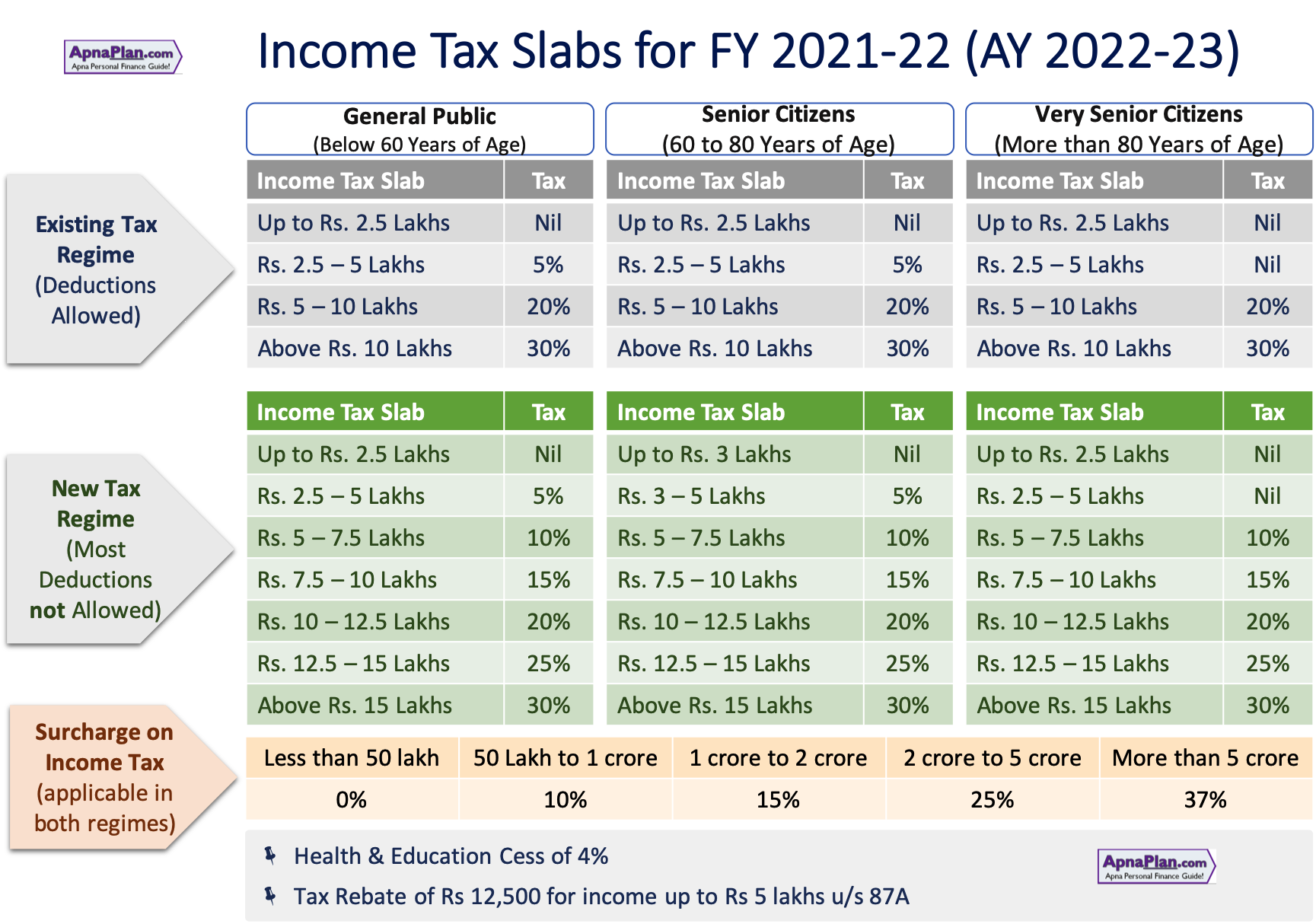

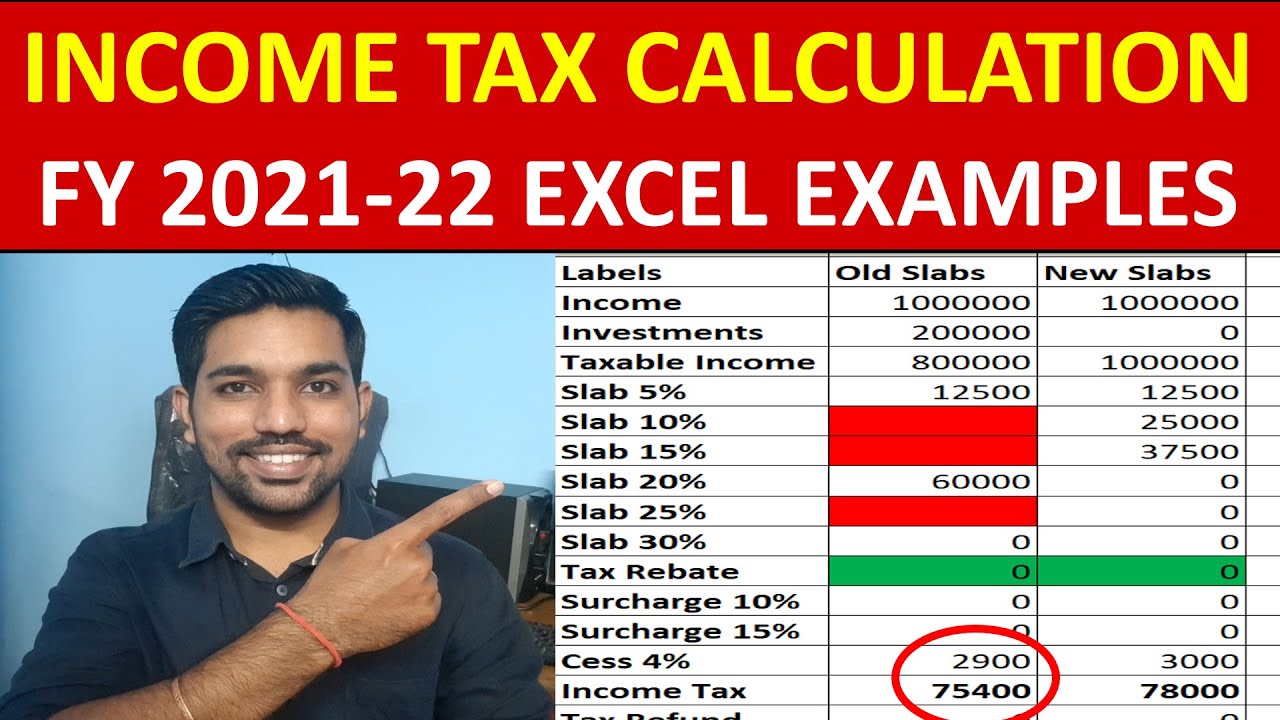

Income Tax Slab Rate For Fy 2022 23 For Salaried Person Web Feb 7 2023 nbsp 0183 32 Old Tax Regime Slabs and Rates for Salaried Persons Employees ITR Filing in AY 2023 24 FY2022 23 Rs 2 5 lakh NIL Rs 2 5 5 lakh 5 above Rs 2 5 lakh Rs 5

