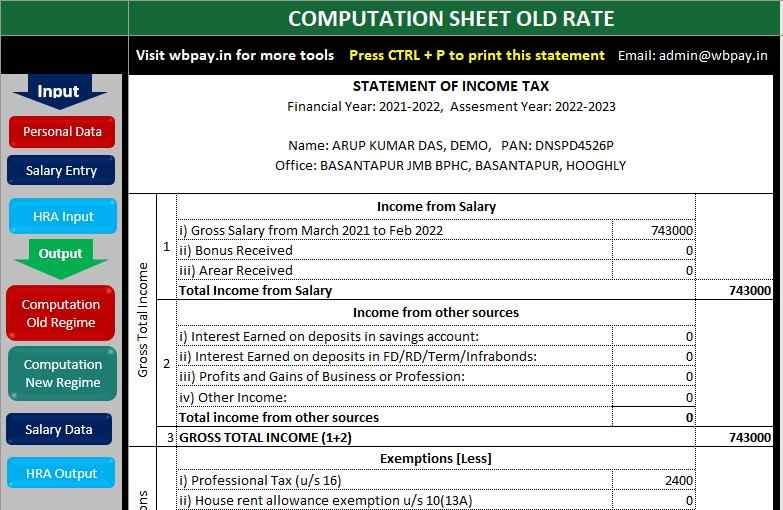

Income Tax Slab For Fy 2020 21 Old Regime Web The Income tax calculator is an online tool that helps you calculate your Income Tax liability for the current Financial year FY 2021 22 i e AY 2022 23 and the previous Financial Year FY 2020 21 i e AY 2021 22 Also compare your Income Tax Liability and the effective tax rate under both the Old and New Income Tax Regime

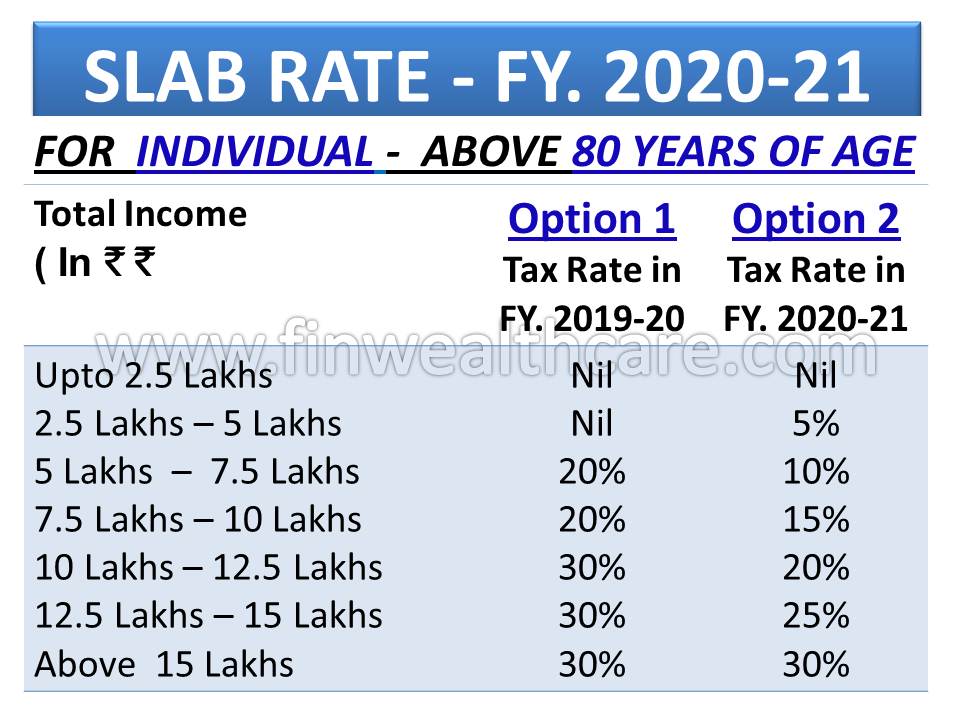

Web Old Tax Regime Slab in Rs New Tax Regime Slab in Rs Old Tax Rates New Tax Rates Tax calculation of Mr X Tax Calculation of Mr Y 0 25 lakh 0 3 lakh NIL NIL NIL NIL 25 lakh 5 lakh 3 lakh 6 lakh 5 5 12500 15000 5 lakh 10 lakh 6 lakh 9 lakh 20 10 100000 30000 10 lakh and Above 9 lakh 12 lakh 30 15 Web Nov 6 2020 nbsp 0183 32 If you opt for the latest income tax slabs for 2020 21 you will have to relinquish at least 70 exemptions and deductions including those available under sections 80C 80D 80CCD except section 80CCD 2 and more Here is a brief list of exemptions that you will have to forego Life insurance investments House rent allowance

