Income Tax Rate For Assessment Year 2022 23 Transfer Pricing Mutual Agreement Procedure MAP Multilateral Instrument MLI Non Resident Certificate of Residence e Residence Advance Pricing Arrangement Foreign Exchange

How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each tax band TAX RATES In this part you can gain knowledge about the normal tax rates applicable to different taxpayers For special tax rates applicable to special incomes like long term capital

Income Tax Rate For Assessment Year 2022 23

Income Tax Rate For Assessment Year 2022 23

Income Tax Rate For Assessment Year 2022 23

https://studycafe.in/wp-content/uploads/2020/04/Capture-12-768x441.jpg

Assessment Year Select 2024 25 2023 24 2022 23 2021 22 2020 21 2019 20 2018 19 2017 18 2016 17 2015 16 2014 15 2013 14 2012 13 2011 12 2010 11 Tax Payer

Templates are pre-designed documents or files that can be utilized for numerous functions. They can save effort and time by supplying a ready-made format and layout for developing various type of material. Templates can be utilized for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Income Tax Rate For Assessment Year 2022 23

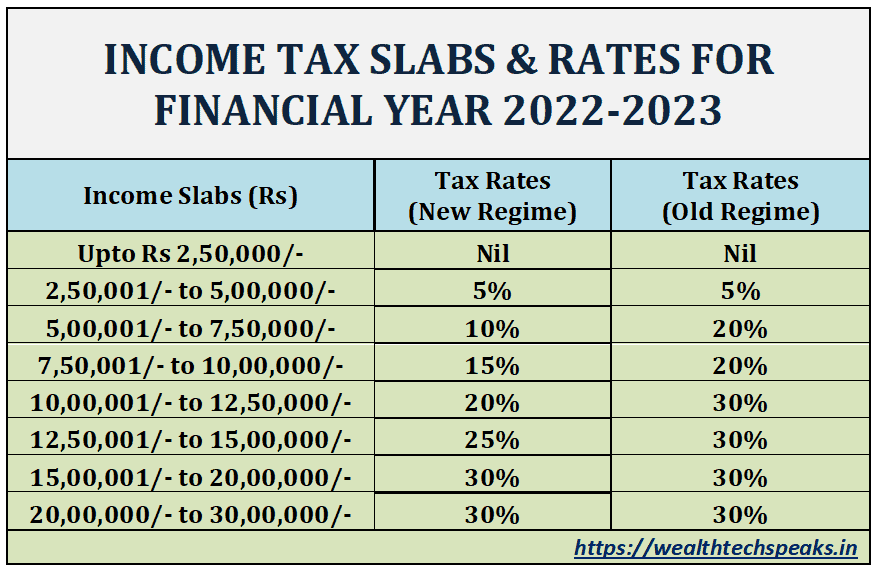

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

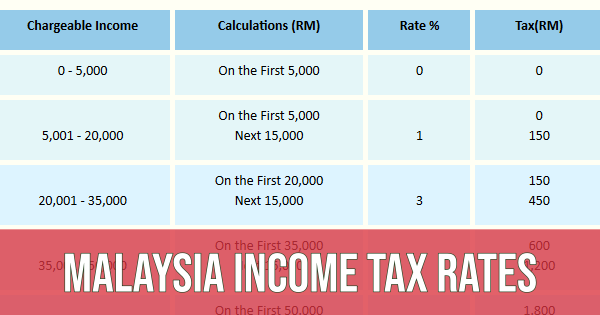

Malaysian Income Tax Calculator For Foreigners

Malaysia Personal Income Tax Relief 2022

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

Income Tax Return Malaysia NiataroCarrillo

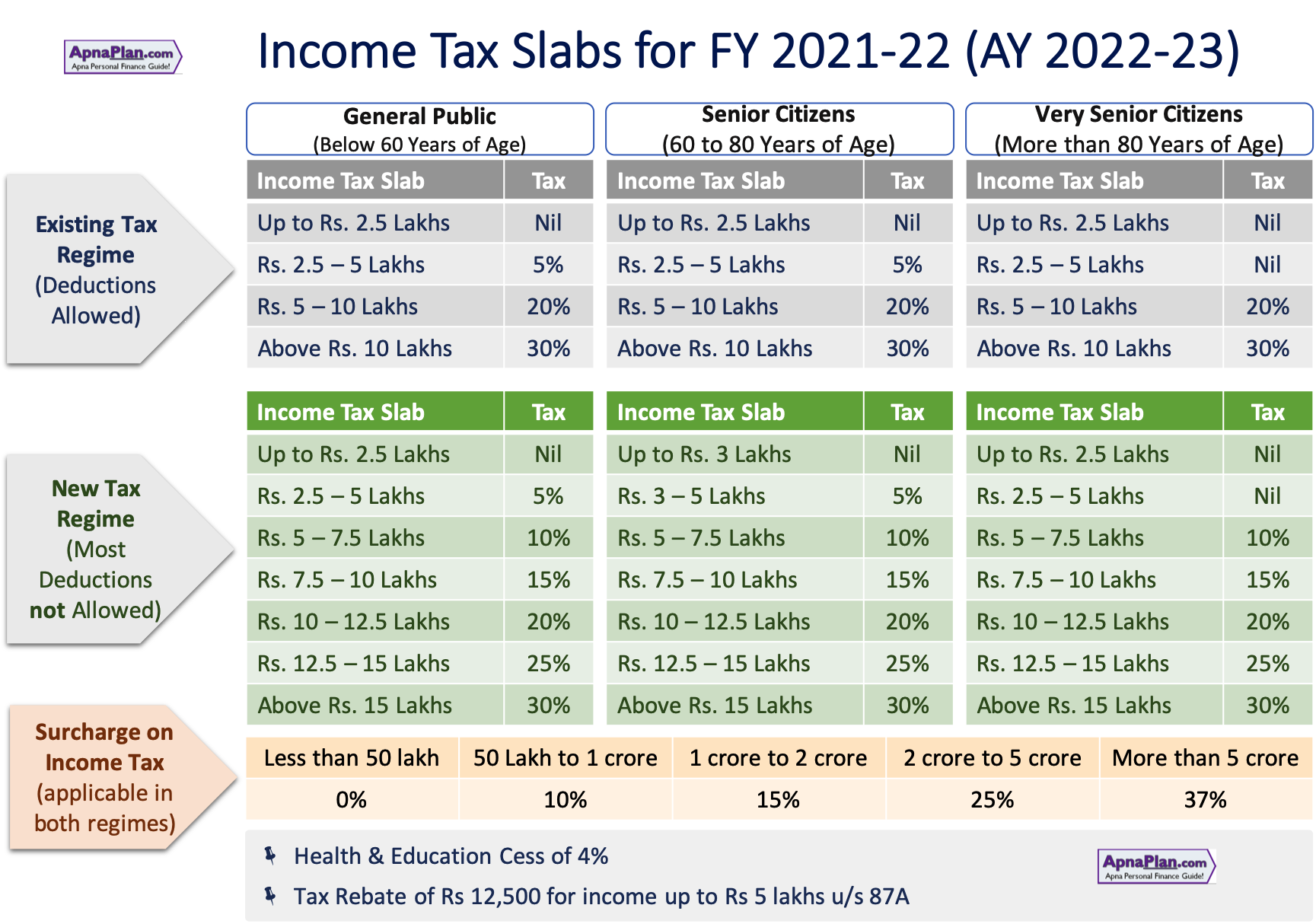

