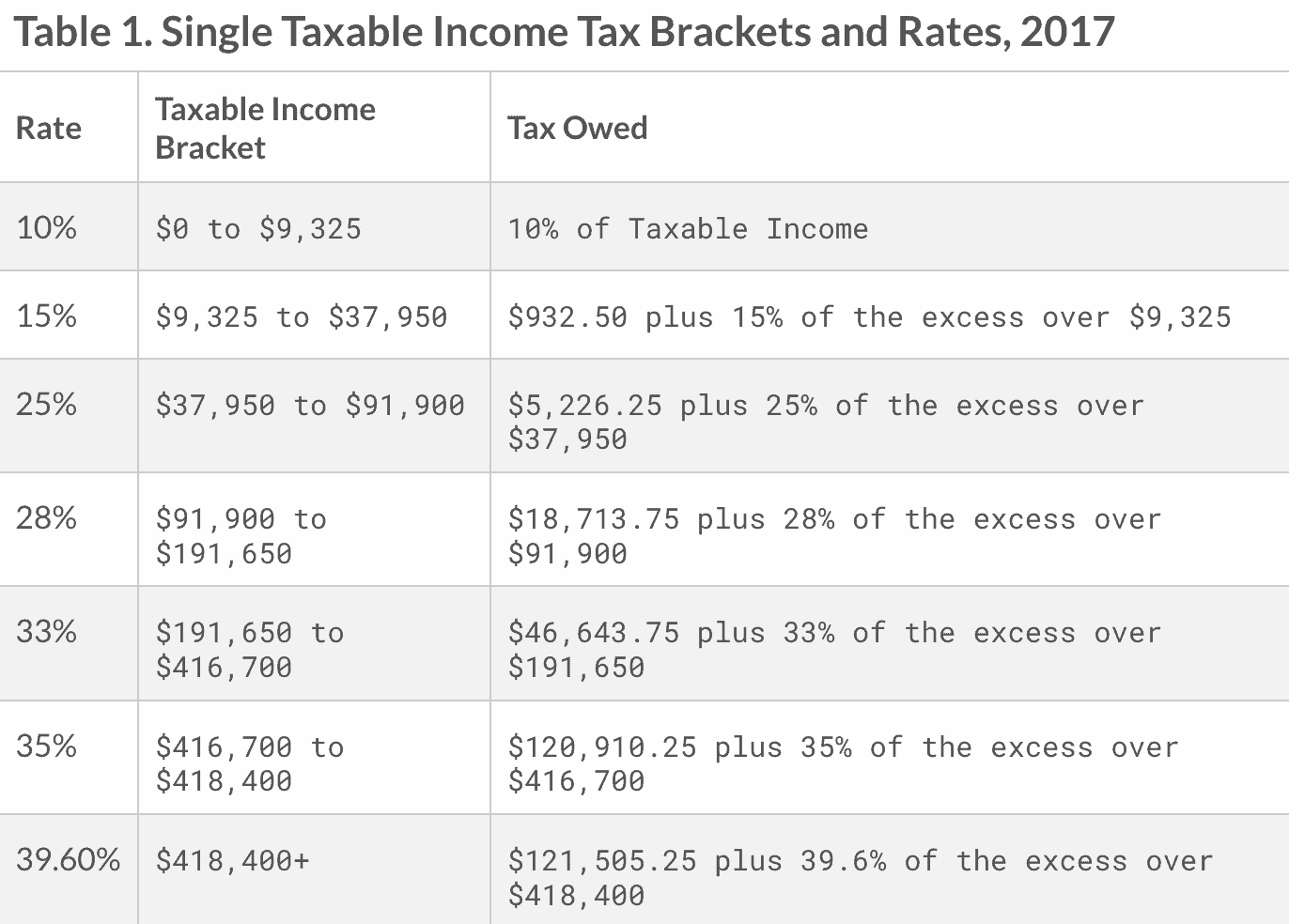

Tax Brackets For 2023 Single Filers WEB Here we outline the 2023 tax brackets and corresponding 2023 tax rates For each bracket the second number is the maximum for that tax rate and the first number in the next bracket is over the highest amount for the previous rate For instance the 10 rate for a single filer is up to and including 11 000 The 12 rate starts at 11 001

