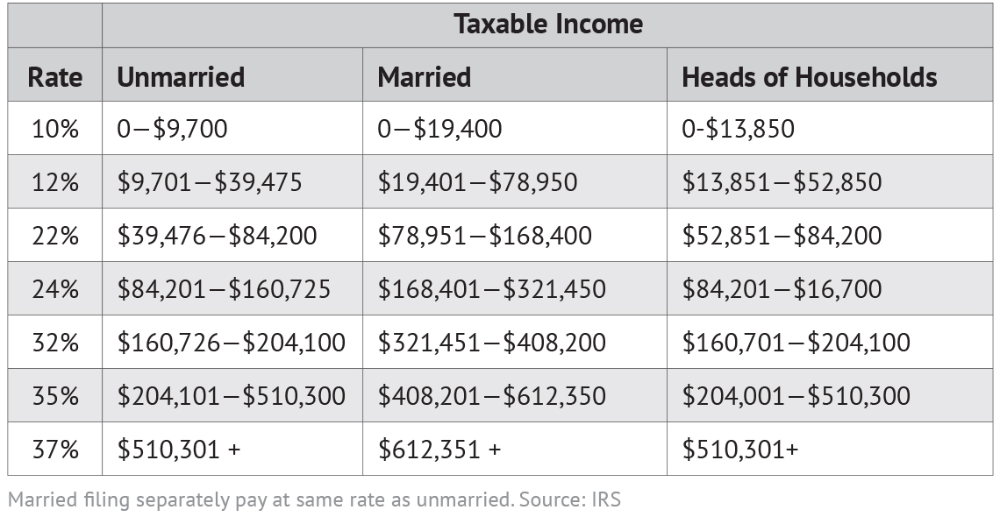

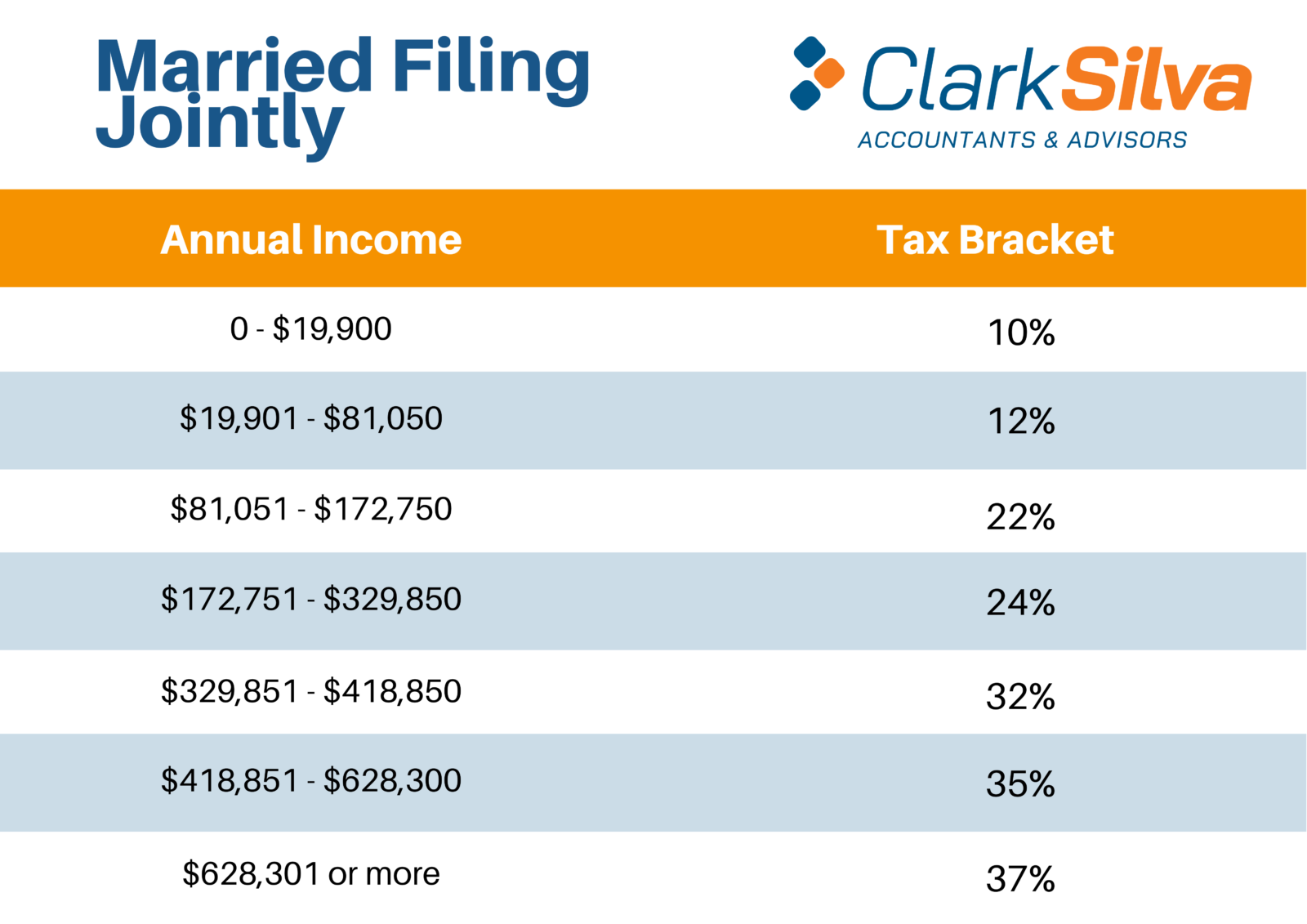

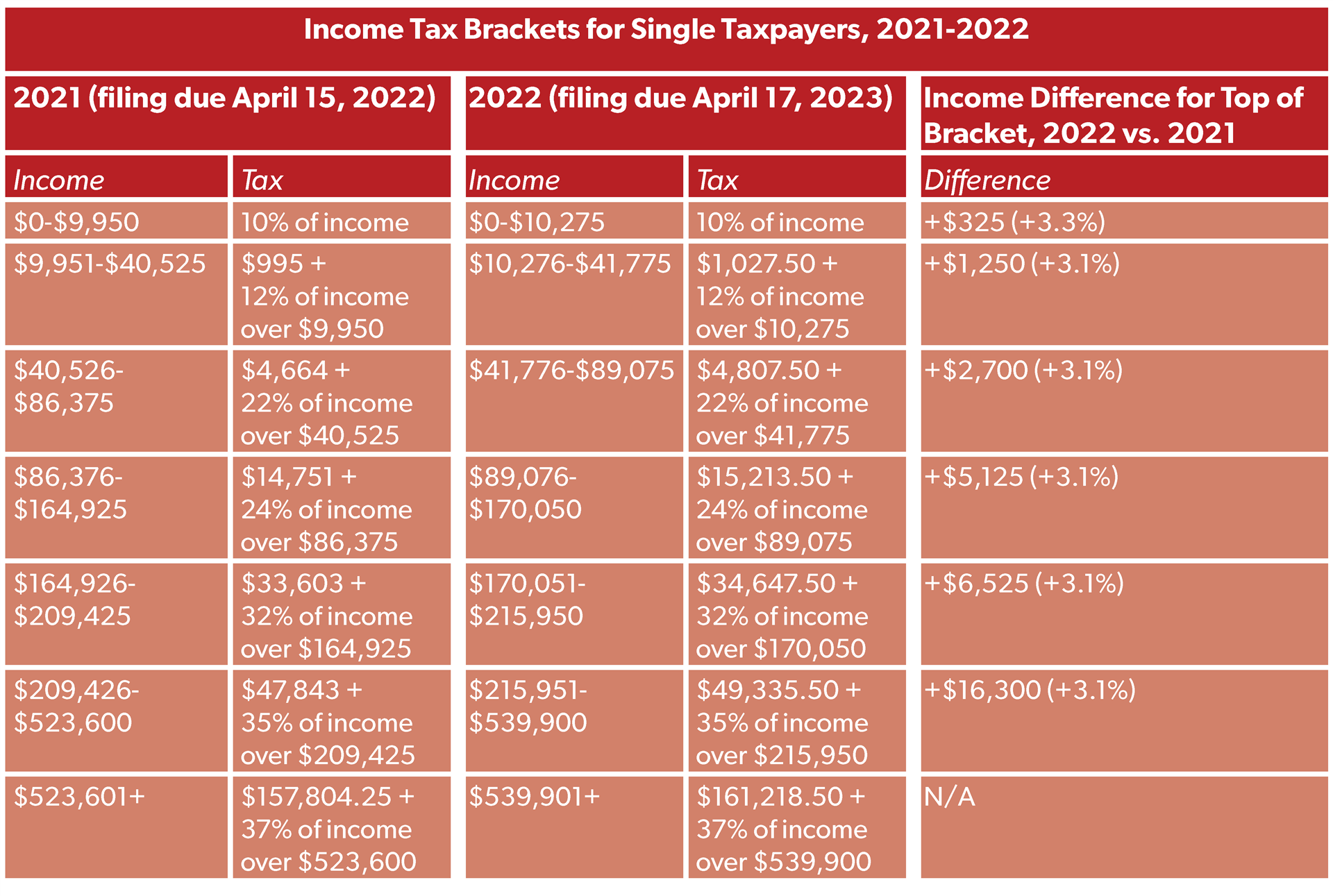

2022 Individual Federal Income Tax Rates Verkko 13 marrask 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2022 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

Verkko 1 marrask 2022 nbsp 0183 32 There are seven tax rates that apply to seven brackets of income 10 12 22 24 32 35 and 37 For tax year 2022 the lowest 10 rate applies to an individual s income of Verkko 27 tammik 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each

2022 Individual Federal Income Tax Rates

2022 Individual Federal Income Tax Rates

2022 Individual Federal Income Tax Rates

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

Verkko 8 rivi 228 nbsp 0183 32 Estimate your 2022 taxable income for taxes filed in 2023 with our tax bracket calculator Want to estimate your tax refund Use our Tax Calculator 2022 tax brackets and federal income tax rates View all

