Income Tax Slab For Assessment Year 2022 23 Old Regime Verkko 30 maalisk 2021 nbsp 0183 32 Various Mode of Cash Deposits under the Income Tax Act 1961 187 Read about Income Tax Slab Rates for AY 2022 23 for Individuals opting for old tax regime for Partnership Firm Companies in this article

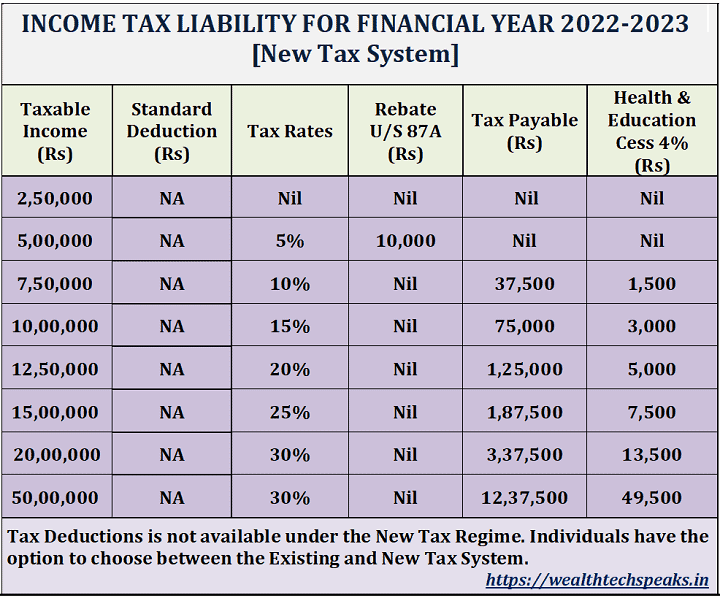

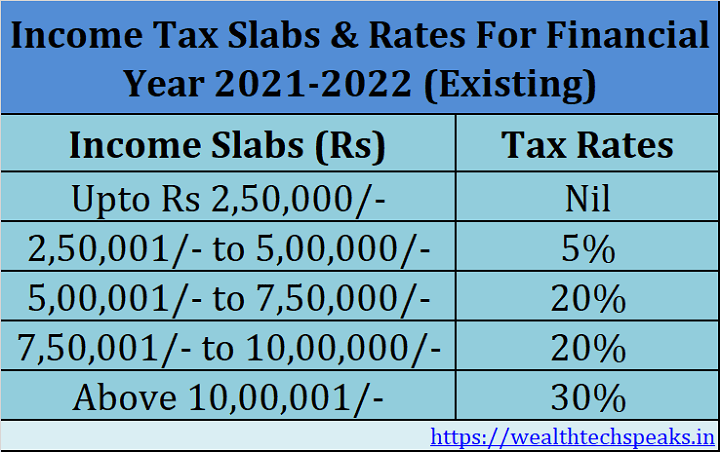

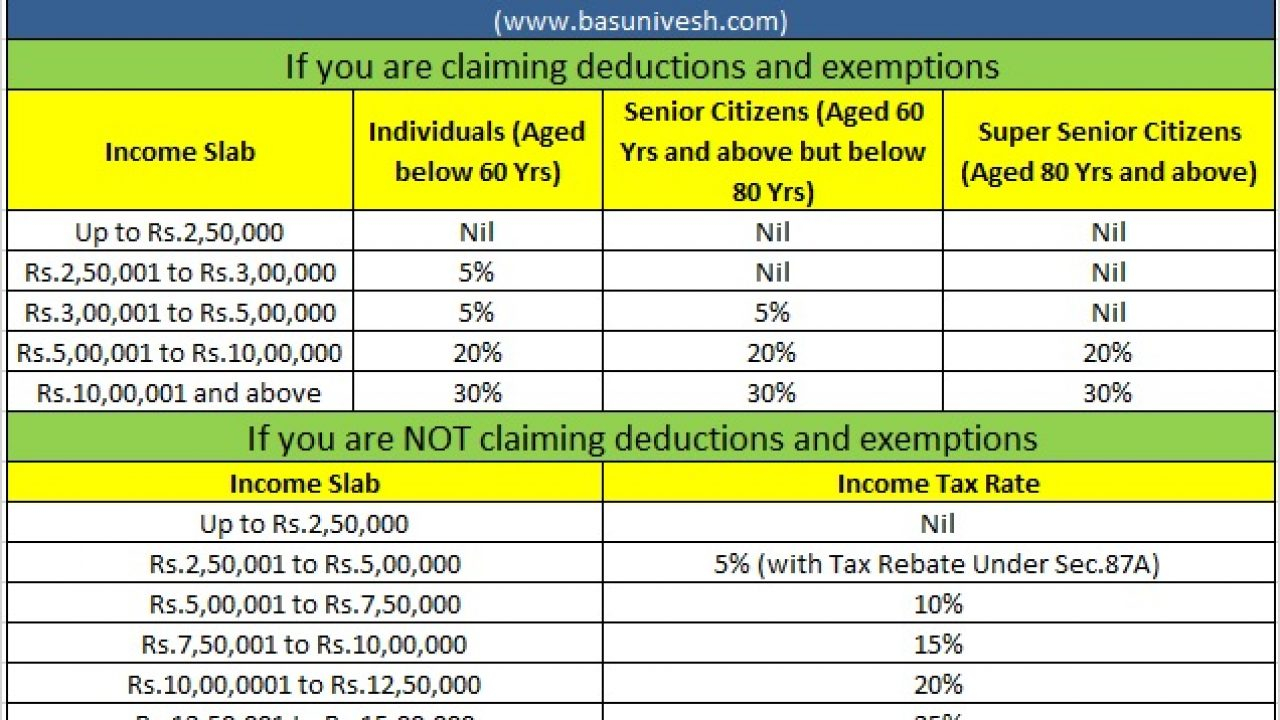

Verkko 15 elok 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A Verkko 30 syysk 2023 nbsp 0183 32 Income Tax Slabs FY 2023 24 and AY 2024 25 New amp Old Regime Tax Rates Sobiya Ameen 30 Sep 2023 What is the Income Tax slab Budget 2023 Update Revised Slabs for New Tax Regime Old Tax Regime FY 2023 24 and AY 2024 25 Individuals Hindu Undivided Family Including AOP BOI and Artificial

Income Tax Slab For Assessment Year 2022 23 Old Regime

Income Tax Slab For Assessment Year 2022 23 Old Regime

Income Tax Slab For Assessment Year 2022 23 Old Regime

http://cachandanagarwal.com/wp-content/uploads/2022/12/51805DBD-BAC4-4644-8380-1BCEA472764E.png

Verkko 21 jouluk 2022 nbsp 0183 32 Nifty 50 Income Tax Rates 2023 Assessment Year 2023 24 The Income Tax rates and slabs that were applicable in AY 2022 23 are expected to remain the same in AY 2023 24 under Old Regime

Templates are pre-designed files or files that can be utilized for different functions. They can conserve time and effort by supplying a ready-made format and layout for developing various sort of material. Templates can be utilized for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Income Tax Slab For Assessment Year 2022 23 Old Regime

What s Beneficial Tax Under Old Or New Regime Tax Slabs FY 2020 2021

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

New Vs Old Tax Slabs Fy 2022 23 Which Is Better Calculator Stable Www

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Slab For FY 2022 23 FY 2021 22 Revised Tax Slabs New

https://cleartax.in/s/income-tax-slabs

Verkko 16 lokak 2023 nbsp 0183 32 Income Slabs New Tax Regime FY 2022 23 AY 2023 24 0 2 50 000 2 50 000 5 00 000 5 tax rebate u s 87A is available 5 00 000 7 50 000 10 7 50 000 10 00 000 15 10 00 000 12 50 000 20 12 50 000 15 00 000 25 gt 15 00 000 30

