Income Tax Slab For Fy 2021 22 Old Regime WEB The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with

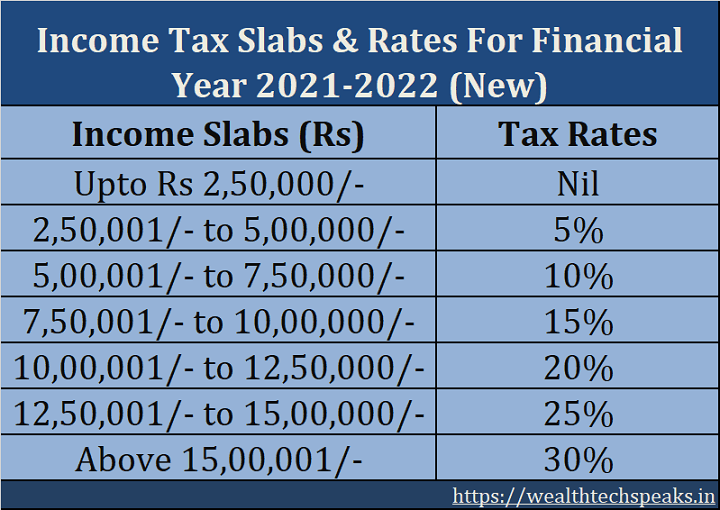

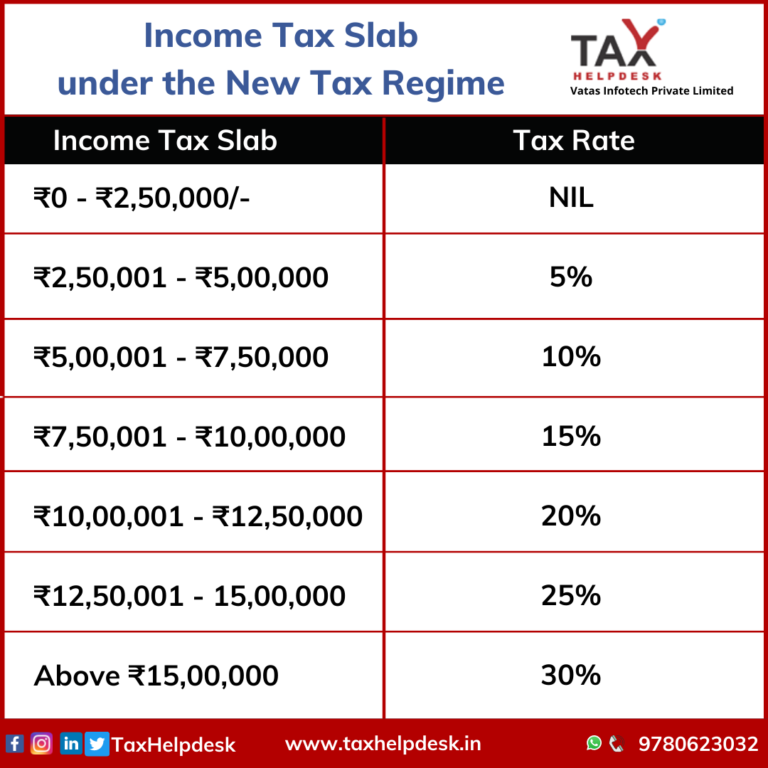

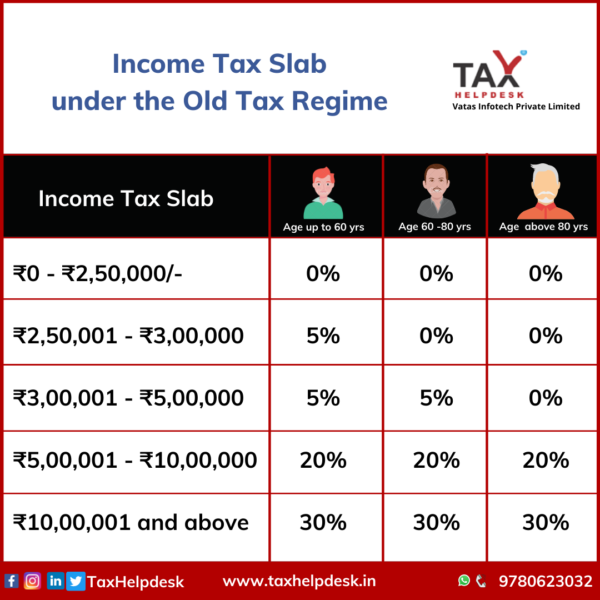

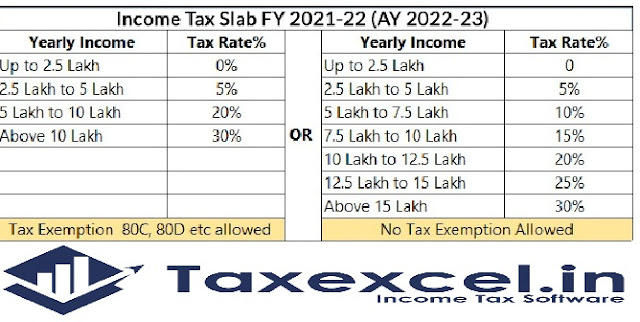

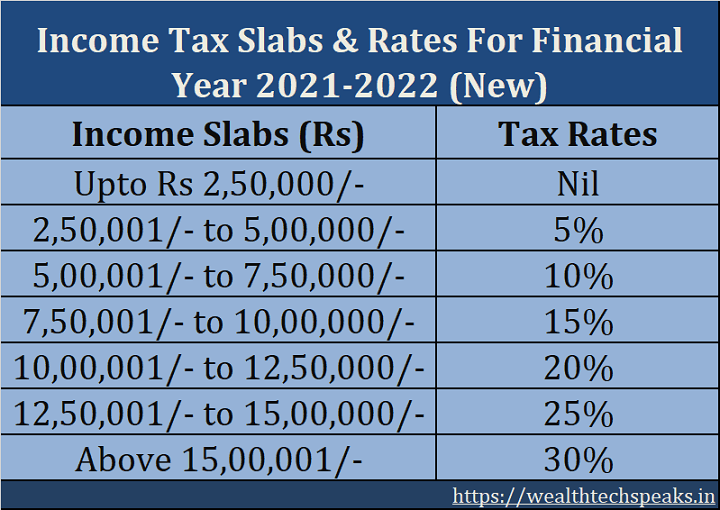

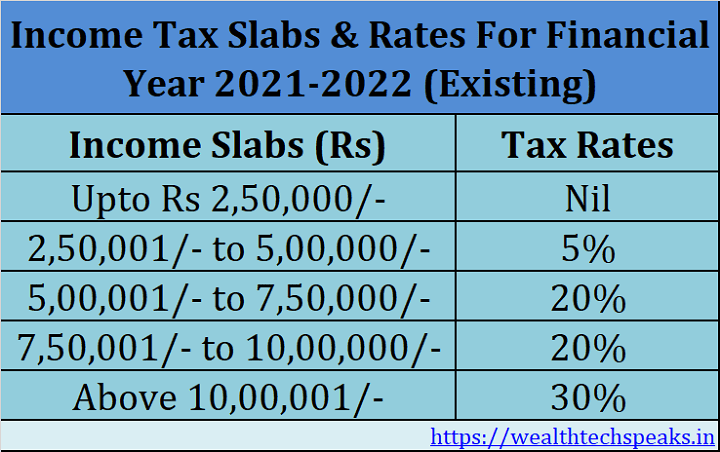

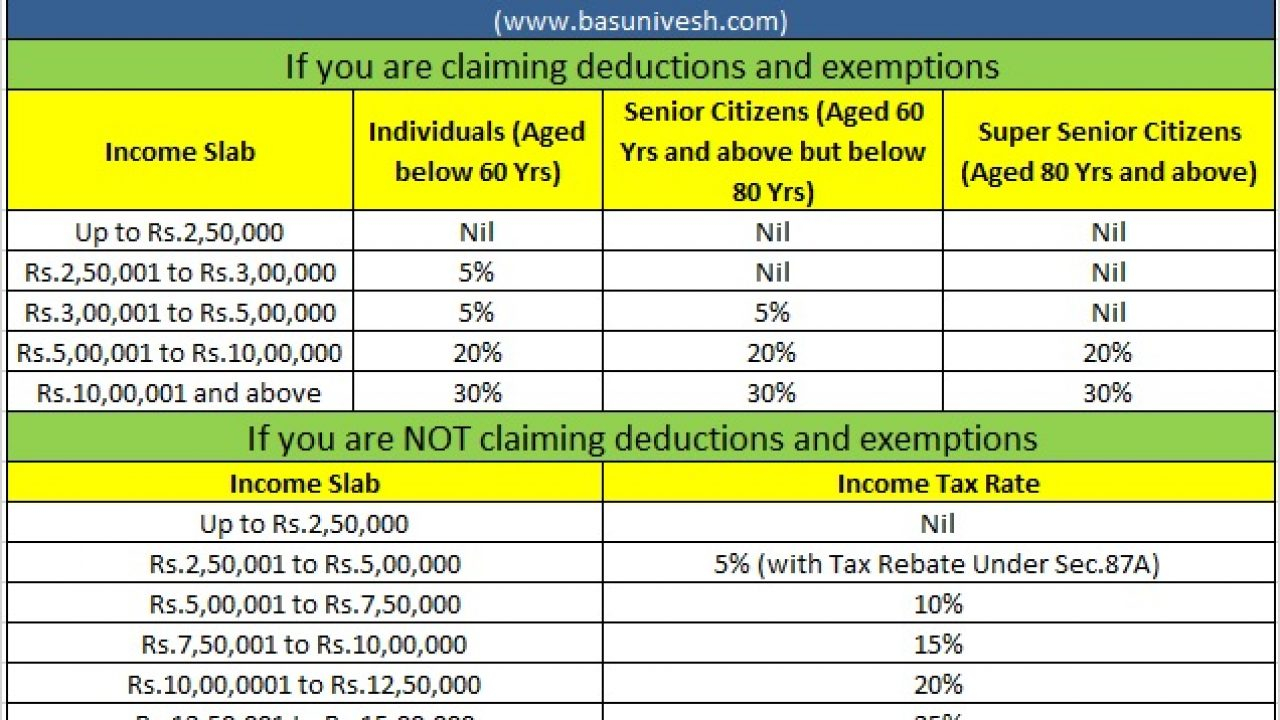

WEB Jul 22 2022 nbsp 0183 32 We will be comparing income tax slabs and rates under the new and old tax regimes for individuals senior citizens and super senior citizens for FY 2021 22 and FY WEB Apr 6 2021 nbsp 0183 32 Income Tax Slabs and Tax Rates for AY 2021 22 amp AY 2022 23 for Individual HUF Firm Local Authority Co op amp Companies for both regimes in user

Income Tax Slab For Fy 2021 22 Old Regime

Income Tax Slab For Fy 2021 22 Old Regime

Income Tax Slab For Fy 2021 22 Old Regime

https://wealthtechspeaks.in/wp-content/uploads/2020/07/New-Income-Tax-Slab-Rates-FY-2021-22.png

WEB 5 days ago nbsp 0183 32 Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax

