Income Tax Slab For Fy 2020 21 Old Regime Calculator Web Updated on 08 Apr 2024 05 05 PM India follows a progressive tax system where the tax rates increase as income levels rise The income tax slabs in India determine the applicable tax rates for different income brackets

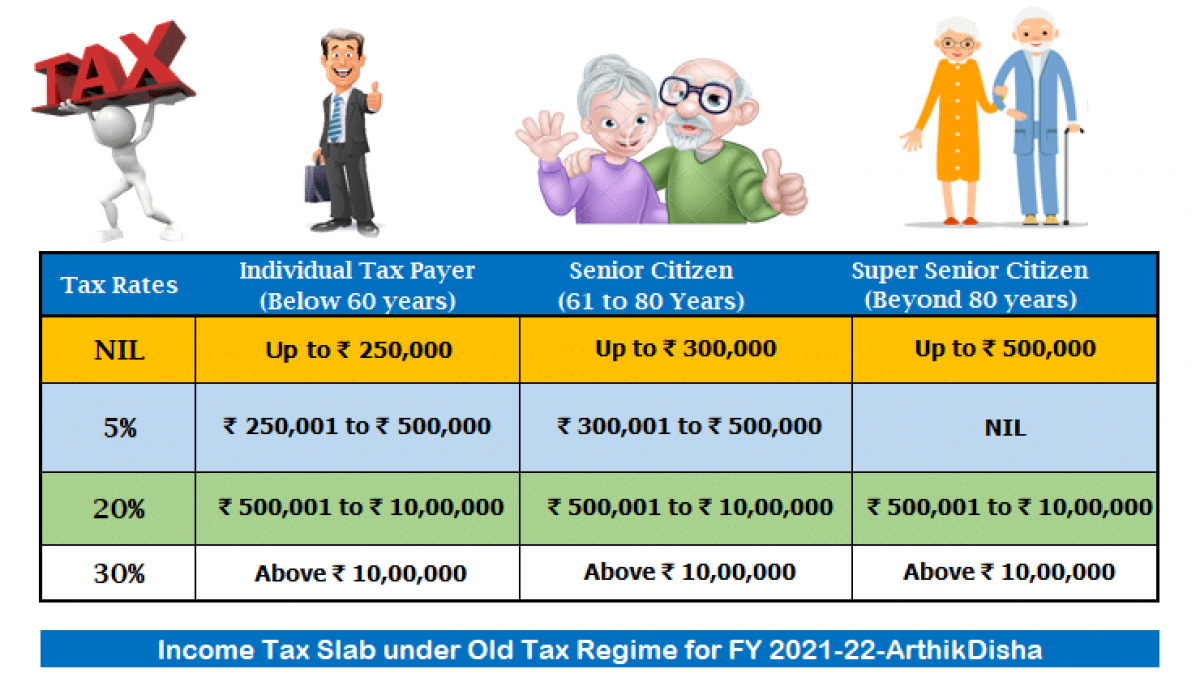

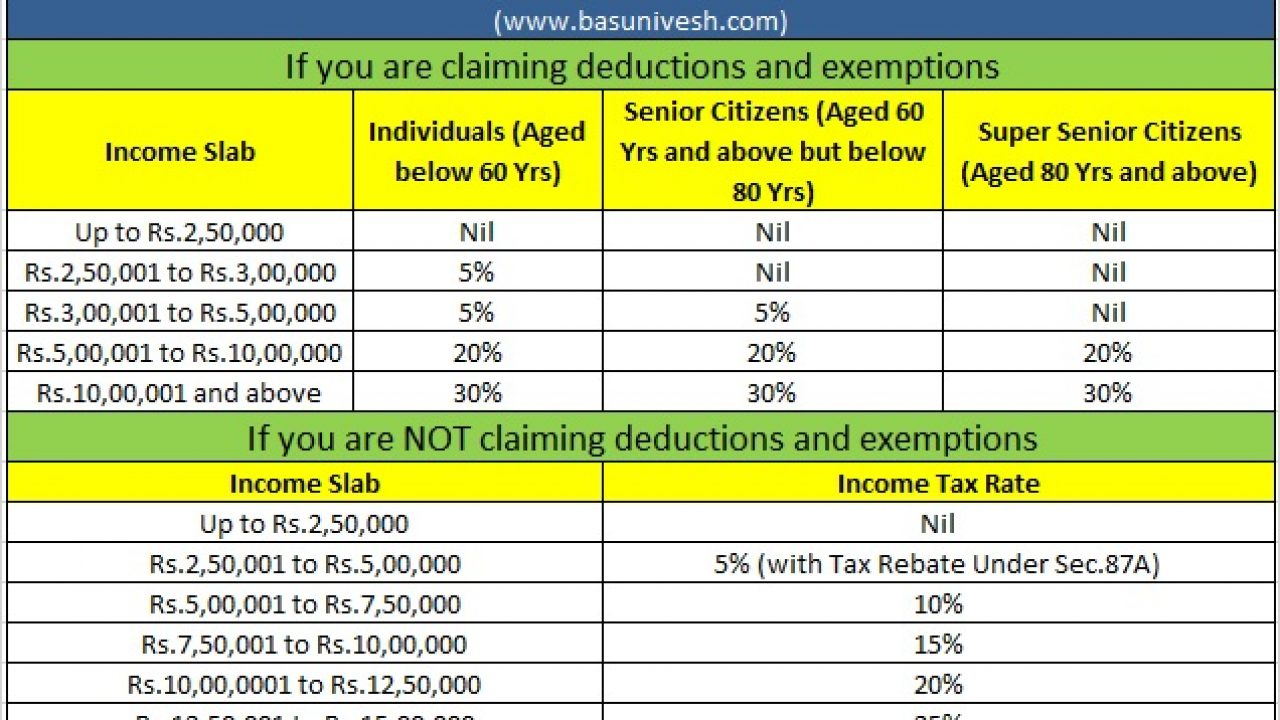

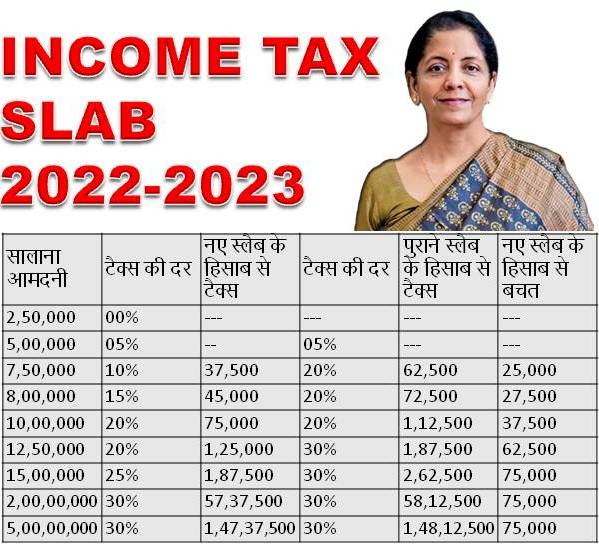

Web Apr 16 2021 nbsp 0183 32 Income Tax Slab Existing Regime Slab Rates for FY 20 21 New Regime Slab Rates for FY 20 21 Resident Individuals lt 60 years of age amp NRIs Resident Individuals gt 60 to lt 80 years Resident Individuals gt 80 years Applicable for All Individuals Rs 0 0 Rs 2 5 Lakhs NIL NIL NIL NIL Rs 2 5 Rs 3 00 Lakhs 5 tax rebate u s 87a is Web Income Tax Calculator Assessment year 2023 2024 2024 2025 2023 2024 2022 2023 2021 2022 Age category Below 60 60 or Above 60 80 or Above 80 Income Gross salary income Annual income from other sources Annual income from interest Annual income from let out house property rental income

Income Tax Slab For Fy 2020 21 Old Regime Calculator

Income Tax Slab For Fy 2020 21 Old Regime Calculator

Income Tax Slab For Fy 2020 21 Old Regime Calculator

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Web Sep 10 2021 nbsp 0183 32 What are the Income Tax Slab rates for FY 2020 21 Chandra Sekhar Reddy Last updated 10 September 2021 Share Update CBDT extends the due date for filing of Income Tax Returns and Various Reports of Audit for AY 2021 22 INCOME TAX CALCULATION UNDER OLD AND NEW TAX REGIMES

Pre-crafted templates offer a time-saving service for creating a diverse series of files and files. These pre-designed formats and designs can be utilized for various personal and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the content creation process.

Income Tax Slab For Fy 2020 21 Old Regime Calculator

How To Choose Between The New And Old Income Tax Regimes Chandan

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

New And Old Tax Regime Comparision For FY 2023 24 Income Tax Slab FY

