Tax Brackets For 2023 Tax Year Web Feb 13 2023 nbsp 0183 32 For married couples filing jointly the standard deduction is 27 700 for 2023 up from 25 900 in the 2022 tax year That s an increase of 1 800 or a 7 bump For single taxpayers and married

Web 5 days ago nbsp 0183 32 For example assume a hypothetical taxpayer who is married with 150 000 of joint income in 2024 and claiming the standard deduction of 29 200 They would owe the following taxes 10 of the first 23 200 2 320 12 of the next 71 100 8 532 22 of the remaining 26 500 5 830 Web Oct 18 2022 nbsp 0183 32 For a married couple filing a joint tax return that deduction will jump to 27 700 in 2023 from 25 900 in 2022 for singles and couples filing separately it will rise to 13 850 from 12 950

Tax Brackets For 2023 Tax Year

Tax Brackets For 2023 Tax Year

Tax Brackets For 2023 Tax Year

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

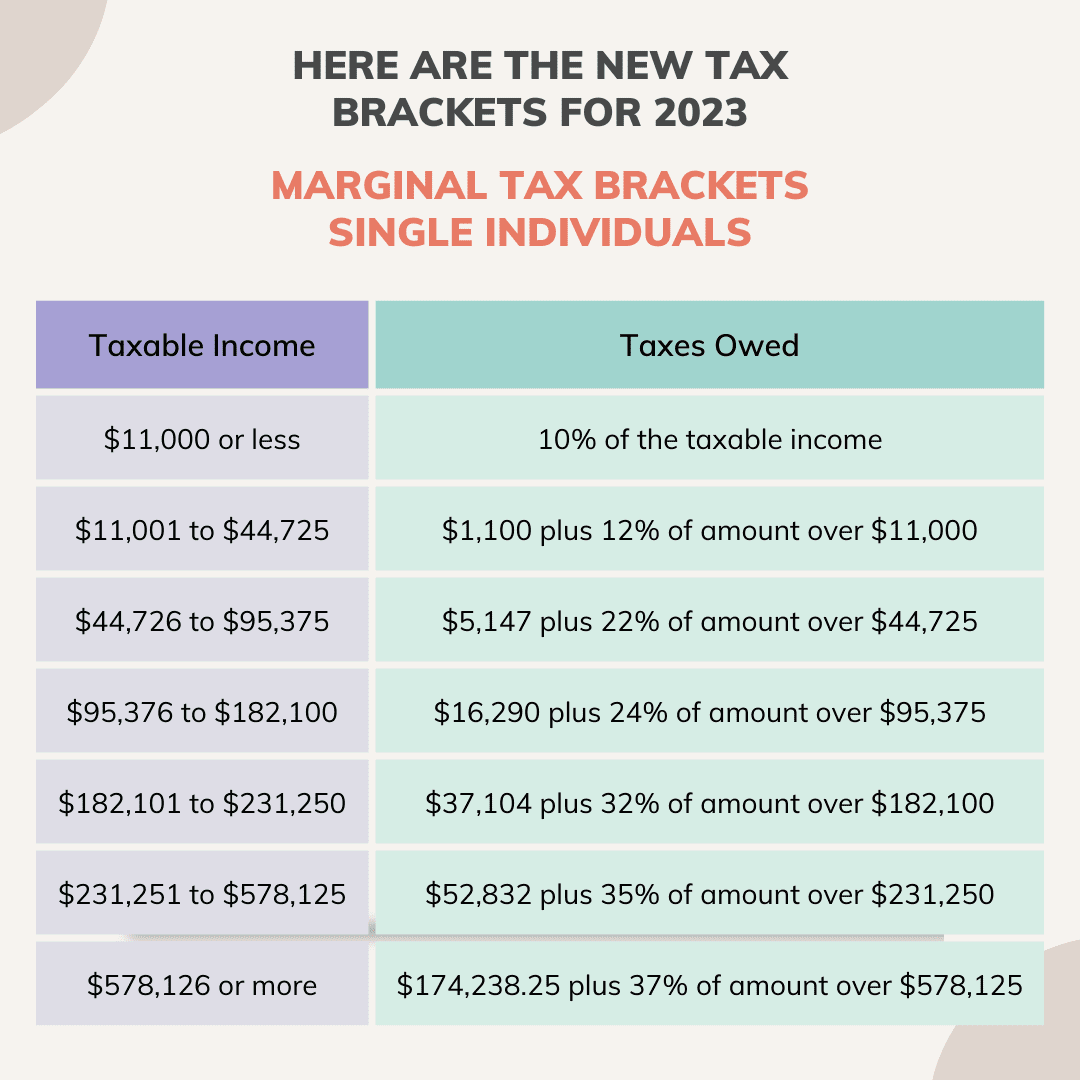

Web Jan 7 2024 nbsp 0183 32 the 2023 tax brackets For individual filers For married couples filing jointly 37 on the portion of income above 578 100 35 on the portion of income between 231 251 and 578 100 32

Templates are pre-designed files or files that can be utilized for various purposes. They can conserve effort and time by offering a ready-made format and design for developing different kinds of material. Templates can be used for personal or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Tax Brackets For 2023 Tax Year

2022 Tax Brackets Internal Revenue Code Simplified

New Federal Tax Brackets For 2023

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets Irs Calculator

2023 California Tax Brackets W2023H

2022 Tax Brackets DhugalKillen

https://www.irs.gov/newsroom/irs-provides-tax...

Web Oct 18 2022 nbsp 0183 32 Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly The other rates are 35 for incomes over 231 250 462 500 for married couples filing jointly

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

Web Jan 2 2024 nbsp 0183 32 The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status

https://turbotax.intuit.com/tax-tips/irs-tax...

Web Jan 3 2024 nbsp 0183 32 Let s say for the 2023 tax year filing for 2024 you earned a taxable income of 90 000 and you filed as single Based on the tax brackets you ll fall under the third tax bracket for taxable incomes between 44 725 and 95 375 which has a tax rate of 22 However you won t pay a 22 tax rate on the entirety of your 90 000 taxable

https://www.forbes.com/advisor/taxes/taxes-federal

Web 6 days ago nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37

https://turbotax.intuit.com/tax-tools/calculators/tax-bracket

Web Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate

Web Oct 21 2022 nbsp 0183 32 That s up 900 from 2022 s 12 950 standard deduction For married couples filing jointly for tax year 2023 the standard deduction climbs to 27 700 That s an 1 800 increase from 2022 For Web Oct 14 2022 nbsp 0183 32 The US Bureau of Labor Statistics reported that the consumer price index increased just 0 1 for August after no change in July However inflation remains a concern because over the last 12 months the index rose 8 3 before seasonal adjustment And those rates could impact your 2023 tax picture The CPI measures the cost of goods and

Web Oct 20 2022 nbsp 0183 32 Changes in the tax code to account for inflation affect the most people Here are 12 IRS changes for tax year 2023 for returns filed in 2024 that could save retirees and pre retirees money and offset the financial hit of higher consumer prices 1 Tax brackets While the 2023 tax brackets remain the same at 10 percent 12 22 24 32 35