https://www.news18.com/news/business/tax/income-tax-slab-ay-22-23-ol…

Verkko 13 hein 228 k 2022 nbsp 0183 32 first published July 13 2022 15 41 IST last updated July 13 2022 17 00 IST Income Tax Return AY 22 23 There are over 70 exemptions and deductions available under the old tax regime to lower the tax burden of the individuals New tax regime has lower tax rates compared to old system

https://www.myitronline.com/blog-post/old-and-new-tax-regime-rates-for...

Verkko New Income Tax Slab Rates introduced in the Budget 2020 for AY 2021 22 onwards is kept optional for the taxpayers where they are open to choose the tax slabs of old regime FY 2021 22 The New Tax Slabs are made common for taxpayers of all age groups with reduced income tax rates allowed in income brackets up to INR 15 00 000

https://www.paybima.com/.../old-tax-regime-income-tax-slabs-and-rates

Verkko 7 marrask 2022 nbsp 0183 32 Income Tax Slabs New Regime After looking at the income tax slabs for the existing old regime in the sections above let us now look at the slabs announced in the new regime i e for FY 2022 23 AY 2023 24 Income Tax Slab Rate of Tax Payable Up to Rs 2 50 000

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Verkko Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax

Verkko Income Tax Slab Rates FY 2022 23 Old Tax Regime Income Tax Slab Rates FY 2022 23 New Tax Regime Up to Rs 2 5 lakh Nil Nil Rs 2 50 001 to Rs 3 lakh 5 Rs 3 00 001 to Rs 5 lakh 5 Rs 5 00 001 to Rs 7 5 lakh 20 10 Rs 7 50 001 to Rs 10 lakh 15 Rs 10 00 001 to Rs 12 5 lakh 30 20 Rs 12 50 001 to Rs 15 lakh Verkko 1 helmik 2022 nbsp 0183 32 Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5 lakh 5 per cent 20 per cent From 5 00 001 to 7 5 lakh From 7 50 001 to 10 lakh 10 per cent 15 per cent 30 per cent

Verkko 17 elok 2022 nbsp 0183 32 Old Tax Regime in Rs New Tax Regime in Rs Gross Income 10 00 000 10 00 000 Deductions U S 80C 1 50 000 U S 80 25 000 U S24 b 75 000 Taxable Income 7 50 000 10 00 000 Tax Slab OLD 0 2 5 lakh 2 5 lakh 5 lakh 5 12 500 5 lakh 10 lakh 20 50 000 gt 10 lakh 30 Tax Slab