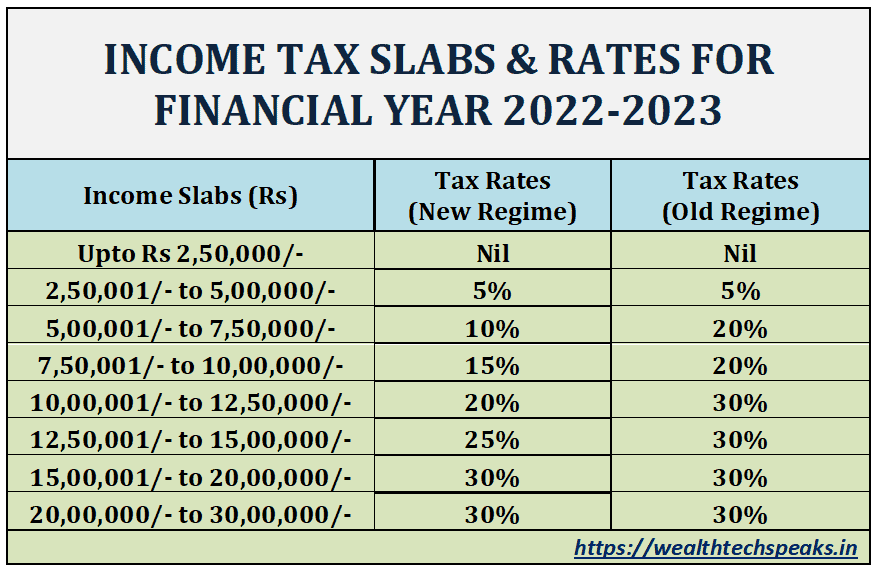

Income Tax Slabs For Assessment Year 2022 23 Web Yes the new income tax slabs for AY 2023 24 FY 2022 23 under the new tax regime does not change based on the age of the tax payer So the limit of maximum tax exempt income is Rs 2 5 lakh regardless of the individual taxpayer s age

