2022 Arizona Individual Income Tax Rates Web Creates a two tier individual income tax rate structure of 2 55 and 2 98 for Taxable Year TY 2022 depending on your filing status and taxable income and if general fund revenue thresholds are met a reduced two tier individual income tax rate structure of 2 53 and 2 75 or a 2 5

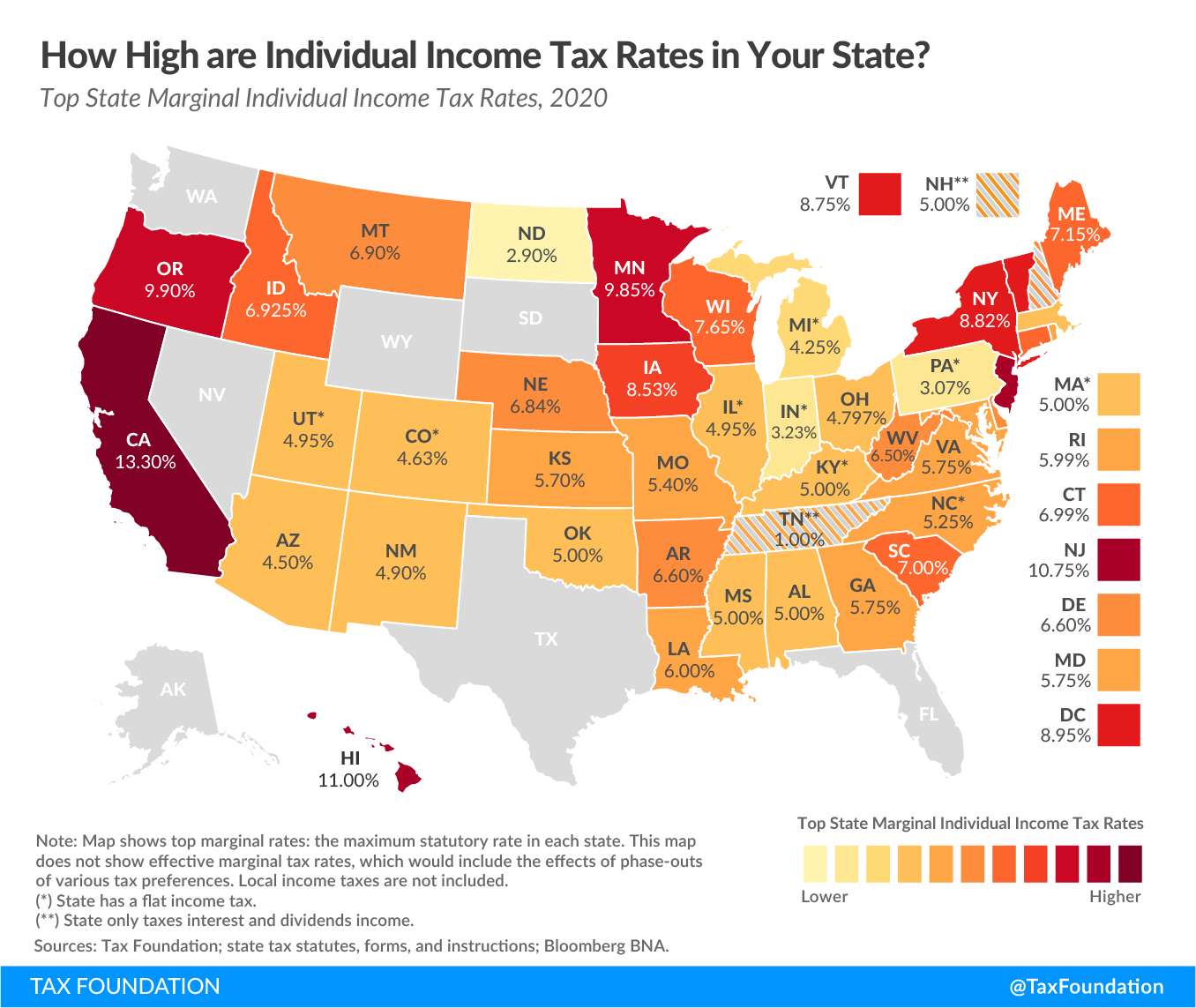

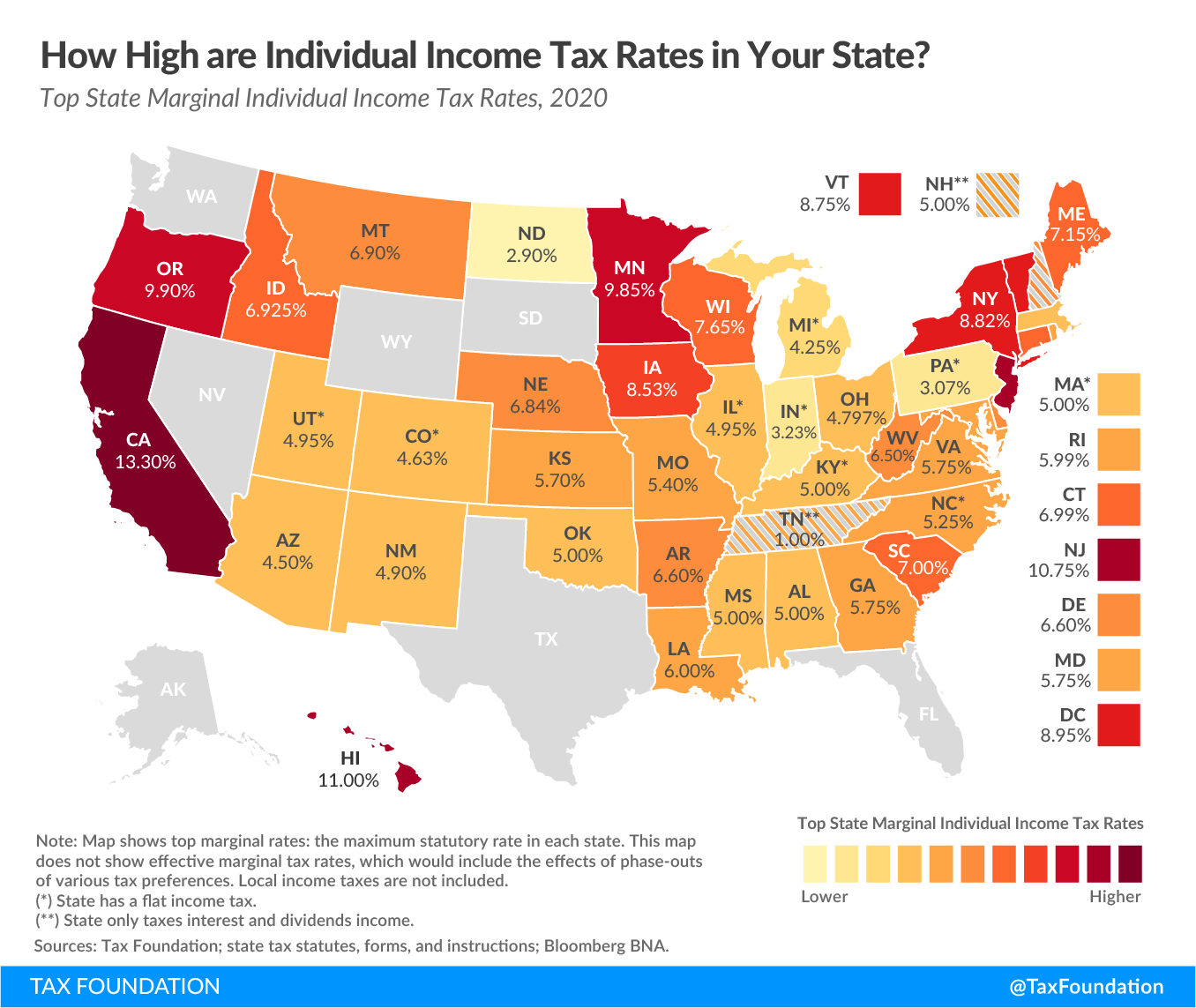

Web Download Data 2015 2022 Key Findings Individual income taxes are a major source of state government revenue accounting for 36 percent of state tax collections in fiscal year 2020 the latest year for which data are available Web the tax year following the receipt of the stage two revenue notice to implement a 2 5 percent tax rate SB 1828 section 16 e xempts from individual income tax beginning with tax year 2021 the full amount of a benefit annuity and pension received as a retired member of the uniformed services of the United States

