Tax Tables For 2022 Income Tax Web Jan 23 2023 nbsp 0183 32 You can find the latest tax table which you ll use in 2023 to file 2022 taxes on the IRS website specifically its publication named Tax Year 2022 1040 and 1040 SR Tax and Earned Income Credit Tables Tax tables are used to calculate the tax you owe based on your filing status and taxable income

Web Jan 18 2022 nbsp 0183 32 tax tables 2022 edition 1 taxable income base amount of tax plus marginal tax rate of the amount over not over over single 0 10 275 0 10 0 0 10 275 41 775 1 027 50 12 0 10 275 41 775 89 075 4 807 50 22 0 41 775 89 075 170 050 15 213 50 24 0 89 075 170 050 215 950 34 647 50 32 0 Web Jan 18 2022 nbsp 0183 32 26 tax rate applies to income below 103 050 206 100 28 tax rate applies to income over Child Tax Credit Gift tax annual exclusion 16 000 Estate gift amp generation skipping transfer tax exclusion amount per taxpayer 12 060 000 Exclusion on gifts to non citizen spouse 164 000 Maximumes tae gift amp generation skipping ax r e

Tax Tables For 2022 Income Tax

Tax Tables For 2022 Income Tax

Tax Tables For 2022 Income Tax

http://computerfasr262.weebly.com/uploads/1/2/4/1/124110469/331511735.jpg

Web Nov 10 2021 nbsp 0183 32 The tax year 2022 maximum Earned Income Tax Credit amount is 6 935 for qualifying taxpayers who have three or more qualifying children up from 6 728 for tax year 2021 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs

Pre-crafted templates use a time-saving service for developing a diverse series of files and files. These pre-designed formats and layouts can be made use of for numerous individual and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the content development process.

Tax Tables For 2022 Income Tax

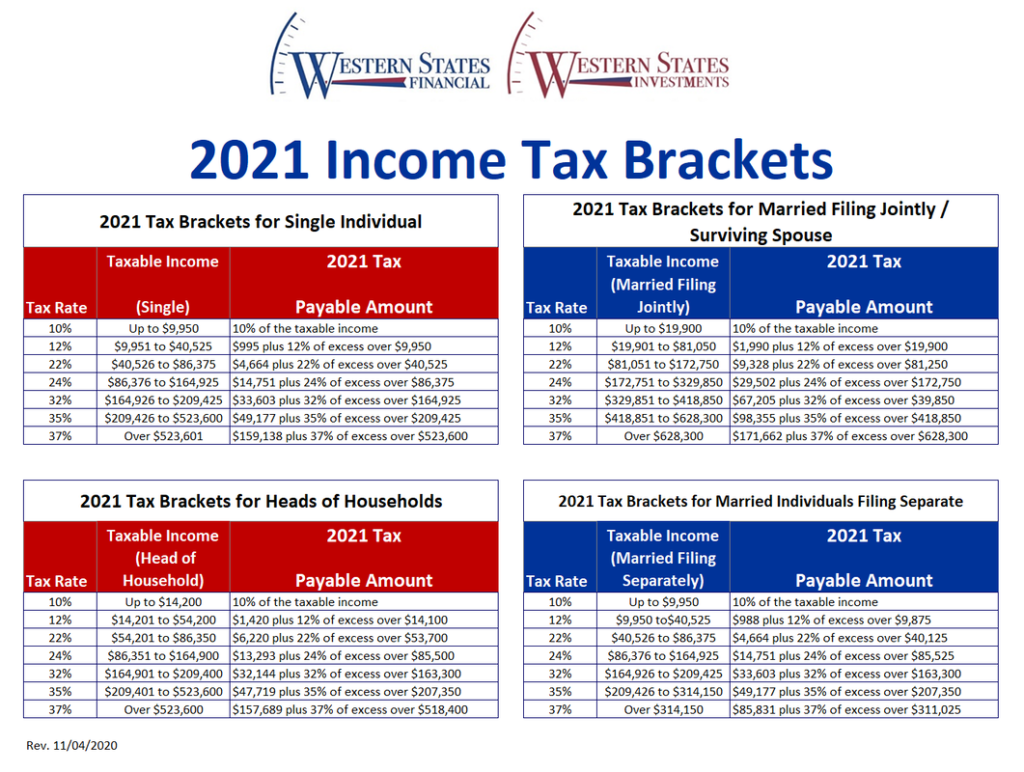

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

2022 Income Tax Rate Tables Printable Forms Free Online

2020 Form 1040 Tax Table 1040TT

Federal Income Tax Withholding 2022 Latest News Update

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.purposefulfinance.org/home/articles/...

Web Dec 2 2021 nbsp 0183 32 If you are looking for the tax tables for filing your 2021 taxes by April of 2022 click the button below This article references the 2022 tax tables for the tax forms to be filed in April 2023 Click Here for 2021 Tables 2022 Income Tax Brackets 2021 Income Tax Tables Married Filing Jointly amp Single Click on image to enlarge

https://www.irs.gov/instructions/i1040tt

Web 2022 Tax Table See the instructions for line 16 to see if you must use the Tax Table below to figure your tax

https://www.irs.gov/pub/irs-pdf/p17.pdf

Web Part Four Figuring Your Taxes and Refundable and Nonrefundable Credits Chapter 13 How To Figure Your Tax Chapter 14 Child Tax Credit and Credit for Other Dependents 2022 Tax Table 2022 Tax Computation Worksheet 2022 Tax Rate Schedules Your Rights as a Taxpayer How To Get Tax Help Index Where To File Your Rights as a Taxpayer

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

Web The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year This page provides detail of the Federal Tax Tables for 2022 has links to historic Federal Tax Tables which are used within the 2022 Federal Tax Calculator and has supporting Web Jul 1 2023 nbsp 0183 32 There are no changes to other withholding schedules and tax tables for the 2023 24 income year The legislated stage 3 income tax cuts are not due to commence until 1 July 2024 the 2024 25 income year Tax tables quick links The following tax tables apply from 1 July 2023 Regular payments

Web All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate