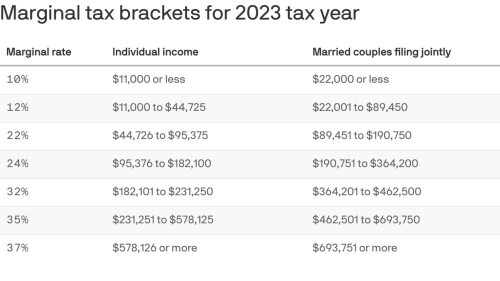

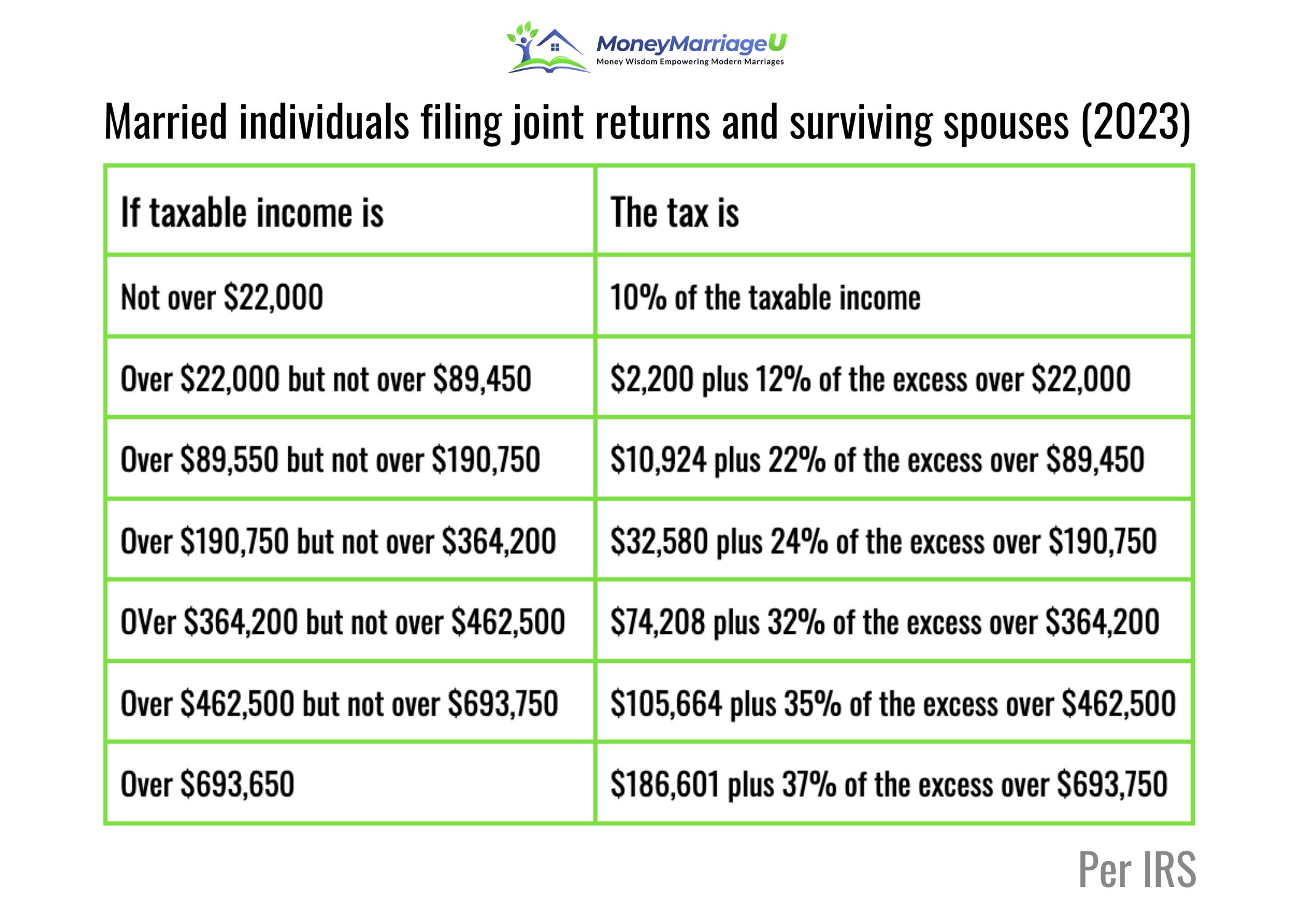

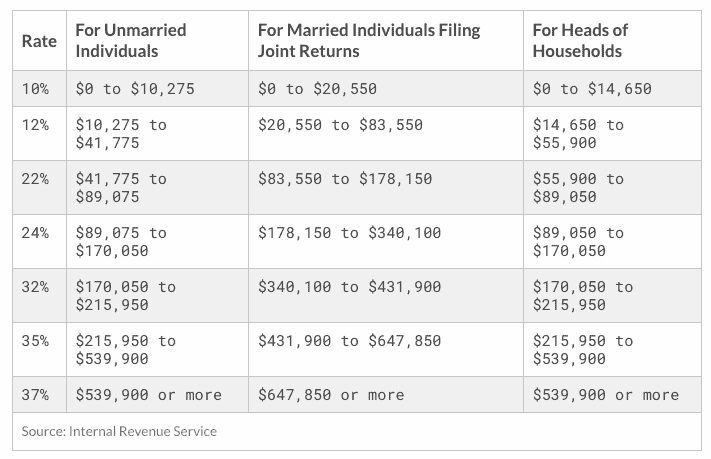

Tax Brackets For 2023 WEB Oct 18 2022 nbsp 0183 32 Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly The other rates are 35 for incomes over 231 250 462 500 for married couples filing jointly

WEB Jun 6 2024 nbsp 0183 32 The next tax bracket is 12 of taxable income levels between 11 601 to 47 150 The tax rates continue to increase as someone s income moves into higher brackets The IRS uses different federal income tax brackets and ranges depending on filing status Single filers Married couples filing a single joint return together WEB Aug 22 2023 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments

Tax Brackets For 2023

Tax Brackets For 2023

Tax Brackets For 2023

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

WEB May 29 2024 nbsp 0183 32 For taxes on 2023 income high inflation prompted the IRS to raise thresholds 7 for income tax brackets an unusually large percentage The IRS has also released tax bracket changes for 2024

Pre-crafted templates offer a time-saving service for producing a diverse range of files and files. These pre-designed formats and layouts can be made use of for various individual and expert projects, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the content production process.

Tax Brackets For 2023

Payroll Tax Withholding Calculator 2023 SallieJersey

New Federal Tax Brackets For 2023

Married Tax Brackets 2021 Westassets

Federal Taxation Of Individuals In 2023 LBMC

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2023 IRS Limits The Numbers You Have Been Waiting For

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Jun 21 2024 nbsp 0183 32 Full 2023 tax tables Publication 17 2023 Your Federal Income Tax Page Last Reviewed or Updated 21 Jun 2024 See current federal tax brackets and rates based on your income and filing status

https://www.forbes.com/advisor/taxes/taxes-federal

WEB Apr 16 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37

https://turbotax.intuit.com/tax-tools/calculators/tax-bracket

WEB Calculator 2023 Estimate your 2023 taxable income for taxes filed in 2024 with our tax bracket calculator Want to estimate your tax refund Use our Tax Calculator How Many Tax Brackets Are There The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates

https://www.cnbc.com/2022/10/19/irs-here-are-the...

WEB Oct 19 2022 nbsp 0183 32 The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing together and 13 850 for single

https://www.bankrate.com/taxes/tax-brackets

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Your tax bracket

[desc-11] [desc-12]

[desc-13]