Pre-crafted templates provide a time-saving service for developing a varied series of files and files. These pre-designed formats and layouts can be utilized for different individual and professional tasks, including resumes, invites, flyers, newsletters, reports, presentations, and more, improving the material creation process.

2022 Individual Federal Income Tax Rates

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 Tax Brackets DhugalKillen

2022 Tax Brackets Irs Calculator

Federal Income Tax Withholding 2022 Latest News Update

Gift Tax Calculator 2022 Latest News Update

2020 State Individual Income Tax Rates And Brackets Tax Foundation

https://www.irs.com/en/2022-federal-income-tax-brackets-rates-standard...

Verkko 21 helmik 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for

https://taxfoundation.org/data/all/federal/summary-latest-federal...

Verkko 20 tammik 2022 nbsp 0183 32 Summary of the Latest Federal Income Tax Data 2022 Update January 20 2022 By Erica York Download Data The Internal Revenue Service IRS

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments...

Verkko 10 marrask 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for

https://www.ntu.org/foundation/detail/what-ar…

Verkko 18 lokak 2022 nbsp 0183 32 Individual income tax rates are marginal This means that if you re an individual earning income in 2023 you will pay a 10 percent rate on the first 11 000 you earn On your 11 001st dollar

https://www.cnbc.com/2021/11/10/2022-income-tax-brackets-and-standa…

Verkko 10 marrask 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on your

Verkko 18 lokak 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 Verkko 8 marrask 2023 nbsp 0183 32 Those rates are 10 12 22 24 32 35 and 37 These federal income tax rates typically don t change unless Congress passes tax

Verkko 26 jouluk 2022 nbsp 0183 32 Federal Income Tax Brackets for Tax Year 2022 Filed in 2023 In the table below you can find the tax rate and the income brackets for three different filing