Income Tax Slab For Fy 2020 21 Old Regime For Senior Citizens Web Age Below 60 Years 60 to 80 Years Above 80 Years Residential Status Resident Not Ordinarily Resident Non Resident Next Clear All Total Tax payable is 0 under both Tax Regime File your ITR in 5 minutes

Web New Income Tax Slab for Super Senior Citizens FY 2020 21 amp AY 2021 22 Additional health and education cess of 4 is levied on taxable Web 1 Income Tax Slab Rate for AY 2021 22 amp AY 2020 21 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the

Income Tax Slab For Fy 2020 21 Old Regime For Senior Citizens

Income Tax Slab For Fy 2020 21 Old Regime For Senior Citizens

Income Tax Slab For Fy 2020 21 Old Regime For Senior Citizens

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

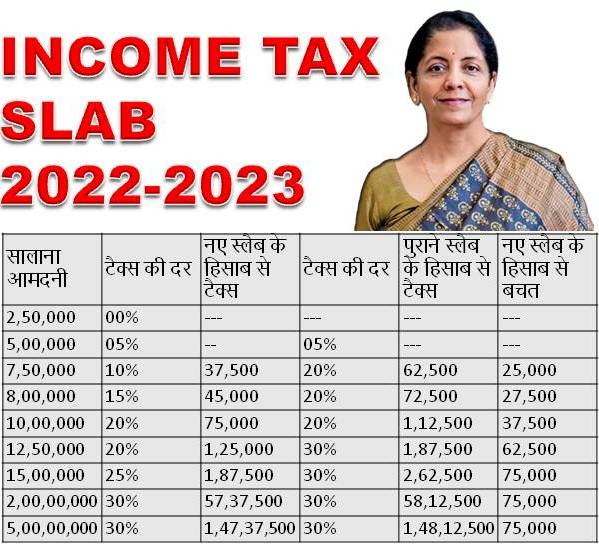

Web Jul 22 2022 nbsp 0183 32 Tax slabs The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income tax slabs and rates for FY

Pre-crafted templates provide a time-saving service for developing a varied range of files and files. These pre-designed formats and layouts can be utilized for different personal and professional tasks, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the material development procedure.

