Income Tax Slab For Financial Year 2022 23 Old Regime WEB The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with respect to income s earned and deductions claimed as per the Act

WEB Sep 14 2024 nbsp 0183 32 The present article covers the Income tax slab 2022 23 rates as applicable for the Assessment Year 2021 2022 Financial Year 2021 2022 Income Tax Slab 2022 23 for individuals including resident senior citizen WEB Income Tax Department gt Tax Tools gt Tax Calculator Click to view services related to PAN TAN and more Tax Helpline Click to view Tax Helpline As amended upto Finance Act 2023 Tax Calculator Click here to view relevant Act amp Rule Assessment Year

Income Tax Slab For Financial Year 2022 23 Old Regime

Income Tax Slab For Financial Year 2022 23 Old Regime

Income Tax Slab For Financial Year 2022 23 Old Regime

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

WEB Comparison IT Calculator Financial Year 2022 23 Age Select Age Below 60 Years Normal Citizen Between 60 Years to 79 Years Senior Citizen Above 79 Years Super Senior Citizen

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by supplying a ready-made format and design for developing different sort of content. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Income Tax Slab For Financial Year 2022 23 Old Regime

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

Income Tax Calculator Ay 2023 24 Excel Old And New Regime Pay Period

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Slab For 2022 23 Pay Period Calendars 2023

How To Choose Between The New And Old Income Tax Regimes Chandan

https://taxguru.in/income-tax/income-tax-rates...

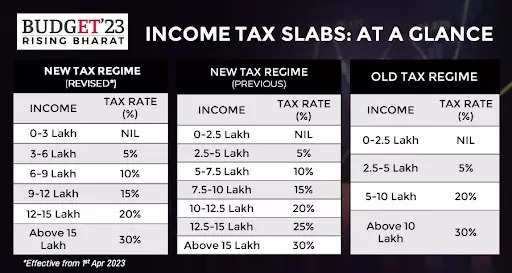

WEB Sep 9 2023 nbsp 0183 32 New tax regime also known as alternative tax regime is optional for the Assessment Year 2023 24 An individual or HUF has to exercise the option under Section 115BAC 5 to avail its benefit However for the Assessment Year 2024 25 the new tax regime is the default tax regime for the Individual or HUF

https://taxguru.in/income-tax/income-tax-rates...

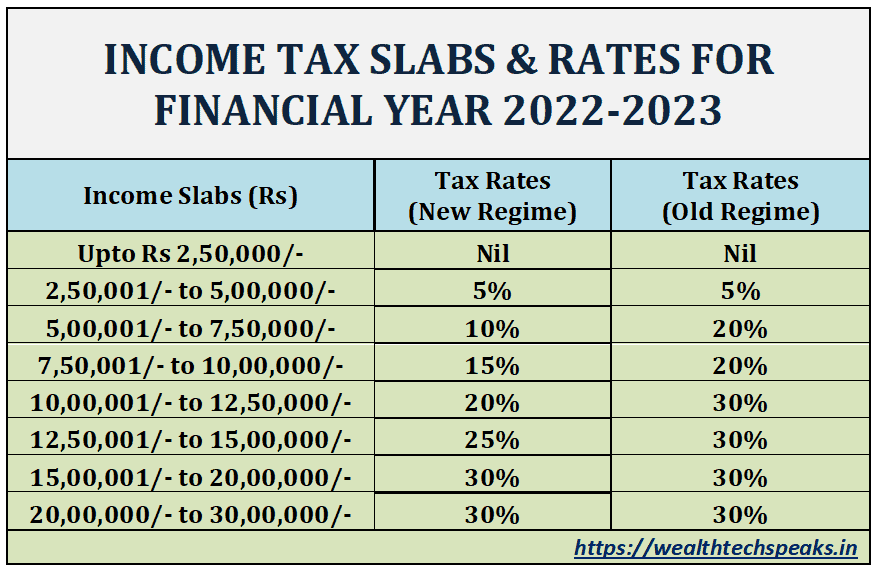

WEB Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs companies and more

https://economictimes.indiatimes.com/wealth/tax/...

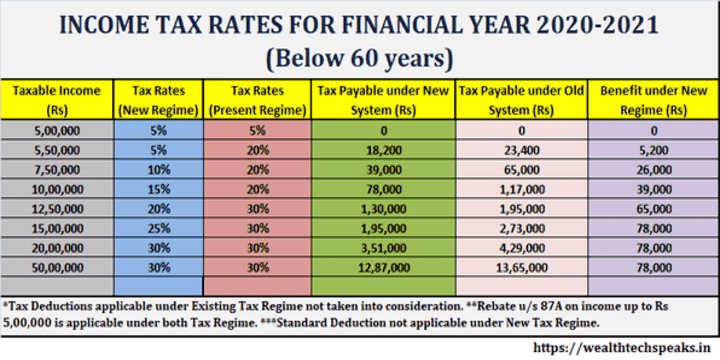

WEB Jul 28 2022 nbsp 0183 32 With regards to income tax slabs the old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six income tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes and FY 2022 23 for tax saving purposes

https://cleartax.in/s/income-tax-slabs

WEB 3 days ago nbsp 0183 32 Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 Old Tax Regime For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed Rs 5 00 000 not applicable for NRIs New Tax Regime Tax Slab for FY 2023 24 Tax Rate

https://charteredindia.com/income-tax-slab-rates

WEB Aug 15 2023 nbsp 0183 32 Income Tax Slabs amp Rates for FY 2022 23 2023 24 New Tax Regime vs Old Tax Regime Which Tax Regime Should I opt Deductions in new regime

WEB Aug 26 2024 nbsp 0183 32 If you have an income of Rs 10 lakhs the old tax regime will benefit you only if you have made tax savings investments deductions other than standard deductions of over Rs 2 62 500 If these deductions are less than Rs 2 62 500 then the new regime will be better for you WEB A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between the new or old tax regime and pay applicable income

WEB How to Use the Income Tax Calculator for FY 2024 25 AY 2025 26 and FY 2023 24 AY 2024 25 Following are the steps to use the tax calculator Step 1 Choose the financial year for which you want your taxes to be calculated Step 2 Select your age accordingly Tax liability under the old regime differs based on the age groups