Pre-crafted templates use a time-saving service for developing a varied variety of files and files. These pre-designed formats and designs can be utilized for different personal and professional tasks, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the content production process.

Income Tax Slab For Fy 2021 22 Old Regime

New Income Tax Slab Rates Vs Old Rates Which One Is Better

Income Tax Slabs For FY 2022 23 FY 2021 22

Income Tax Slabs For FY 2022 23 FY 2021 22

Calculate Your Projected Income Tax For FY 2020 21 In New Tax Regime

Income Tax Slab For Fy 20 21 Ay 2021 22 SkTaxLawFirm

New And Old Tax Regime U s 115 BAC And Option Form 10 IE For The F Y

https://economictimes.indiatimes.com/wealth/tax/...

WEB Jul 22 2022 nbsp 0183 32 Tax slabs The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income

https://www.goodreturns.in/personal-finance/…

WEB Apr 24 2021 nbsp 0183 32 Old And New Taxation Regime Tax Slabs And Rates For AY 2021 22 Old taxation regime Here are the tax slab rates for individuals less than 60 years old For senior citizens

https://incometaxindia.gov.in/Pages/tools/tax-calculator.aspx?ID=442

WEB Disclaimer The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

WEB However the eligible taxpayers have the option to opt out of new tax regime and choose to be taxed under old tax regime The old tax regime refers to the system of income tax

https://taxguru.in/income-tax/income-tax-rat…

WEB Feb 12 2021 nbsp 0183 32 Rates of Income Tax for Financial year FY 2020 21 i e Assessment Year AY 2021 22 and FY 2021 22 AY 2022 23 applicable to various categories of persons viz Individuals Firms companies etc

WEB Aug 17 2022 nbsp 0183 32 The new tax regime includes seven lower income tax slabs thus it is beneficial for taxpayers who make low investments Any individual paying taxes without WEB Use the Income Tax Calculator to calculate your taxes in India for FY 2021 22 and AY 2021 22 under the Old amp New Tax Regime Learn how to calculate Tax payable using

WEB 5 days ago nbsp 0183 32 Section 115BAC the new tax regime system came into force from FY 2020 21 AY 2021 22 The new tax regime introduced concessional tax rates with reduced