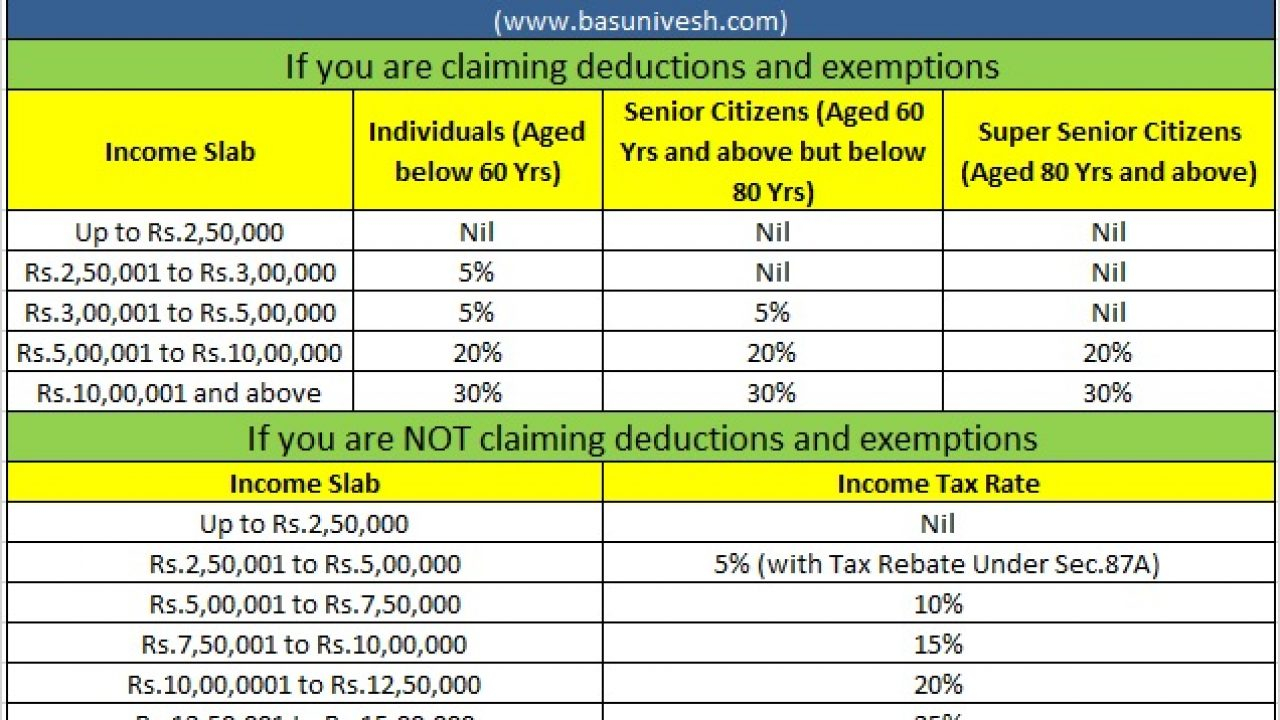

Web Feb 27 2023 nbsp 0183 32 12 of the amount of income tax when the total income exceeds INR 1 Crore Check the Income tax rates for assessment in 2023 Know Income tax slab for individuals including resident senior citizen and resident super senior citizen opting for old tax regime Indiafilings Web Feb 1 2022 nbsp 0183 32 The new tax regime The income tax department gave an option from the assessment year 2021 22 onwards to pay income tax at a lower rate but without availing the benefits of deductions and exemptions The tax rate is

Income Tax Slabs For Assessment Year 2022 23

Income Tax Slabs For Assessment Year 2022 23

Income Tax Slabs For Assessment Year 2022 23

http://outsourcebookkeepingindia.com/wp-content/uploads/2020/06/income-tax-calculator-india-fy-2020-21-ay-2021-22-1.png

Web The income tax rates for Assessment Year 2023 24 are the same as applicable in Assessment Year 2022 23 with minor changes in surcharge rates on co operative societies and specific AOPs Hence comparative tax tables are provided in

Pre-crafted templates provide a time-saving option for developing a varied range of documents and files. These pre-designed formats and designs can be used for various personal and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the content creation procedure.

Income Tax Slabs For Assessment Year 2022 23

New Vs Old Tax Slabs Fy 2022 23 Which Is Better Calculator Stable Www

New Income Tax Slab Rates Vs Old Rates Which One Is Better

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

New Income Tax Slab FY 2020 21 India Vs Old

New Vs Old Tax Slabs Fy 2022 23 Which Is Better Calculator Stable Www

New Income Tax Slabs FY 2014 15 Income Tax Slabs AY AY 2015 16 AP

https://taxguru.in/income-tax/income-tax-rates...

