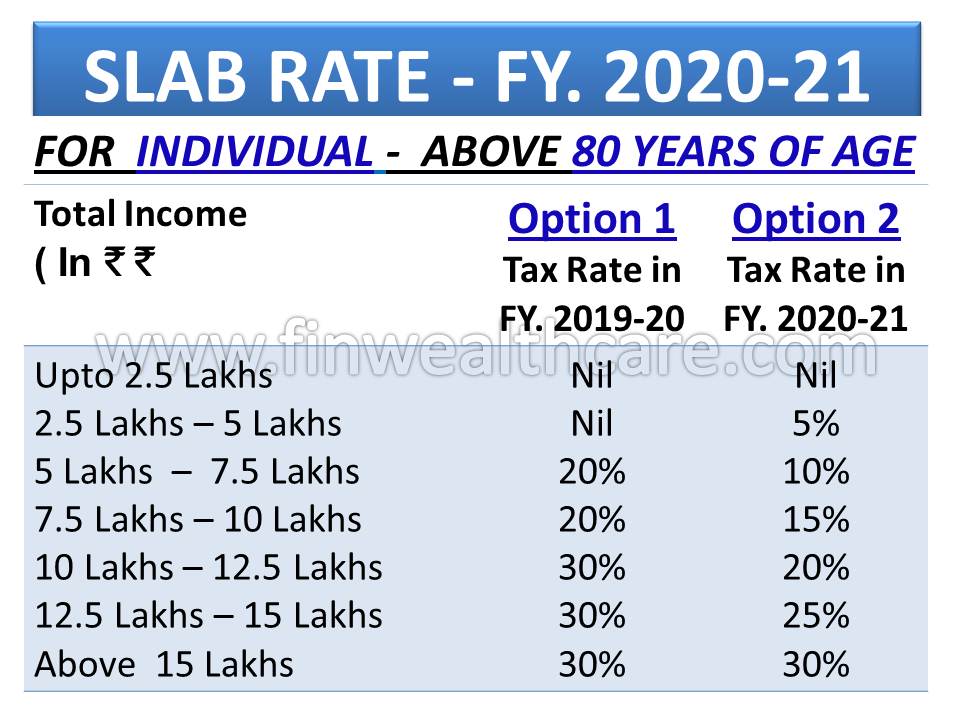

Income Tax Rates For Ay 2020 21 Old Regime Feb 1 2020 nbsp 0183 32 Income Tax Slab Rates FY 20 21 AY 21 22 Taxpayers were given an option to choose between the existing old tax regime or a new alternate tax regime in the Union Budget 2020 announced on 1st February 2020