Income Tax Slab For Fy 2020 21 Old Regime For Senior Citizens

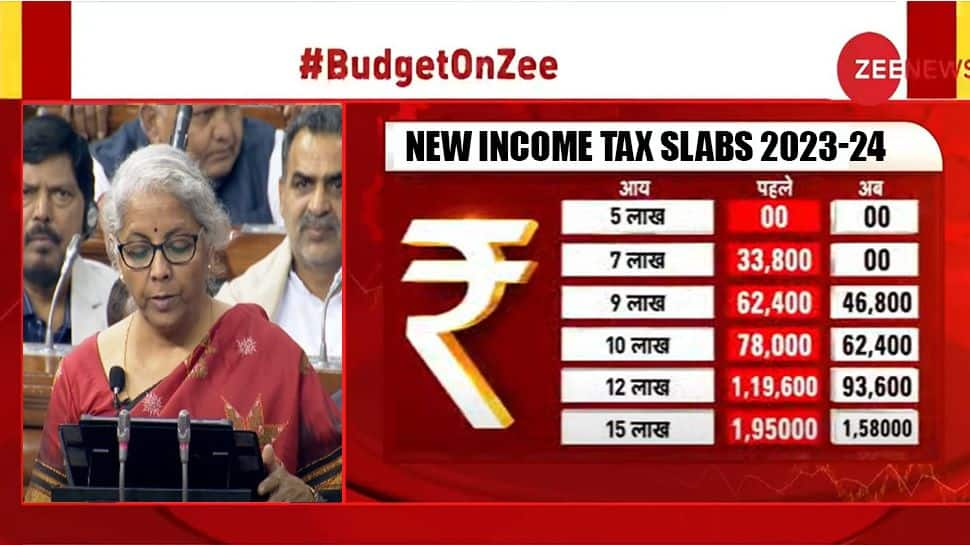

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

Income Tax Slab Rates FY 2023 24 Tax Calculation With Old Vs New Tax

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

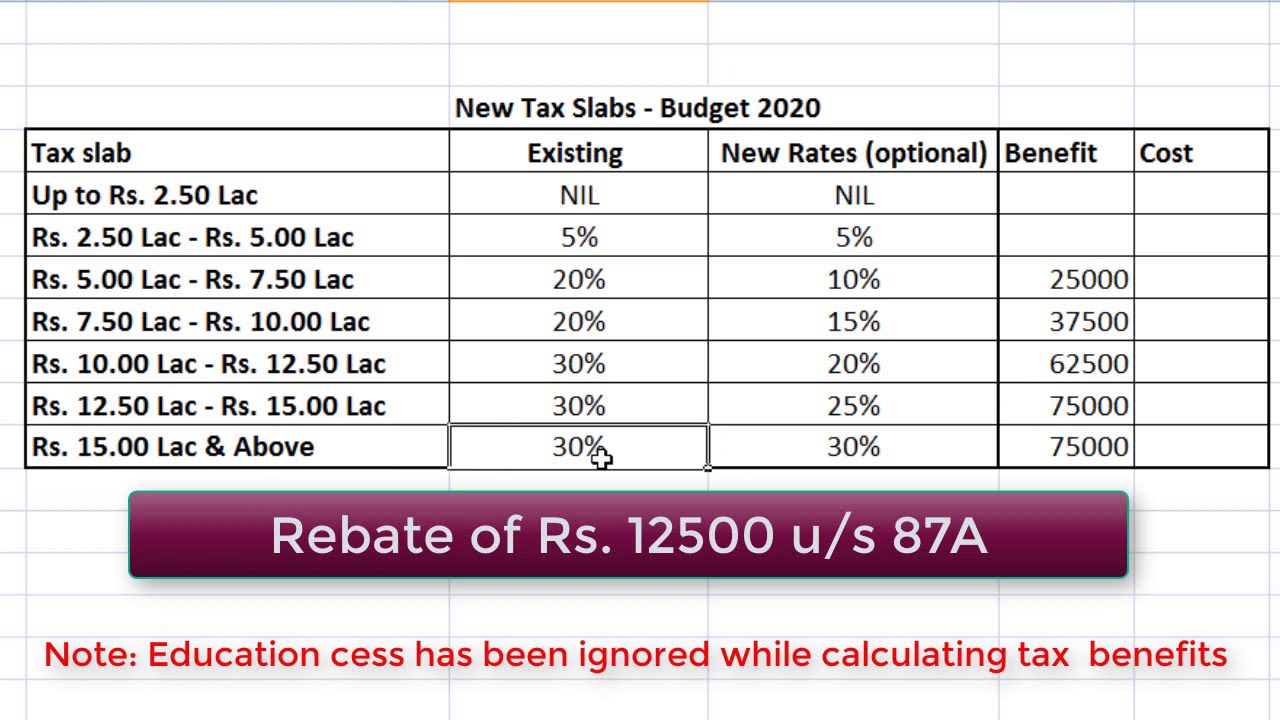

What s Beneficial Tax Under Old Or New Regime Tax Slabs FY 2020 2021

https://taxguru.in/income-tax/income-tax-rat…

Web Feb 12 2021 nbsp 0183 32 1 Income Tax Rates applicable to Individuals Resident Non Resident for FY 2020 21 amp 2021 22 2 Income Tax Rates for FY 2020 21 amp FY 2021 22 for HUF AOP BOI Other Artificial Juridical Person 3

https://www.taxscan.in/article/old-tax-slab-vs …

Web Feb 16 2021 nbsp 0183 32 New Income Tax Slab for Senior Citizens in 2020 21 The Taxpayers above 60 years of age and less than 80 years of age are

https://taxguru.in/income-tax/income-tax-slab...

Web Apr 16 2021 nbsp 0183 32 Income Tax Slab Existing Regime Slab Rates for FY 20 21 New Regime Slab Rates for FY 20 21 Resident Individuals lt 60 years of age amp NRIs Resident

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

Web Tax Slabs for AY 2023 24 Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income

https://www.goodmoneying.com/old-or-new-income-tax-slab-rates

Web If Income is up to Rs 5 lakh only then section 87A Rebate can be claimed Basic tax exemption Slab for Senior Citizen Above 60 years is up to Rs 3 lakh and for Super

Web Jul 19 2023 nbsp 0183 32 The income tax slabs for senior citizens under the new regime are as follows Senior citizens can choose between the two regimes based on their income Web There would be two options use existing tax slabs with all exemptions use new simplified tax structure but forgo all exemptions Income Tax Slabs There is NO separate tax slab

Web Jan 16 2024 nbsp 0183 32 Income Tax Slab Rate For Senior Citizen and Super Senior Citizen New Tax Regime What benefits are available to the senior and super senior citizens