2022 Arizona Individual Income Tax Rates

2022 Arizona Individual Income Tax Rates

2022 Arizona Individual Income Tax Rates

https://upstatetaxp.com/wp-content/uploads/2020/02/PIT-2020-dv2-01.png

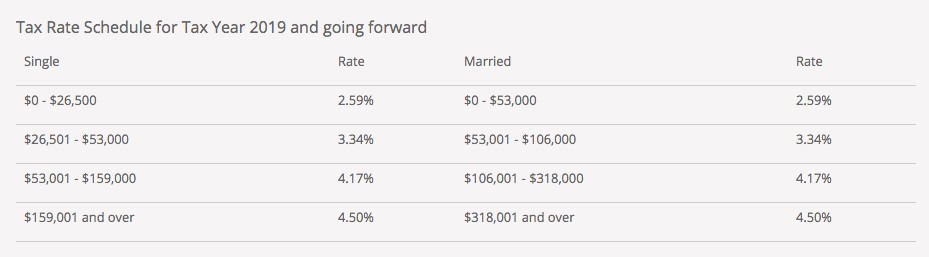

Web Those rates vary from low to high based on the amount of income you earn Arizona is considered to be a tax advantaged state meaning the Arizona tax rates are lower than many other states in the U S The Arizona tax brackets based in filing status of Single and Married are as follows Single Rate Married Rate 0 26 500

Pre-crafted templates provide a time-saving service for creating a varied series of files and files. These pre-designed formats and layouts can be utilized for various personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, streamlining the content development process.

