Tax Brackets For 2023 Single Web Dec 13 2023 nbsp 0183 32 For example for 2023 the 22 tax bracket range for single filers is 44 726 to 95 375 while the same rate applies to head of household filers with taxable income from 59 851 to 95 350

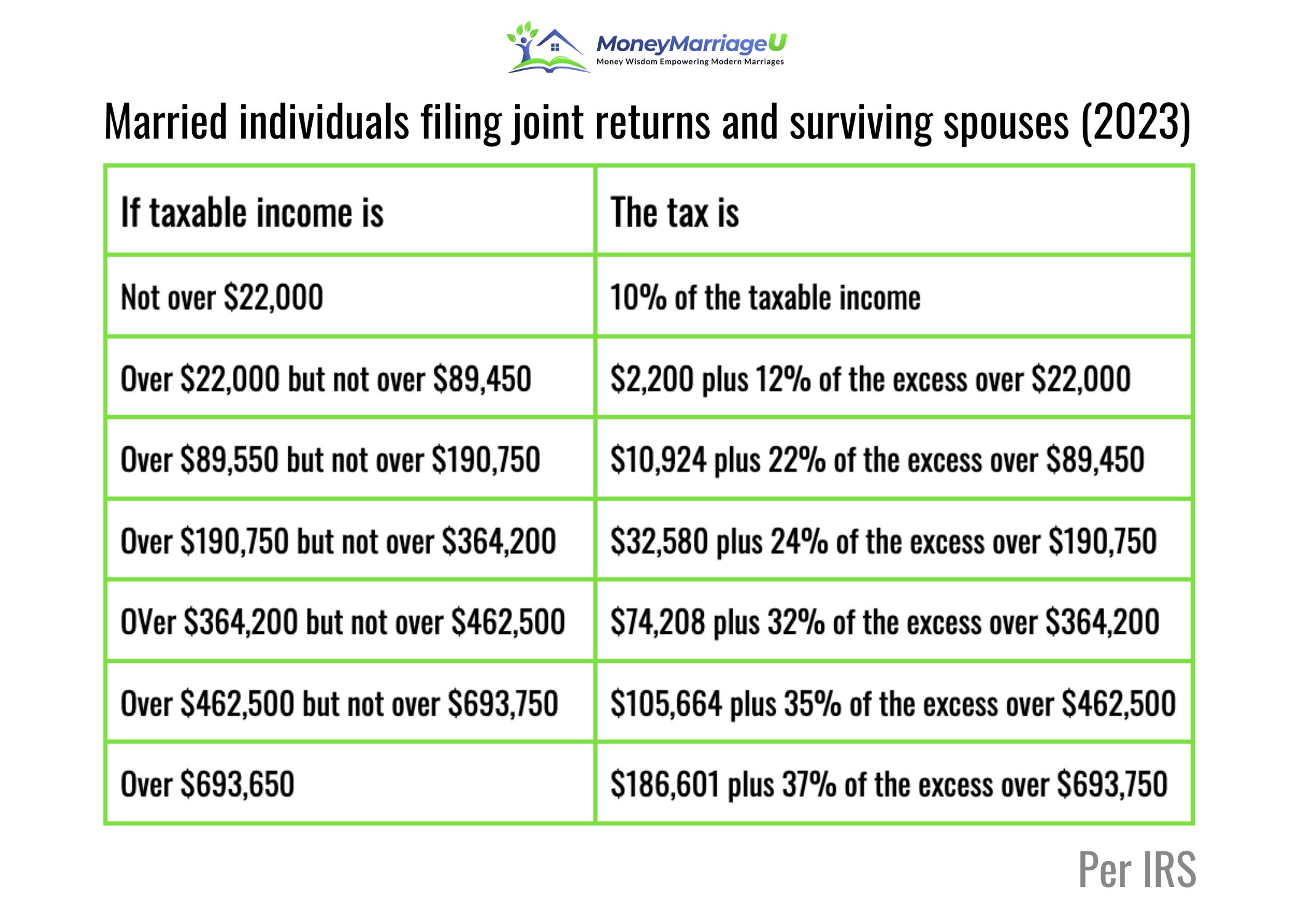

Web Oct 19 2022 nbsp 0183 32 The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing together and 13 850 for single Web Oct 25 2022 nbsp 0183 32 For married couples filing jointly the new standard deduction for 2023 will be 27 700 This is a jump of 1 800 from the 2022 standard deduction The 2023 standard deduction for single taxpayers

Tax Brackets For 2023 Single

Tax Brackets For 2023 Single

Tax Brackets For 2023 Single

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Web Oct 18 2022 nbsp 0183 32 The IRS released inflation adjusted marginal rates and brackets for 2023 on Tuesday and many workers will see higher take home pay in the new year as less tax is withheld from their

Templates are pre-designed files or files that can be utilized for various functions. They can conserve effort and time by offering a ready-made format and design for creating different sort of material. Templates can be utilized for individual or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Tax Brackets For 2023 Single

2023 Federal Tax Brackets 2023

10 2023 California Tax Brackets References 2023 BGH

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2022 Tax Brackets KatherynYahya

New Federal Tax Brackets For 2023

2022 Tax Brackets Irs Calculator

https://www.forbes.com/advisor/taxes/taxes-federal

Web Jan 9 2024 nbsp 0183 32 The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37

https://turbotax.intuit.com/tax-tips/irs-tax...

Web 6 days ago nbsp 0183 32 Let s say for the 2023 tax year filing for 2024 you earned a taxable income of 90 000 and you filed as single Based on the tax brackets you ll fall under the third tax bracket for taxable incomes between 44 725 and 95 375 which has a tax rate of 22 However you won t pay a 22 tax rate on the entirety of your 90 000 taxable

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

Web Jan 2 2024 nbsp 0183 32 For example if you re a single filer in 2023 with 35 000 of taxable income you would be in the 12 tax bracket If your taxable income went up by 1 you would pay 12 on that extra

https://www.wsj.com/buyside/personal-finance/tax...

Web Nov 9 2023 nbsp 0183 32 That works out to a tax bill of 16 207 for 2023 compared with 16 636 for 2022 Here s where the income thresholds fall for the taxes you ll file in 2024 if you are single

https://www.forbes.com/sites/janetnovack/2022/10/...

Web Oct 18 2022 nbsp 0183 32 The Internal Revenue Service has released dozens of inflation adjustments affecting individual income tax brackets deductions and credits for 2023 and no surprise today s four decade high

Web Estimate your 2023 taxable income for taxes filed in 2024 with our tax bracket calculator Want to estimate your tax refund Use our Tax Calculator Tax Bracket Calculator Enter your tax year filing status and taxable income to calculate your estimated tax rate What Is My Tax Rate 2021 Filing status Annual taxable income Web Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly The other rates are 35 for incomes over 231 250 462 500 for

Web Oct 14 2022 nbsp 0183 32 The US Bureau of Labor Statistics reported that the consumer price index increased just 0 1 for August after no change in July However inflation remains a concern because over the last 12 months the index rose 8 3 before seasonal adjustment And those rates could impact your 2023 tax picture The CPI measures the cost of goods and