Income Tax Return Slab Assessment Year 2022 23 Bangladesh WEB income tax return for the assessment year 2022 2023 is on 30th November 2022 unless extended Hence if Mr X brings back the undisclosed income for the income year 2021

WEB 1 This return of income shall be signed and verified by the individual person as prescribed by the Income Tax Act 2023 2 Enclose where applicable a Salary statement for WEB The Income tax rates and personal allowances in Bangladesh are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below

Income Tax Return Slab Assessment Year 2022 23 Bangladesh

Income Tax Return Slab Assessment Year 2022 23 Bangladesh

Income Tax Return Slab Assessment Year 2022 23 Bangladesh

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

WEB SUMMARY OF TAXATION RULES IN BANGLADESH 2022 2023 295 BOARD OF DIRECTORS FOR 2022 PRESIDENT Mr Md Saiful Islam Assessment year and

Templates are pre-designed documents or files that can be used for numerous functions. They can save effort and time by supplying a ready-made format and layout for creating various kinds of material. Templates can be utilized for personal or expert projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Income Tax Return Slab Assessment Year 2022 23 Bangladesh

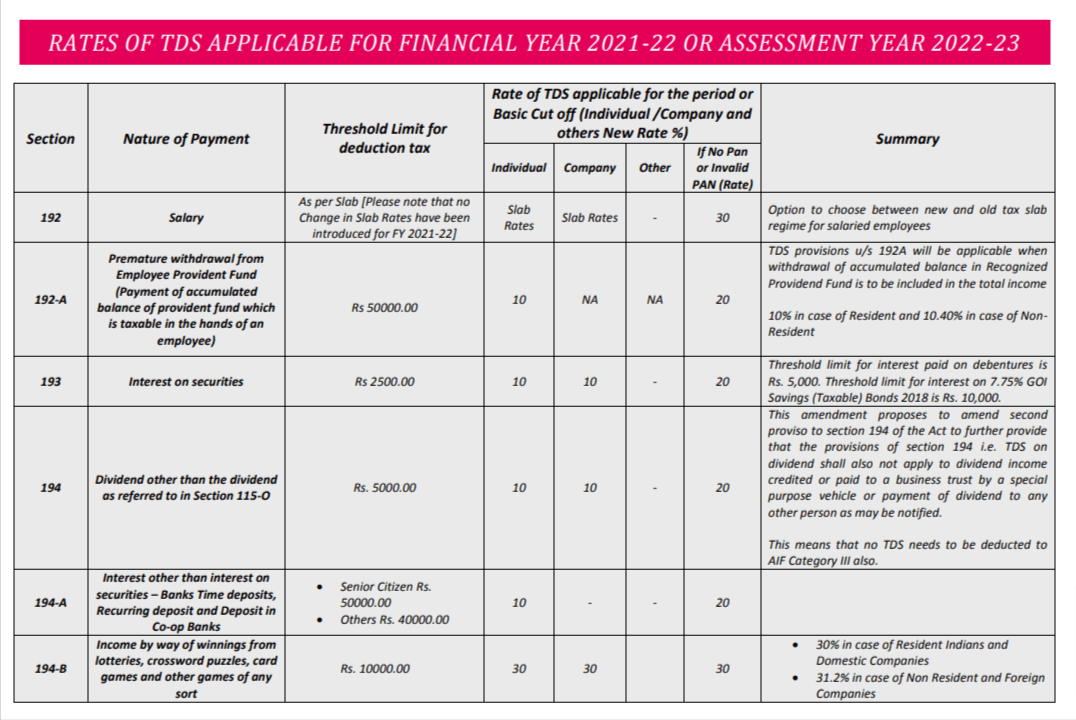

Latest TDS Rates Chart For FY 2022 23 PDF

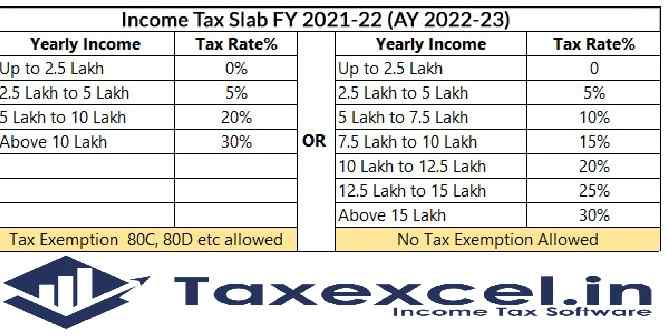

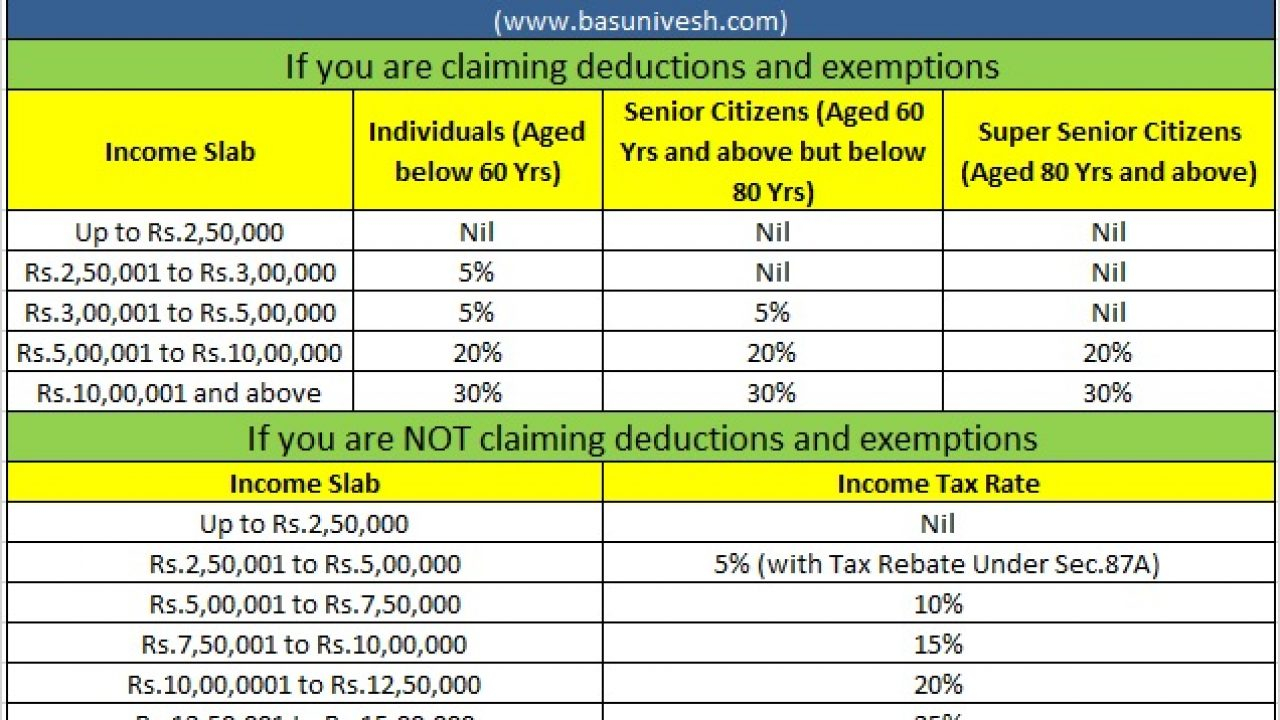

New Income Tax Slab 2021 And Tax Rates For AY 2021 22 And 2022 23

Income Tax Slab Old Regime For FY 2021 22 Income Tax Slab

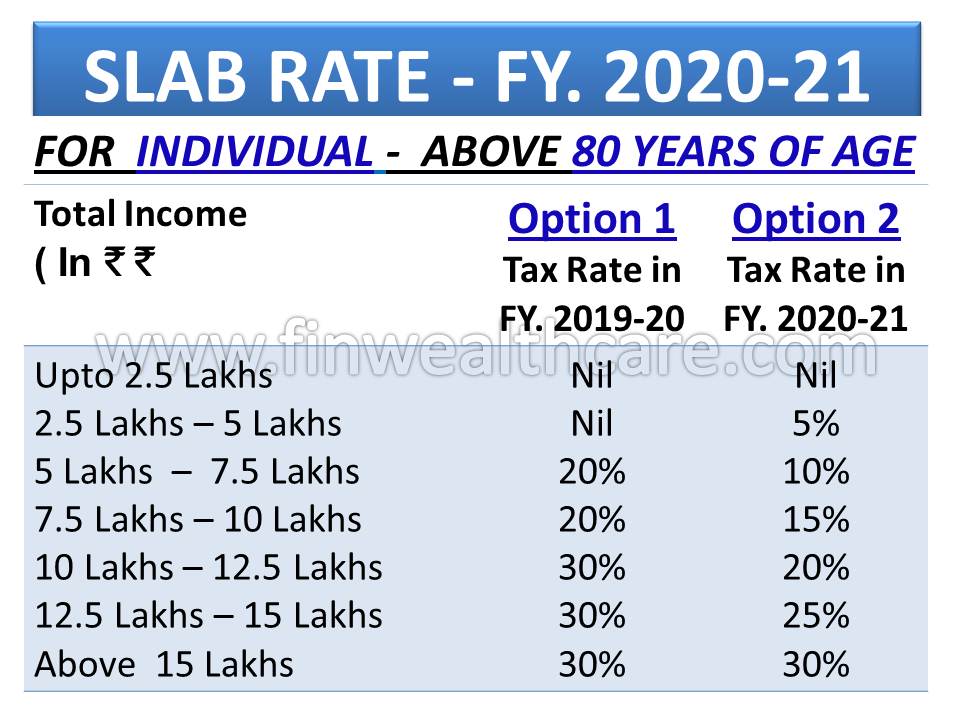

Income Tax Slab For Individual For AY 2020 21 Income Tax Slab

New Income Tax Slab FY 2020 21 India Vs Old

Income Tax Slab F Y 2021 22 With Automated Income Tax Calculator All

https://www.icmab.org.bd/wp-content/uploads/2022/...

WEB This write up present a brief description overall taxes and non taxes issues of the budget and the Finance Act 2022 have been discussed in brief and overall changing of the

https://aceadvisory.biz/wp-content/uploads/2022/09/...

WEB Jun 30 2022 nbsp 0183 32 Tax Year Residency In Bangladesh taxation depends on residency Bangladeshi residents are taxed on their worldwide income while non residents are

https://nbr.gov.bd/uploads/paripatra/Paripatra_2022-2023_.pdf

WEB Major sources of income subject to deduction or collection of tax and advance payment of tax Rates applicable for Financial Year 2022 2023

https://kpmg.com/bd/en/home/insights/2022/10/tax.html

WEB This Handbook incorporates many of the important provisions of the Income Tax Ordinance 1984 as amended up to the Finance Act 2022 and major changes brought in by the

https://aceadvisory.biz/publications/banglade…

WEB Jun 10 2022 nbsp 0183 32 These insights incorporate many important aspects of the Income Tax Ordinance 1984 as amended up to and including the changes in the Finance Act 2022 and the respective major changes in the VAT

WEB All resident companies and foreign companies with Bangladesh source income are required to file an annual income tax return This includes companies engaged in WEB The objective of this writing is to provide a summarized picture of the current scenario of Income Tax BD All the information in this writing has been made under the light of

WEB Jun 9 2022 nbsp 0183 32 Despite demands from different quarters to increase the income tax threshold the government has proposed to keep the tax free income limit for individual