Income Tax Calculation Fy 2020 21 Income Tax Calculator Ay 2020 21

https://cleartax.in/paytax/taxcalculator

Web Income Tax Calculator How to calculate Income taxes online for FY 2020 21 AY 2021 22 2021 2022 amp 2020 21 with ClearTax Income Tax Calculator Refer examples amp tax slabs for easy calculation

https://tools.quicko.com/income-tax-calculator

Web Income Tax Calculator Calculate Taxes for FY 2021 22 and AY 2021 22 Quicko Select financial year Add income details amp eligible deductions to calculate your Income Tax liability under the Old amp New Tax Regime FY 2023 24 Age Below 60 Years 60 to 80 Years Above 80 Years Residential Status Resident Not Ordinarily Resident Non Resident Next

https://cleartax.in/s/income-tax-slabs

Web Apr 1 2024 nbsp 0183 32 Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed Rs 5 00 000 not applicable for NRIs NOTE Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs

https://eztax.in/income-tax-calculator

Web Feb 1 2024 nbsp 0183 32 Income Tax Calculator to know the taxes to be paid for a given Income and to compare Old vs New tax regimes scheme for IT declaration with your employer or to know your tax exposure Including Marginal Relief for new tax regime Surcharge Cess Updated per latest Interim Budget 2024 rules Calculate Income Tax Old vs New Tax

https://www.etmoney.com/tools-and-calculators/income-tax-calculator

Web Income Tax Calculator Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime FY 2023 24 and FY 2022 23 in a few simple steps Check how much income tax you need to pay 1 Basic details 2 Income details 3 Exemptions 4 Capital gains 5 Deductions Financial Year My age is

Web Feb 4 2020 nbsp 0183 32 Income Tax Slabs for AY 2021 22 FY 2020 21 Tax slab for Men up to 60 years of age Tax slab for Women up to 60 years of age Tax slab for Senior Citizen aged above 60 years Old Tax Regime vs New Tax Regime Web Disclaimer The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc

Web Latest Income Tax Slab Rates FY 2020 21 AY 2021 22 With Automated Income Tax Master of Form 16 Part B for F Y 2019 20 amp A Y 2020 21