WEB Apr 16 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your WEB Oct 25 2022 nbsp 0183 32 The 2023 standard deduction increased to 13 850 from 12 950 for single filers and to 27 700 from 25 900 for married couples filing jointly Taxpayers may see their tax liability cut in 2023

Tax Brackets For 2023 Single Filers

Tax Brackets For 2023 Single Filers

Tax Brackets For 2023 Single Filers

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

WEB Oct 21 2022 nbsp 0183 32 2023 Federal Tax Standard Deduction Update The IRS raised the standard deduction increased about 7 across every category for 2023 Married filing jointly 25 900 to 27 700 Single filers and married filing separately 12 950 to 13 850 Head of household 19 400 to 20 800

Pre-crafted templates provide a time-saving service for creating a diverse series of documents and files. These pre-designed formats and designs can be used for various personal and expert jobs, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the material creation procedure.

Tax Brackets For 2023 Single Filers

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Federal Tax Brackets And Standard Deduction Printable Form

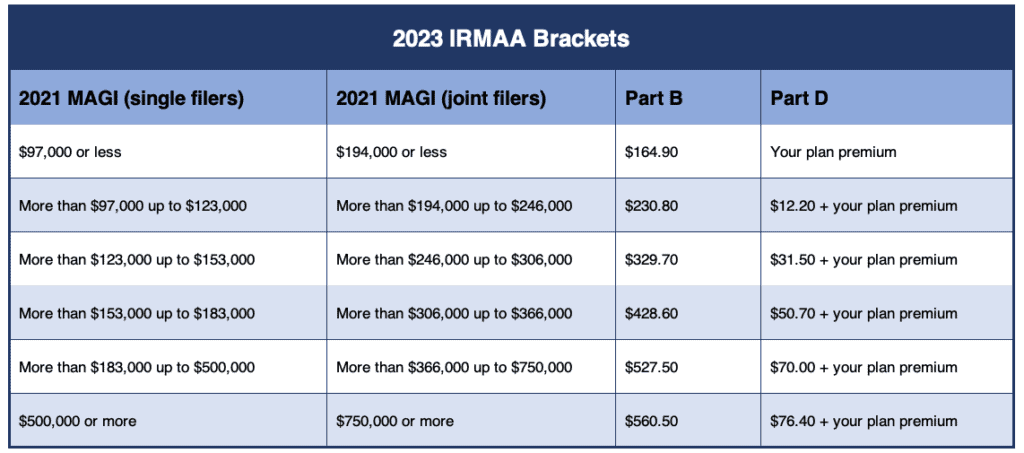

The 2023 IRMAA Brackets Social Security Intelligence

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.irs.gov › filing › federal-income-tax-rates-and-brackets

WEB Jul 1 2024 nbsp 0183 32 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the Related

https://www.fidelity.com › learning-center › personal-finance › tax-brackets

WEB Jun 6 2024 nbsp 0183 32 To figure out your tax bracket first look at the rates for the filing status you plan to use single married filing jointly married filing separately or head of household Next determine your taxable income

https://www.kiplinger.com › taxes › tax-brackets › income-tax-brackets

WEB Jul 23 2024 nbsp 0183 32 However previously for 2023 for single filers the 22 tax bracket started at 44 726 and ended at 95 375 However for head of household filers last year s bracket was from 59 851 to

https://www.bench.co › blog › tax-tips › tax-brackets

WEB Here are the 2023 tax brackets according to the IRS These will be used for your 2023 tax year tax filing It s broken into the four most common filing statuses individual single filers married individuals filing jointly heads of households and

https://www.irs.gov › newsroom

WEB For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022

WEB Feb 13 2023 nbsp 0183 32 The IRS boosted tax brackets by about 7 for each type of tax filer for 2023 such as those filing separately or as married couples The top marginal rate or the highest tax rate based WEB May 29 2024 nbsp 0183 32 The first 11 000 of income will be taxed at 10 The next 33 725 will be taxed at 12 The last 50 275 will be taxed at 22 That works out to a tax bill of 16 207 for 2023 compared with

WEB Aug 8 2024 nbsp 0183 32 Federal tax brackets example If you had 50 000 of taxable income in 2023 as a single filer you d pay 10 on that first 11 000 and 12 on the chunk of income between 11 001 and 44 725 Then