Income Tax Calculator India FY 2021 22 AY 2022 23 ApnaPlan

https://taxguru.in/income-tax/income-tax-rates...

Sep 9 2023 nbsp 0183 32 Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims

https://taxguru.in/income-tax/income-tax-rates-fy...

Feb 4 2022 nbsp 0183 32 Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc

https://www.taxmann.com/post/blog/income-tax-slab-rates-for-ay-2022-23

Mar 30 2021 nbsp 0183 32 Read about Income Tax Slab Rates for AY 2022 23 for Individuals opting for old tax regime for Partnership Firm Companies in this article

https://www.indiafilings.com/learn/income-tax-rates-for-assessment-year-

Mar 27 2024 nbsp 0183 32 Check the Income tax rates for assessment in 2023 Know Income tax slab for individuals including resident senior citizen and resident super senior citizen opting for old

https://cleartax.in/s/income-tax-slabs

2 days ago nbsp 0183 32 Latest Income Tax Slab amp Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

The assessment year is when you file your tax returns declaring the income earned during the previous year For example if you are filing your tax returns for 2023 24 the assessment year Jun 10 2022 nbsp 0183 32 Following tax rates will be applicable for Individual amp HUF who opted for NEW TAX REGIME for financial year 2022 23 assessment year 2023 24 Plus Surcharge amp

Income Tax Calculator How to calculate Income taxes online for FY 2023 24 AY 2024 25 2024 25 amp 2023 24 with ClearTax Income Tax Calculator Refer examples amp tax slabs for