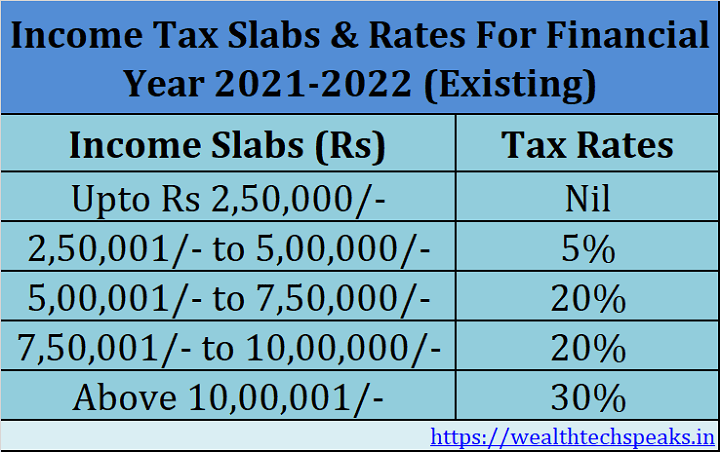

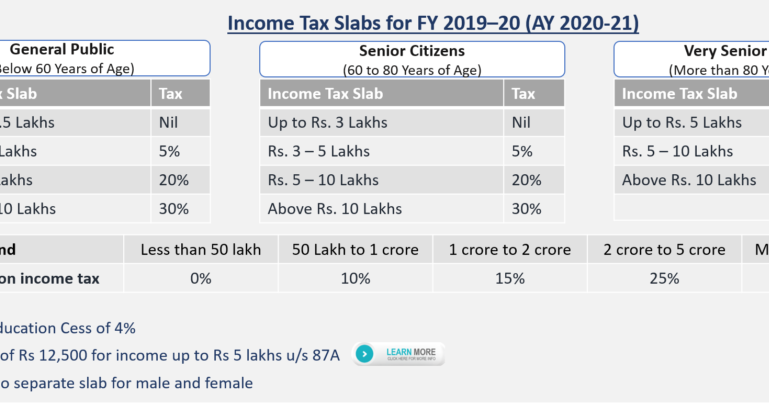

Web Jun 13 2022 nbsp 0183 32 Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Senior Citizen who is 60 years or more at any time during the previous year Net Income Range Rate of Income tax

https://cleartax.in/s/income-tax-slabs

Web Income Tax Slabs Tax Rate Tax Amount Income up to Rs 2 50 000 No tax Income from Rs 2 50 000 Rs 5 00 000 5 Rs 5 00 000 Rs 2 50 000 Rs 12 500 Income from Rs 5 00 000 10 00 000 20 Rs 8 00 000 Rs 5 00 000 Rs 60 000 Income more than Rs 10 00 000 30 Tax Rs 72 500 Cess 4 of Rs 72 500 Rs 2 900 Total tax in FY 2022

https://taxguru.in/income-tax/income-tax-rates...