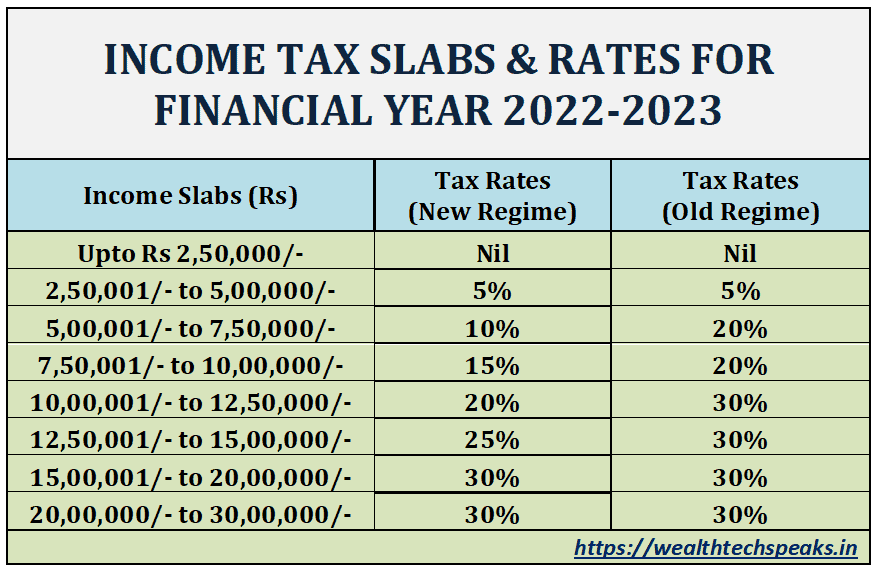

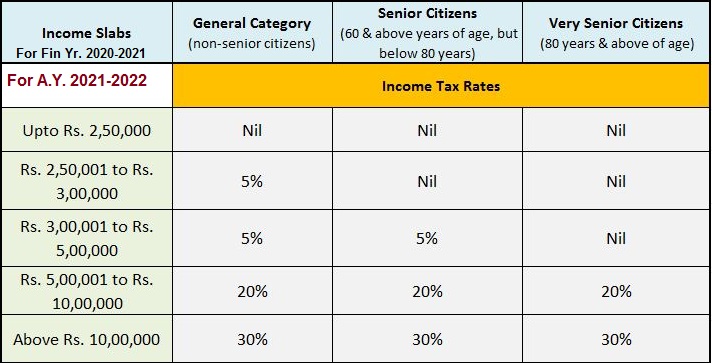

Web Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 Web Income Tax Slab for Salaried Person Below 60 Years of Age and HUF FY 2022 23 AY 2023 24 It is the duty of taxpayers who receive monthly salaries to file their returns for

