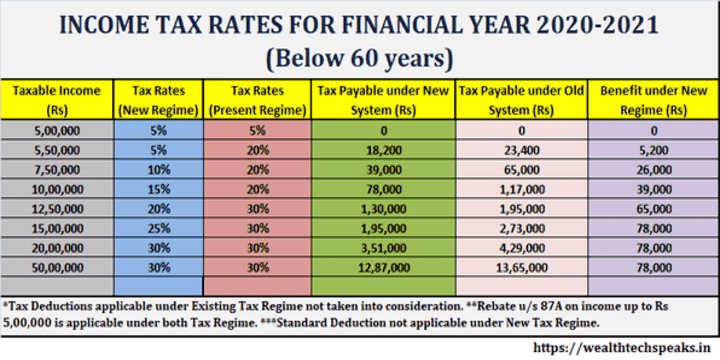

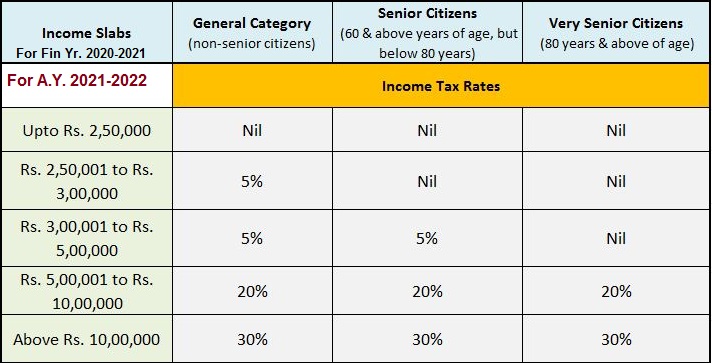

Income Tax Slab Rates For Fy 2022 23 Pdf WEB Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs