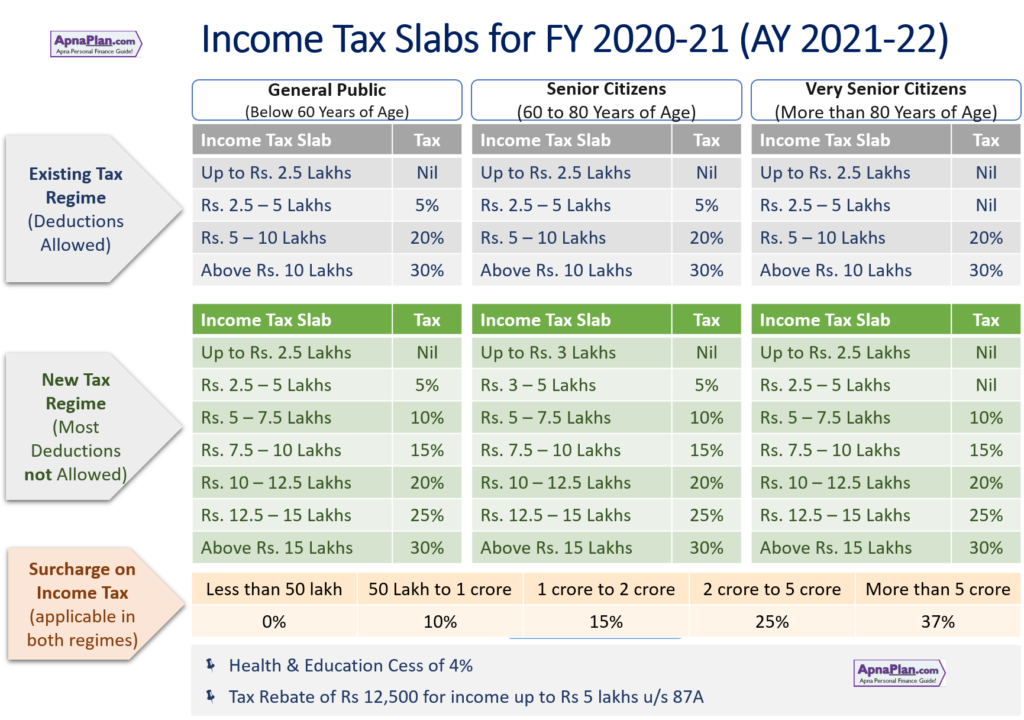

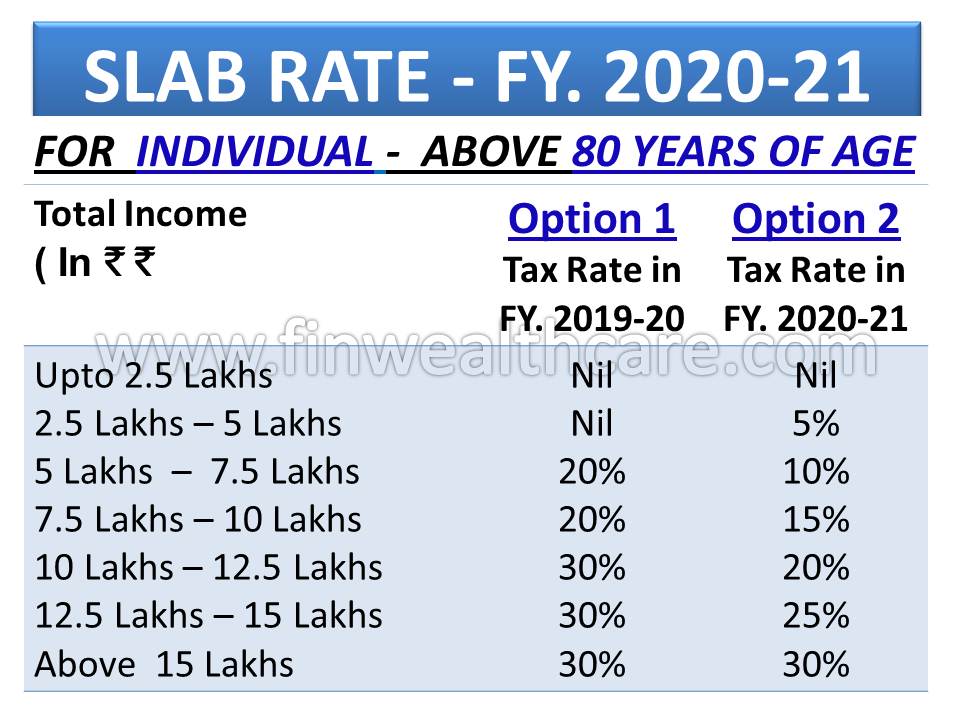

Web Feb 2 2021 nbsp 0183 32 On satisfaction of certain conditions as per the provisions of section 115BAC an individual or HUF shall from assessment year 2021 22 onwards have the option to pay tax in respect of the total income at following rates Total Income Rs Rate Upto 2 50 000 Nil From 2 50 001 to 5 00 000 5 per cent From 5 00 001 to 7 50 000 10 per cent

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

https://taxguru.in/income-tax/income-tax-rates...

Web 20 per cent From 12 50 001 to 15 00 000 25 per cent Above 15 00 000 30 per cent Similarly a co operative society resident in India has the option to pay tax at 22 per cent for assessment year 2021 22 onwards as per the provisions of section 115BAD subject to fulfilment of certain conditions

Web Feb 18 2022 nbsp 0183 32 Income Tax Slabs amp Rates under the existing tax regime with income tax deductions amp exemptions remain unaltered in the Union Budget 2022 for the Financial Year 2022 23 Tax Rebate U S 87A up to maximum of Rs 12 500 is available to the Individuals with income up to Rs 5 lacs Web In India income tax is calculated using income tax slabs and rates for the applicable financial year FY and assessment year AY The income tax slab for AY 2023 24 was published as part of the Union Budget 2022 23 Income Tax Slab Individual taxpayers must pay income tax based on the slab system into which they fall Individuals may fall

Web Current rates and allowances How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each