Tax Brackets For 2022 Income Tax Web Nov 10 2021 nbsp 0183 32 The tax year 2022 maximum Earned Income Tax Credit amount is 6 935 for qualifying taxpayers who have three or more qualifying children up from 6 728 for tax year 2021 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs

Web 4 days ago nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status Credit cards Web Nov 11 2021 nbsp 0183 32 The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for decedents who die in 2022 will

Tax Brackets For 2022 Income Tax

Tax Brackets For 2022 Income Tax

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Web This page shows Tax Brackets s archived Federal tax brackets for tax year 2022 This means that these brackets applied to all income earned in 2022 and the tax return that uses these tax rates was due in April 2023

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by providing a ready-made format and design for producing different sort of material. Templates can be used for individual or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Tax Brackets For 2022 Income Tax

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

10 2023 California Tax Brackets References 2023 BGH

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Irs Tax Table 2022 Married Filing Jointly Latest News Update

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

2022 Tax Brackets MeghanBrannan

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher

https://www.irs.com/en/2022-federal-income-tax...

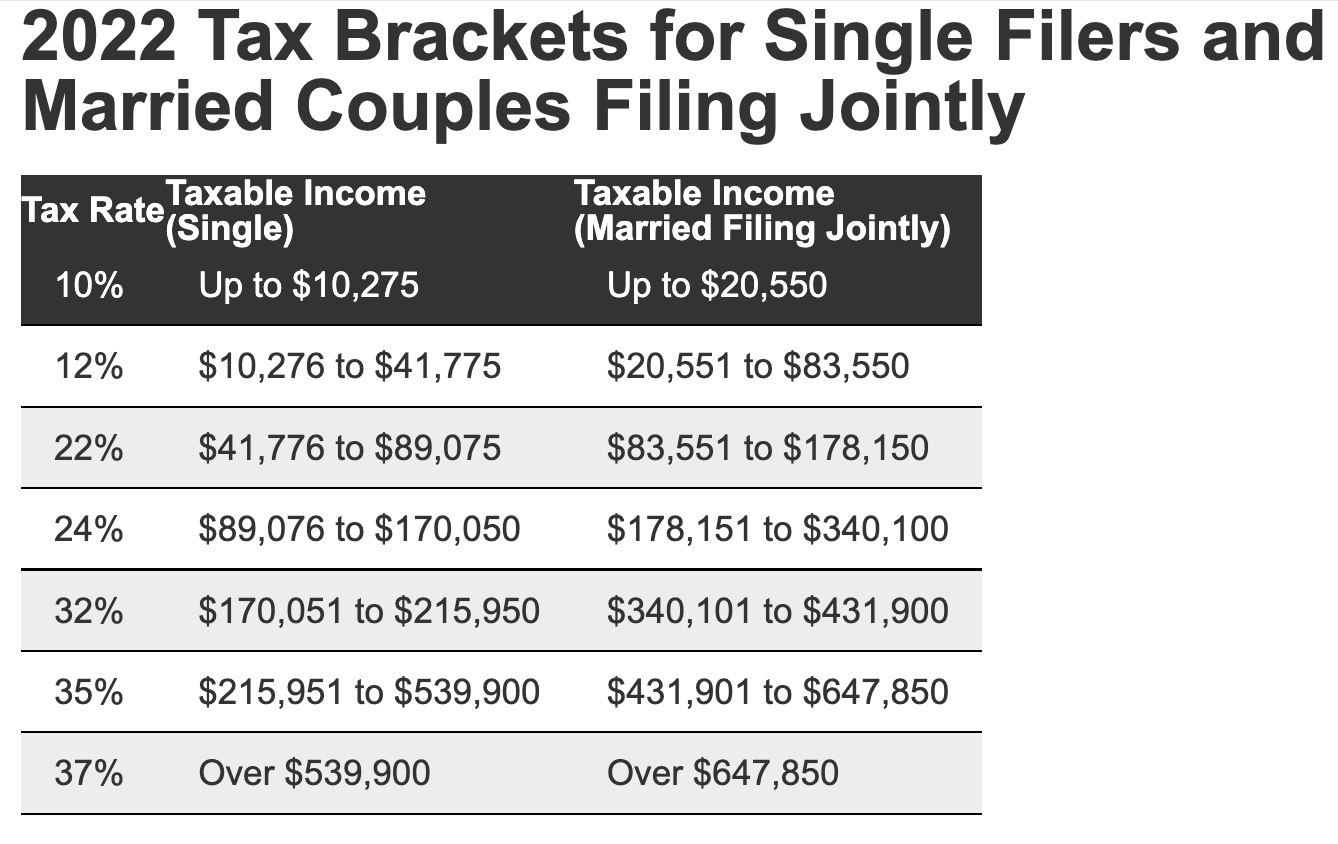

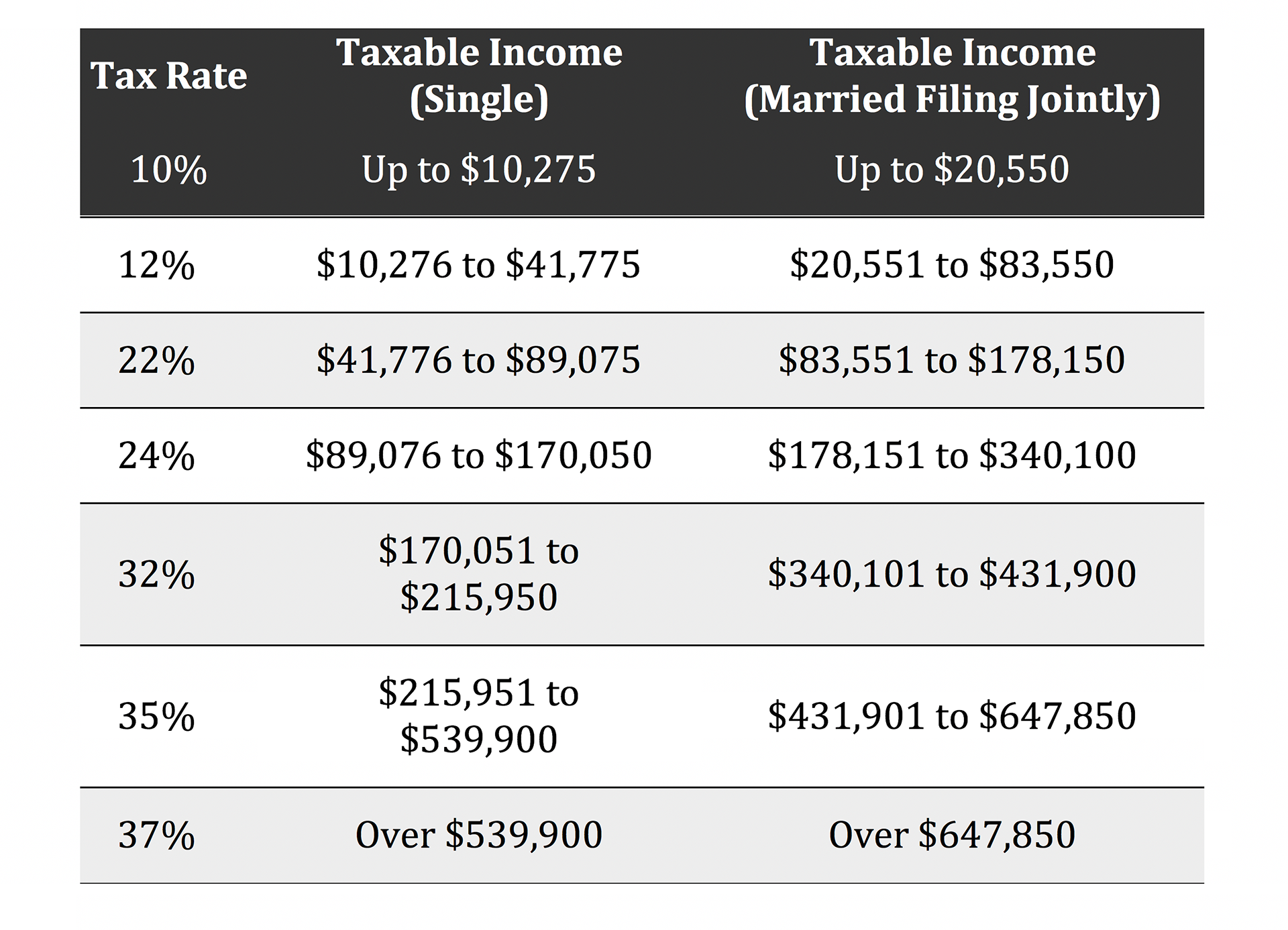

Web Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket

https://www.gov.uk/income-tax-rates

Web Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-australian-residents

Web Sep 28 2023 nbsp 0183 32 Australian residents tax rates 2022 23 The above rates do not include the Medicare levy of 2 Australian residents tax rates 2021 22 The above rates don t include the Medicare levy of 2 Australian residents tax rates 2020 21 Australian residents tax rates 2019 20 Australian residents tax rates 2010 to 2019

https://www.forbes.com/sites/ashleaebeling/2021/11/...

