Income Tax Slab Rates For Assessment Year 2022 23 WEB Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI and Artificial Juridical Person

WEB Feb 4 2022 nbsp 0183 32 Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc WEB Income Tax Department gt Tax Tools gt Tax Calculator Click to view services related to PAN TAN and more Tax Helpline Click to view Tax Helpline As amended upto Finance Act 2023 Tax Calculator Click here to view relevant Act amp Rule Assessment Year

Income Tax Slab Rates For Assessment Year 2022 23

Income Tax Slab Rates For Assessment Year 2022 23

Income Tax Slab Rates For Assessment Year 2022 23

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

WEB How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each tax band Some income is

Pre-crafted templates use a time-saving solution for producing a diverse variety of documents and files. These pre-designed formats and layouts can be utilized for different personal and professional tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, simplifying the content development procedure.

Income Tax Slab Rates For Assessment Year 2022 23

Income Tax Slab Rates For The A Y 2020 21 And A Y 2021 22 YouTube

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

New Income Tax Slab Rates Vs Old Rates Which One Is Better

Income Tax Slab Rates For Assessment Year 2021 22 Check The Latest

Tds Slab Rate 2019 20

Current Tax Slab Income Tax Slab

https://taxguru.in › income-tax

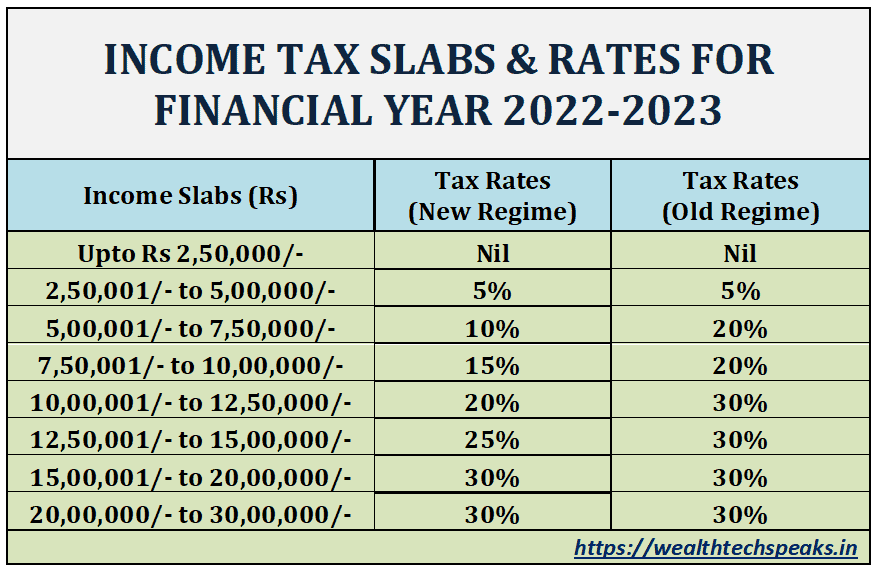

WEB Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs companies and more

https://www.indiafilings.com › learn › income-tax-rates...

WEB Sep 14 2024 nbsp 0183 32 Check the Income tax rates for assessment in 2023 Know Income Tax Slab 2022 23 for individuals including resident senior citizen and resident super senior citizen opting for old tax regime Indiafilings

https://cleartax.in › income-tax-slabs

WEB 6 days ago nbsp 0183 32 Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 Old Tax Regime For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed Rs 5 00 000 not applicable for NRIs New Tax Regime Tax Slab for FY 2023 24 Tax Rate

https://tax2win.in › guide › income-tax-slabs

WEB Sep 10 2024 nbsp 0183 32 Income tax slab FY 2023 24 AY 2024 25 Check out the latest income tax slab for salaried individuals and senior citizens by the IT department Discover the tax rates for both the new tax regime and the old tax regime

https://www.taxmann.com › post › blog

WEB Mar 30 2021 nbsp 0183 32 Read about Income Tax Slab Rates for AY 2022 23 for Individuals opting for old tax regime for Partnership Firm Companies in this article