Income Tax Slab For Fy 2020 21 Old Regime

Income Tax Slab For Fy 2020 21 Old Regime

Income Tax Slab For Fy 2020 21 Old Regime

https://i.pinimg.com/originals/82/83/8e/82838efe8769b68c13e42559187dbc6e.png

Web May 8 2023 nbsp 0183 32 These budget changes will be applicable from FY 2020 21 From FY 2020 21 it will be up to the taxpayer to select the tax regime based on their Income and Investments situation Following are the pros of following a new tax regime The Income Tax Slab Rates are lower A simplified Tax Structure i e Ease in filing ITR

Pre-crafted templates offer a time-saving solution for creating a varied range of documents and files. These pre-designed formats and layouts can be made use of for different personal and expert tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, enhancing the material production procedure.

Income Tax Slab For Fy 2020 21 Old Regime

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

All In One Income Tax Calculator For FY 2021 22 Old New

What s Beneficial Tax Under Old Or New Regime Tax Slabs FY 2020 2021

Calculate Your Projected Income Tax For FY 2020 21 In New Tax Regime

New Income Tax Slab FY 2020 21 India Vs Old

Income Tax Slab Rates FY 2020 21 Budget 2020 Highlights

https://cleartax.in/s/income-tax-slabs

Web The income tax slabs are different under the old and the new tax regimes Further the slab rates under the old tax regime are divided into three categories Indian Residents aged lt 60 years All the non residents 60 to 80 years of age Resident Senior citizens More than 80 years Resident Super senior citizens

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Web A new tax regime was introduced in Budget 2020 wherein the tax slabs were altered and taxpayers were offered concessional tax rates However those who opt for the new regime cannot claim several exemptions and deductions such as HRA LTA 80C 80D and more Because of this the new tax regime did not have many takers

https://www.taxscan.in/article/old-tax-slab-vs-new...

Web Feb 16 2021 nbsp 0183 32 Annual Income New Tax Regime Old Tax Regime Up to Rs 2 5 lakh Exempt Exempt Rs 2 5 lakh Rs 5 lakh 5 5 Rs 5 lakh Rs 7 5 lakh 10 20 Rs 7 5 lakh Rs 10 lakh 15 20 Rs 10 lakh Rs 12 5 lakh 20 30 Rs 12 5 lakh Rs 15 lakh 25 30 Above Rs 15 lakh 30 30

https://taxguru.in/income-tax/income-tax-slab...

Web Apr 16 2021 nbsp 0183 32 Income Tax Slab Existing Regime Slab Rates for FY 20 21 New Regime Slab Rates for FY 20 21 Resident Individuals lt 60 years of age amp NRIs Resident Individuals gt 60 to lt 80 years Resident Individuals gt 80 years Applicable for All Individuals Rs 0 0 Rs 2 5 Lakhs NIL NIL NIL NIL Rs 2 5 Rs 3 00 Lakhs 5 tax rebate u s

http://irtsa.net/pdfdocs/Income-Tax-Slabs-New-&-Old...

Web Income Tax Slab Rate for AY 2021 22 amp AY 2020 21 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year Net income range Income Tax rate AY 2021 22 With no deductions allowed Nil Income Tax rate AY 2020 21 With all existing deductions allowed Nil 5

Web Sep 10 2021 nbsp 0183 32 INCOME TAX CALCULATION UNDER OLD AND NEW TAX REGIMES On 13th April 2020 the CBDT issued a circular to employers to obtain a declaration from their employees if they wish to opt for concessional slab rates for FY 2020 21 under the new Income Tax regime for the purpose of TDS deduction under section 192 under the new Web Income Tax Calculator How to calculate Income taxes online for FY 2020 21 AY 2021 22 2021 2022 amp 2020 21 with ClearTax Income Tax Calculator Refer examples amp tax slabs for easy calculation

Web Feb 18 2020 nbsp 0183 32 The rebate is allowed for the old regime as well as the new regime For people earning above Rs 5 00 000 their tax slab rates start from Rs 2 50 000 People in the salary group between Rs 5 00 000 and Rs 7 50 000 must pay 10 tax with the old regime they must pay 20 Salary group between Rs 7 50 000 and Rs 10 00 000 must