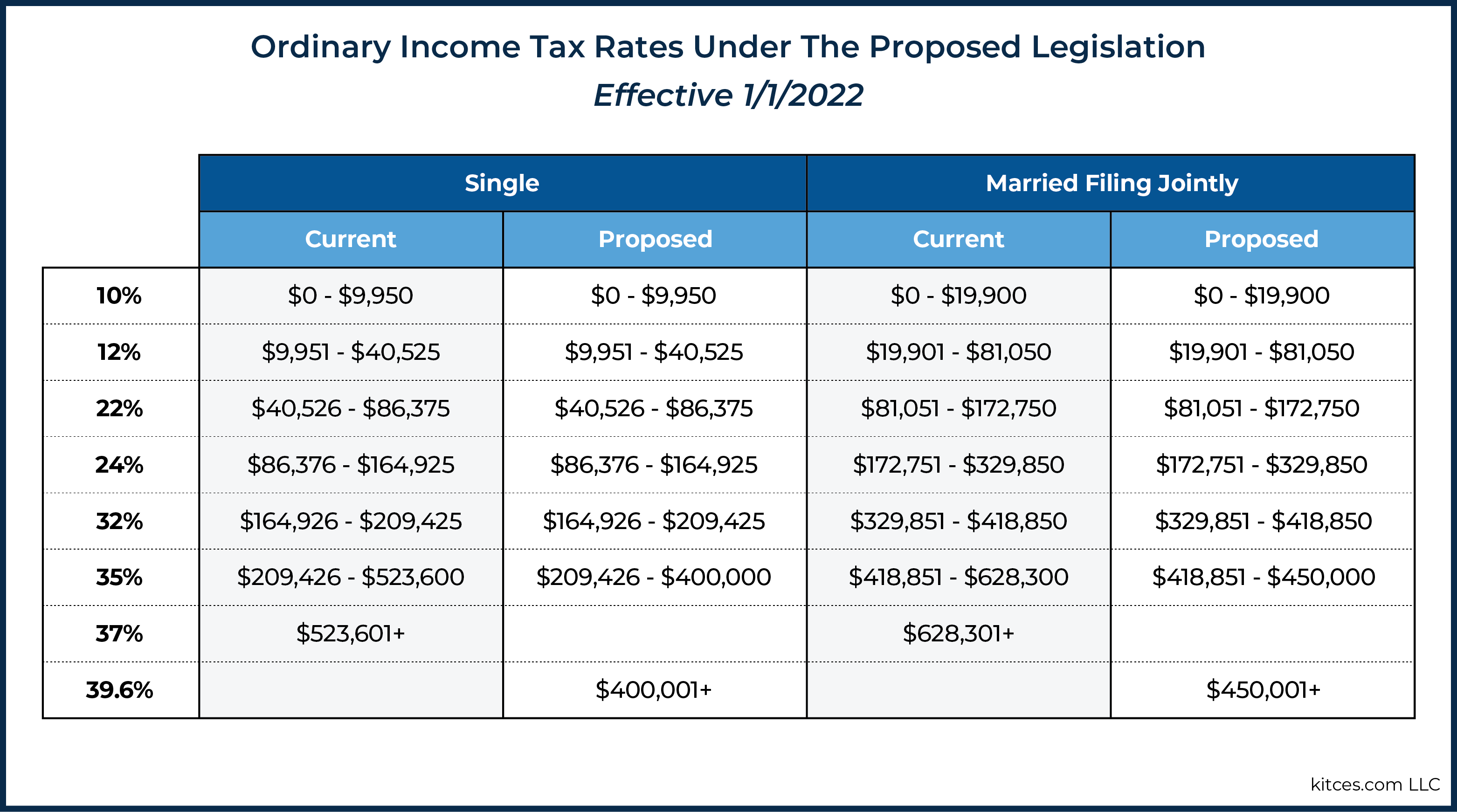

Web Nov 10 2021 nbsp 0183 32 There s one big caveat to these 2022 numbers Democrats are still trying to pass the now 1 85 trillion Build Back Better Act and the latest November 3 legislative text includes income tax

Web Apr 8 2022 nbsp 0183 32 But instead of paying 24 000 to the federal government the person would pay much less 18 174 50 in income tax That works out to an effective tax rate of just over 18 This might seem Web Nov 10 2021 nbsp 0183 32 Here are the new brackets for 2022 depending on your income and filing status For married individuals filing jointly 10 Taxable income up to 20 550 12 Taxable income between