2022 Arizona Individual Income Tax Rates

Arizona Individual Income Tax Rates Update Wolters Kluwer

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Arizona Individual Income Tax Proposition 208 REDW

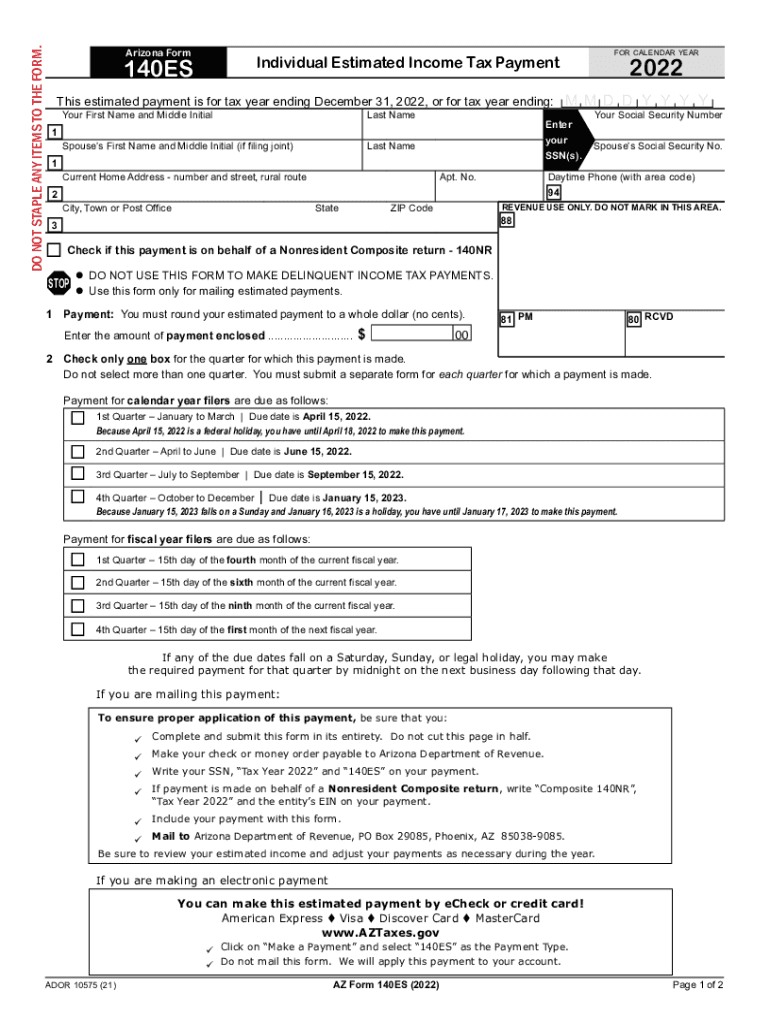

Arizona Form 140Es 2022 Fill Out And Sign Printable PDF Template

Income Tax Bands 2022 23 Kitchen Cabinet

2022 Income Tax Brackets California

https://azdor.gov/sites/default/files/2023-03/...

Web 2022 Arizona Tax Tables X and Y Full Year Residents If your taxable income is less than 50 000 you may use the Optional Tax Tables or Tax Tables X and Y to figure your tax If your taxable income is 50 000 or more you must use Tax Tables X and Y

https://azdor.gov/forms/individual-income-tax-highlights

Web 2022 Individual Income Tax Rates For 2022 Tax Tables X amp Y were adjusted for inflation Taxpayers with taxable income more than 50 000 must use Tax Tables X and Y to compute their tax liability

https://azdor.gov/individuals

Web Your Arizona taxable income is less than 50 000 regardless of your filing status The only tax credits you are claiming are the family income tax credit or the credit for increased excise taxes Part Year Residents You are a part year resident if you did either of the following during the tax year

https://azdor.gov/sites/default/files/2023-03/...

Web Increase was modified For tax year 2022 the allowable portion of your charitable contributions used to compute your Standard Deduction Increased was increased from 25 to 27 of the qualified charitable contributions made during the tax year Taxpayers must complete page 3 of their personal income tax form to claim the Standard

https://www.forbes.com/advisor/income-tax-calculator/arizona

Web Arizona Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Arizona you will be taxed 9 877 Your average tax rate is 11 67

Web regardless of their taxable income The 2022 Optional Tax Table Arizona resident for taxpayers with taxable income less than 50 000 was also adjusted for inflation To determine your tax liability see the Optional Tax Table 2022 Arizona Small Business Income SBI Tax The tax rate applicable to small business taxable income Web May 24 2022 nbsp 0183 32 Tax amp Accounting May 24 2022 Arizona individual income tax rates update By CCH AnswerConnect Editorial Recent court decisions have settled some of the uncertainty about Arizona income tax rates for 2021 and beyond Income tax surcharge struck down In March a court ruled that Proposition 208 was unenforceable

Web Jul 24 2023 nbsp 0183 32 Next effective January 1 2022 SB 1828 consolidates the state s four general marginal individual income tax rates into two by eliminating the 4 5 percent and 4 17 percent general rates and reducing the two lower rates from 3 34 to 2 98 percent and from 2 59 to 2 55 percent benefiting all individual income taxpayers