Income Tax Slab Rate For Fy 2022 23 For Salaried Person

Income Tax Slab Rate For Fy 2022 23 For Salaried Person

Income Tax Slab Rate For Fy 2022 23 For Salaried Person

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

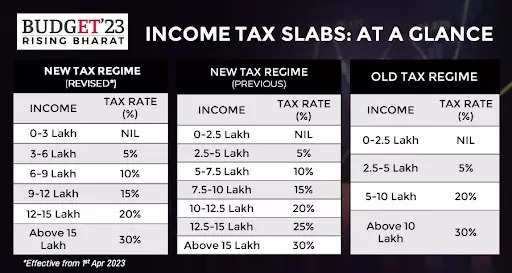

Web Feb 4 2023 nbsp 0183 32 Income tax slabs in new tax regime till FY 2022 23 Income tax slabs In Rs Income tax rate Between 0 and 2 50 000 0 Between 2 50 001 and 5 00 000

Templates are pre-designed documents or files that can be used for numerous purposes. They can save effort and time by offering a ready-made format and layout for creating different sort of material. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Income Tax Slab Rate For Fy 2022 23 For Salaried Person

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

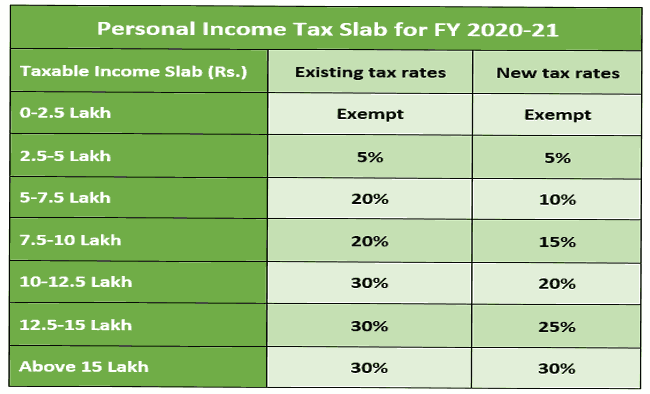

Personal Income Tax Slab For FY 2020 21

Income Tax Rate For Fy 2022 23 Calculator Pay Period Calendars 2023

Income Tax Slab For FY 2022 23 FY 2021 22 Revised Tax Slabs New

Income Tax Slab Income Tax Slab For Ay 2021 22 Pdf Download

How To Tax Save For FY 2021 22 Download Tax Planning Ebook ApnaPlan

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5

https://cleartax.in/s/income-tax-slabs

Web Apr 14 2017 nbsp 0183 32 Income Slabs Income Tax Rates FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000

https://propakistani.pk/2023/06/25/budget-202…

Web Jun 25 2023 nbsp 0183 32 The revised income tax slab for salaried class revealed that where taxable income exceeds Rs 6 000 000 the rate of tax would be Rs 1 095 000 plus 35 percent of the amount exceeding

https://tax.net.pk/2022/07/09/income-tax-sla…

Web Jul 9 2022 nbsp 0183 32 According to the revised income tax slabs for FY 2022 23 Income tax rates has been revised and have been increased as compare to previous tax year i e Tax Year 2022 Now let s learn more about the

https://www.news18.com/news/business/tax/i…

Web Feb 1 2022 nbsp 0183 32 Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From

Web Jan 16 2024 nbsp 0183 32 Stay up to date with the latest Income Tax Slab Rates for the financial year 2022 23 with this comprehensive guide from Tax2win Understand the new tax rates exemptions deductions and the impact Web Feb 1 2023 nbsp 0183 32 Personal Income Tax quot The new tax rates are 0 to Rs 3 lakhs nil Rs 3 to 6 lakhs 5 Rs 6 to 9 Lakhs 10 Rs 9 to 12 Lakhs 15 Rs 12 to 15 Lakhs 20 and

Web Feb 1 2022 nbsp 0183 32 Note Along with the applicable taxes you have to additional surcharges at below rates Surcharge 10 surcharge on income tax if the total income exceeds