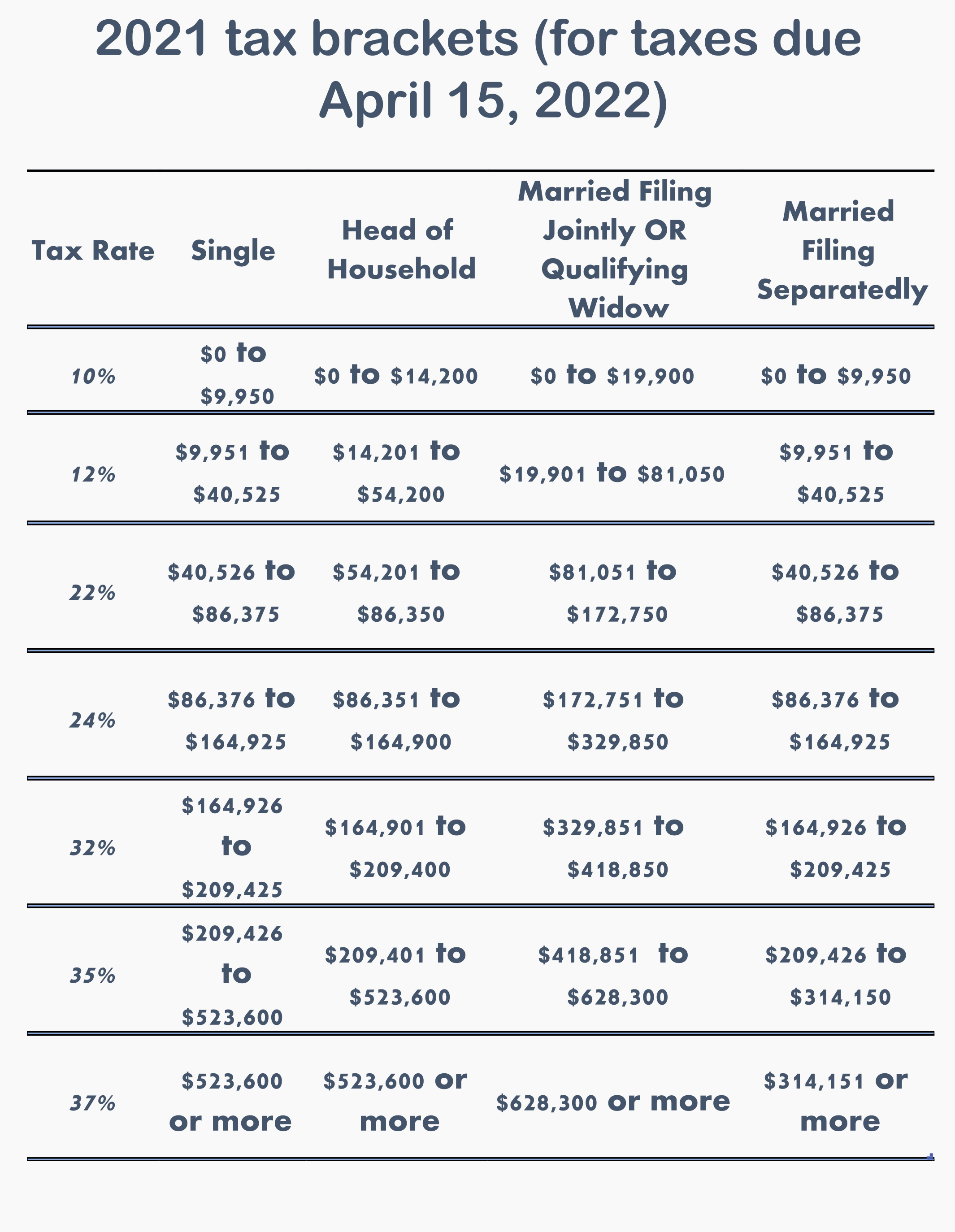

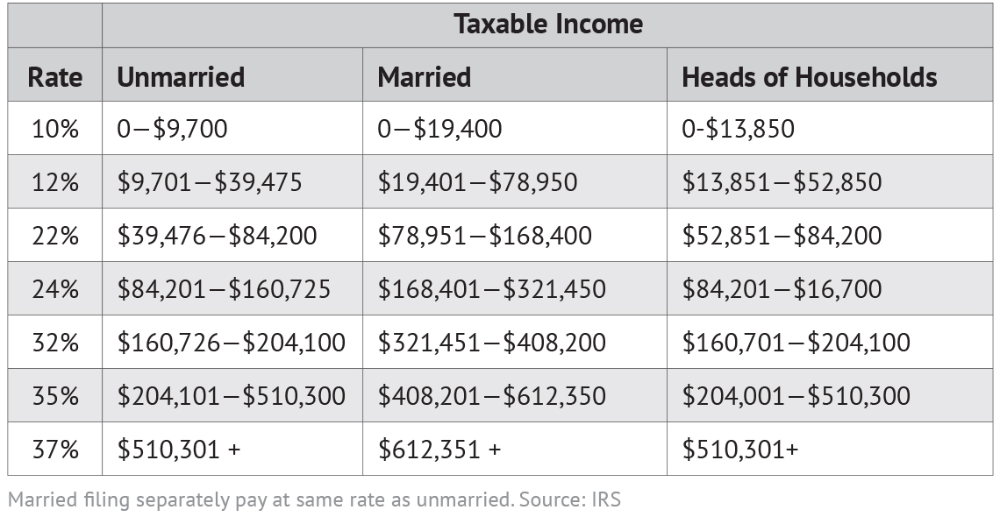

Web What are Tax Brackets How Many Tax Brackets Are There The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and federal income tax rates View all filing statuses