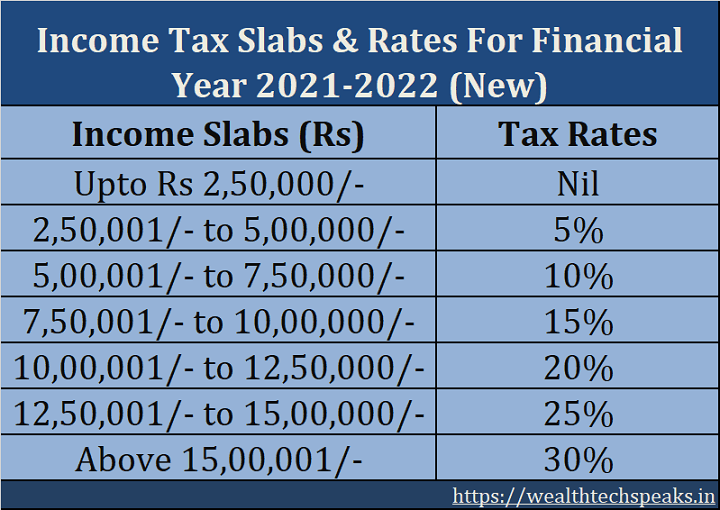

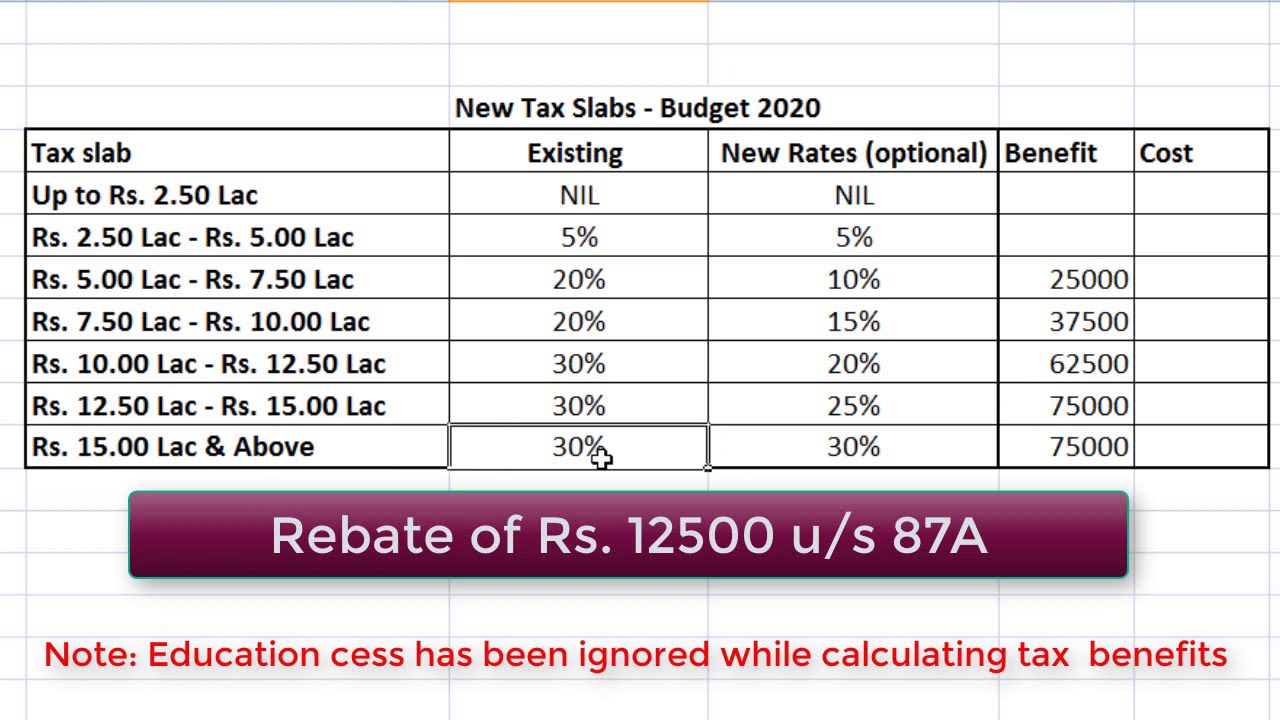

Jun 9 2021 nbsp 0183 32 Assessees opting Old regime shall continue to avail all exemptions and deductions while assessees opting New regime will have to forgo certain exemptions and deductions Jan 29 2025 nbsp 0183 32 As the new administration offers seven lower income tax slabs anyone paying taxes without claiming tax deductions can benefit from paying a lower tax rate under the new tax regime

Income Tax Rates For Ay 2020 21 Old Regime

Income Tax Rates For Ay 2020 21 Old Regime

Income Tax Rates For Ay 2020 21 Old Regime

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Income Tax Slabs amp Tax Rate in India for FY 2020 21 with old regime and new regime comparison Calculate it with easy steps just follow instruction and choose benefit

Pre-crafted templates use a time-saving service for creating a varied series of files and files. These pre-designed formats and layouts can be utilized for different individual and professional jobs, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content development process.

Income Tax Rates For Ay 2020 21 Old Regime

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay Mobile

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

New Income Tax Slab FY 2020 21 India Vs Old

http://irtsa.net › pdfdocs

Income Tax Slab Rate for AY 2021 22 amp AY 2020 21 for Individuals 5 of income in excess of Rs Nil 2 50 000 Plus Surcharge 10 of income tax where total income exceeds Rs

https://financialcontrol.in › history-of-inco…

Jan 15 2022 nbsp 0183 32 You can see the change in income tax slab rates for last 20 years which is changed by 50 000 to 5 00 000 1000 change

https://www.referencer.in › Income_Tax

The normal tax rates applicable to a resident individual will depend on the age of the individual However in case of a non resident individual the tax rates will be same irrespective of his age

https://taxguru.in › income-tax

Dec 25 2019 nbsp 0183 32 Here are the income tax slab rates for the Financial Year 2019 20 relevant to Assessment Year 2020 21 for Resident Individual Below 60 Years Old HUF and AOP BOI Artificial juridical person Senior Citizens 60 Years Or

https://incometaxmanagement.com › Pages › Amendment › ...

A new tax regime for Individual and HUF has been proposed by the Finance Bill 2020 to tax the income of such assessees at lower tax rates if they agree to forego prescribed deductions and

Apr 9 2020 nbsp 0183 32 Here we have compared and concluded how your tax liability changes when you opt to prefer new tax regime over the old regime We being a team of leading tax practitioners Feb 9 2020 nbsp 0183 32 Old regime is essentially the existing income tax rates and slabs with all the available deductions from income tax New regime aims to tax income at lower rates albeit with

Feb 23 2019 nbsp 0183 32 Income Tax Rates for AY 2021 22 Get income tax slab rates for individuals senior citizens partnership firm tax rates for companies HUF AOP BOI co operative society