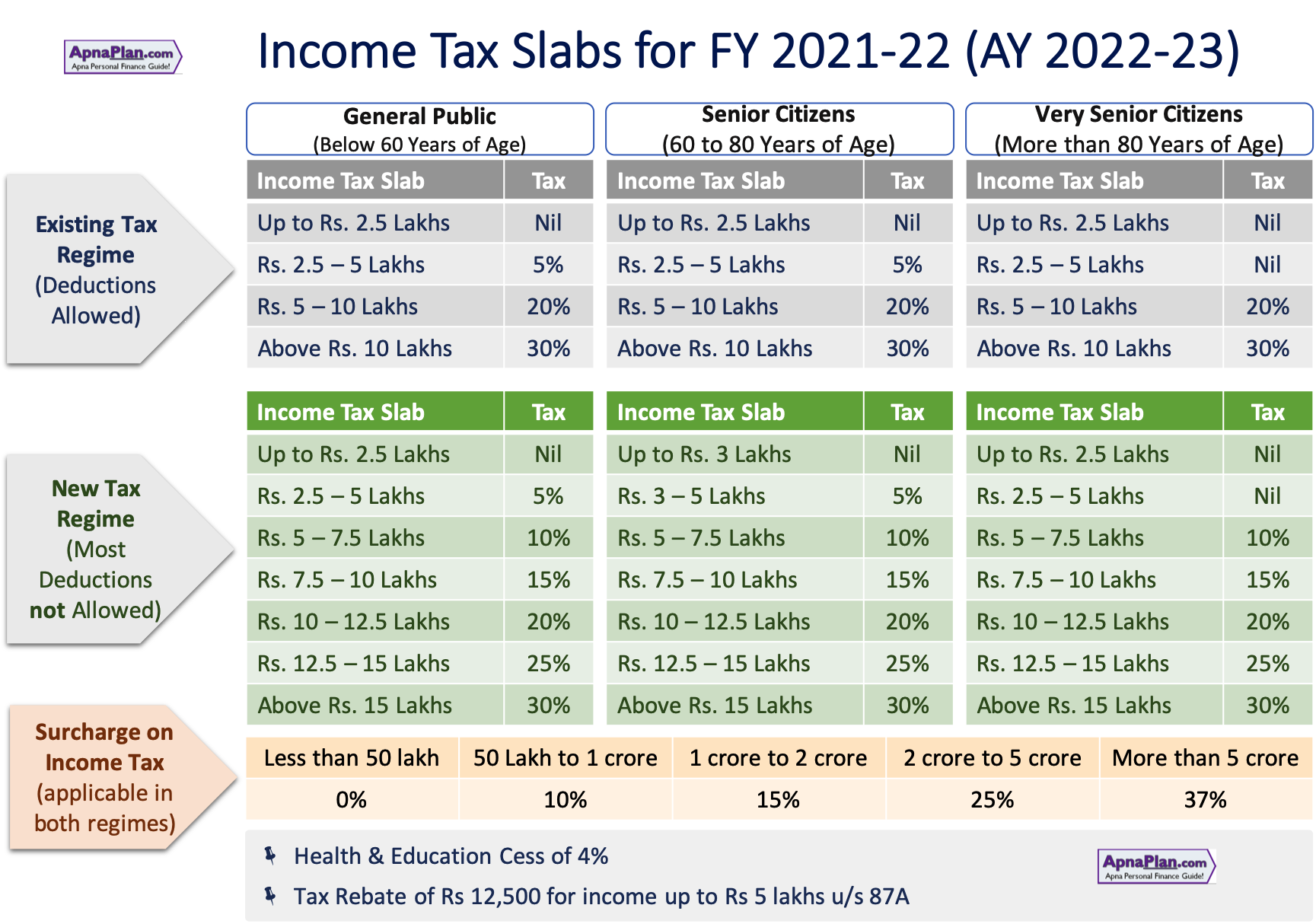

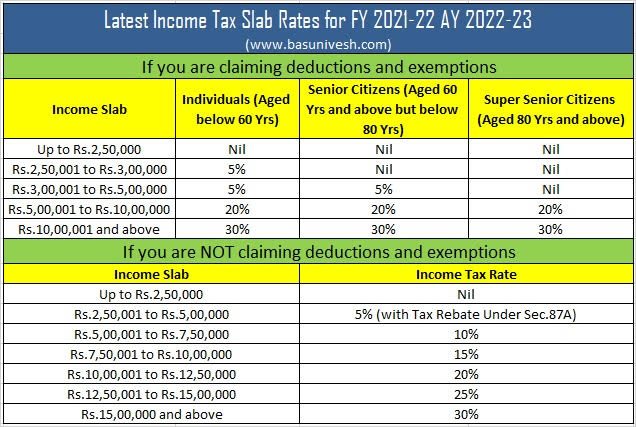

WEB 6 days ago nbsp 0183 32 New Income Tax Slabs For FY 2023 24 AY 2024 25 As per the Union Budget 2023 a few key changes have been introduced under WEB Jan 16 2024 nbsp 0183 32 Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 16 Jan 2024 05 49 PM New Tax Regime Slabs Rates Exemptions amp Deductions Availability

Income Tax Slab Rates For Fy 2022 23 Pdf

Income Tax Slab Rates For Fy 2022 23 Pdf

Income Tax Slab Rates For Fy 2022 23 Pdf

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

WEB Sep 28 2023 nbsp 0183 32 Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000

Pre-crafted templates provide a time-saving service for developing a diverse variety of files and files. These pre-designed formats and designs can be used for different individual and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, improving the material creation procedure.

Income Tax Slab Rates For Fy 2022 23 Pdf

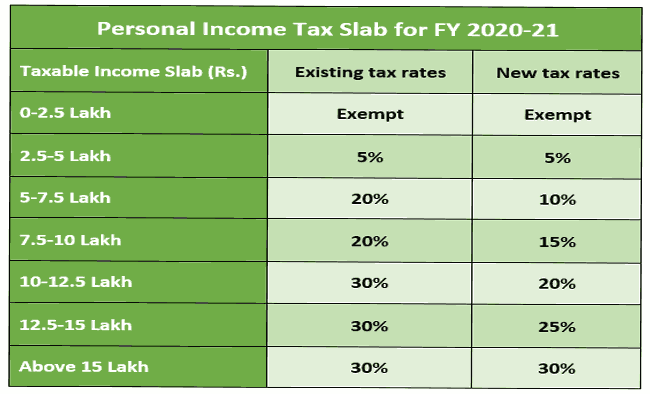

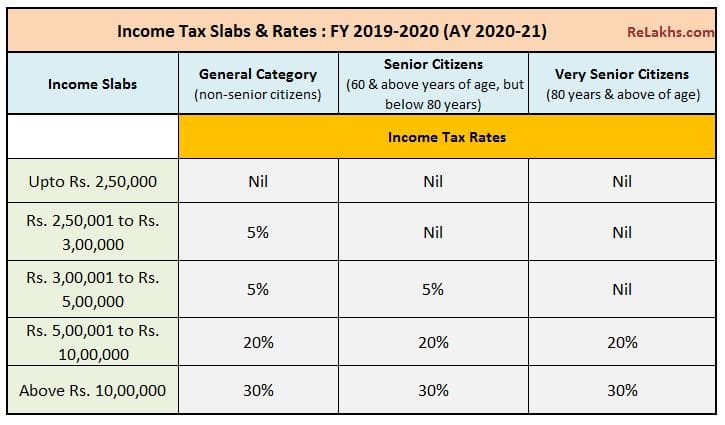

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

Income Tax Slab Fy 2022 23 Ay 2023 24 New Income Tax Slab Rate For Fy

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

Income Tax Slab FY 2022 23 Old New Regime BankBazaar

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Tax Slab 2022 Budget

https://www.incometax.gov.in/iec/foportal/help/...

WEB New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 2 50 000 Nil 2 50 001 5 00 000 5

https://bizsewa.com/income-tax-rates-n…

WEB Updated Income Tax rates in Nepal for 2079 2080 2022 23 including tax rates and rules for Individuals and Couples and businesses The tax

https://www.icmap.com.pk/.../TaxRateCard_2022-23.pdf

WEB Tax Rate Card for Tax Year 2022 23 Tax Rates for Salaried persons First Schedule Part I Division I S Taxable Income Rate of Tax 1 Up to Rs 600 000 0 2 Rs 600 001 to

https://taxguru.in/income-tax/income-tax-rates...

WEB Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5

https://incometaxindia.gov.in/Tutorials/2 Tax Rates.pdf

WEB Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly

WEB New Tax Regime Income Tax Slab Rates FY 2022 23 Old Tax Regime Income Tax Slab Rates FY 2022 23 Up to Rs 2 5 lakh Exempt Exempt Rs 2 50 001 to Rs 5 lakh 5 WEB Jan 16 2024 nbsp 0183 32 The income tax slab rates for FY 2023 24 AY 2024 25 under the new tax regime are as follows The insights of the Income Tax Slabs for FY 2022 23 AY 2023

WEB The Budget 2023 changed the income tax slabs under the new tax regime The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under