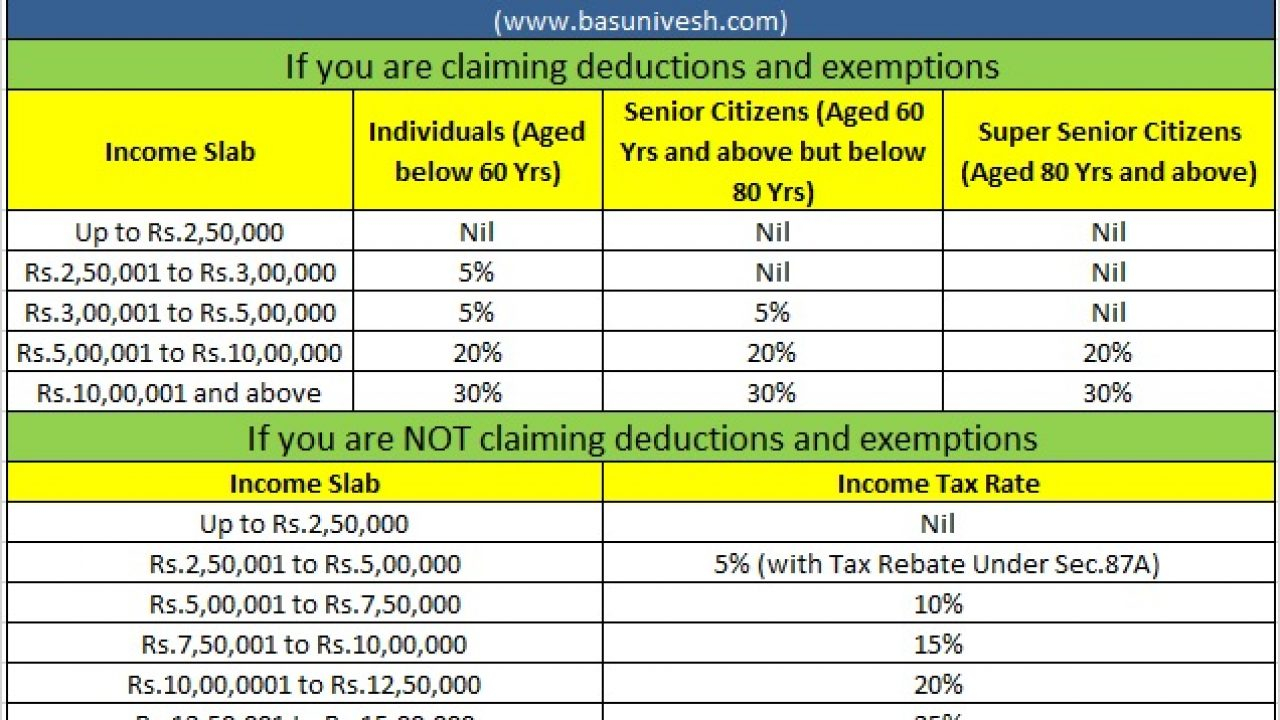

WEB INCOME TAX RATES ASSESSMENT YEAR 2022 2023 RELEVANT TO FINANCIAL YEAR 2021 2022 The normal tax rates applicable to a resident individual will depend on the age of the individual However in case of a non resident individual the tax rates will be same irrespective of his age WEB Apr 29 2023 nbsp 0183 32 Overview Below are the income tax slabs for the financial year 2022 23 assessment year 2023 24 for resident individuals below 60 years of age Hindu Undivided Family HUF and Non Resident Indians NRI with income in India Income Tax Slabs FY 2022 23 AY 2023 24 for Senior Citizen Taxpayers

WEB In India income tax is calculated using income tax slabs and rates for the applicable financial year FY and assessment year AY For this year the financial year will be 2024 25 and the assessment year will be 2025 26